The download on Chime starts here.

Make financial progress with Chime in a few easy steps.

See how it works ›

How it works

Learn how we collect and use your information by visiting our Privacy Notice

What is Chime?

Chime is unlike any other banking app.

Chime® believes banking should be helpful, easy, and free. That’s why Chime doesn’t rely on overdraft fees, monthly service fees, or minimum balance requirements. If this sounds unlike your current banking app, it’s time to switch to Chime.

Simple.

Everything you need to unlock financial progress is in the app.

Simple.

Simple.

Everything you need to unlock financial progress is in the app.

Wallet-friendly.

No fees for signing up, overdraft, monthly service, minimum balance, or card replacement.

Wallet-friendly.

Wallet-friendly.

No fees for signing up, overdraft, monthly service, minimum balance, or card replacement.

Build credit and cash back.1

Everyday purchases and on-time payments2 can help safely build your credit with Chime Card.TM 3

Build credit and cash back.1

Build credit and cash back.1

Everyday purchases and on-time payments2 can help safely build your credit with Chime Card.TM 3

Get Paid When You Say.®

MyPay® lets you get up to $500 of your pay before payday.4

Get Paid When You Say.®

Get Paid When You Say.®

MyPay® lets you get up to $500 of your pay before payday.4

Millions

of people

trust Chime.

You earned your money, so you deserve to keep it. We believe an online checking account with no monthly fees should be available to everyone. And that’s why Chime is The #1 Most Loved Banking App®.5

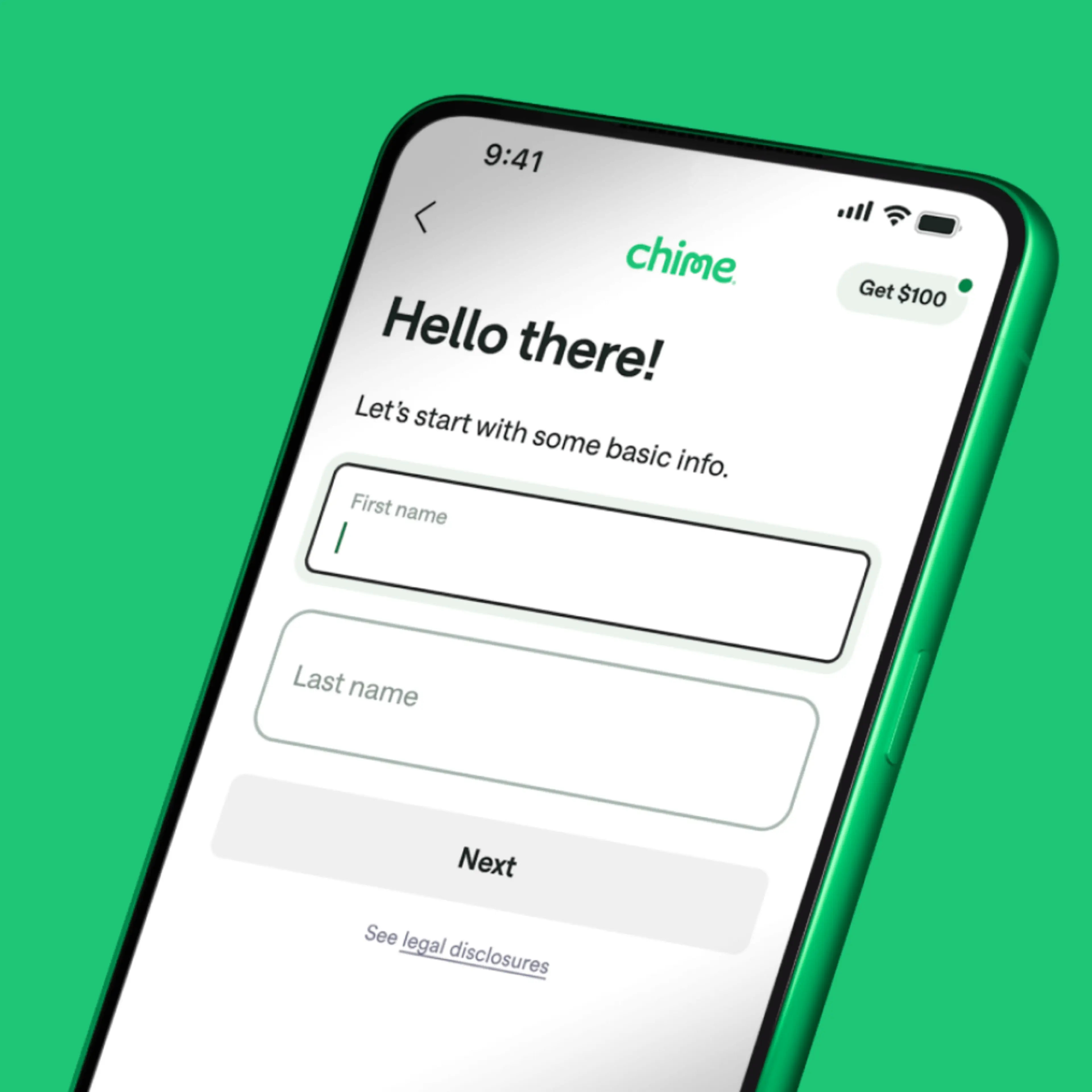

Long, boring setup process? Not here.

Two minutes— that’s all you need to set up your Chime account. The best part? It’s completely free to sign up. Since time is money, we make the steps easy, quick, and secure.

1. Fill in the basics

First, we’ll ask your first and last name, your date of birth to verify that you’re over 18, and an email to connect you to your account.

2. Confirm your account

Next, we’ll ask for your phone number, home address, and a password. We use this information to protect your account, mail you your card(s), and to keep in touch.

3. Verify your identity

To make sure you’re you, we’ll ask for your social security number (SSN). This won’t affect your credit score and your information is secured by strong encryption.

3 ways to fund your Chime account.

When it comes to depositing money into your Chime Checking Account, you’ve got options—like direct deposit, ACH transfers, and good old-fashioned cash deposits.6

Link a Checking Account.

Log into the other bank’s website or app

Look for the “Transfer” menu option

Once there, add your Chime routing and account numbers. Find them in the app under “Settings”

Set up direct deposit.

Open the Chime app and go to Settings to find your routing and account numbers

Provide your employer or payroll this information. You can even send it from the app

Chime takes care of the rest

Deposit cash.6

Open the Chime app and tap “Move Money”

Select “Deposit Cash” to see your closest retail deposit locations

Once there, just tell the cashier you want to make a deposit and give them your debit card or Chime Card.

Get Chime’s best features when you direct deposit.

You’ll unlock access to MyPay, SpotMe® fee-free overdraft up to $200,7 Get Paid Early,8 and more.

Open a Chime Checking Account in 2 minutes.

No credit check. No opening deposit requirement. No monthly fees.

Have questions about Chime?

Who can use Chime?

Legal residents of the United States 18 years and older are welcome to apply! While Chime cards work all over the world, currently we can only offer accounts to members with a valid SSN, living in the United States and District of Columbia.

What type of account am I opening when I enroll with Chime?

Chime is a full-featured checking account. Your account can receive direct deposits and it supports pre-authorized withdrawals and interbank transfers.

Chime gives you:

A Chime Visa® Debit Card

An FDIC-insured deposit account that can be managed entirely from your smartphone

An optional Savings Account that helps you save money without thinking about it

Deposits in deposit accounts opened through Chime are insured up to the standard maximum deposit insurance amount of $250,000 through our partner banks, The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. Chime is a financial technology company, not an FDIC-insured bank. Deposit insurance covers the failure of an insured bank.

Does Chime charge any fees?

We don’t believe in unnecessary fees or profiting from our members’ misfortune. We have no fees to sign up, no overdraft fees, no monthly service fees, no minimum balance fees, no transaction fees, and no card replacement fees either. We do charge one fee ($2.50) when you get cash from either an over the counter withdrawal, or an out-of-network ATM that is not part of Chime’s fee-free network of 47,000+ ATMs.9

Please note that third-party services, such as money transfer services used to deposit funds or out of network ATM used to withdraw funds to your Chime Checking Account may impose their own fees per transaction.

What ATM network does Chime use?

We have a network of 47,000+ ATMs9 for Chime members. Get fee-free transactions at any FCTI ATM in a 7-Eleven® location and at any Allpoint or Visa Plus Alliance ATM. To find a fee-free ATM near you, download the Chime mobile app and tap on ATM map. You can also search our ATM network.

Is the money in my Chime Account FDIC-insured?

Deposits in deposit accounts opened through Chime are insured up to the standard maximum deposit insurance amount of $250,000 through our partner banks, The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. Chime is a financial technology company, not an FDIC-insured bank. Deposit insurance covers the failure of an insured bank.

Is Chime secure?

Our top priority is protecting our members. We use 128-bit AES encryption, access control, and security processes to ensure your money is always safe with Chime. If you notice an unauthorized transaction, you can disable transactions on your Chime card immediately in the settings section of the Chime app and website to prevent further unauthorized card transactions.

Does Chime charge other fees?

Chime charges a fee if you withdraw cash from out-of-network ATMs or make over the counter (OTC) withdrawals. The fee is $2.50, and again, it only applies to out-of-network ATMs or OTC withdrawals.

You can withdraw cash without a fee at more than 47,000 Allpoint® or Visa Plus Alliance® ATMs or FCTI® ATMs located in retailers you love, like Target® and inside 7-Eleven® locations. FCTI ATMs not in a 7-Eleven® location will be subject to fee(s). Refer to your Chime app on how to find in-network ATMs.

Cash deposits6 are fee-free for Chime members at checkout counters at Walgreens® and Duane Reade® stores. Cash deposits made at other locations may incur a fee, which is charged by the merchant and not Chime.

While there is no mandatory fee to use MyPay and you can receive your advance fee-free* within 24 hours of requesting it, you have the option to get your MyPay advance instantly for $2 to $5 per advance.10

Does Chime have Fee-Free Overdrafts?

When do I receive my Chime Visa® Debit Card after I open a Chime Checking Account?

After you open a Checking Account, we get started on personalizing your new Chime Visa Debit Card. Your Chime Visa Debit Card is usually placed in the mail within one (1) business day after you open your Checking Account. It can take 7 to 10 business days for your Chime Visa Debit Card to arrive at your home address.

If you don’t have your Chime Visa Debit Card within 10 business days after opening your Checking Account, please contact our Member Services team at 1-844-244-6363.

How does Chime make money?

Chime makes money from the interchange fee charged on card transactions. Every time you use your Chime Visa® Debit Card and your secured Chime Visa® Credit Card for purchases and paying bills, Visa processes the transaction and charges an interchange fee to merchants for the service. Chime receives a portion of this fee. This is how Chime can continue building new and better products that help members get the most from their money.