From planning for short-term needs like an emergency fund to reaching long-term goals in retirement, learn everything to know about how to set and reach achievable savings goals.

To use our savings goal calculator, enter your savings target, current savings, interest rate (if applicable), and when you want to reach your goal to figure out how much you should save each month.

Savings Goal Calculator

You need to save:

$XXX

per month for the next

X months

to reach your savings goal.

Your monthly deposit breaks down to:

Payment per day:

$XXX

Payment per week:

$XXX

This calculator is for educational purposes only. It calculates the amount you may need to save in order to reach a savings goal, based on the information you provide. Your estimated savings goal amount may change if any of the information varies. You should enter figures that are appropriate to your individual situation. The purpose of this calculator is not to offer any tax, legal, financial, or investment advice.

@chime Today’s savings look good on future you. 🔮 Link in bio to get the calculator. #savingmoney #fintok #moneytok #howtosavemoney #savemoney #savings #moneytips

How to set savings goals in 5 steps

Saving money can be a challenge, especially when you’re faced with a long list of expenses and limited income. But by clearly defining what you’re saving for and creating a plan you can stick to, reaching your savings goals becomes far more attainable.

Establish a plan for your finances and take control of your future: whether saving for a new car or finally paying off your credit card, here’s how to set savings goals in five steps.

1. Define your specific savings goals

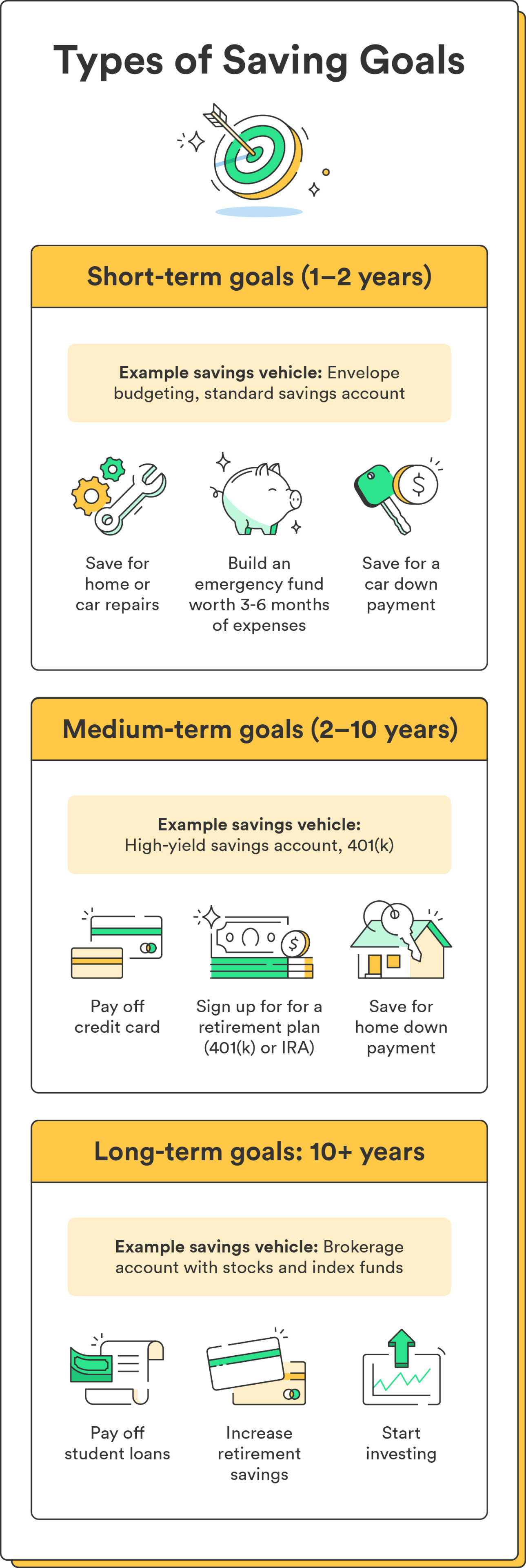

First, decide what you want to save for. Be as specific as possible – instead of setting a vague goal like “save more money,” think about what you want to accomplish with your savings. It can help to break them into short-term and long-term goals.

Key short-term goals:

- Building an emergency fund

- Paying off a credit card

- Paying off debt

- Saving for a car down payment

Key long-term goals:

- Increase retirement fund savings (like in a 401(k) or IRA)

- Saving for a child’s college education

- Paying off student loans

- Building a long-term investment portfolio

Once you know your top savings goals, write them down and keep them somewhere you can see them regularly.

2. Give each goal a deadline

Next, give each goal a deadline. When do you want to accomplish this goal? Without a specific time frame, it’s easy to lose sight of your goals and let them fall by the wayside.

Short-term goals, like building an emergency fund or saving for a vacation, can help build momentum and create a sense of accomplishment. Conversely, long-term goals, like growing your retirement fund, require more planning and patience.

Review your list of goals and determine when you need the money for each. Remember to be flexible with your timeline and adjust your savings goals if necessary.

3. Decide on a savings vehicle

Next, choose where you’ll keep your savings. There are several types of accounts to consider, each with its advantages and disadvantages:

- Savings account: This basic account allows you to deposit and withdraw money at any time. It typically offers low interest rates and is best for short-term savings goals, emergency funds, or a place to keep money you may need to access quickly.

- High-yield savings account: This account offers higher interest rates than a traditional savings account. Some of these accounts may require a higher minimum balance, but the extra interest earned can add up over time. High-yield savings accounts are best for long-term savings goals or people wanting to earn more interest.

- Money market account: Similar to a high-yield savings account, a money market account typically has a higher minimum balance requirement and may offer even higher interest rates. Money market accounts are best for people with more significant savings balances who want to earn the most interest possible.

- Certificates of deposit (CDs): CDs offer a fixed interest rate for a specific period, usually ranging from three months to five years. The longer the term, the higher the interest rate. CDs are best for long-term savings goals where you can afford to lock your money away for a set amount of time.

When choosing a savings vehicle, consider your savings goals, how quickly you’ll need access to your money, and how much interest you want to earn. The right type of savings account can maximize your savings and help you achieve your financial goals faster.

4. Determine how much to save each month

Knowing how much to save each month requires reviewing your monthly budget and making some calculations. Then you can determine how much you can save each month without sacrificing your essential expenses.

A good rule of thumb is to put at least 20% of your income toward savings. This practice aligns with the 50/30/20 rule, a budgeting method that divides your budget between needs, wants, and savings. Use whatever budgeting method works best for you – just be sure it sticks!

Once you have a clear picture of your monthly budget, calculating how much you should save each month is simple:

- Write your savings goal and deadline.

- Divide your savings goal by the number of months until your deadline.

This calculation shows how much you should save each month to reach your goal. If the amount seems too high, consider adjusting your deadline or finding ways to cut expenses to free up more money for savings. By tracking your income and expenses, you can see exactly where your money is going and quickly identify areas where you can cut back on spending.

@chime When your math isn’t mathing, we’ll do it for you. Head to the link in our bio to check out the ultimate budgeting calculator. #moneytok #fintok #howtobudget #budget #monthlybudget #budgetingforbeginners #budgetingtips #budgeting101

5. Track your progress

One of the keys to successfully saving for a goal is to track your progress consistently. There are several ways to do so:

- Create a spreadsheet

- Use a savings planner

- Use a budgeting app

Pick a method that’s easy for you to stick to. You could also set up monthly automatic transfers to your savings account. That way, even if you forget to track your progress one month, you know you’re still contributing to your savings goal.

In addition to tracking your progress, you should periodically review and adjust your goals if necessary. Things like getting a raise or running into an unexpected expense may warrant adjusting your goals temporarily or permanently. Regularly reviewing your goals can keep them achievable and relevant to your finances and life milestones.

Consistency is your friend when it comes to successfully tracking your savings goals. Set aside time each month to review your progress and make any necessary adjustments, and use our printable savings goal tracker to track and celebrate your milestones along the way.

Achieve your savings goals one step at a time

Remember, setting savings goals is not a one-time deal – it’s an ongoing process requiring consistency. But achieving your savings goals is an empowering and rewarding experience.

Stay the course and be flexible as your financial priorities change. It’s a marathon, not a sprint! You’re on the right track, and you’re closer to achieving your financial goals with each passing day.

Grow your savings automatically with Round Ups* and Save When I Get Paid† to reach your financial goals faster.

Log in

Log in