Chime Banking

Banking like it should be.

Welcome SuperMoney users!

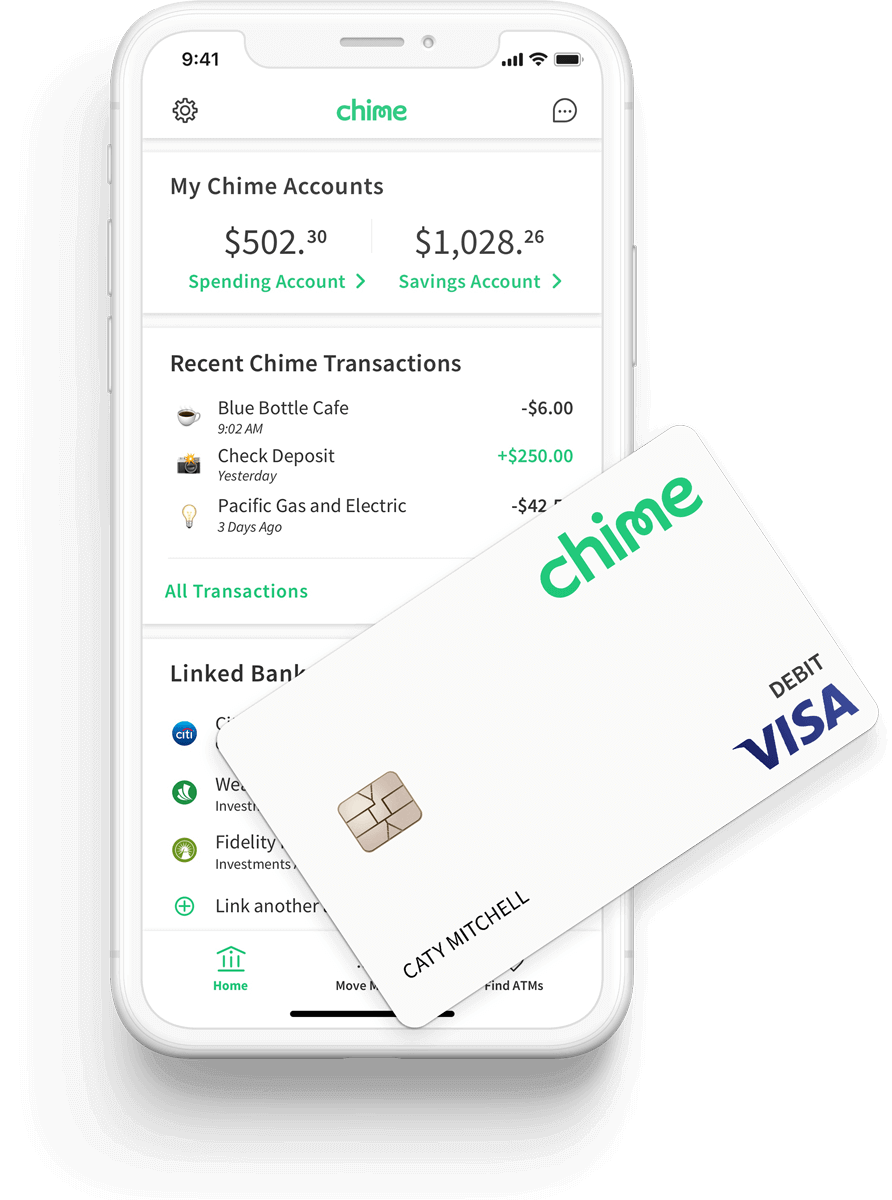

Chime is an award-winning mobile banking app and debit card.

✓ No hidden bank fees

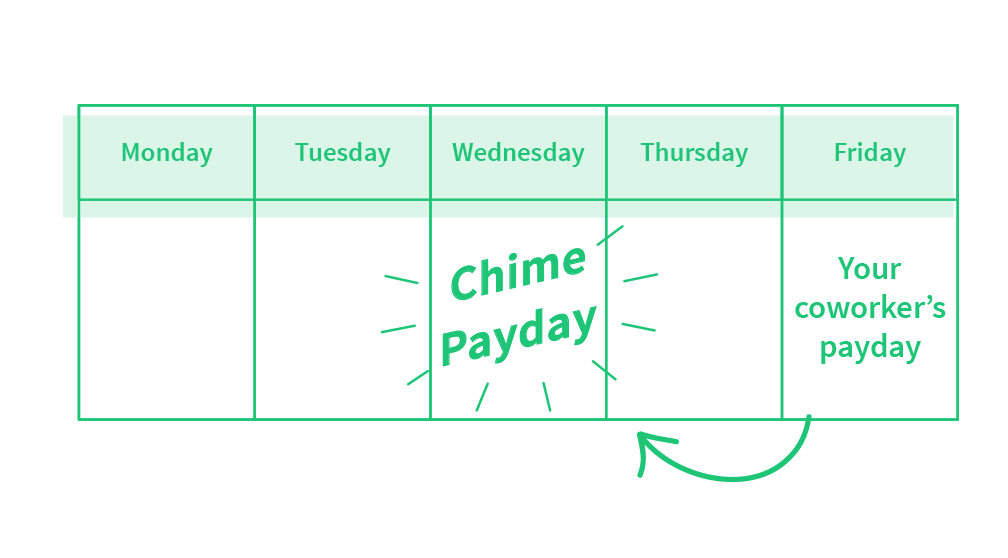

✓ Get paid up to 2 days early with direct deposit¹

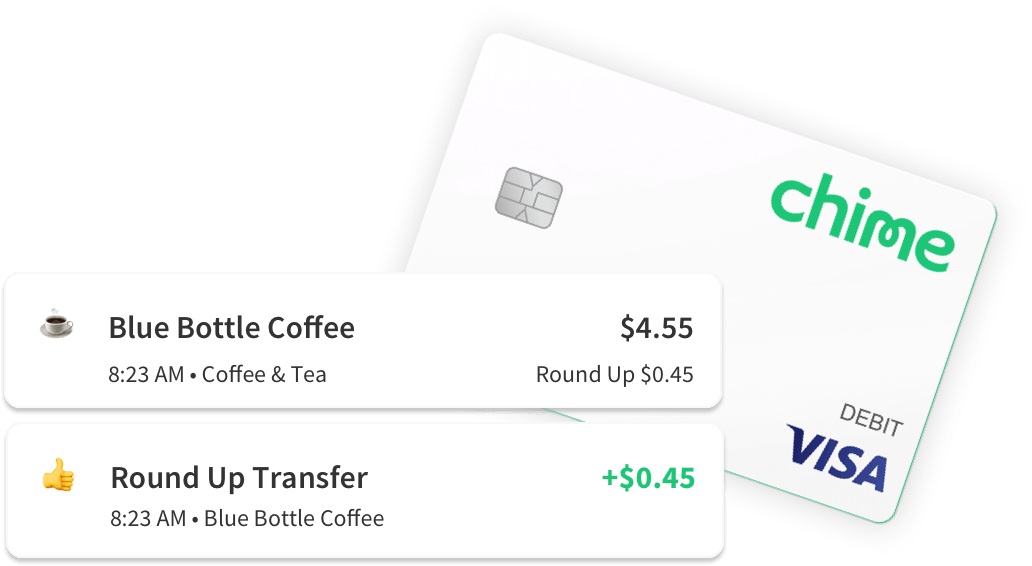

✓ Grow your savings automatically

✓ Free to apply and only takes 2 minutes!

Learn how we collect and use your information by visiting our Privacy Notice

Award-winning Mobile Banking

Chime is one of the fastest growing mobile banking apps in the U.S. with over 4.0 Million accounts opened to date. With Chime, you get a Chime Visa® Debit Card, a Checking Account, and an optional Savings Account – all managed through an award-winning mobile banking app that helps you have complete control of your money everywhere you go.

50,000+ 5-Star app reviews

Get your paycheck early.

Set up Direct Deposit and receive your paycheck up to 2 days earlier than your co-workers!¹

Say goodbye to unnecessary bank fees.

No minimum balance requirements. No monthly service fees. No foreign transaction fees. No transfer fees. Over 38,000 fee-free MoneyPass® and Visa Plus Alliance ATMs.

Grow your savings, automatically.

Reach your goals faster by saving money automatically. Our Automatic Savings features help you save money any time you spend or get paid.

Security and control on the go.

Chime’s mobile app makes branchless banking a breeze. Manage your money and account on the go, wherever you go.

Your deposits are insured up to $250,000 through The Bancorp Bank, N.A. or Stride Bank; Member FDIC.

Visa’s Zero-Liability Policy protects all unauthorized purchases.**

Over 38,000 fee-free ATMs and 30,000 cash-back locations.

Real-time alerts for every banking transaction.

Automatic Savings takes the effort out of saving.

No minimum balance fees or monthly fees.

Log in

Log in