Early Payday

Why do we wait for payday? When you direct deposit with Chime you have two options to get paid early. No interest1, no credit check, and no mandatory fees.

Explore products

How to set up direct deposit.

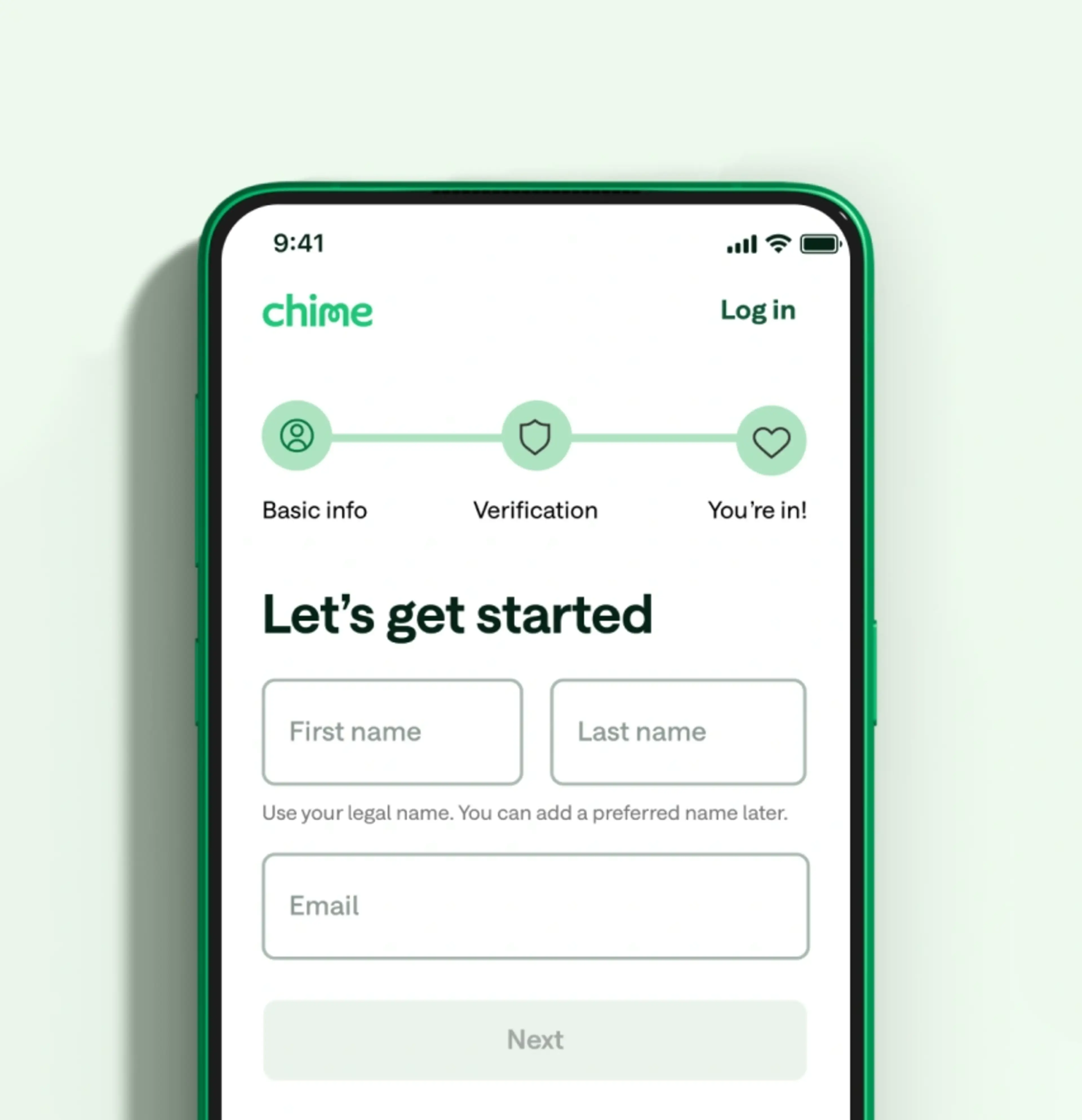

Enter your personal information.

You’ll need to enter some basic information, like your name and date of birth, in order to verify your identity.

Download the Chime app.

From our mobile app, you’ll be able to manage your account, deposit money, view your balance, and more.

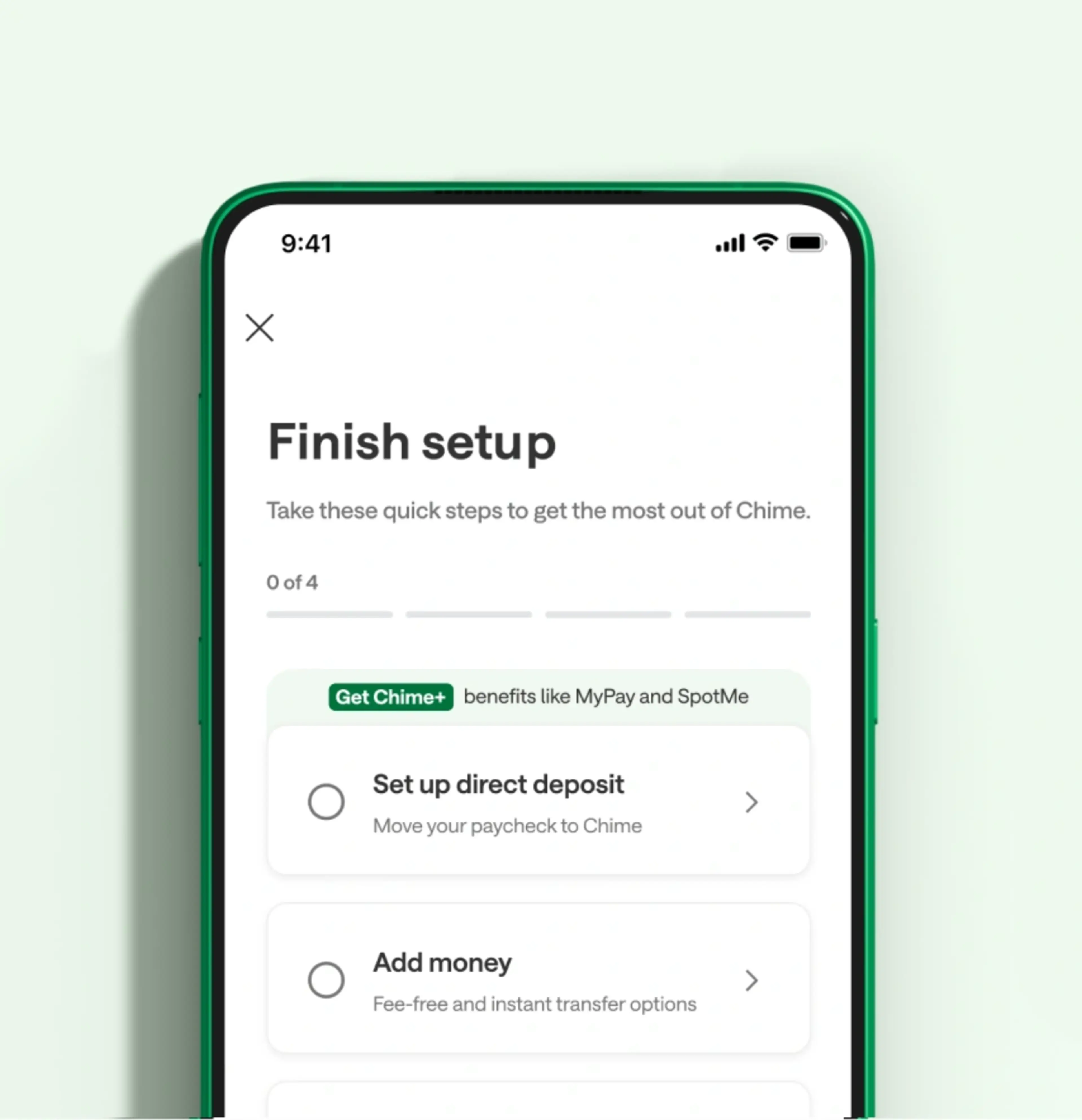

Set up direct deposit and get Chime+.

Once you’ve set up direct deposit using your Chime routing and account numbers you’ll be able to take advantage of Chime+ benefits.

Why members love us.

Not only is Chime The Most Loved Banking App®, but we’ve made a real and lasting impact on our members’ lives. Don’t take our word for it—we’ll let the numbers speak for themselves.

Bridges the gap 3x more

Members say our products help bridge the gap until their next paycheck almost 3x as often as customers of traditional banks4

Bridges the gap 3x more

Bridges the gap 3x more

Members say our products help bridge the gap until their next paycheck almost 3x as often as customers of traditional banks4

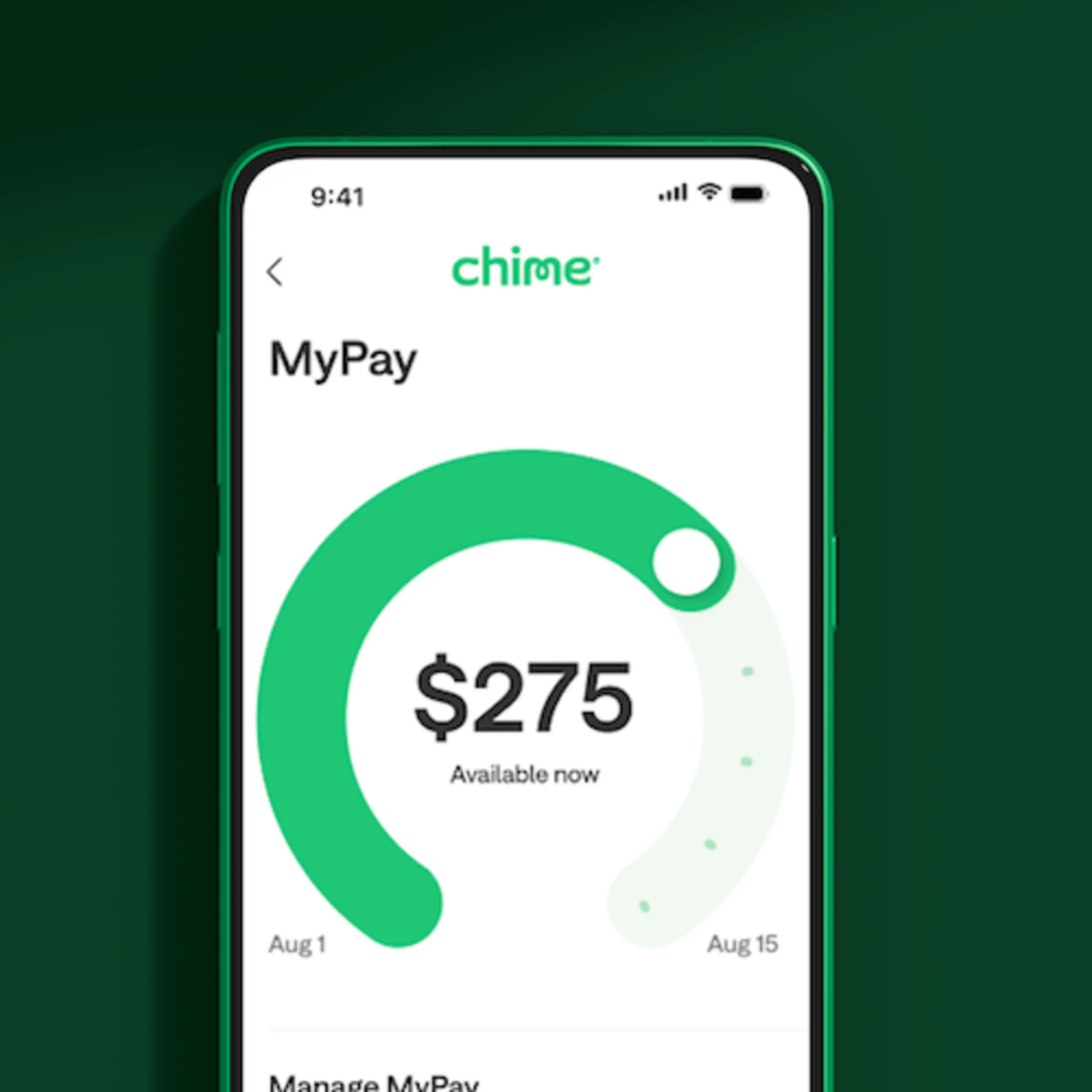

Billions unlocked

Chime members are unlocking billions of their pay before payday with MyPay

Billions unlocked

Billions unlocked

Chime members are unlocking billions of their pay before payday with MyPay

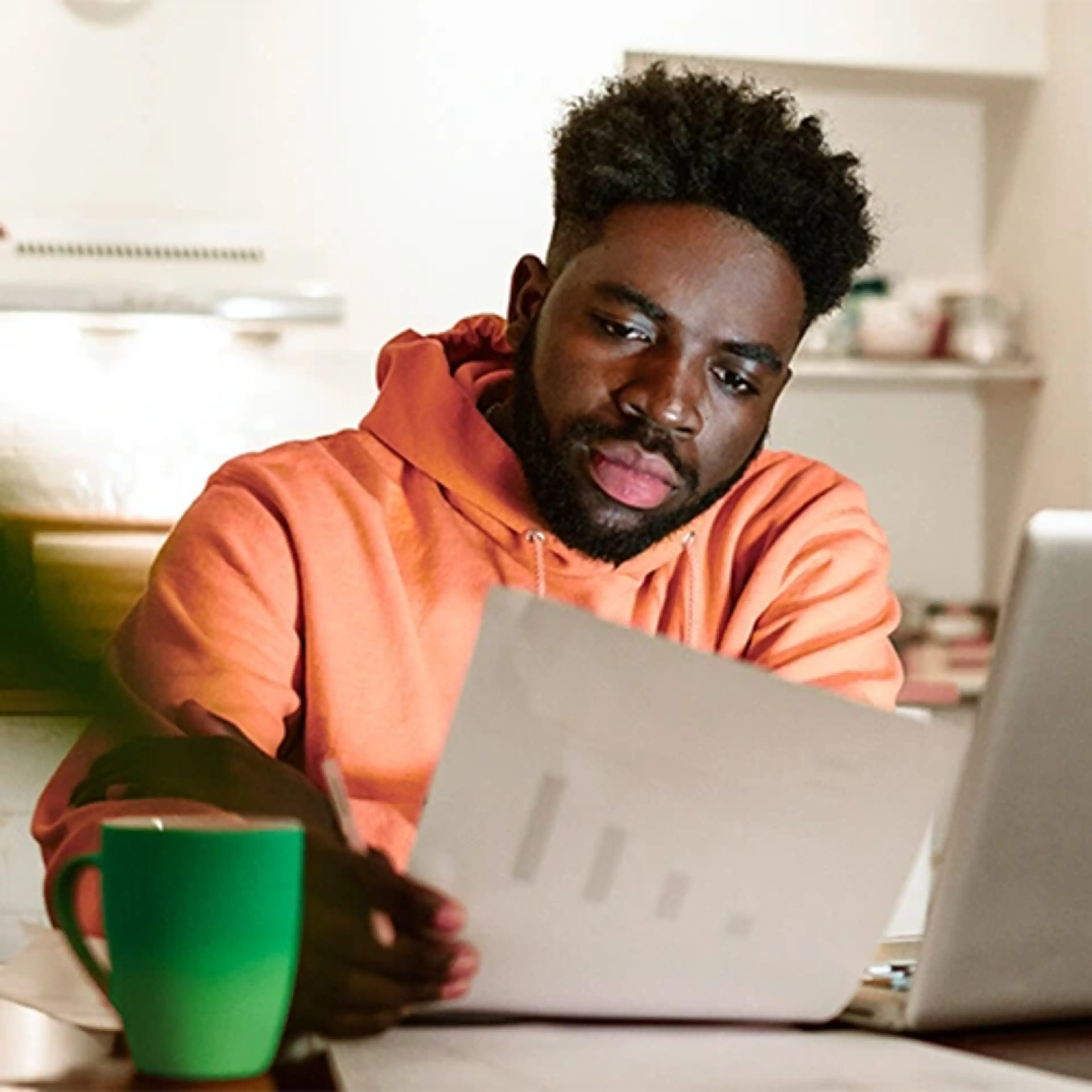

MyPay helps with bills

Over half of Chime members who use MyPay say it has helped them avoid late or missed bill payments5

MyPay helps with bills

MyPay helps with bills

Over half of Chime members who use MyPay say it has helped them avoid late or missed bill payments5

2 out of 3 more confident

2 out of 3 MyPay users say they feel more confident handling unexpected expenses5

2 out of 3 more confident

2 out of 3 more confident

2 out of 3 MyPay users say they feel more confident handling unexpected expenses5

Chime+

Unlock Chime+ for free with direct deposit.

Chime+ gives you access to even more of our products, and it’s free when you set up a qualifying direct deposit.6

FAQs

How can you get paid early?

Are you wondering how to get paid early when you’re in a pinch? Some banks, credit unions, and fintech companies offer an early paycheck feature for their checking accounts, also called early direct deposit. For example, when you set up direct deposit for your Chime Checking Account, you can get your whole paycheck up to two days early.2

How is MyPay different from Get Paid Early and SpotMe®?

At Chime, we believe you should get your pay as soon as possible. With Get Paid Early,2 you can also get your paycheck up to 2 days earlier than you normally would when you set up direct deposit to your Chime Checking Account.2

SpotMe® is fee-free overdraft you don’t have to think about. If your account hits $0, SpotMe is there to cover you up to $200 on debit and credit card transactions, and cash withdrawals, as applicable, automatically, based upon your available limit.7 If you are enrolled in SpotMe, please check your Chime mobile app for details on your SpotMe limit.

MyPay puts you in control of payday by allowing you take an advance, up to $500 any day before payday,3 depending on your credit limit, per pay period.

How does direct deposit work?

To set up direct deposit, you usually just need to supply your employer or payroll provider with your bank account number and routing number. Once you have successfully enrolled in direct deposit, your payroll provider can make payments directly into your designated account electronically, without mailing a paper check.

You might set up direct deposit with an employer, companies you work with as a contractor, or even the U.S. government for tax refunds or Social Security benefits.

How do you set up Chime direct deposit?

Setting up direct deposit with Chime is easy. Just launch the Chime app, tap Move Money and then Move your direct deposit. Here, you can copy your account and routing numbers to share with your payroll provider.

Chime can also email you a completed direct deposit form for you to hand in to your employer when you tap Get completed form. Even better: Some eligible employers are already connected in the Chime app. Just tap Find Employer and follow the prompts on your screen.

Not big on mobile? You can log in to your Chime account online to access your account and routing numbers and to print or download a direct deposit form – whichever is easier for you.

How long does direct deposit take on Chime?

Chime’s get paid early feature means you’ll get your paycheck as soon as Chime receives it from your employer. For many, that’s up to two days early direct deposit compared to some traditional banks.2

How early do you get paid with Chime?

When you set up direct deposit in the Chime app or online, your paycheck will be available as soon as Chime receives it. That’s often up to two days earlier than you’d get it at some traditional financial institutions.2

Is MyPay available only in certain states?

Right now, MyPay is available to eligible Chime members who live in the states listed in the Bancorp MyPay Agreement and Stride MyPay Agreement, provided all other eligibility requirements are met.3 We are working to expand our state eligibility.

How much does MyPay cost?

It is free to access MyPay and there is no optional tipping. There are no fees for scheduled advances, which arrive in your Chime Checking Account within 24 hours after requesting an advance. You can also choose to get money instantly for $2 to $5 per advance.1

What’s the catch?

We believe in transparency. When you use MyPay, there is never any interest1, no credit check, and no mandatory fees.