Once you file your taxes, you’ll eagerly anticipate your IRS tax refund hitting your account. It’s hard to wait, and the IRS’s timeline can lag if there are any errors with your tax return.

If your return is error-free, there are ways to speed up the refund process and access your tax return status as soon as possible.

Let’s take a look at how the tax refund process works, the estimated tax refund schedule for 2025, and how to check your tax refund status.

When will I get my 2024 tax refund?

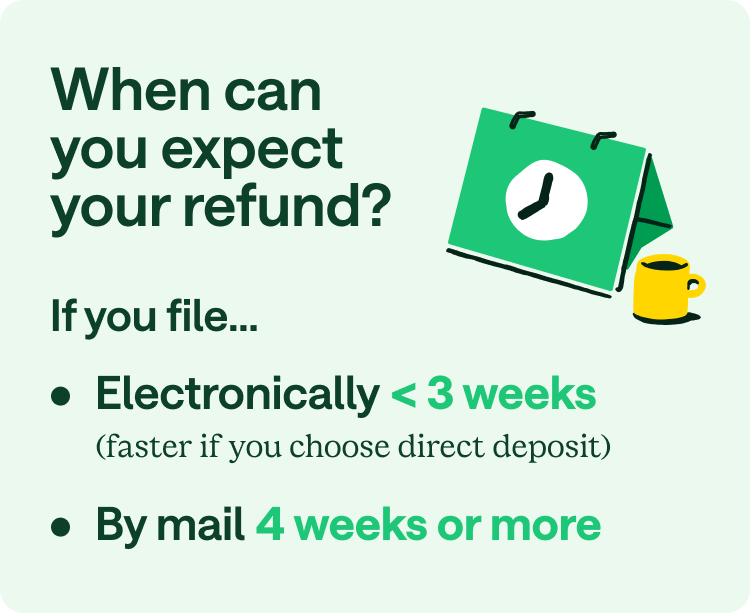

If you e-filed your return, you could receive your refund through direct deposit faster than if you mailed in your tax documents. You can expect a paper tax refund in the mail in 4 weeks or more. You can usually get an electronically filed refund in less than three weeks – even faster if you choose direct deposit.¹

Although direct deposit is faster, you should still expect to wait a few extra days for the funds to show up in your account. Depending on your financial institution, your waiting time may vary.

To e-file, you can file online through the IRS Free File tool.

When e-filing, you’ll indicate how you want to receive your payment. While direct deposit is the most popular, there are several ways to receive your federal tax refund:¹

- Direct deposit (you can split this among three separate financial accounts)

- Paper check

- Prepaid debit card

- Mobile payments app

- Contribution to a traditional IRA, Roth IRA, or SEP-IRA

- Purchase of up to $5,000 in U.S. Savings Bonds²

If you’re a Chime member, you can choose to direct deposit your refund into your Chime account. Just input your Chime Checking Account number and corresponding routing number, and that’s it!

From there, you just have to wait for your refund to show up in your account. Enable notifications and, once your refund is available, Chime will send you a notification. This way, you’ll know that the money is there right when you receive it.

Not too fast: Filing your taxes as early as possible certainly gets you your refund faster, but make sure you take advantage of all the tax write-offs you’re eligible for.

2024 tax year refund schedule

How soon you’re likely to receive your refund in 2025 for the 2024 tax year depends in part on the IRS schedule. This schedule varies depending on:

- When you file: Filing earlier in the year may help you get a refund sooner. If you file closer to the deadline, the IRS might have a considerable amount of backlogged returns to sort through.

- How you file: If you file electronically you can get your return in roughly three weeks.¹ Note that it may take a couple of days for the IRS to receive your return, even when you e-file.

- What credits you claim: When you claim certain tax credits, like the Child Tax Credit or the Estimated Income Tax Credit, this can change the timing of your tax refund.¹

How do I check my tax refund status?

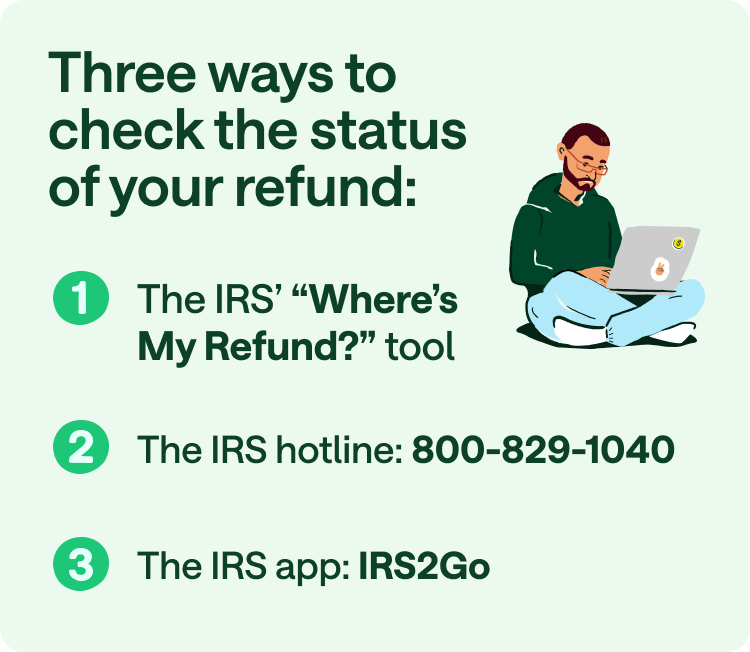

If at any point after filing, you’re curious about your tax refund status you can use one of the following government tools:

- Use the IRS refund status tracker tool: The IRS’s “Where’s My Refund?” tool is a quick and easy way to check the status of your tax refund. This will help you monitor the status of your refund and give you a better idea of when to expect your deposit.

- Call the IRS to check on the status of your refund: You can dial the IRS hotline at 800-829-1040. Again, you will need to provide your Social Security number, tax filing status, and the amount of the refund you are expecting.

- Use the free IRS app called IRS2Go: After downloading the app, similar to the online platform, you’ll need to enter the required information into the mobile tool for an update. It’s never been easier to check your tax status while on the go!

To check the status of your tax refund, you’ll need the following items:³

- Social Security number or individual taxpayer identification number (ITIN)

- Filing status

- The exact refund amount on your return

What to do if you don't receive your tax refund

There are a few reasons you might not receive your IRS tax refund:

- If your tax return has any personal information errors like misspelled names, incorrect Social Security numbers, unsigned forms, or incorrect account information, this can delay your refund.

- It’s also possible your return contains calculation errors. To avoid mistakes, carefully review your tax return before you click submit. If a tax preparer is completing your return for you, make sure they have all of your correct information.

- Another reason for a potential hold-up is if you were a victim of identity theft or fraud. In this case, the IRS may hold onto your return until it can work with you to fix the situation.

If you didn’t receive your refund, you can use the “Where’s My Refund?” tool, call the IRS at 800-829-1040, or check the IRS app IRS2Go for more information.

Track your tax refund status in 2025

Waiting for your tax refund can feel stressful, especially if Uncle Sam owes you a big chunk of change. Choose direct deposit for the fastest refund, and file as soon as possible to get your refund earlier in the year. Don’t forget that you can use free IRS resources to track your tax refund status after filing.

Most importantly, make sure that you set up direct deposit correctly. Getting your tax refund can make a huge difference – here’s what to do if your tax refund was deposited into the wrong account.

Looking for more tax tips? Here are some tax deductions you might not have thought of.

FAQs

My tax refund was accepted. When will it be approved?

The IRS will provide a deposit date or mail date as soon as your return has been processed and your refund approved. If you file electronically, most refunds are issued in less than 21 days, and you can keep track of your refund status starting 24 hours after electronically filing your return.¹ Depending on your delivery option, timelines are subject to change.

How long does it take to get a tax refund?

Paper tax refunds are mailed out in 4 weeks or more, while those filed electronically are issued within three weeks – even faster if you choose direct deposit.¹ The time it takes to receive your IRS tax refund can also vary based on when you submit your return and if there are any errors.

Why are IRS refunds taking so long?

The reason your IRS refund is taking so long could be as simple as a slight math or entry error in your return. The IRS system might also be clogged up with unusually high processing volumes. Some of the most common delays are due to entry errors, tax fraud, or the IRS falling behind due to the number of filings.

If you suspect tax fraud, you can contact the IRS. If the IRS uses your tax refund to offset your debts, such as unpaid student loans, state taxes, or child support, the Federal Bureau of the Fiscal Service will notify you about why your refund was withheld and which debt it offset.⁴ Of course, you have the right to dispute the debt with whichever agency seized your refund.

How do you know when your tax refund has been processed?

If your tax refund was accepted but hasn’t been processed and sent out, there may be a few reasons for the delay. There could be an error with your filing, which could hold up the process as the IRS works to fix the issue. If you find that there’s a long waiting period after filing, you can contact the IRS directly or monitor the status of your refund on a daily basis using the IRS Refund Status Tracker Tool.

Log in

Log in