Calculating your approximate gross pay and take-home pay can help you estimate your income after taxes so you can manage your money with more confidence. Whether you’re a salaried or hourly employee, our paycheck calculator can estimate your gross and net income.

This calculator is a representational tool, and your actual take-home pay will be different based on your filing status and other factors. This calculator does not account for state income taxes or deductions like health insurance or retirement savings. This calculator assumes a filing status of single or Married filing separately. This calculator assumes you have no dependents. The calculator does factor in marginal federal income taxes. This calculator is for educational purposes only and is not intended to offer any tax, legal, financial, or investment advice.

Paycheck Calculator

Estimate your gross pay and post-tax take-home pay.

Get paid when you say, up to $500, with MyPay.^

How to use the paycheck calculator

Our paycheck calculator estimates weekly, biweekly, and monthly gross and net income – for both salaried and hourly employees. Use it as a starting point to learn your average take-home pay.

Here’s how to use it:

Hourly or salary: Select how you receive pay.

Hourly wage: Enter your wage per hour.

Average weekly hours: Enter how many hours you work weekly.

Annual salary: Enter how much you earn every year (if applicable).

Overtime hourly wage: If you have overtime pay to include, enter how much you earn per overtime hour.

Average weekly overtime hours: If you have overtime pay to include, enter how many hours of overtime you work weekly.

Put your details into the paycheck calculator to see your results.

How to calculate take-home pay

Net income, or your take-home pay, is the amount of pay you’ll actually receive, including overtime pay and after taxes, withholdings, and deductions.

To calculate net income, you’ll subtract federal taxes, deductions, and withholdings from your gross pay. Tax deductions can differ by state; however, everyone is subject to federal tax deductions regardless of which state they’re in.

For example:

- If your annual income (in a state with no income tax) is $60,000, you fall into the $44,726 to $95,375 tax bracket and can expect to pay a 22% federal tax rate.¹

- If we break this into monthly pay periods, your gross monthly income would be $5,000, and your net income would be around $3,980, not including deductions from health insurance, retirement contributions, or state taxes.

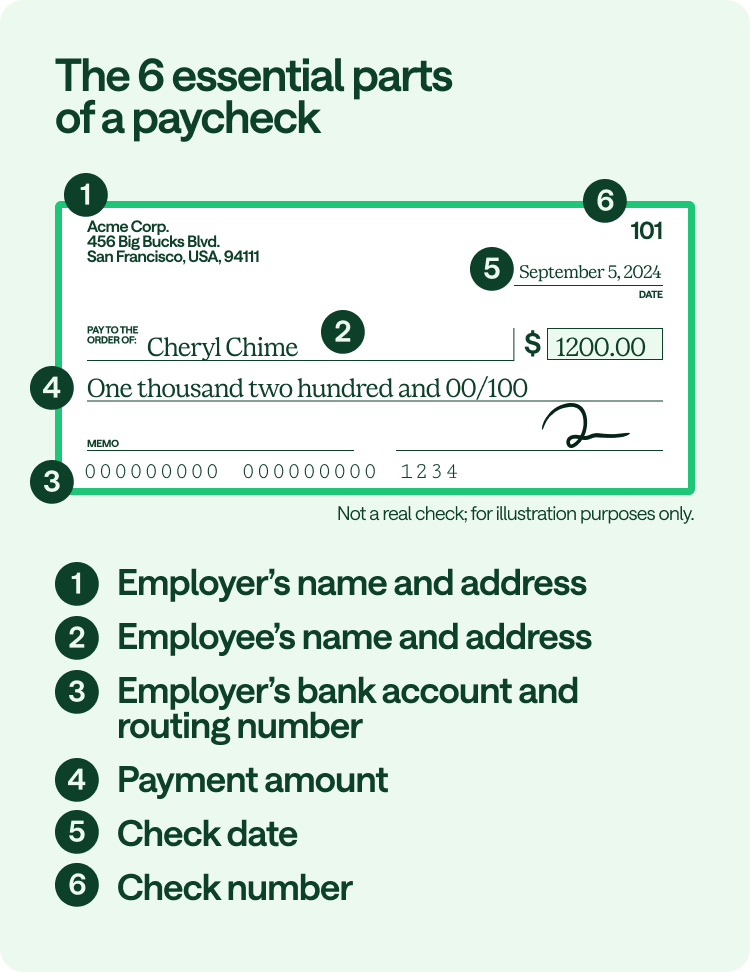

How to read a paycheck

Every paycheck should have the same essential parts. Here is what each part of your paycheck means:

- Check number: A unique identification number assigned to a specific check.

- Employer’s name and address: The official name and physical address of your employer or company issuing the check.

- Employee’s name and address: Your name and address.

- Check date: The date when the check is issued.

- Payment amount: The exact sum of money the employee earns, in both numerical and written form.

- Employer’s bank account and routing numbers: The bank account number and routing number of your employer’s account.

Your paycheck will generally be in the form of your net pay, or take-home pay, for this pay period.

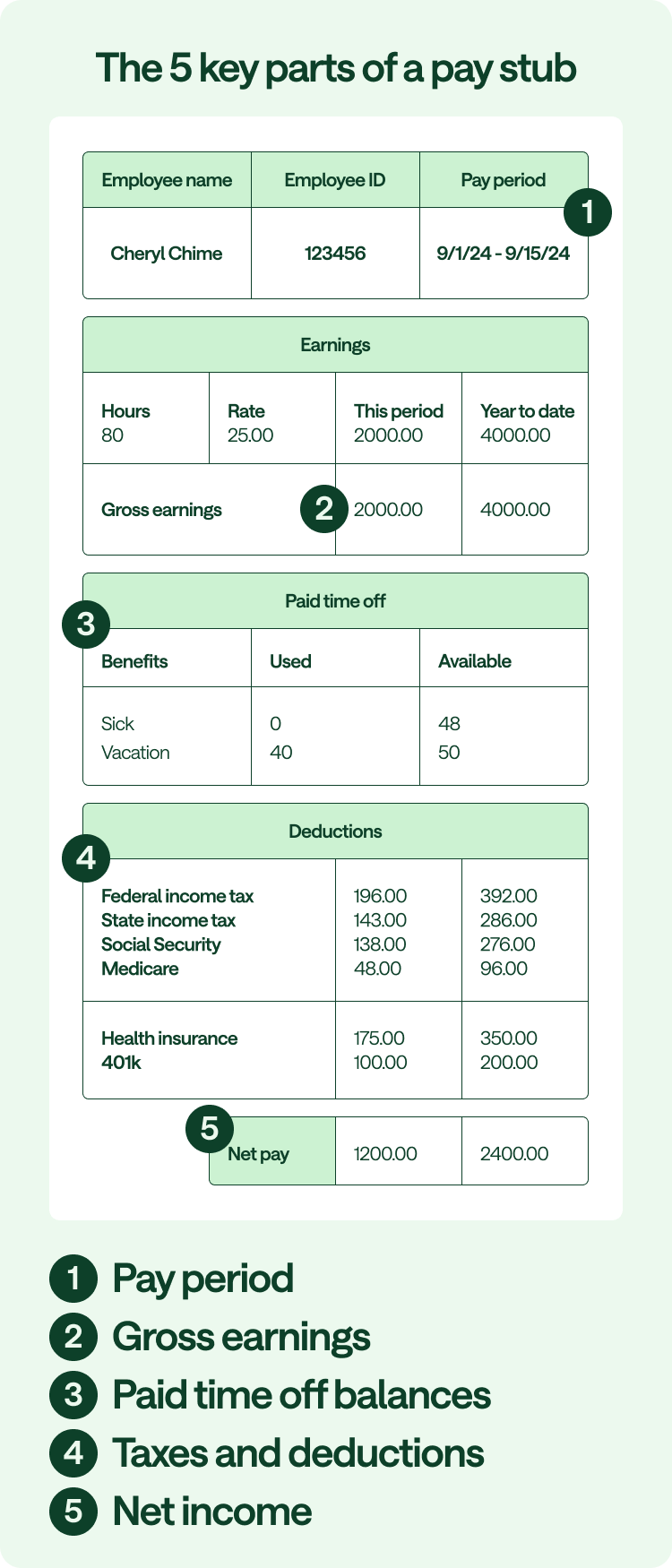

How to read a pay stub

A pay stub details your earnings, withholdings, and deductions each time you get paid at work. It’s a separate document that employers combine with your paycheck. Here are the main parts of a pay stub:

- Pay period start and end date: The time frame during which your work hours are recorded for calculating this paycheck’s earnings.

- Hours worked: The total number of hours you work during the pay period.

- Gross pay: The total earnings you receive before any deductions or taxes are withheld.

- Net or take-home pay: The amount you receive after deductions, taxes, and any other withholdings are subtracted from your gross pay.

- Federal taxes: The portions of your earnings withheld by the federal government to fund public services.

- State income taxes: Taxes from your state to fund local services.

- Medicare and Social Security: Deductions from your paychecks that contribute to Medicare and Social Security programs.

- Deductions for benefits: A sum from your gross pay to cover contributions to benefit programs, like health insurance and retirement plans.

- Year-to-date totals: Cumulative figures indicating the total earnings, deductions, and taxes withheld from your pay from the beginning of the calendar year to the present pay period.

- Paid time off (PTO) balances: The amount of accrued time off you have, including vacation days, sick leave, or other paid time off.

- Wage garnishments (if applicable): Court-ordered deductions from your wages to repay debts or other financial obligations.

Chime tip: Even if you receive your paycheck via direct deposit, your employer should still be able to provide a digital copy of your paystub for your financial records.

Understanding paycheck withholdings

Paycheck withholdings cover medical and social program expenses. Put simply, paycheck withholdings cover your financial obligations as a taxpayer.

Employers often take money from your gross pay in the form of:

Taxes: Mandatory financial charges from federal and local governments to pay for ongoing social services.

Social withholdings: A portion of your wage that covers your Medicare and Social Security contributions.

Deductions: Individual amounts subtracted from your gross income to fund retirement plans, health insurance premiums, or other employee-selected programs.

Your employer will share all of your relevant taxes, withholdings, and deductions on your pay stub. You can ask your employer to update your Form W-4 if you need to readjust your federal tax withholdings.

How paycheck withholdings work

Paycheck withholdings are calculated based on information provided by the employee on their Form W-4, which includes details like:

- Filing status: This indicates if you are filing as single, married filing jointly, married filing separately, or head of household. Different filing statuses have varying tax implications.

- Dependents: These are based on the number of dependents you have and other factors that can affect tax liability. Claiming more allowances generally means less withholding tax, while fewer allowances lead to higher taxes.

- Additional withholdings: This is an extra amount that you can request to be withheld from each paycheck to cover potential tax liabilities that may not be met by the standard withholding amount. This can help ensure you do not owe a significant amount in taxes at the end of the year.

Employers use this information to determine the appropriate amount to deduct from each paycheck, ensuring you pay the necessary taxes throughout the year.

State-based paycheck withholding considerations

Each state has its own rules and regulations for income tax withholding, which can significantly impact your paycheck deductions. Here are some state-based paycheck withholding considerations:

- State-specific tax rates: The rates at which states levy income taxes on individuals or businesses within their jurisdiction. Each state has the authority to set its tax rates, which can vary based on the state’s needs and budget requirements.

- Varying tax brackets: States often use a tiered tax system with various tax brackets, where different income levels are taxed at different rates. An individual may move into a higher tax bracket as their income increases, requiring them to pay higher taxes on additional income.

- State-specific deductions: These are specific allowances and reductions provided by the state’s tax code to help taxpayers lower their overall tax liabilities. State-specific deductions can include education-related costs, property taxes, or contributions to state-sponsored retirement plans.

- State-specific tax credits: These credits reduce the tax owed and can consider various criteria, like investments in renewable energy, childcare expenses, or income earned from certain sources within the state.

These brackets differ from federal tax brackets and are specific to each state’s tax structure. Some states have no income tax and require citizens to play a flat tax rate or impose different tax rates based on their income range.

Here is a breakdown of income tax criteria in each state:¹

| States with tiered income tax ranges | States with no income tax | States with a flat income tax rate |

|---|---|---|

|

|

|

†Iowa is transitioning to a flat tax rate by the 2026 tax year.¹

Employers must stay informed about the state’s specific requirements for accurate and compliant employee paycheck withholdings. Likewise, employees should familiarize themselves with their state’s withholding regulations to clearly understand how their take-home pay is affected and avoid any potential surprises come tax season.

How to calculate your paycheck

Here is the step-by-step process to manually estimate your paycheck:

Find your gross salary or hourly rate: You can find your gross income on your pay stub or offer letter.

Calculate the numbers of hours worked (if hourly): Add the hours worked during your weekly, biweekly, or monthly pay period.

Calculate additional overtime pay (if applicable): Multiply your hourly rate by one and a half times to calculate your overtime pay rate per hour. Multiply that number by the hours worked to calculate your overtime pay.

Add overtime pay to your gross income: Combine your overtime pay with your pre-tax gross income pay for this pay period.

Determine your tax bracket: See which federal tax bracket your annual income corresponds to.

Discover your federal tax rate: Your federal tax rate will depend on your annual income bracket. Multiply your gross income by your federal tax rate to discover how much you’ll pay in federal taxes.

Find your state income tax (if applicable): Check if your state has an income tax structure. If so, multiply your gross income by your state income tax rate to discover how much you’ll pay in state income taxes.

Subtract your total taxes from your gross income: Add your federal and state taxes together and subtract the sum from your gross income to determine your net income.

A quick example

Now that we know how to manually calculate our paycheck, let’s plug in some numbers to see the process in action. For this example, you earn $20 an hour. During a monthly pay period, you worked 40 hours every week. Here is the formula for calculating your gross pay:

Weekly gross pay = 20×40

Your gross pay for the week would be $800. To calculate which tax income bracket you’re in, we’ll need to multiply your weekly gross pay by 52 (since there are 52 weeks in a year).

Annual gross pay = (20×40) x 52

Your annual gross would come out to $41,600 in this example. Since that figure falls into the federal tax bracket range of $11,001 to $44,725, you’ll pay 12% of your annual income as taxes. We’ll use the equation below to crunch this number.

Federal income tax = 41,600 x .12

In this scenario, you’ll pay $4,992 in taxes this year. To calculate your net income for the year, simply subtract your taxes from your gross income:

Annual net income = 41,600 – 4,992

Your annual net income would equate to $36,608. To calculate your monthly net income, divide this number by 12.

Monthly net income = 36,608/12

Finally, your monthly net income would equal $3,051.

You can use the same formula to calculate different paycheck amounts. You can also add state income tax rates and overtime payments when those conditions apply.

Calculate your pay today

With the help of our paycheck calculator, creating a budget or a plan to tackle upcoming expenses doesn’t have to wait. You can begin approximating your take-home pay today – before your pay hits your checking account.

Are you ready to get paid when you say™? When you sign up for Chime, members in eligible states with qualifying direct deposits can try MyPay™. MyPay lets you get your pay when you want, up to $500 before payday.^

MyPay comes with no interest*, no credit check, and no monthly fees. You’re in control and can navigate the time between paydays with confidence.

Paycheck calculator FAQ

How do you calculate overtime pay?

Overtime pay is often one and a half times the regular rate.² Multiply the amount of overtime hours worked by the overtime pay rate to calculate overtime pay.

What percent will be taken out of my paycheck?

The percentage of federal taxes taken out of your paycheck depends on your income bracket. For example, if your income is $36,000, you fall into the $11,001 to $44,725 income bracket and will likely pay around 12% in federal taxes that pay period.

Is a pay stub the same as a paycheck?

No, a pay stub is not the same as a paycheck. A pay stub is a document that outlines the details of an employee’s pay, including earnings, deductions, and net pay. A paycheck is the physical or digital form of payment an employer issues to an employee.

How do I calculate my hourly rate as a salaried employee?

To calculate your hourly rate as a salaried employee, divide your annual salary by the number of hours you work in a year.

Log in

Log in