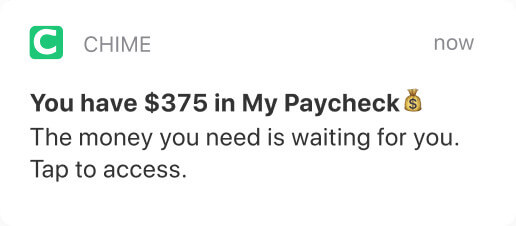

Meet My Paycheck

A better way to get money when you want it. Be ready for anything with just a tap.

Track your $ as you work

Set up recurring direct deposits of $200+ from your employer, then track your estimated income right in the app as you work.

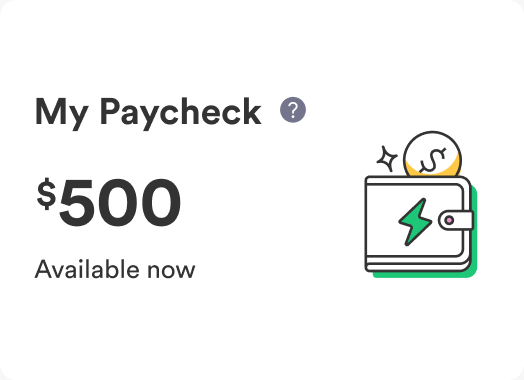

Choose how much to access

Each pay period depending on your limit, you can access between $20 and $500 total. Access as often as you want.

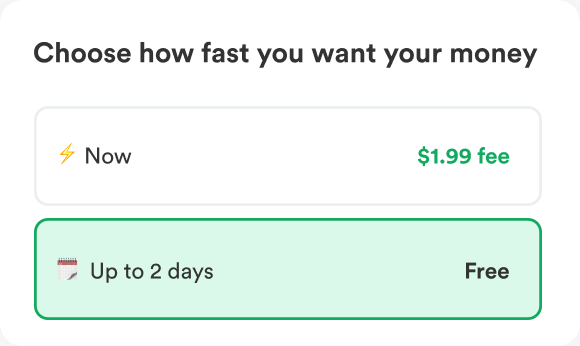

Get it as fast as you need it

In up to 2 days, your money hits your Checking Account entirely fee-free, or instantly for $1.99—your choice. When your next deposit hits, we’ll settle your balance minus what you accessed and any applicable fees.

Access money on your terms

Real members. Sponsored content.

Safe, secure & trusted

by millions

Your funds are FDIC insured up to $250,000 through The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC and we keep your money safe and secure with periodic security tests of our systems.

Access money on your schedule

FAQs

How do I get access to My Paycheck?

Right now, My Paycheck is available to anyone who lives in the states listed in our eligibility requirements, provided all other eligibility requirements are met. We are working to expand our state eligibility.

How does accessing my income work?

During each pay period, you are able to see the amount that is available to you to access that day. Money can be accessed right from the Chime mobile app, and is transferred directly into your Chime Checking Account. The minimum amount that can be transferred at a time is $20, and the maximum is your available amount, up to your pay period max. Your pay period max may increase over time, up to $500, depending on factors such as direct deposit data and transaction history. See full MyPay limits for more information.

What is available income and how does it work?

Available income is the estimated amount that you have earned within your current pay period. Verifying your employment status helps us keep estimated income better up to date. It can also help you access more of your income.

How much does My Paycheck cost?

There is no cost to access or use My Paycheck. We do not charge any mandatory fees, and optional tipping is not required. Standard transfers of the funds to your Chime Checking Account are free and take up to 2 days to occur; if you choose, you can transfer your available income to your account instantly for $1.99.

Are there any mandatory fees?

No! We believe in transparency and never charge any mandatory fees. With My Paycheck, you can get your money in up to 2 days for free—or instantly for $1.99. You have the option to pick how quickly you’d like to receive your available income!

Log in

Log in