Find ATMs in your network.

47K+ fee-free ATMs1 - more than the top 3 national banks combined2

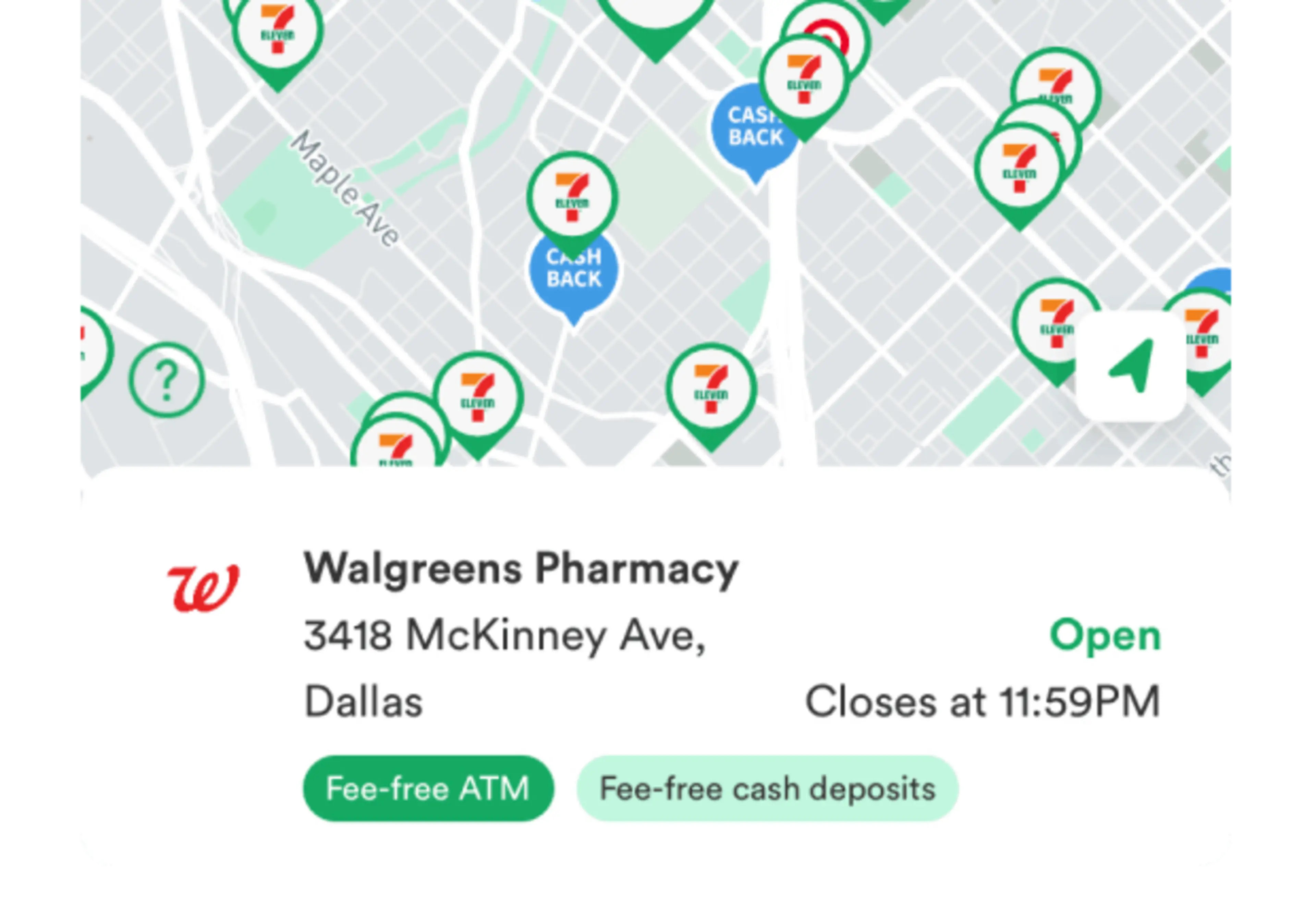

Find a convenient ATM near you with the Chime app

Get fee-free overdraft up to $2003 on cash withdrawals with SpotMe®

Fee-free ATM Locations

Learn how we collect and use your information by visiting our Privacy Notice ›

More fee-free ATMs than the top 3 national banks combined.2

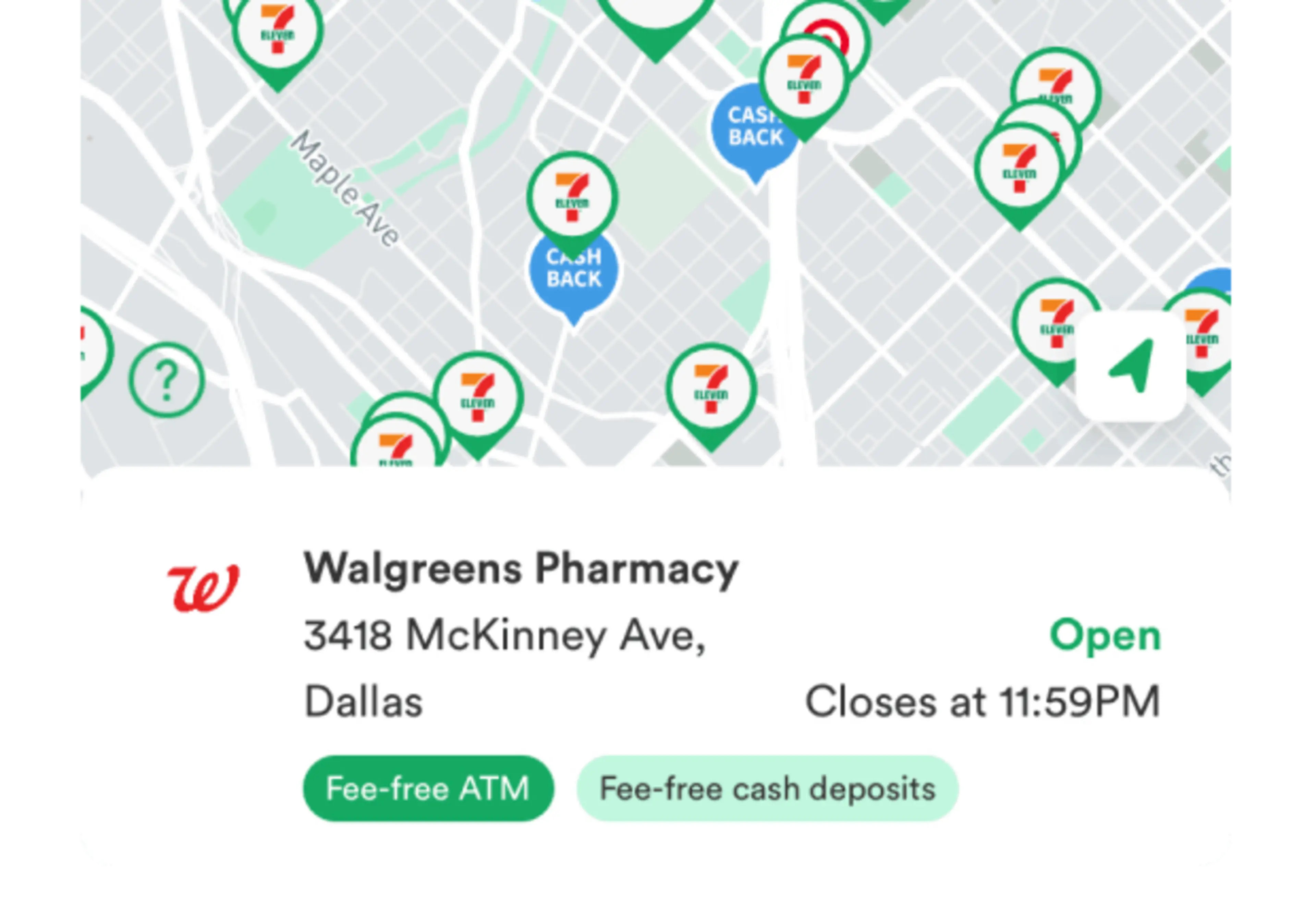

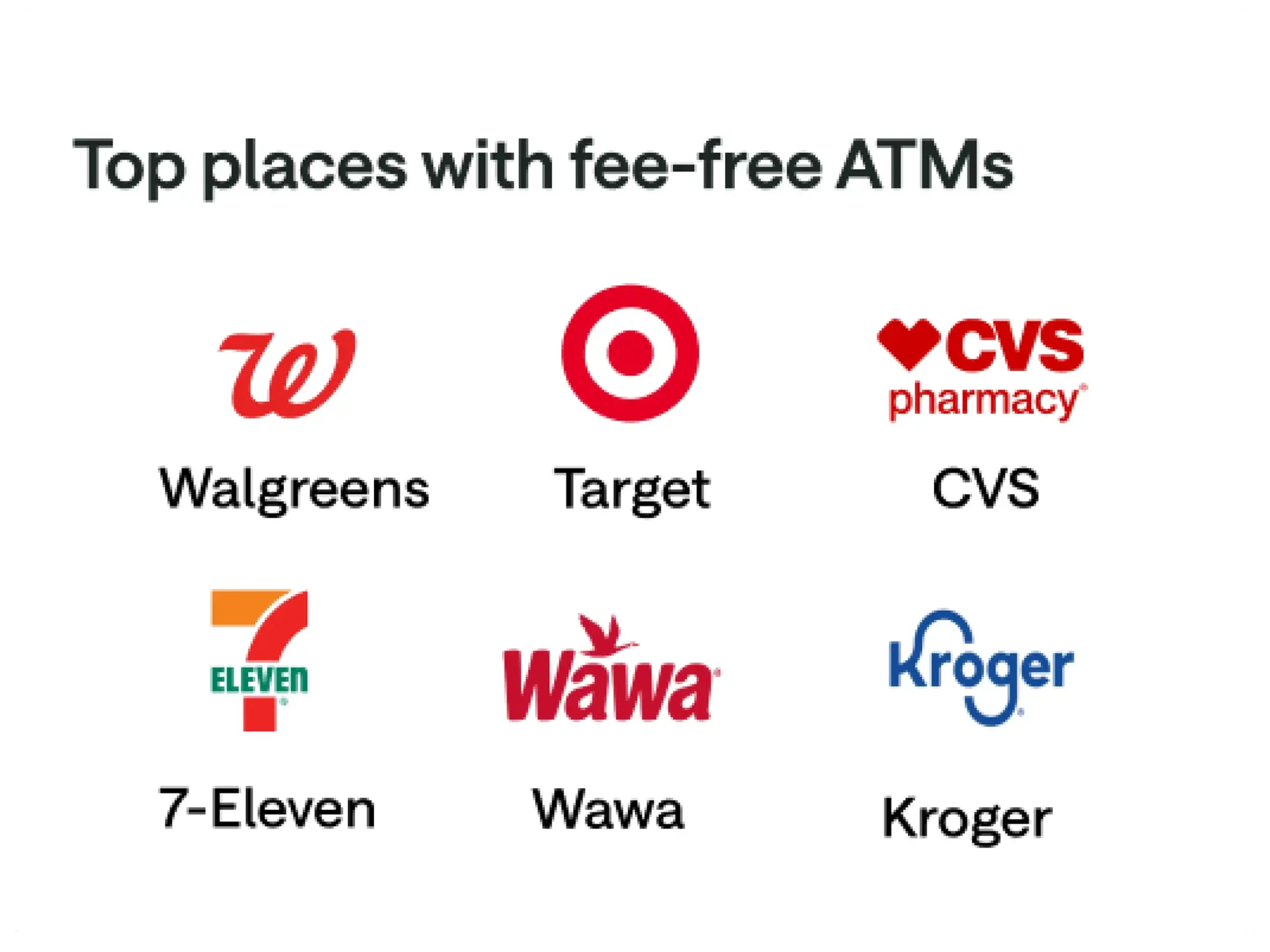

With access to 47,000+ fee-free ATMs1 at stores like Walgreens®, 7-Eleven®, CVS Pharmacy®, and Circle K, we’re making it more convenient to get cash on the go.

47K+ fee-free ATMs nationwide.

Access your money when you need it with fee-free ATMs1 at stores like Walgreens®, 7-Eleven®, Target®, Circle K, and CVS Pharmacy®.

Get your cash, your way.

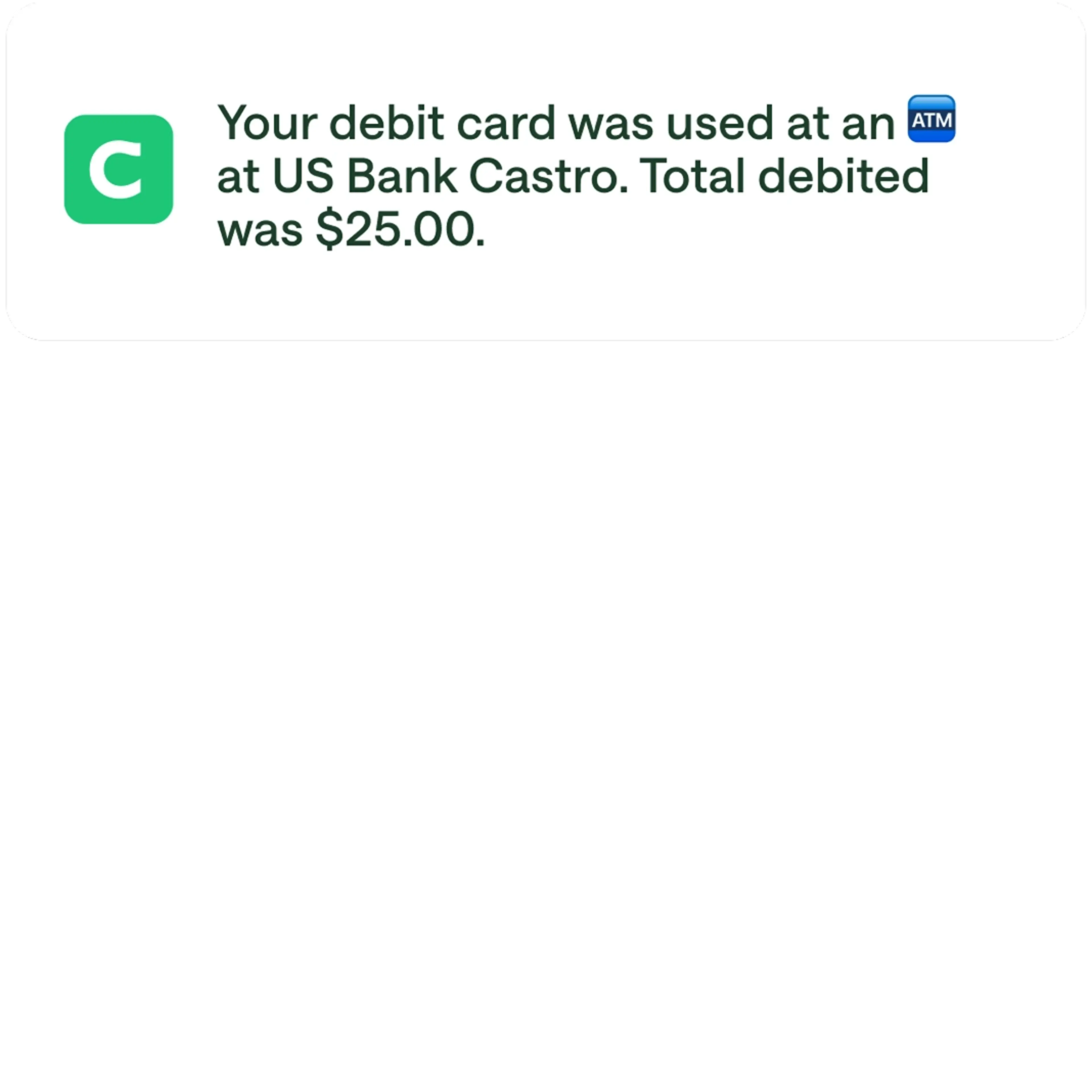

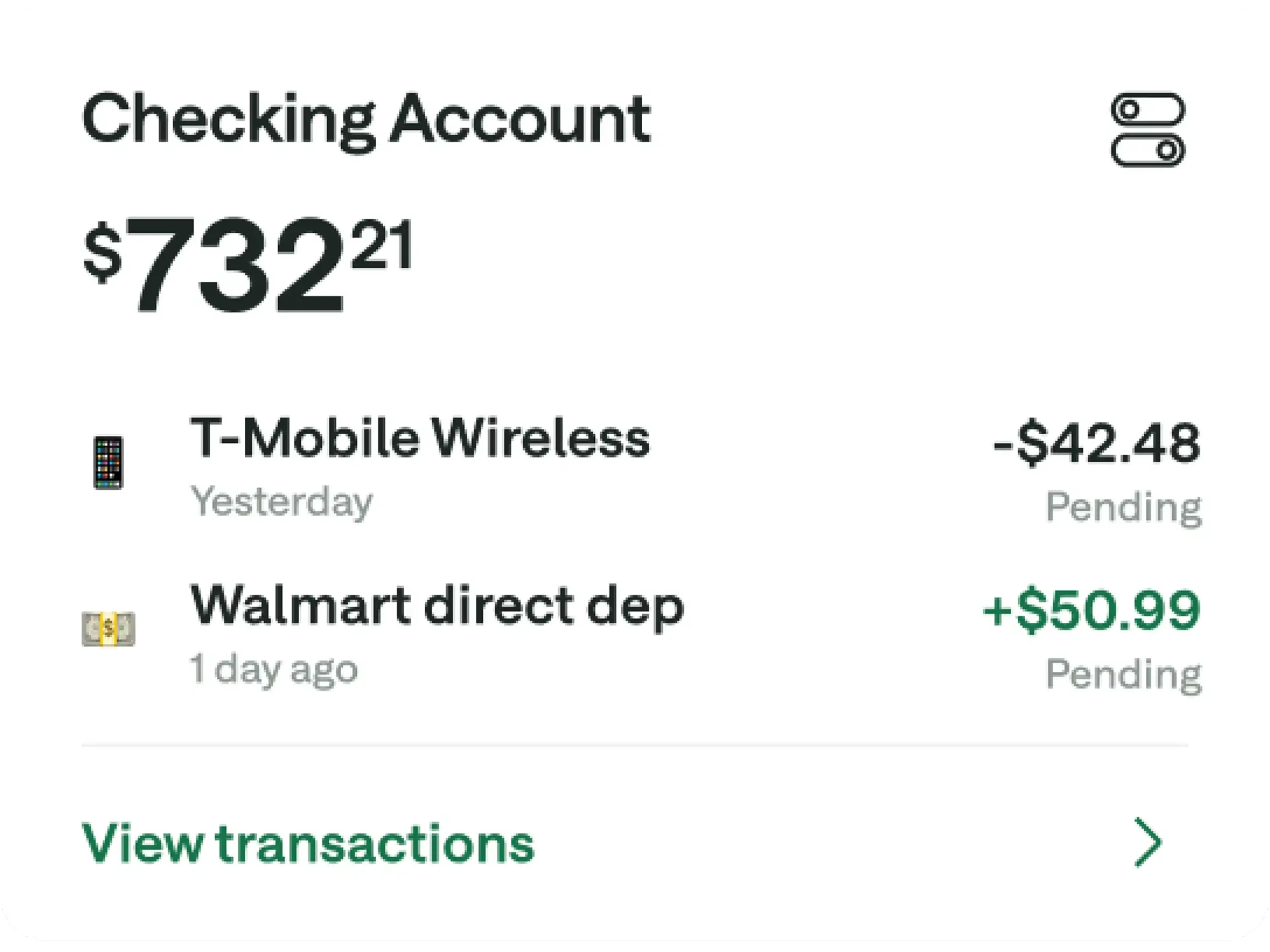

Use your Chime Visa® Debit Card to take out cash from your Checking Account. When you need it, there is fee-free overdraft up to $2003 at ATMs. You can also use your secured Chime Visa® Credit Card to get cash: we won’t charge you interest.4

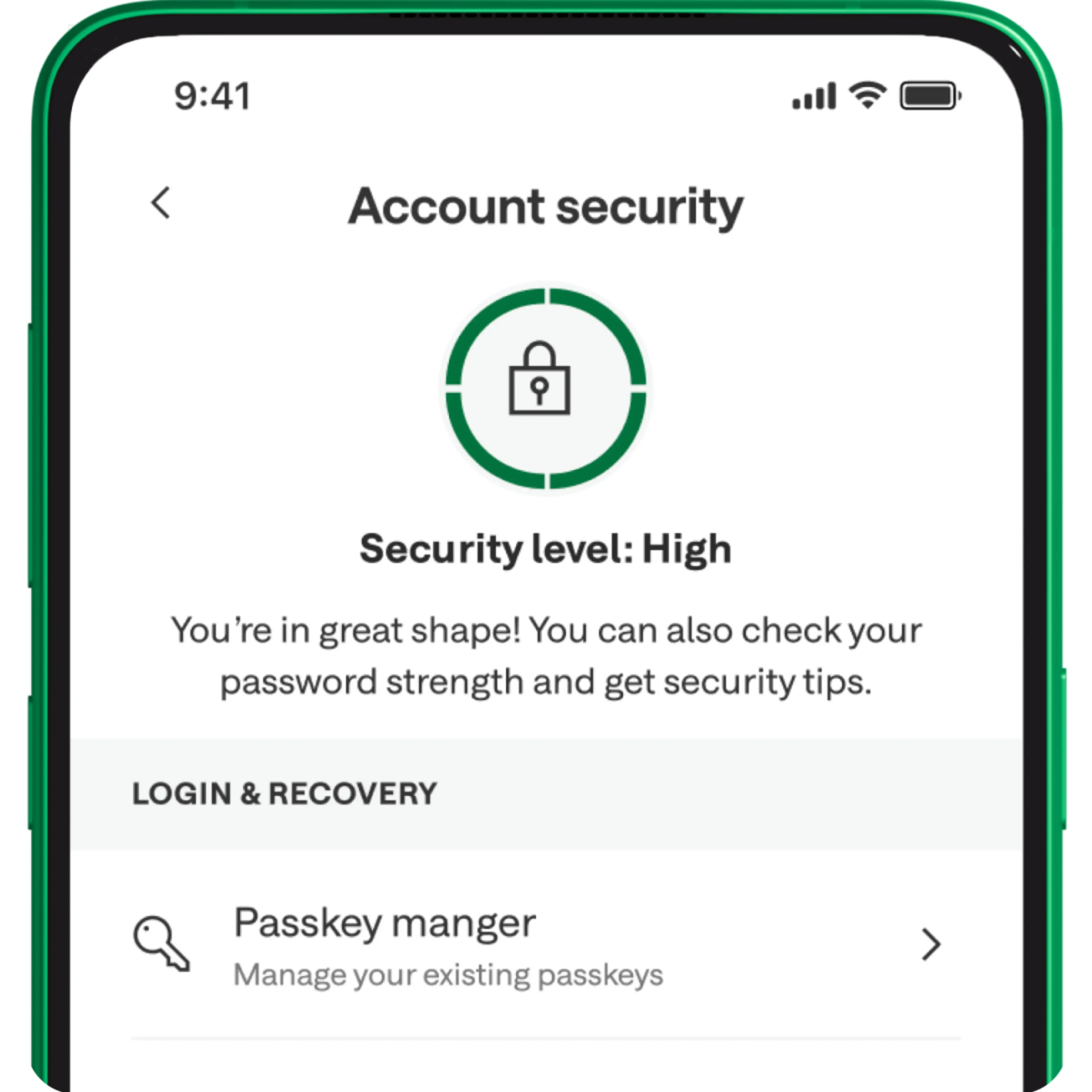

Money in your Chime Checking Account is secure.

With Visa® Zero Liability Policy,5 your Chime cards are covered if they’re lost, stolen, or fraudulently used. Transaction alerts, custom card security features, and 24/7 customer support help you track every dollar.

Make fee-free cash deposits6 at Walgreens®.

Deposit cash with the cashier conveniently at over 7,900 Walgreens® locations nationwide.

In-network ATM near me.

Bank through Chime for cash withdrawals at fee-free ATMs1 using your card. Just launch the ATM Finder in your Chime app to find ATMs near you. You can also find more fee-free cash withdrawals locations like Walmart, Dollar General, Target®, and other retailers.2

Get your money when you need it.

Open a Chime account for more fee-free ATMs1 than the top 3 national banks combined.

How to withdraw cash from in-network ATMs.

Find an ATM. Open the ATM Finder in your Chime app to locate the closest fee-free ATM1 near you.

Use your cards to access funds. Use your card to access funds. Just insert your debit card or Chime Card at the ATM and enter your PIN to see your account.

Take out your hard-earned cash. Conveniently withdraw money and count on SpotMe to overdraw up to $2003 when you need it.

How to deposit cash at in-network ATMs.

Find the closest Walgreens®. Chime offers fee-free deposits6 at any Walgreens®. You've got 7,900+ to choose from!

Or check out other retailers. You can deposit cash at 95,000+ locations in the US. Find participating retailers in the app: tap "Deposit Cash" in the "Move Money" tab.

Work with a cashier. Retail cashiers deposit cash directly into your Chime Checking Account. Make up to three deposits totaling up to $1,000 every day – up to $10,000 every month!

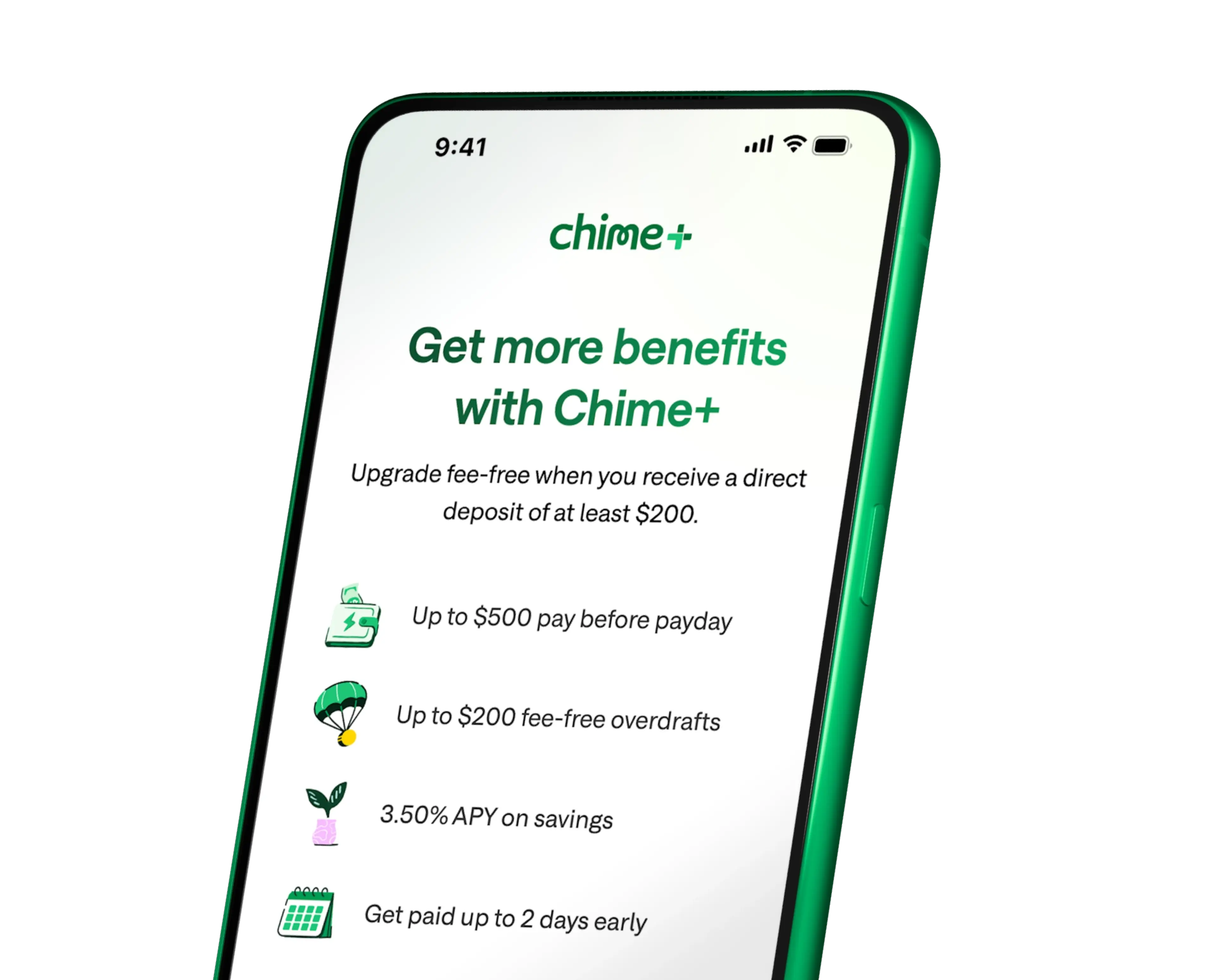

Direct deposit

and get Chime+

for free.

Unlock even more Chime benefits when you

set up a qualifying direct deposit.7

Open a Chime account in 2 minutes.

Unlock fee-free cash withdrawals at 47K+ ATMs1 nationwide.

FAQs

How do I find an in-network ATM near me?

You can find nearby fee-free ATM locations by opening the Chime mobile app and using the ATM Finder. Chime has 47,000+ fee-free ATMs1 in the US, plus a wide network of cash-back retailers for even easier ways to withdraw your money.

What ATM network does Chime use?

We have a network of 47,000+ ATMs1 for Chime members. Get fee-free transactions at any FCTI ATM in a 7-Eleven® location and at any Allpoint or Visa Plus Alliance ATM. To find a fee-free ATM near you, download the Chime mobile app and tap on ATM map. You can also search our ATM network.

How many ATMs accept the Chime debit card?

You can get cash at more than 47,000 fee-free ATMs1 – more than the top 3 national banks combined8! Including ATMs at popular retail stores like Walgreens®, CVS®, 7-Eleven®, Circle K®, and Target®.

Get fee-free transactions at any FCTI® ATM in a 7-Eleven location and at any Allpoint® or Visa® Plus Alliance® ATM. Otherwise, out-of-network ATM withdrawal fees may apply.

Where can I find a fee-free ATM for Chime?

There are tens of thousands of in-network fee-free ATMs1 across the country. Just open your Chime mobile app, tap 'Move', and select 'Find an ATM' to find a fee-free ATM near you.

How much are in-network ATM fees?

Chime doesn’t charge ATM fees at any of our 47,000+ in-network ATMs.1 If you withdraw cash from an out-of-network ATM, you’ll pay a $2.50 Cash Withdrawal fee, plus any fees the out-of-network ATM provider charges

Where can I withdraw money from my Chime card?

With your Chime Debit Card, you can withdraw cash at many fee-free1 ATM locations across the country. You can also get cash-back at participating retailers like Walmart and Dollar General. Use the ATM Finder in your Chime mobile app to find ATMs and cash-back near you. Your Chime card works at out-of-network ATMs, but fees will apply.

You can also withdraw cash at a traditional bank or credit union by presenting your debit card to the teller. This is called an Over The Counter Withdrawal, and there’s a $2.50 fee every time you withdraw cash this way.

Can I use my Chime Card to withdraw money?

Yes! You can use your Chime Card to get cash fee-free at any of our 47,000+ in-network ATMs nationwide.1 Find in-network ATMs in stores you love like Walgreens®, 7-Eleven®, and more. Go into your Chime App and use the ATM Map to find one closest to you. You can also withdraw cash from any out-of-network ATM, but there’s a $2.50 fee.

What’s the in-network ATM withdrawal limit?

You can withdraw up to $515 a day from your Chime account using your debit card and up to $1,015 per day with your Chime Card at an ATM. The withdrawal amount and any fees you incur from out-of-network withdrawals count toward your daily limit on your Chime credit and debit cards. Personal limits may vary, check the Chime app for your personal limit.

Can I use Chime SpotMe at an ATM?

You can withdraw cash at an ATM using Chime SpotMe for up to $200.3 The amount you can overdraft when making a withdrawal varies depending on your personal SpotMe eligibility and limits.

Can I overdraft my Chime card at an ATM?

If you are eligible for SpotMe through Chime, you can overdraft your Chime card at an ATM for up to $200. Eligibility requirements and limits apply.

What ATM can I deposit cash for Chime?

Unfortunately, you cannot make an ATM deposit into Chime.

If you have cash on hand that you want to deposit in your Chime account, just go to a Walgreens® cashier for a fee-free cash deposit.6 There are more than 7,900 locations nationwide – and you can find them all using the ATM Finder in your Chime mobile app. If you can’t find a Walgreens®, you can deposit cash into your Chime account at more than 95,000 retail locations nationwide, including Walmart, CVS®, and Family Dollar. Fees may apply.

Where can I go to add money to my Chime account?

You can add money to your Chime Checking Account by making a fee-free cash deposit6 at any Walgreens® location nationwide. And it’s not just Walgreens – for a fee, you can deposit cash into your Chime account at more than 95,000 retailers across the country.

You can also fund your Chime card with direct deposit, mobile check deposit,9 instant transfers,10 and bank transfers, all in the mobile app.

How long does a cash deposit take for Chime?

If you make a cash deposit at a retailer (it’s fee-free at Walgreens®6), the money will be available for your use within 24 hours, in most cases it occurs in minutes. Please see your issuing bank’s Deposit Account Agreement or Credit Card Agreement for more information on deposits and funds availability.