Get a bank account with no monthly fees.

No monthly fees and no minimum balance fees

No overdraft fees

47,000+ fee-free1 ATMs at stores like Walgreens®, 7-Eleven®, CVS Pharmacy®, Circle K & more

Banking with no monthly fees

Learn how we collect and use your information by visiting our Privacy Notice ›

Banking shouldn’t cost you money.

You earned it, so you deserve to keep it. We believe an online checking account with no monthly fees should be available to everyone. That’s why Chime offers a checking account with no minimum balance fees and no monthly fees.

No fees for overdrafts.

Traditional banks charged $11 Billion in overdraft fees in 2019.2 At Chime, we do things differently. Instead of charging you an overdraft fee, we allow you to overdraft on debit card purchases with no fees when you qualify for SpotMe®.3 Learn more about SpotMe.

47,000+ fee-free ATMs at stores you love.1

Avoid out of network ATM fees. With Chime, you get access to 47,000+ fee-free ATMs1—more than the top 3 national banks combined! Find them at stores you love, like Walgreens®, CVS®, 7-Eleven® and Circle K. You can also use the map in your Chime app to find the closest fee-free ATM near you.

Checking Account and Debit Card with no monthly fees.

When you open a Chime Checking Account, you will receive a Visa Debit Card that can be used everywhere Visa debit cards are accepted. We also provide free debit card replacement.

Direct deposit

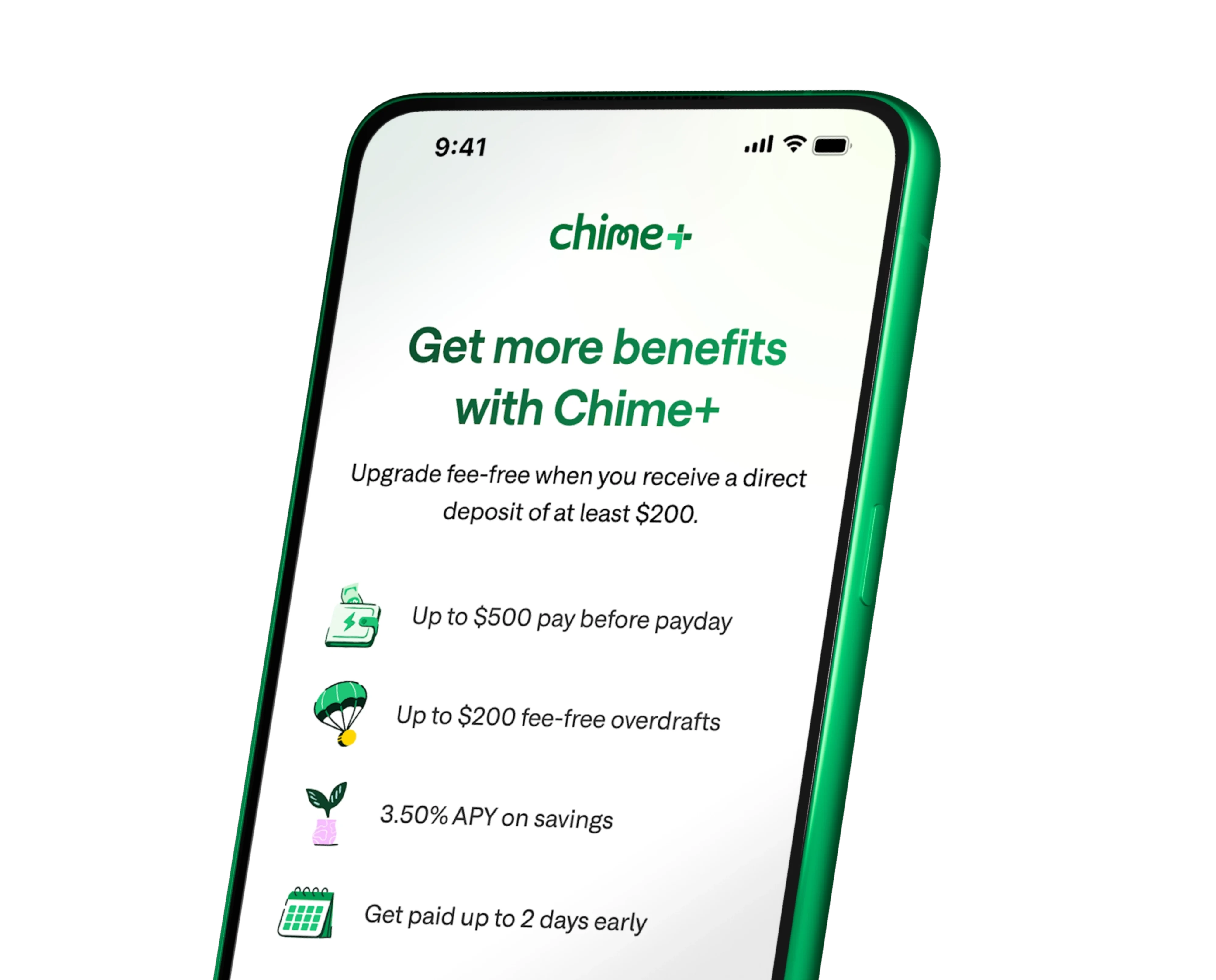

and get Chime+

for free.

Unlock even more Chime benefits when you

set up a qualifying direct deposit.4

Chime vs. Traditional banks.

You earned it, so you deserve to keep it. We believe an online checking account with no monthly fees should be available to everyone. That’s why Chime offers a checking account with no minimum balance fees and no monthly fees.

Chime | Chase5 | Bank of America6 | |

|---|---|---|---|

Overdraft Fee | $0 | $34 | $35 |

Minimum Balance Requirements | $0 | $25 | $100 |

Monthly Account Service Fee | $0 | $25 | $25 |

Get started today.

Applying for an account is free and takes less than 2 minutes with no impact to your credit score.