File taxes 100% free. Max out your refund, aka your free-fund.™

File your federal and state taxes for free with 100% accuracy guaranteed,1 max out your tax refund,2 and get your federal tax refund up to 5 days early3 when you direct deposit it with Chime.

Truly free to file.

No upsells, ever.

100% accuracy.

File your federal and state taxes confidently, 100% for free. Zero fees to file. No upsells. No, really.

Get your maximum tax refund with 100% accuracy.1 You’re covered up to $10,000 if the IRS finds an error.

Federal tax refunds shouldn’t wait. Yours comes up to 5 days early3 when you deposit it with Chime.

Did you know? Your child could be eligible for a free Trump Account.

Give your child a jump start with a Trump Account, a new free investment account with tax benefits for children under 18. Eligible children could get a free $1,000 from the U.S. Treasury. File your taxes for free through Chime to enroll.

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

100% free to file

How it works

How to file taxes for free through Chime.

1. Become a member

Sign up in minutes. Download the Chime App or enroll here.

2. File your taxes

It’s easy, free, and all through app. From your home screen, tap Taxes to get started. Have your key tax documents handy for easy filing.

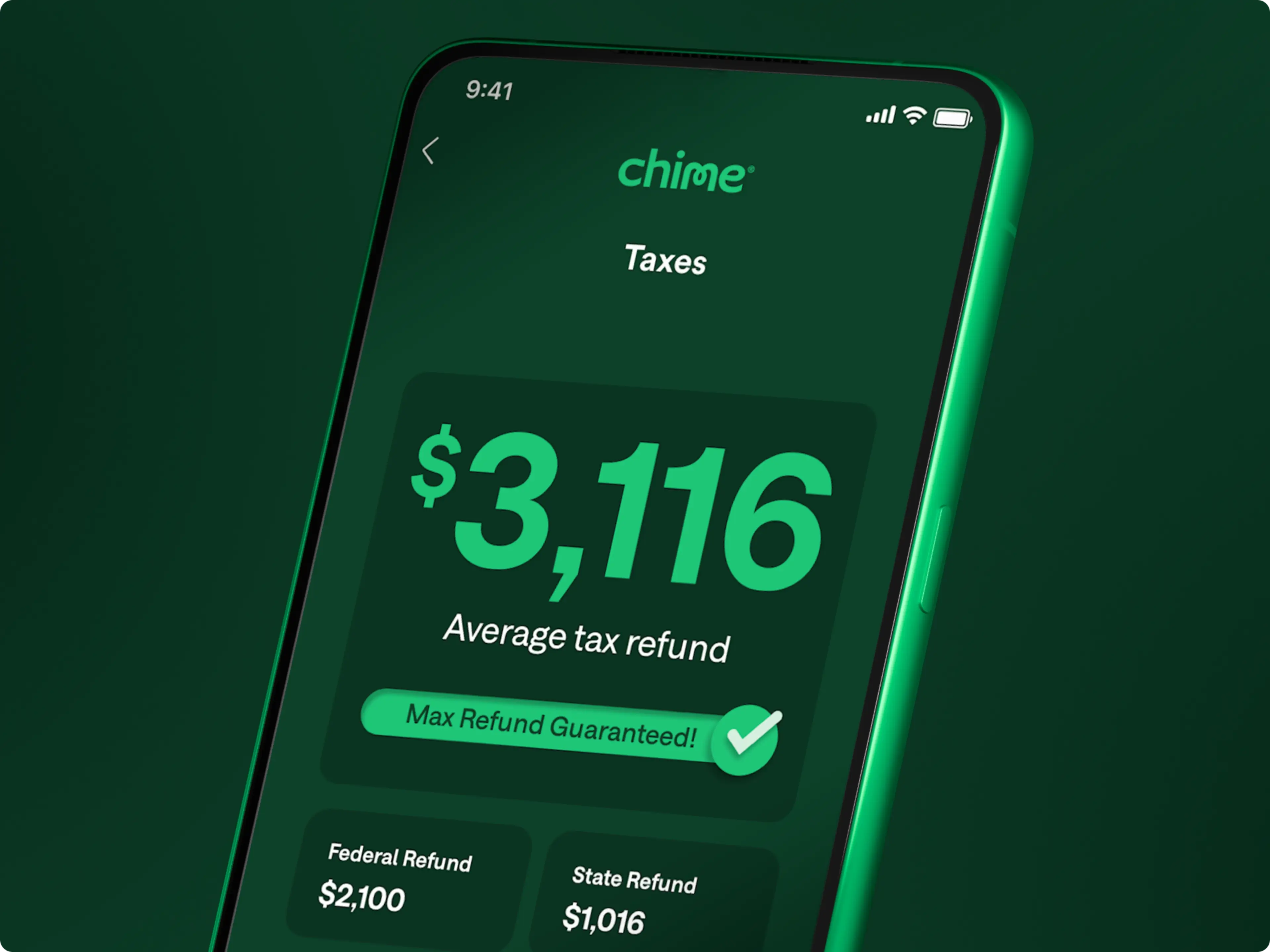

3. Max refund guaranteed

Max out your refund and get it up to 5 days early when you direct deposit it with Chime—100% accuracy guaranteed. Make your refund go further when you deposit it with Chime.

Money doesn't grow on fees.™

So why pay to file taxes? Answer: you shouldn't. See why it's smarter to file through Chime.

Through Chime | TurboTax4 | H&R Block5 | FreeTaxUSA6 | |

100% free to file for federal and state tax |

|

|

| |

No additional fees or upsells | ||||

100% accuracy guaranteed |

|

|

| |

Max refund guaranteed |

|

| ||

Covers most common tax situations |

|

| ||

Free tax filing support |

|

|

|

Tax e-file services provided by April Tax Solutions Inc. (“april”).

Don't miss your max refund. The average tax refund is $3,116.7

$ Billions

in tax refunds deposited with Chime8

IRS authorized

for secure tax filing

File 7x faster9

than the IRS reported national average

Chime member testimonials

I filed my taxes with Chime this year and couldn't have had a better experience! It was super easy and only took me a total of 20 minutes9 to finish.

Kristie S.

First time ever filing my own taxes. It was so easy ... AND IT WAS FREE!! And received my refund before the IRS even gave me a deposit date.

Pamela S.

I normally use TurboTax because it is free. I was told at the end I would be charged $125 for a simple tax return. Thankfully I opened my Chime app and was able to do my taxes for free. I received my tax return very fast, and without any issues.

Matthew H.

Real members. Paid testimonials.

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

100% accuracy guaranteed

Have questions about filing through Chime?

The following is publicly available information and general details on filing personal taxes through Chime, not tax advice. Please consult your accountant for tailored tax guidance and visit IRS.gov for tax filing resources.

How do I file my taxes through Chime?

We partner with april to help you file your taxes for free directly through the Chime app. Yes, it’s actually free for both federal and state. Plus, get your federal tax refund up to 5 days early when you direct deposit it with Chime.

File with someone else last year? No problem. Just upload last year’s form and the rest is handled for you.

If you’re not a Chime member already, enroll today so you don’t have to pay to file your taxes this season.

Why is it free to file taxes through Chime?

At Chime, we want banking services to be easy, accessible, and most of all, free. And now we’ve made tax filing free when you file through Chime (in partnership with april to power the experience).

So far, billions in tax refunds have been deposited with Chime.8

File through Chime for a better way to file your taxes:

Truly 100% free to file, including for federal and state

Accurate calculations guaranteed to get you your max refund. Don’t settle for less than what you’re owed.

Get your federal tax refund up to 5 days earlier when you direct deposit it with Chime.

If you’re not a Chime member already, enroll today so you can enjoy 100% free tax filing.

When can I start filing my taxes for 2025?

You can start filing through Chime starting early January.

Remember—the earlier your file, the earlier you can get your refund. File in early January to be one of the first in line when the IRS starts processing returns.

When are 2025 taxes due?

The tax filing deadline is April 15, unless you file for an extension. Make sure to file before the deadline to avoid IRS penalties.

What documents do I need to file my taxes?

To file your taxes smoothly and get your refund faster, have these ready:

Personal info: Social Security number (or ITIN), current address, and bank details for direct deposit.

Income forms:W-2 for employer income

1099 for freelance, gig, or contract work

1099-INT for bank interest (including Chime)

Other 1099s for unemployment, investments, or retirement income

Deductions & credits: Receipts for education, child care, donations, or mortgage interest

Last year’s return (optional, but helpful)

For a full checklist, visit Chime’s Tax Documents Checklist.

How do I file a tax extension?

Filing an extension for federal taxes doesn’t automatically extend to your state tax deadline. Here’s the breakdown:

Methods for filing a federal tax extension:

Pay online: Make a payment through an IRS online payment option like IRS Direct Pay, or by debit or credit card, and indicate that the payment is for an extension. This automatically grants you an extension without needing to file a separate form.

Use tax software or a tax professional: Tax software programs and tax professionals can electronically file an extension for you.

Mail Form 4868: Print and mail a paper copy of Form 4868 to the IRS by the tax deadline.

For your state extension:

Check your state’s tax authority to determine its specific extension rules.

Not sure if you should file one? Read more at our guide to tax extensions.

What happens if I file taxes late?

If you miss the filing deadline and owe taxes, the IRS charges penalties and interest until you file and pay. The failure-to-file penalty is usually 0.5% of unpaid taxes per month, up to 25%.

If you’re owed a refund, there’s no penalty—you just won’t get your refund until you file. Even if you can’t pay in full, file as soon as possible to reduce penalties or set up a payment plan.

Learn more in our guide to filing late taxes.

What is a tax refund check?

A tax refund check is money the government gives you when you’ve paid more in taxes than you actually owed for the year.

For four common scenarios that can lead to receiving a tax refund and whether you qualify for certain tax credits, explore more here.

How long does it take to get a tax refund?

The IRS typically issues most refunds in less than 21 calendar days. If you direct deposit your federal tax refund through Chime, we make it available to you even sooner—up to 5 days early.

Where's my tax refund?

You can usually expect your tax refund within about three weeks if you e-file and choose direct deposit. Paper returns can take four weeks or more. To track your refund, use the IRS’s “Where’s My Refund?” tool or the IRS2Go app.

What tax situations are covered through Chime?

Just about everything. Salary, self-employed, freelance, gig work income, unemployment income, crypto or stock sales, and itemized deductions:

W-2 income: Standard income from an employer.

Self-employed income: Including freelance and gig-economy work.

Unemployment income: Benefits received during periods of unemployment.

Retirement income: Distributions from retirement plans.

Social Security income: Income received from Social Security benefits.

Investment income: Income from stock and cryptocurrency sales.

Bank account interest: If you earned over $10 in interest, Chime will provide a Form 1099-INT.

And remember it’s 100% free to file. Always.