MyPay™: The interest-free1 alternative to payday loans.

Payday loans can fill temporary cash flow gaps but often at a high cost. MyPay is an alternative to a payday loan that allows you to access up to $5002 when you need it without paying interest1 or oversized fees.

No credit check

No mandatory fees

Easy access to funds

Learn how we collect and use your information by visiting our Privacy Notice ›

A safer, long-term alternative to payday loans.

MyPay offers flexible, convenient access to your money when you need it. It’s a tool that can help you manage your finances between paychecks with less stress. Here’s what makes MyPay unique:

No interest.

MyPay charges no interest1 ever, as opposed to payday loans which are one of the most expensive ways to borrow, with some lenders charging effective interest rates approaching 400%.3

No credit check.

Bad credit? No credit? No problem with MyPay. There's no credit check required and using MyPay won't impact your credit scores.

No mandatory fees.

With MyPay, there are no subscription fees or mandatory fees. MyPay never requires you to tip, either. Payday loans, on the other hand, can come with fees ranging from $10 to $30 dollars for every. $100 borrowed.4

Get up to $500 before payday.2

Budget shortfalls and unplanned expenses happen. MyPay lets you access up to $500 without having to wait until payday. You can pay bills, buy groceries - whatever you need to cover the gap.

Ease and flexibility.

MyPay makes it as easy as possible to get up to $500 of your paycheck,2 with no credit checks, high fees, or interest.1 You can get cash when you need it and repay the balance with your next direct deposit.5

Instant transfers.

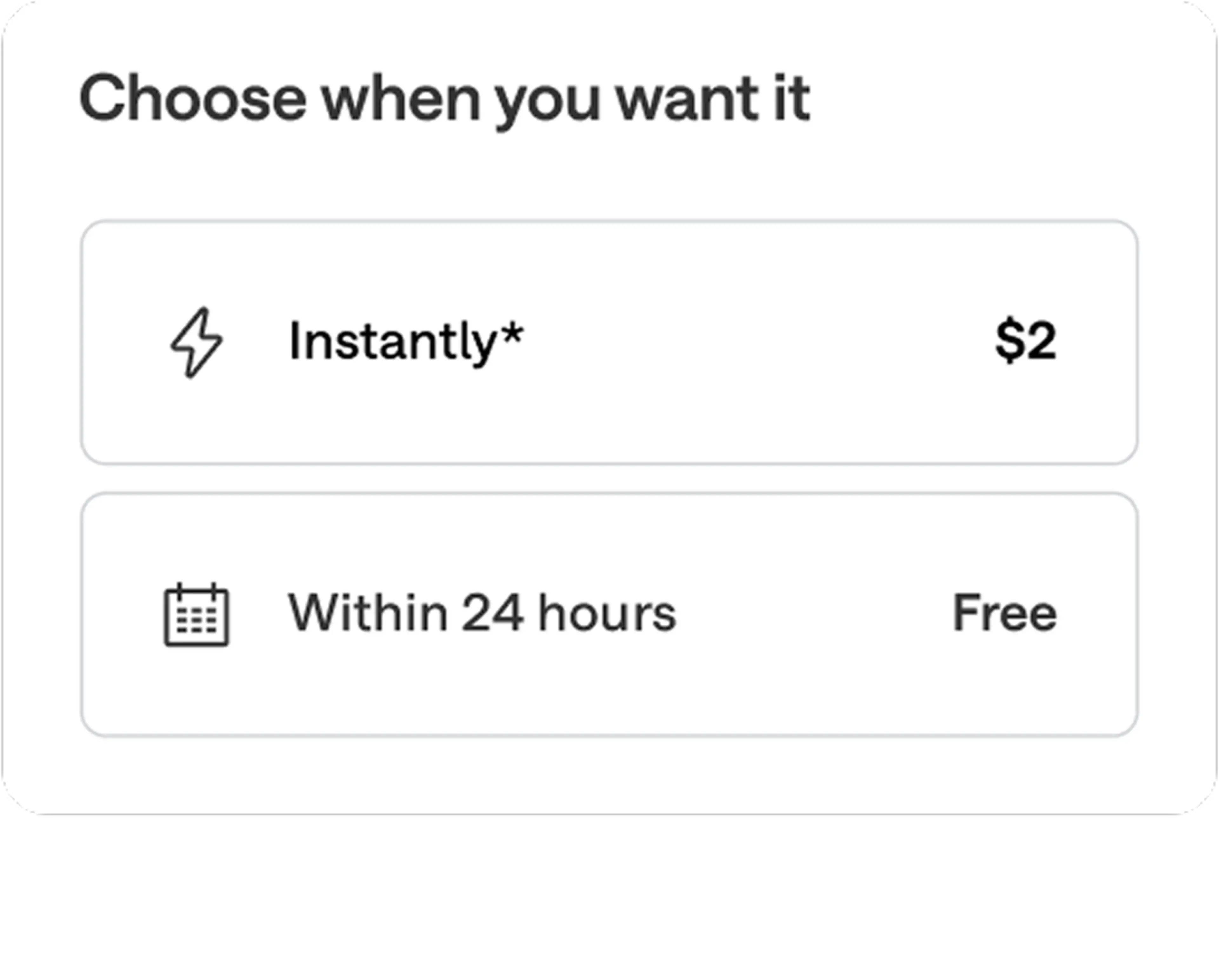

MyPay makes funds available within 24 hours, with no fee. If you need your pay faster, you can request an instant transfer, though a $2 to $5 fee per advance will apply.1

MyPay leaves other alternatives to payday loans behind.

MyPay sets itself apart from traditional payday loans, cash advance apps, and credit card cash advances. This is a simple, seamless way to access your money from future direct deposits with just a few taps of a button.

Chime | EarnIn6 | Dave7 | Brigit8 | |

|---|---|---|---|---|

#1 Most Loved Banking App™9 with no monthly fees | ||||

Fee-free daily access to pay1 | ||||

Fee-free overdraft10 | ||||

Fee-free credit building11 | ||||

Early payday (up to 2 days)12 | ||||

47K+ fee-free ATMs13 |

Get paid when you say.

Need your pay today? Get started with MyPay.

How to use My Pay

Getting a MyPay advance is easy. First, you'll need a Chime® Checking Account to get started, which is quick and easy to open online. Here's what you'll need to do!

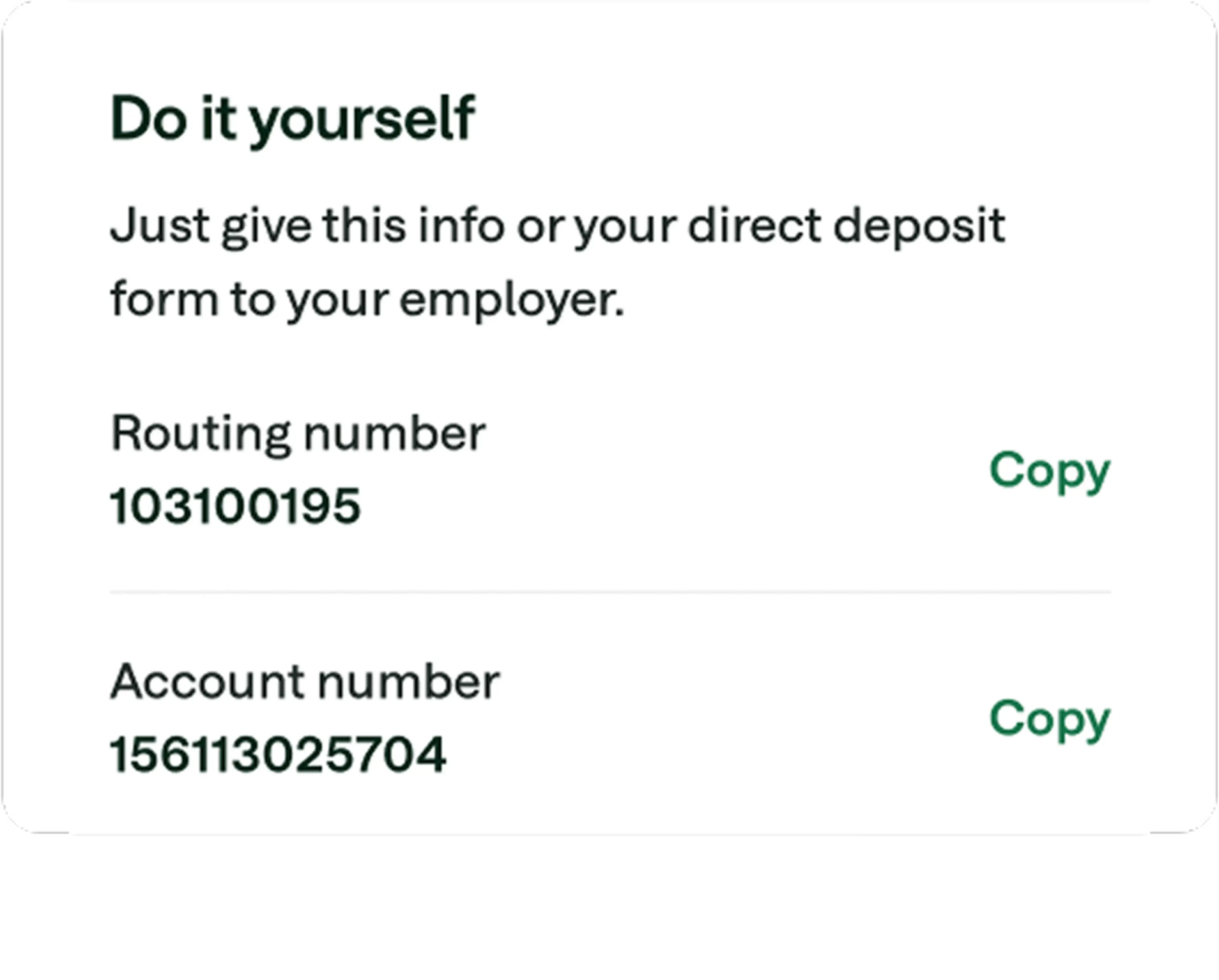

Set up Direct Deposit.

You'll need 1-2 qualifying direct deposits of $200 or more within 36 days in addition to other eligibility requirements.2

Go to MyPay

once you have enrolled and set up your direct deposit to see the amount you can take as an advance. MyPay limits range from $20 to $500 per pay period. Your limit is based on your direct deposit history, income, and other factors.

Tap 'Get Money'

and enter the amount you'd like to receive. The amount you can enter should be equal to or less than your MyPay available credit limit.

Pick your funding speed.

Choose Instantly to receive your pay right away for $2 to $5 per advance1, or select 'Within 24 hours' to get a fee-free advance. Instant Advance fees are deducted from your Chime checking account.

Tap 'Next' to complete the transfer.

If you chose Instantly for funding speed, you should see the money in your Chime account right away. Otherwise, you'll need to check back in 24 hours to confirm that your advance has hit your account.

Being able to get that $500 boost when needed has helped me avoid paying late fees for bills that come sooner than the paycheck.

Shirley F.

I am not always able to make my paycheck stretch long enough until next payday. Having access to my pay when I need it is quite important and can make a really big difference in my overall wellbeing.

Brittany J.

This has literally been a life saver for pet and car emergencies. Being able to get my pay on my terms when I need it has literally saved my pets' life. I've been able to pick up the tab for friends at the last minute, and even go on spontaneous trips.

Catherine L.

Now that I have access to MyPay, you couldn't ask me to go back. It helps out with everything in my life.

Ryan L.

Thanks to MyPay, I can live life a little easier. I have access to my money, when I need it! That type of peace of mind is almost unheard of!

Joseph H.

Real members. Paid testimonials.

FAQs

What is a payday loan?

A payday loan is a short-term, high-interest loan that allows you to borrow against your paycheck.3 Repayment is due on your next payday unless you roll the loan over. You can apply for payday loans online or in person through a local lender.

Are payday loans bad?

Payday loans generally have a negative reputation due to their high interest rates and fees. Payday lending can also lead to a cycle of debt if you continuously roll the loan over versus paying it off on your next payday. Compared to personal loans, payday loans are often a more expensive way to borrow.

How do payday loans work?

Payday loans work by allowing you to access some of your future pay. You can get cash the same day and repay it when you get paid again. Payday lenders can charge fees for payday loans, though fees (and loan amounts) are typically capped by state law.4

Do payday loans check credit?

It’s common to see advertisements for payday loans without a credit check or payday loans with bad credit accepted. Payday lenders often don’t require a minimum credit score to borrow. Approval for a payday loan more often hinges on your income and whether you have a bank account.

What do you need for a payday loan?

Fast payday loans often have minimal requirements to apply and get approved. Lenders may ask you for a valid, government-issued photo ID, a copy of your paystubs, and a bank statement or your bank account number and routing number. You’ll also need to provide some basic personal information like your address and phone number.14

MyPay, on the other hand, requires only a Chime Checking Account with a qualifying direct deposit. With MyPay there are no fees typically associated with payday loans or other types of instant loans.