A cash advance alternative without the fees and interest1

No subscription fees or mandatory fees

No credit check and no interest

Up to $500 of your pay ahead of payday2

Learn how we collect and use your information by visiting our Privacy Notice

The better way to get your payday in advance.

When you clock out at the end of the day, it could take weeks before you actually see that money from your employer. With Chime MyPay, you can access your money much sooner. Here’s what you’ll love about MyPay:

No interest.

Traditional credit card cash advances come with high interest rates (often up to 29.99%3) that start accruing immediately. That kind of debt stacks up fast. Chime doesn't charge any interest1 to use MyPay.

No mandatory fees.

Some of the most popular cash advance apps charge monthly fees for the service – and some even ask you for tips when you take out cash. But MyPay isn’t a cash advance. It’s here to help.

Instant transfers.

Need an instant advance? You can get money into your Chime checking account instantly for just $2.

Fast funding.

You might not always need an instant advance, but MyPay’s fee-free option still gets you your funds fast – within 24 hours. Some quick cash advance apps can take two or even three business days to get you your money unless you pay extra.

No credit checks.

Still working on your credit score? No problem. There’s no credit check needed to qualify for MyPay.

Up to $500 before payday.

With MyPay, you can access up to $500 of your pay2 for any reason: unexpected bills, a last-minute trip to the grocery store, or a weekend getaway. It’s your money – use it how and when you want.

MyPay leaves other alternatives to cash advances behind.

MyPay is a simple, seamless way to access your money from future direct deposits with just a few taps of a button.

Chime | EarnIn4 | Dave5 | Brigit6 | |

|---|---|---|---|---|

#1 Most Loved Banking App™7 with no monthly fees | ||||

Fee-free daily access to pay1 | ||||

Fee-free overdraft8 | ||||

Fee-free credit building9 | ||||

Early payday (up to 2 days)10 | ||||

47K+ fee-free ATMs11 |

Want a say in when you get paid?

Start by opening a Chime checking account and setting up direct deposits to unlock the power of MyPay.

How to use My Pay

Getting a MyPay advance is easy. First, you'll need a Chime® Checking Account to get started, which is quick and easy to open online. Here's what you'll need to do!

Set up direct deposit.

To qualify for MyPay, you'll need to receive 1 or 2 qualifying direct deposits and meet other eligibility requirements related to MyPay2

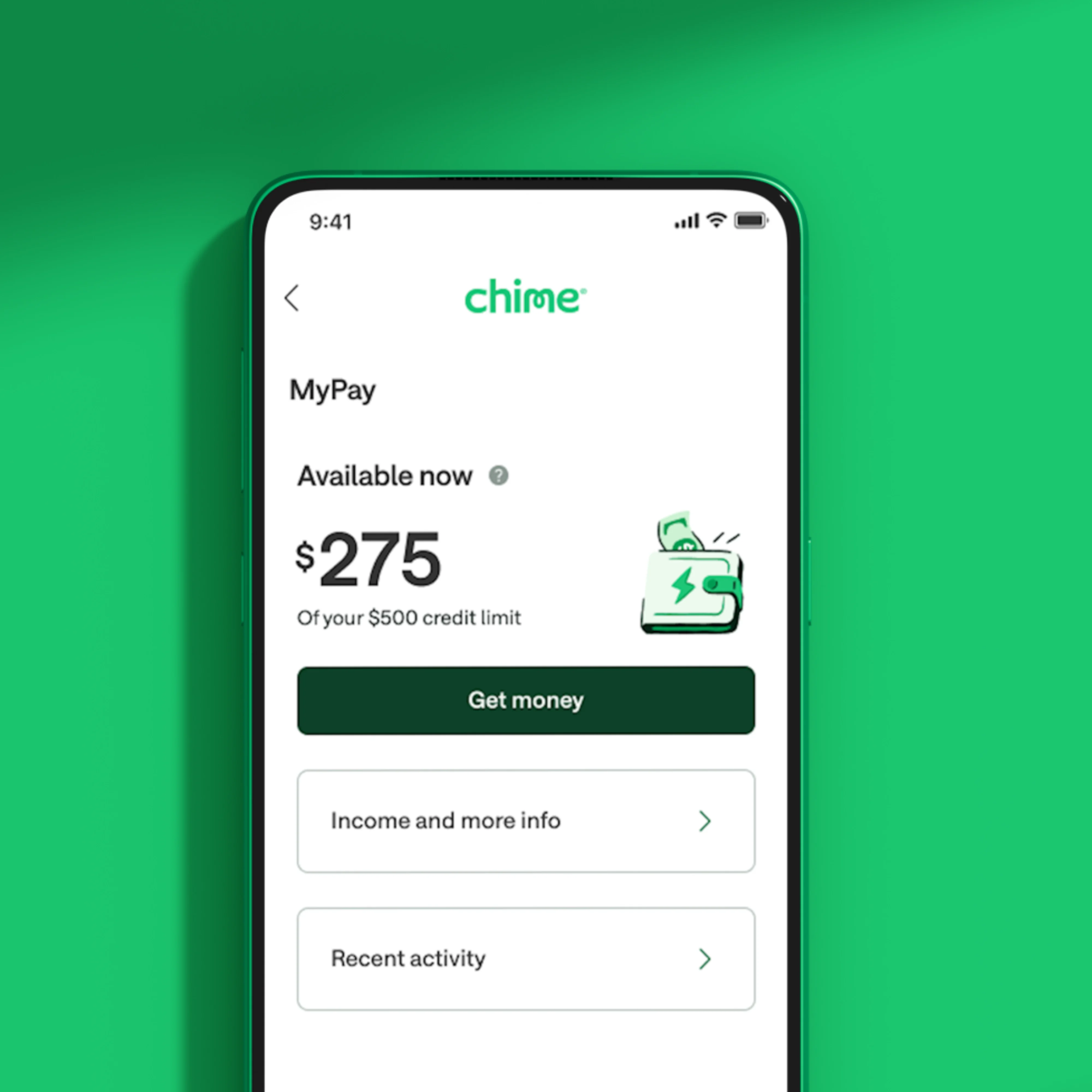

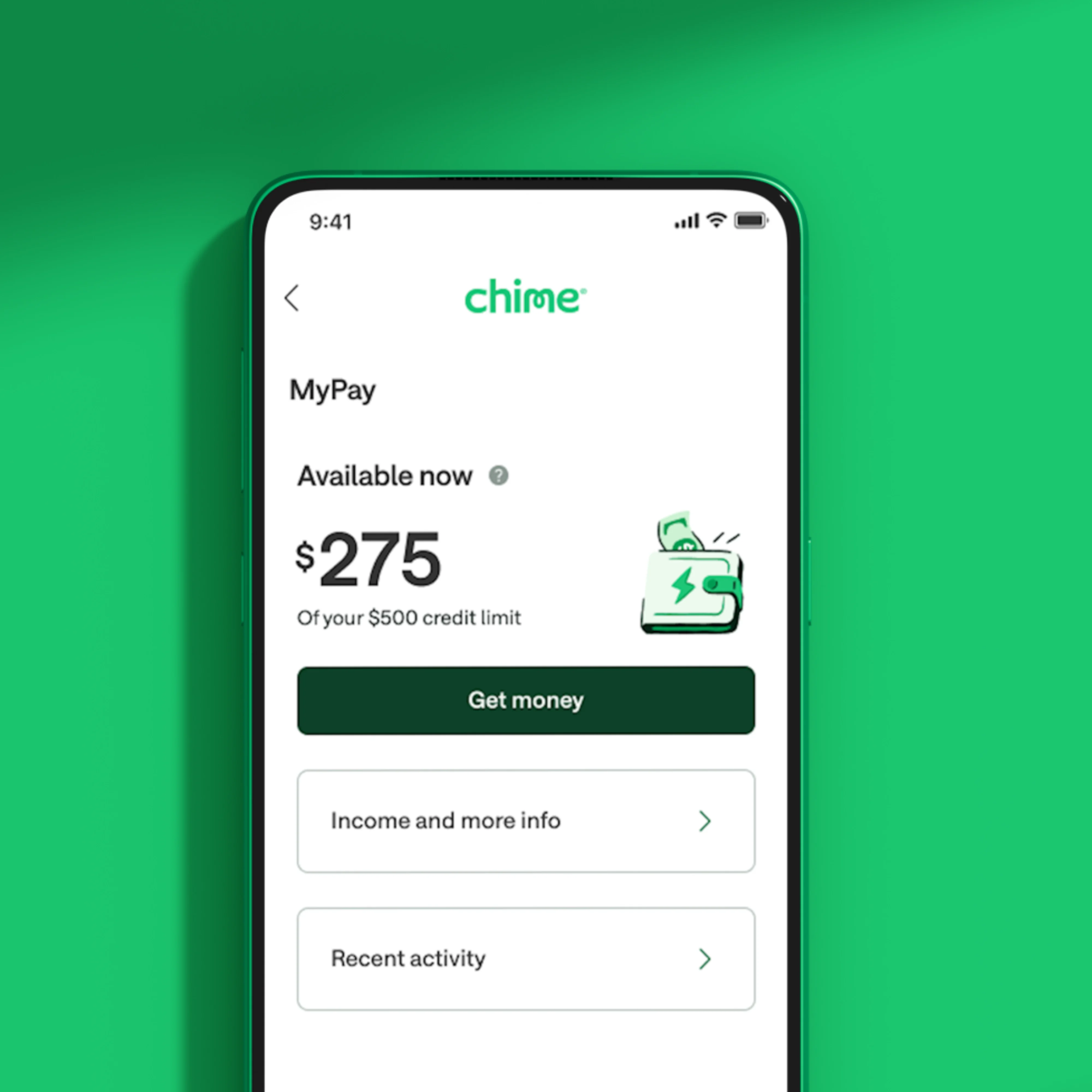

Enroll in MyPay and see how much you can access.

Once you've met the criteria, you'll be able to enroll in MyPay in the app. Here, you can see how much of your pay you can access ahead of payday. Available credit limits can range from $20 to $500.

Tap Get Money and select an amount.

Choose how much money you want to receive. You can select the full amount available or choose a smaller amount, based on your expenses.

Choose a funding speed.

You'll get your money through Chime MyPay within 24 hours - totally free. Need an advance now? You can select an instant advance to get paid instantly for only $2 per advance.

Repay with your next payday.

When your next payday comes, you don't have to do a thing! As soon as your paycheck lands in your Chime checking account, Chime will debit the amount you took earlier (plus any instant advance fees) from the total.

Being able to get that $500 boost when needed has helped me avoid paying late fees for bills that come sooner than the paycheck.

Shirley F.

I am not always able to make my paycheck stretch long enough until next payday. Having access to my pay when I need it is quite important and can make a really big difference in my overall wellbeing.

Brittany J.

This has literally been a life saver for pet and car emergencies. Being able to get my pay on my terms when I need it has literally saved my pets' life. I've been able to pick up the tab for friends at the last minute, and even go on spontaneous trips.

Catherine L.

Now that I have access to MyPay, you couldn't ask me to go back. It helps out with everything in my life.

Ryan L.

Thanks to MyPay, I can live life a little easier. I have access to my money, when I need it! That type of peace of mind is almost unheard of!

Joseph H.

Real members. Paid testimonials.

FAQs

What is a cash advance?

A cash advance is a short-term loan that gives you fast access to money. Traditional credit card cash advances come with high interest rates and fees.

You can also use a cash advance app, typically with qualifying direct deposit, to access a portion of your paycheck ahead of payday. This may be a free service (often with optional tip), or there may be a subscription fee.

How can I borrow cash instantly?

Cash advance apps are a common way to borrow cash instantly. Many popular cash advance apps can get you money within 1 to 3 business days but offer “instant” funding options (for a fee) to get your money within minutes instead.

Some financial institutions allow for fee-free overdraft. Terms and conditions will vary by financial institution. Chime members, for instance, may qualify for SpotMe, a fee-free overdraft up to $200.12

Other options to borrow cash instantly are credit card cash advances and payday loans, but both of these have high interest rates and fees. Payday loans are particularly risky and are illegal in several states.

Finally, certain purchases may be eligible for buy now, pay later (BNPL) loans, which get you credit at checkout.

Do cash advances hurt your credit?

A benefit of a cash advance app is that it typically does not require a credit check. For instance, there’s no credit check to apply for Chime MyPay. These types of advances do not hurt your credit.

A traditional credit card cash advance can affect your credit, however, as each advance increases your credit utilization. And because such cash advances charge high interest and fees, it’s easier to fall behind on payments. Missed payments on a credit card can have a big impact on your credit.

Are there cash advances with no fees?

There are cash advances with no fees. While credit card cash advances often come with high fees and high interest rates, cash advance apps have made it possible to borrow money from your upcoming paycheck without a fee.Some of these apps do charge a monthly subscription fee, request an optional tip, and/or charge for quick cash advances. Chime MyPay has no monthly subscription fees or tips, and qualifying members can get a portion of their pay within 24 hours totally free. Instant advances through MyPay cost $2.

Are cash advances bad?

Cash advances aren’t bad, particularly via cash advance apps with no monthly fees and no interest. These don’t impact your credit and simply allow you to access money before it’s scheduled to be paid out to you.

Credit card cash advances, on the other hand, carry high interest and fees. While they still may not be “bad,” they can be risky, as the interest accumulates quickly and could result in debt you’re unable to pay back.