Grow Your Savings Automatically

Learn how below

Already have an account?Learn how we collect and use your information by visiting our Privacy Notice

250,000+ 5-Star app reviews

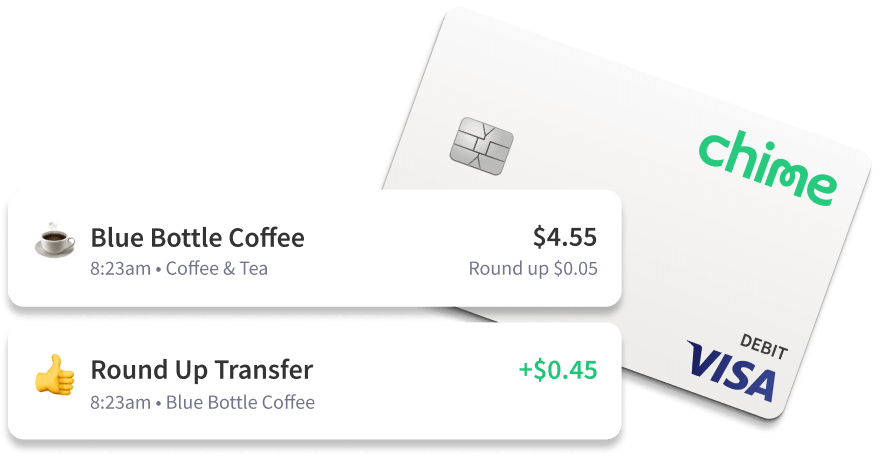

Savings when you spend.

Save money every time you make a purchase or pay a bill with your Chime Visa® Debit Card. Save When You Spend automatically rounds up transactions to the nearest dollar and transfers the Round Up from your Checking Account into your Automatic Savings Account. The more you use your Chime card, the more you build your savings. And unlike other round-up savings apps, Chime is a fully featured bank account so your money is instantly available if you need it.

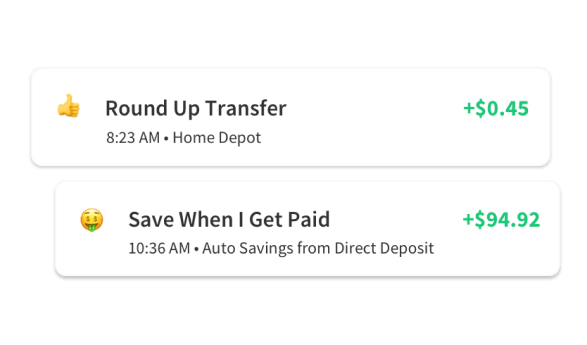

Savings when you get paid.

Save When I Get Paid automatically transfers 10% of your direct deposits of $500 or more into your savings account.

Grow your savings, automatically.

Reach your goals faster by saving money automatically. Our Automatic Savings features help you save money any time you spend or get paid.

Security and control on the go.

Chime’s mobile app makes branchless banking a breeze. Manage your money and account on the go, wherever you go.

Your deposits are insured up to $250,000 through The Bancorp Bank, N.A. and Stride Bank, N.A., Members FDIC.

Visa’s Zero-Liability Policy protects all unauthorized purchases.˜

Over 38,000 fee-free ATMs and 30,000 cash-back locations.

Real-time alerts for every banking transaction.

Automatic Savings takes the effort out of saving.

No minimum, monthly, or overdraft fees.

Log in

Log in