Have you ever wondered why you have to wait until a specific day of the month for your direct deposit to hit your account? At Chime®, we know that life doesn’t wait for payday, and we think you should have access to money when you need it.

Chime’s newest product, MyPay®, gets money in your pocket when you choose – no more counting down the days until payday to tackle life.

What is MyPay?

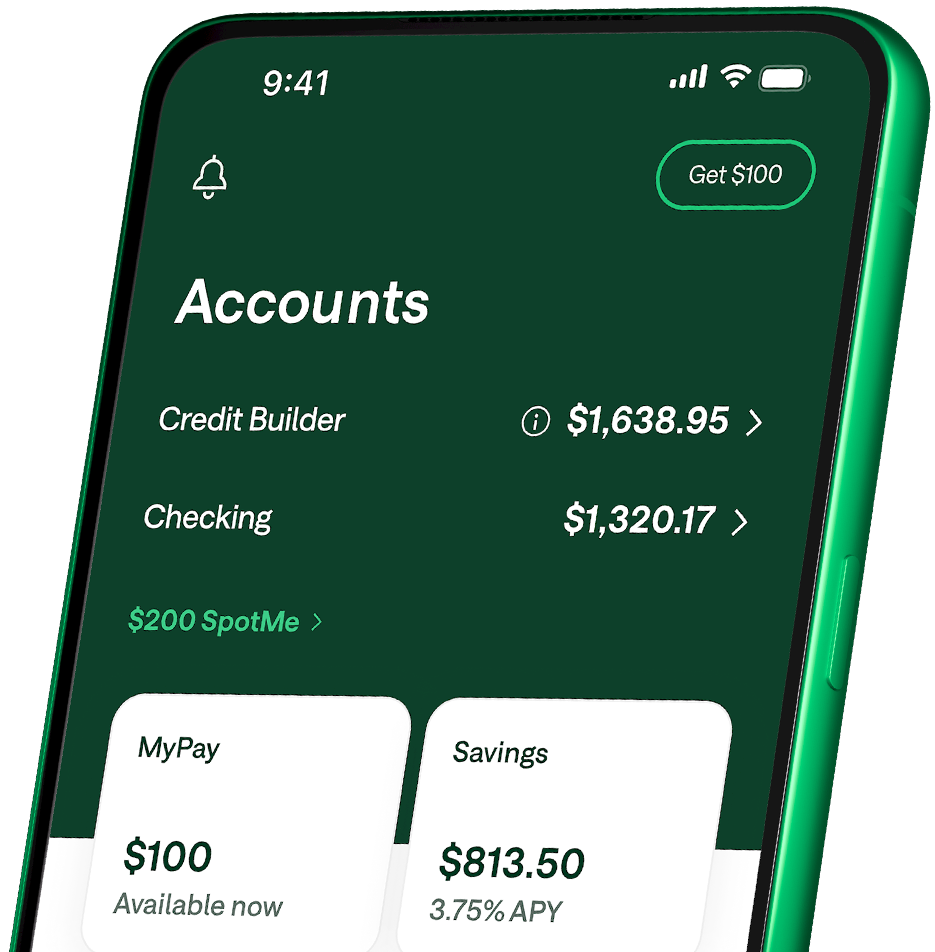

Chime’s MyPay is a line of credit that lets you get up to $500 before payday.^ There are no mandatory fees, no credit checks, and no interest* to get money when you need it. With MyPay, just log into your Chime app, see how much is available to you, and then choose how much you want to access.

Accessing MyPay is totally free, and the money you choose to advance will hit your Chime Checking Account within 24 hours. Need the money sooner? For $2 per advance, you can get it instantly. Limits can range from $20 to $500, depending on factors such as your direct deposit history.

MyPay is great for unexpected expenses, but it’s also helpful when you just want to treat yourself. You could use MyPay to:

- Get money for an upcoming night out with friends

- Pay for an unexpected vet bill or car repair

- Fill up your gas tank ahead of a road trip

- Buy event tickets before they sell out

- Cover a last-minute trip to the grocery store

MyPay is only offered in certain states. Certain eligibility requirements apply to use MyPay. Full details are available in the MyPay Agreement for Stride Bank, N.A. members, and MyPay Agreement for The Bancorp Bank, N.A. members.

Direct deposit and get Chime+ for free.‡

- SpotMe® up to $200+

- MyPay® up to $500^

- 3.75% Savings APY§

How does MyPay work?

MyPay lets you access money before payday! With authorization, outstanding MyPay balances will be repaid from direct deposits to your Chime Checking Account from eligible sources.¹

Best of all, there is no credit check, no interest*, and no mandatory fees. Here’s how it works:

1. Set up direct deposit

If you haven’t already, open a Chime Checking Account. When MyPay is available to you, you’ll need to have received:

- at least two qualifying MyPay direct deposits of $200 or more per deposit within the last 36 days, or

- one qualifying MyPay direct deposit of $200 or more per deposit in the last 36 days and an additional data source such as your work email or work address during MyPay enrollment, or

- one qualifying MyPay direct deposit of $200 or more per deposit in the last 36 days from a government benefits payer,

- and meet other eligibility requirements in the MyPay Agreement to use MyPay.^

2. See how much you can access

After you’ve enrolled in MyPay, check the MyPay hub in the Chime app. There, you’ll be able to see the amount available for you to take as an advance.

3. Choose your amount

The maximum amount you can access each pay period is based on your estimated income. Credit limits can range from $20 to $500, and may increase or decrease over time.^

Just follow the prompts in the app to choose how much you need.

At any given time, the amount you can take as an advance will be less than or equal to your overall credit limit. Both amounts will be available to view in the Chime app.

4. Select the speed

Choose a scheduled advance, and the money will be deposited in your Checking Account within 24 hours, completely fee-free. Or, choose to get your pay instantly for $2 per advance.

How does MyPay repayment work?

When you use MyPay, the amount you advanced during the pay period, plus any fees you incurred ($2 per instant advance) is deducted from your Checking Account to repay your outstanding MyPay balance when your next direct deposit posts.

The repayment transaction may appear in two types of transactions:

- If you choose to use the instant advance option, the first transaction you’ll see will be labeled “MyPay instant advance fees”. This transaction will include the total amount of instant advance fees you accumulated throughout the pay period. All instant advance fees will be repaid under a single transaction.

- The second transaction is labeled “MyPay Repayment” and will include the total amount of your MyPay advances(s). If you don’t make any instant advances, the “MyPay Repayment” will be your only repayment transaction.

What is MyPay not?

Chime launched MyPay to give you a better way to access money when you need it – without mandatory fees, interest*, credit checks, or late fees. That makes MyPay different from the options you’ve had before, including:

- Credit card cash advances: Cash advances from credit card accounts are a way to get money from your credit card to cover emergencies, but these short-term loans can have high fees and interest rates, often between about 17.99% and 29.99%⁴ and are added to the balance of your credit card. Chime’s MyPay has neither.

- Payday loans: Some payday loans from payday lenders require credit checks and can have interest rates as high as 652%.³

- Personal loans: Small personal loans can be useful, but you’ll have to undergo a credit check, you might have to pay an origination fee, and APRs can be as high as 36%.⁴ MyPay, on the other hand, charges no interest and requires no credit check.

- Buy now, pay later: Buy now, pay later (BNPL) is becoming more popular, spreading everyday purchases into multiple, smaller payments. But even these helpful payment plans may charge interest.

Why is Chime offering MyPay?

Chime is offering MyPay to help members get their money when they want it, without having to pay interest* or having their credit checked.

MyPay is just one of the latest products that Chime has designed to help empower our members. For instance, Chime offers a checking account without monthly fees, and you can apply for the secured Chime Visa® Credit Builder card⁵ without a credit check to build credit history and Unlock Financial Progress™. We also helped pioneer fee-free overdrafts.+

Now, we’re empowering you and other members with MyPay so you can get money when you need it.

Get Paid When You Say™

Life doesn’t wait for payday to arrive, so why should you wait to get money when you need it? With Chime’s MyPay, access the money you need when you decide – no surprises and no mandatory fees.

Log in

Log in