It’s one thing to see that your balance is lower than expected, but it’s another thing to get hit with overdraft fees. The Consumer Finance Protection Bureau recently ruled to limit the amount of overdraft fees that banks over $10 billion in assets can charge.¹ At Chime, we put our members first, which is why we pioneered fee-free overdraft with SpotMe® for our members. It’s nice to see some other players are doing away with overdraft fees!

At Chime, we’re all about unlocking financial progress™, not profiting off of our members. With our SpotMe feature, you can overdraft your Chime® Checking Account or get covered when using your Credit Builder card by up to $200 without fees.+

Since we launched SpotMe, we’ve Spotted members over $26 billion and saved members over $34 billion in overdraft fees. That’s quite a chunk of change!

When you turn on SpotMe, we cover you automatically when you need it, up to your limit, no matter which card you use.

Want in? We thought so. Here’s everything you need to know.

How does SpotMe work?

SpotMe is available to Chime members who have activated their Chime Visa® Debit Card or Credit Builder card and receive a qualifying direct deposit of $200 or more a month. Once you’ve enrolled in SpotMe, we’ve got your back when you overdraft your checking account by up to $200. SpotMe is now also available on your Credit Builder card. It’s fee-free to use SpotMe, so you can spend confidently without surprises.

Let’s say you have $40 in your Checking Account. At the grocery store, your total is $52, and you want to pay for it with your Chime Visa® Debit Card. If you spend more than your total balance, we’ll spot you, fee-free. You won’t get hit with a fee.

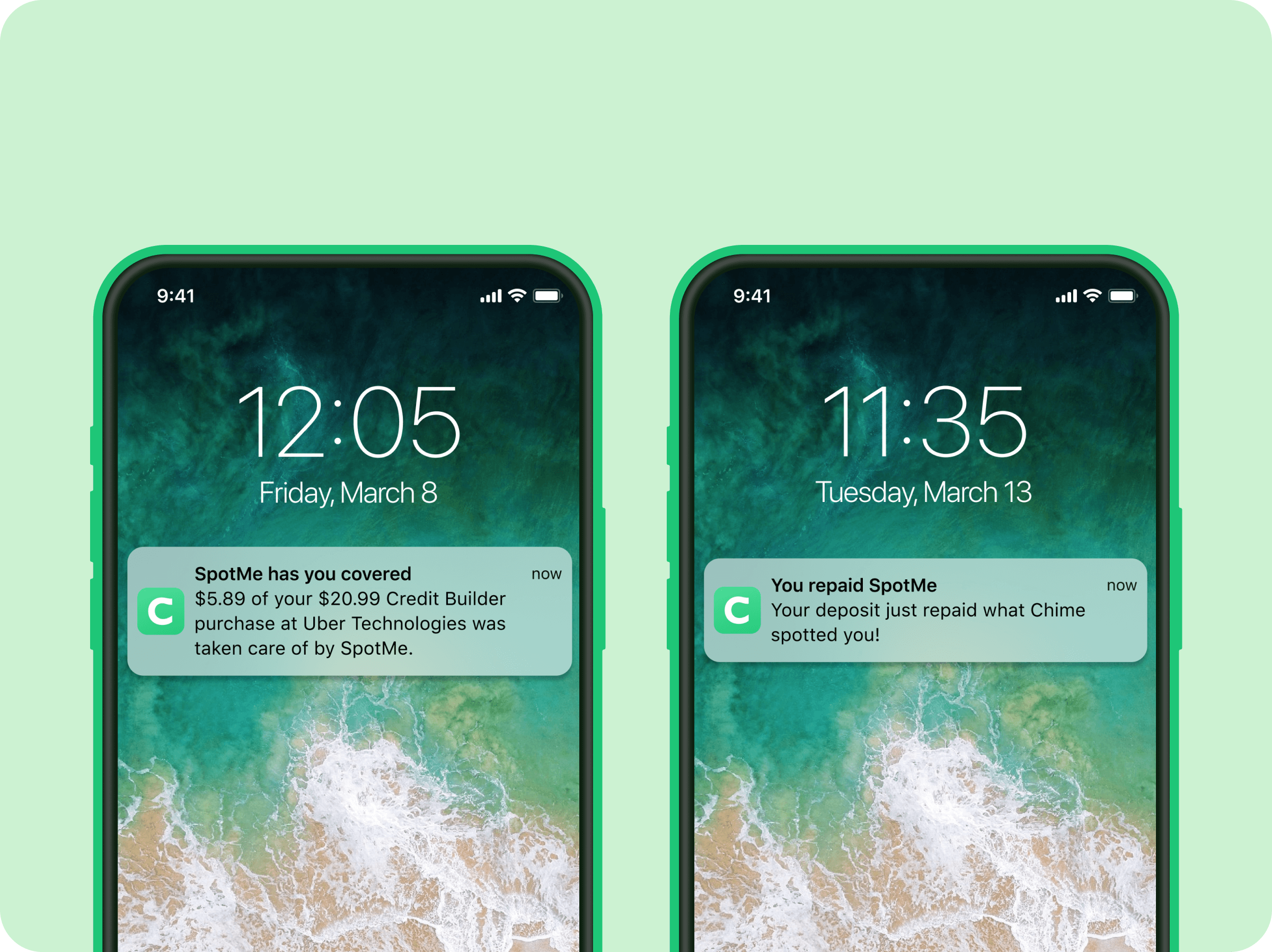

You’ll receive a notification saying “SpotMe has you covered. Your Debit purchase at [name of store] was taken care of by SpotMe.”

Then, the next time money is deposited into your Checking Account, we’ll automatically apply it to your negative balance. You’ll be in the clear, without having paid any overdraft fees.

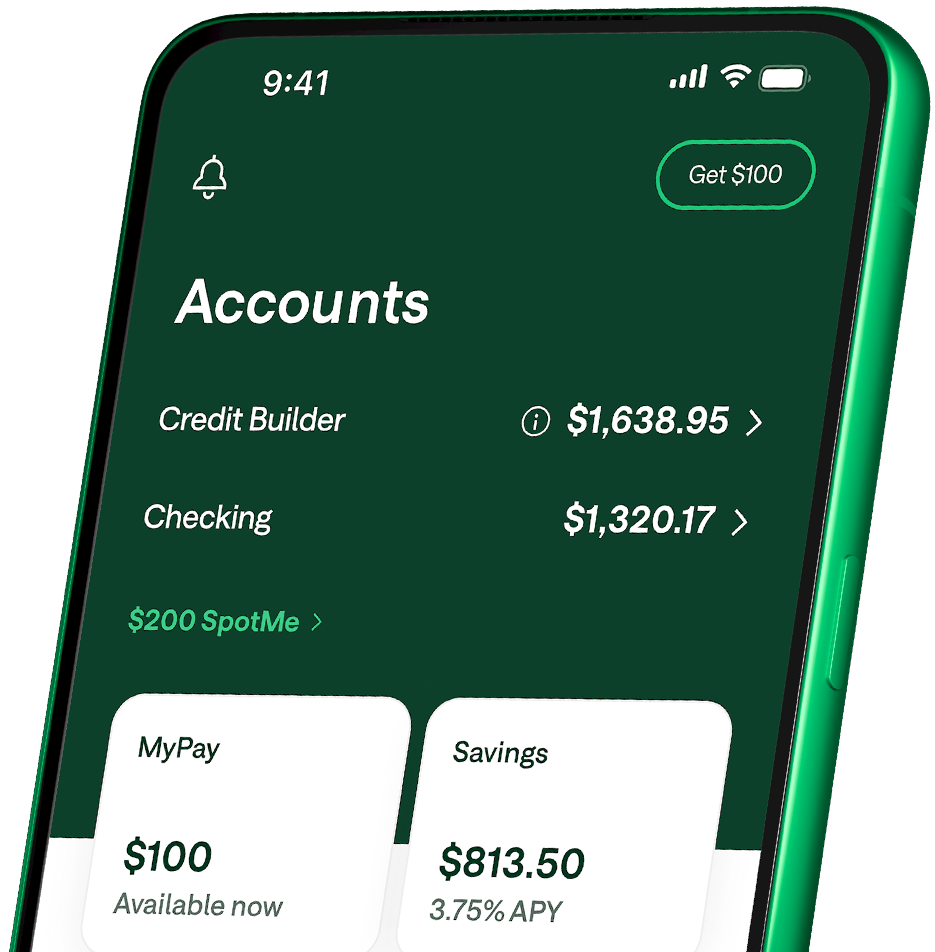

Direct deposit and get Chime+ for free.‡

- SpotMe® up to $200+

- MyPay® up to $500†

- 3.75% Savings APY§

Is SpotMe free?

We know, we know, it sounds too good to be true. But it’s not!

SpotMe is an overdraft service for eligible Chime members. Depending on your personal SpotMe limit, you can overdraft up to $200, and you will not be charged a fee.

How to enroll in SpotMe

If you’re ready to enroll in SpotMe, make sure you have the latest version of the Chime app. Here’s how to enroll!

- Activate your Chime Visa® Debit Card or Chime Credit Builder Visa® Credit Card.

- Set up direct deposit and receive at least one qualifying direct deposit of $200 or more.

- Open the Settings tab in your Chime app to find out if you’re eligible for the SpotMe feature (make sure you have the latest version of the app).

- Once you agree to the SpotMe Terms and Conditions, you are officially enrolled in SpotMe!

- If you ever wish to turn off SpotMe for either card, just head to Settings → SpotMe.

How to use SpotMe

Once you have SpotMe activated, we cover you automatically whenever you make a purchase that exceeds your balance.

- When you make a debit card purchase, Credit Builder card purchase, or cash withdrawal that exceeds your available balance, we’ll spot you up to your limit.

- If you attempt to make a purchase that exceeds your SpotMe limit, the transaction is declined.

- Your next deposit is applied to your negative balance. That’s all there is to it! We never charge fees or interest for using SpotMe.

Your SpotMe limit starts at $20 and can grow over time. Your limit is based on a variety of factors, like a steady direct deposit history, direct deposit amount and the length of time you’ve been with Chime.

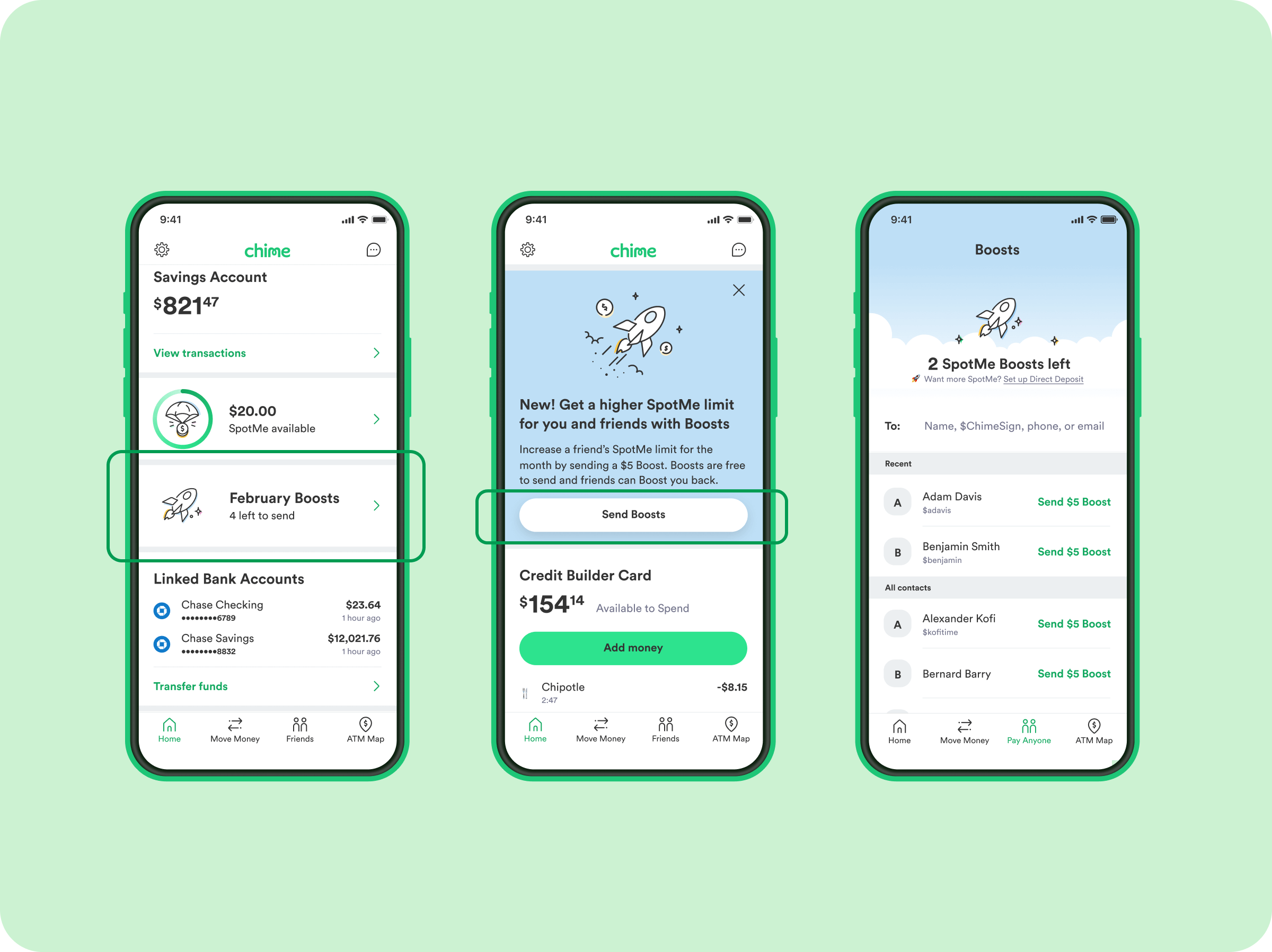

While Chime Member Services can’t manually change your limit, we do occasionally offer promotions that allow you to temporarily increase your SpotMe limit through bonuses— so be on the lookout for those. Another helpful way to temporarily increase your SpotMe limit for the month is if someone sends you a SpotMe Boost!

How to use SpotMe Boosts

We get so much more when we give to others, and it’s that giving spirit that makes SpotMe Boosts² a member favorite. You only have to be on our social channels for a few seconds to spot a “boost 4 boost?” comment from our active community.

With SpotMe Boosts you can temporarily get more SpotMe for the month from friends and family. Sending a Boost temporarily increases someone’s SpotMe limit by $5. And yes, they can Boost you right back! Here’s how to use SpotMe Boosts:

- Once SpotMe is activated, you’ll receive fresh SpotMe Boosts on the 1st of every month.

- You’ll find your SpotMe Boosts on the home screen, where you’ll see the name of the current month and “Boosts” (March Boosts, for example).

- Find the person you want and tap Send $5 Boost next to their name.

You get 4 Boosts per month to send and receive. Boosts last until the first day of the following month, and you can only send one Boost to each friend every month.

Get started with SpotMe today

Ready for fee-free overdrafts with SpotMe?¹ All you need to do is 1) activate your Chime debit or Credit Builder card, 2) have a $200 or more qualifying monthly direct deposit, and 3) enroll.

Once you’re set up with SpotMe, we will spot you automatically, up to your limit, whenever you need it. Unlock your financial progress without overdraft fees slowing you down.

FAQs

How do I change my Chime SpotMe limit?

Your Chime SpotMe limit is set automatically by a variety of factors related to how you use your Chime account. This may include how long you’ve been a member, your account history, and how much you direct deposit per month. We’ll notify you if and when you qualify for a higher limit.

If you want to manually lower your limit to a personal max, it’s easy and fast. If you’re eligible for SpotMe, all you need to do is open your Chime app, Scroll down in your Home feed, Tap Settings, and adjust your limit.

What happens if you try to overdraw your account by more than your limit?

We’ll simply decline the transaction. But don’t worry, you still won’t pay any fees.

SpotMe covers debit card purchases, Credit Builder purchases, and cash withdrawals. It doesn’t apply to Pay Anyone transfers, ACH transfers (including direct debits and services like Venmo or Square Cash), or Chime Checkbook transactions.

If SpotMe covers me, how do I pay it back?

The next time money is deposited into your Checking Account, we’ll automatically apply it to your negative balance. You’ll be in the clear, without having paid any overdraft fees.

Will I ever be charged an overdraft fee through Chime?

No. If you do not have sufficient funds in your Chime Checking Account, Credit Builder card, or have reached your SpotMe limit (if enrolled), then your Chime Visa® Debit Card or Chime Credit Builder Visa® Credit Card will be declined when attempting to use it. There is no fee for declining transactions or for utilizing SpotMe.

Log in

Log in