Get a Chime Visa® Debit Card online.

No monthly fees or maintenance fees

Over 47,000 fee-free ATMs1

Real-time transaction alerts

Chime Visa® Debit Card

Learn how we collect and use your information by visiting our Privacy Notice ›

A debit card you can count on.

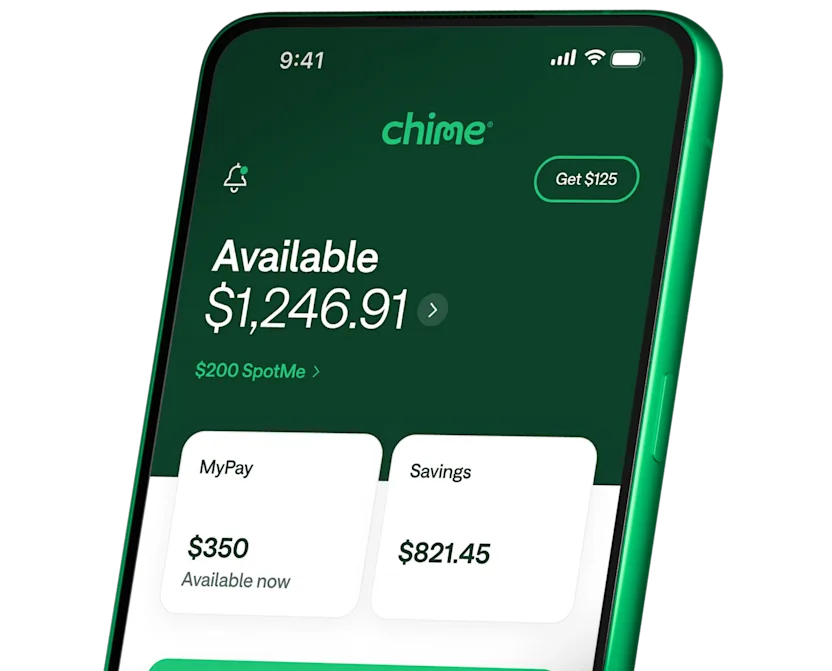

Unlock your financial future with a Chime Visa® Debit Card. Avoid replacement fees and maintenance fees, control your debit card security from your app, get cash back with Chime Deals2, and get cash from over 47,000 fee-free ATMs.1

Sign up for your debit card for free.

Your new Chime Debit Card works anywhere Visa® is accepted

Start using your virtual debit card right away for online purchases

No minimum balance requirements or account maintenance fees

Customizable debit card security.

Get real-time transaction alerts

Disable transactions from the app if you lose your debit card

Still missing? use the app to order a replacement debit card

Pay with your phone

Leave your wallet at home. Connect your virtual debit card to your mobile device. Enjoy quick, secure mobile payments with platforms like Google Pay™ and Apple Pay™.

Grow your savings automatically.

Turn on Round Ups to transfer the change from every purchase on your debit card to your savings account.3 Use Save When I Get Paid to save a percentage of every paycheck automatically.4

Get up to $5005 of your pay before payday.

MyPay lets you get paid when you say. No interest6 and no mandatory fees.

Overdraft up to $200 with no fees7

We understand finances can be tight sometimes. SpotMe® allows Chime members to borrows a bit of money when they need it.

Over 1 Million 5 Star Reviews

4.8

App Store

(1M Reviews)

4.7

Google Play Store

(780K Reviews)

Chime Visa® Debit Card vs. our competitors.

Wells Fargo8, 9, 10 | Chase11, 12 | ||

Overdraft fee | 0 | Up to $35 | Up to $34 |

Monthly account service fee | $0 | Up to $35 | Up to $35 |

International transaction fee | $0 | Up to 3% | Up to 3% |

Fee-free ATMs | 47,000+ | 11,000 | 16,000 |

Direct deposit and get Chime+ for free.

Unlock even more Chime benefits when you set up a qualifying direct deposit.13

How to get a Chime Visa® Debit Card in a few steps.

Sign up in 2 minutes.

Apply for Chime by telling us your name, address, date of birth, and social security number.

Download the Chime app.

Get started on chime.com or log into the mobile app. Set up direct deposit or connect your current bank account to transfer money to your debit card.

Use your virtual debit card today.

Make digital purchases with your virtual debit card. Head to Settings in the Chime app, scroll down to Debit Card, and tap View your card.

Your physical debit card ships in 7-10 business days.

Keep an eye on the mail for your new Chime Visa® Debit Card!

Your Chime Visa® Debit Card awaits.

Apply online for free in less than 2 minutes with no impact on your credit score.

Still have questions about debit cards?

How do I open an online Chime® Checking Account and get a Visa® Debit Card?

Applying for a Chime Debit Card is free and signing up for an account takes less than 2 minutes. Here’s how to apply online:

Visit chime.com to apply and enter your personal info to complete the enrollment. You’ll need:

Your first and last name

Phone number

Date of birth

Email address and an account password

Social Security number

Home address

18+ U.S. Citizen or resident of 50 United States

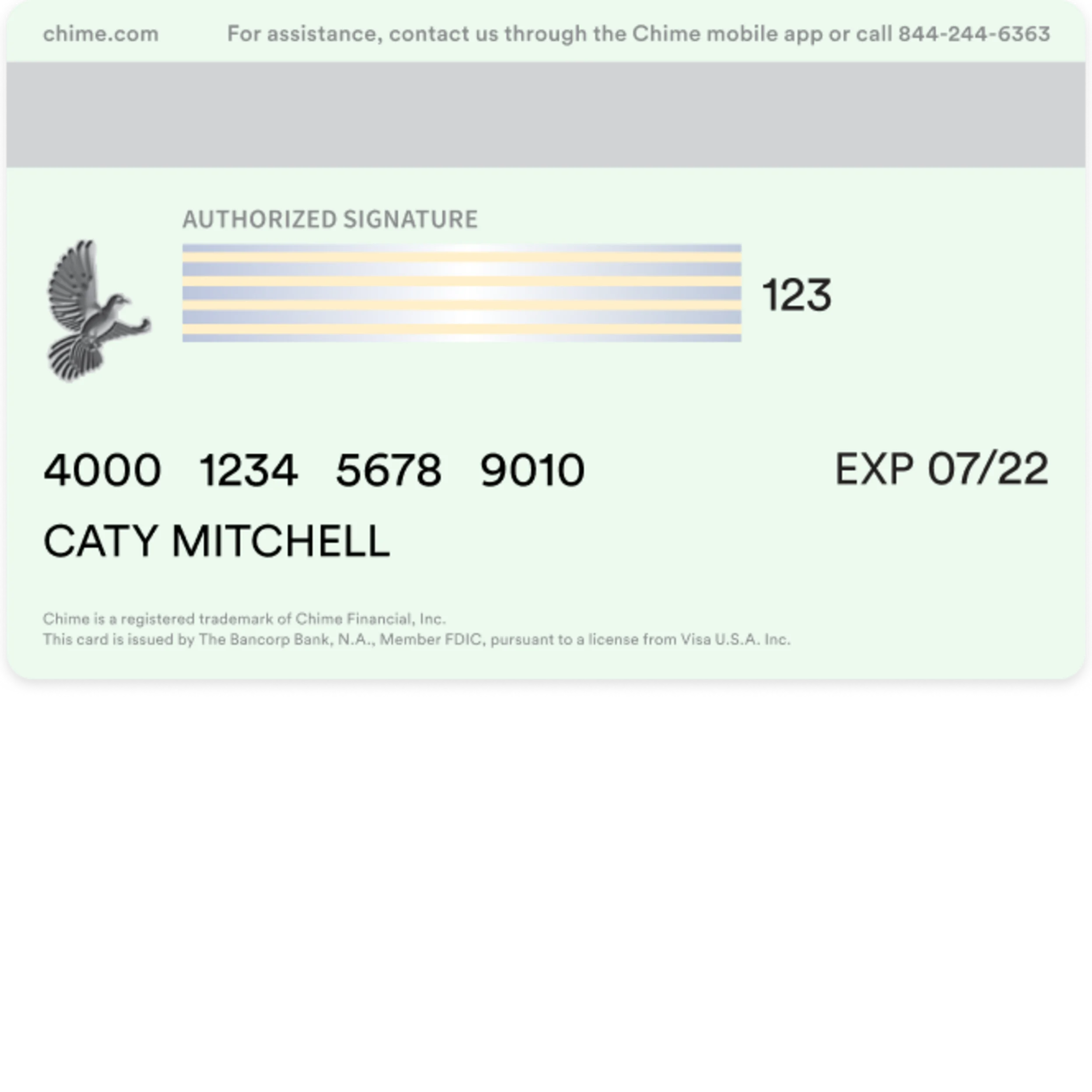

Once enrollment is completed, we’ll send a Chime Visa® Debit Card in the mail to the address you provided. Your free debit card typically arrives in 7-10 business days.

Download our mobile banking app and log in. You can connect your existing bank account to transfer funds or set up direct deposit to your Checking Account. You can also log in to online banking at chime.com whenever you need it.

Do I need a credit check to get a Chime Visa® Debit Card?

Chime does not require a credit check to open an account and receive a Chime Debit Card.

How do I activate my Chime Debit Card?

You just received your Chime Debit Card in the mail. Welcome! To activate your Visa® debit card:

Log in to your account.

You should see a card status widget that reads, “Your card was delivered.” Tap the Activate button.

If you do not see this button, ask the Chatbot “Activate my card”.

You’re all set! Now you can start using your free Chime Debit Card in stores. If you have any problems activating your Chime Debit Card, contact our call center at 1-844-244-6363.

Where can I use my Chime Debit Card?

Your Chime Visa® Debit Card works everywhere Visa® debit cards are accepted.

Does my Chime Debit Card have a chip?

Your Chime Visa® Debit Card comes equipped with the latest EMV chip technology to make your debit card more secure.

Will I ever be charged an overdraft fee through Chime?

No. If you don’t have sufficient funds in your Chime Checking Account or have reached your SpotMe limit (if enrolled), your Chime Visa® Debit Card will be declined. There is no fee for declining transactions or for utilizing SpotMe.

How many ATMs accept the Chime Debit Card?

You can get cash with your debit card at more than 47,000 fee-free ATMs – that’s more than the top 3 national banks combined! Bank ranking and number of ATMs according to U.S. News & World Report® 2023.

Find fee-free ATMs at your favorite retail stores like Walgreens®, CVS®, and 7-Eleven®. Enjoy fee-free debit card transactions at any FCTI ATM in a 7-Eleven location and at any Allpoint or Visa Plus Alliance ATM. Otherwise, out-of-network ATM withdrawal fees may apply.

How can I see the checking account or card number for my debit card?

To see your routing number and account number, go to Move Money and select Direct Deposit in the Chime app or at chime.com.

To see your card number, go to Settings, scroll down to Account info, and select your card under View cards.

Is a Chime Debit Card Visa® or Mastercard®?

The Chime Debit Card is a Visa® debit card.

Does Chime offer free prepaid debit cards?

Chime does not offer a prepaid debit card. However, Chime offers a full-featured deposit account that is a great alternative to prepaid cards. Your account can receive direct deposits, and it supports pre-authorized withdrawals and interbank transfers through the Automated Clearing House (ACH) Network. Deposits are FDIC insured to at least $250,000 through The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

What if my Chime Debit Card is lost, stolen, or misplaced?

If you need a new debit card, tap the “Replace My Card” button in the Card Settings of your Chime app. You will be asked whether your card was Lost, Stolen, or Damaged.

After confirming your address, a replacement card will arrive within two weeks. Keep an eye out for a green envelope.

In the meantime, you can continue to make purchases using your virtual debit card.

Can you activate a Chime Debit Card over the phone?

The easiest way to activate any Chime Debit Card is via the Chime app (version 3.3 or later):

After you log in, you should see a card widget at the top of the app that says “Card Status”

In the widget, you should see a big green button that says “Activate Card”

If you do not see this button, ask the Chatbot “Activate my card”. Chatbot is available from the top of the home screen.

If you have any problems activating your Chime Debit Card, contact our call center at 1-844-244-6363.

Does my Chime Debit Card include any insurance?

Chime Debit Cards are backed by Visa’s Zero Liability Policy14. Members can shop worry-free at millions of locations, knowing they’re not responsible for unauthorized charges if their Chime Visa® Debit Card is lost, stolen, or fraudulently used, online or offline. Members must notify Chime immediately of any unauthorized use. For specific restrictions, limitations, and other details, please consult your issuer.

How do I add money to my Chime Debit Card?

To have money available on your debit card, you’ll need to add money to your checking account. There are many ways to do so.

One option is to set up direct deposit by providing your Chime routing and account number to your employer or payroll provider. Your routing number can be found in the Move Money and Settings sections of the Chime app or at chime.com. You can also have a direct deposit enrollment form emailed to you from the Move Money section of the Chime app.

We will only post deposits that are sent under your name. All others will be returned to the sender.

Another way to add money to your checking account is through a mobile check deposit or bank transfer. Read our help article for full instructions.

You can also deposit cash into your Chime Checking Account15 at several participating stores.