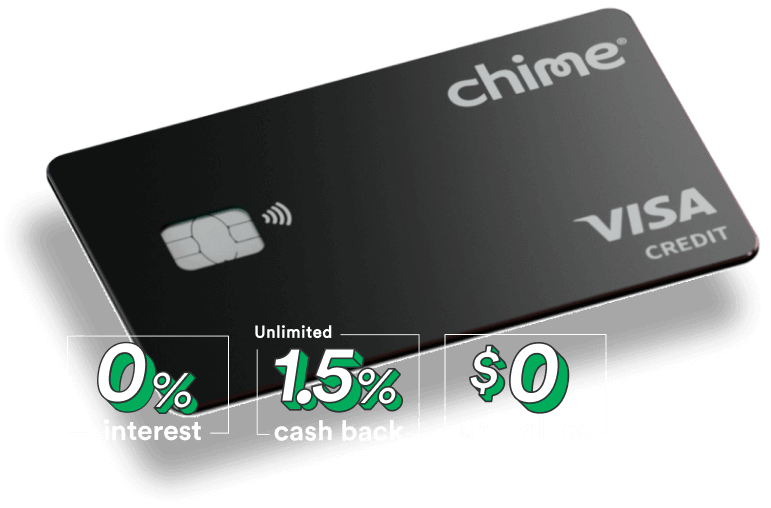

Finally, cash back that has your back

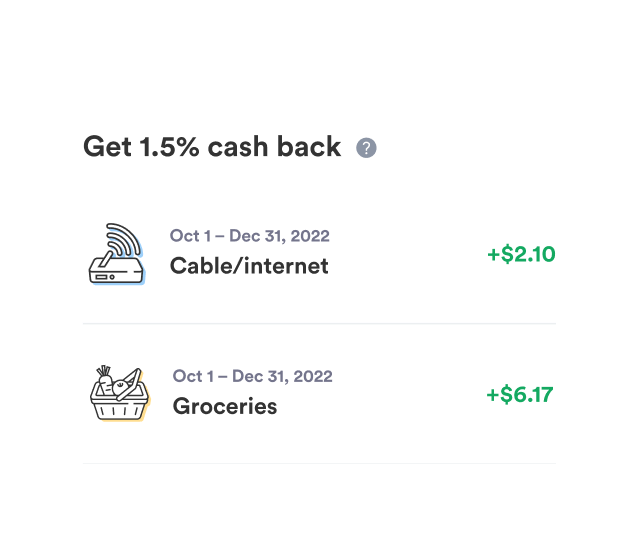

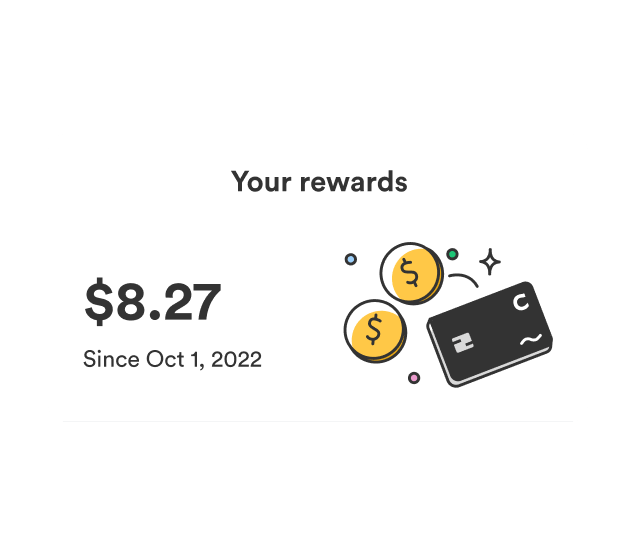

Build credit and earn unlimited 1.5% cash back on rotating categories1. No interest,2 no annual fees, and no credit check to apply. See how it works.

Click for terms and conditions

Privacy Policy for info on data collection and uses

CASH REWARDS SECURED CREDIT CARD

A card so dreamy, it feels made up

Picture getting 1.5% cash back3. Nice, right? Now imagine building credit without worrying about it. That’s Cash Rewards — the first card of its kind.

No other card does so much yet costs so little

Safe, secure & trusted by millions

Your funds are FDIC insured up to $250,000 through The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC and we keep your money safe and secure with periodic security tests of our systems.

Get crackin’ on the cash backin’

No credit check to apply

Questions?

What’s the difference between Credit Builder and Cash Rewards?

The Chime Credit Builder Visa® Credit Card is our no annual fee, no interest, secured credit card that helps you build your credit.2

The Chime Cash Rewards Visa® Credit Card is a new card we’re testing within a small population, and is not yet widely available. If you’re interested in increasing your chances of being included in new offers, try the following:

- Monitor and boost your FICO® Score with Experian Boost®. Learn more at: https://www.chime.com/blog/new-grow-your-fico-score-inside-the-chime-app/

- Build credit with everyday purchases using our Chime Credit Builder Visa® Credit Card*. Learn more at: https://www.chime.com/credit-builder/

What do I need to apply for a Credit Builder or Cash Rewards card?

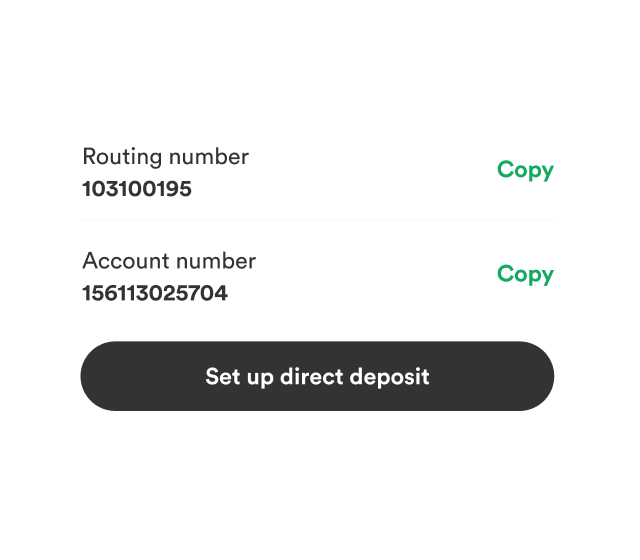

All you need is a Chime Checking Account and qualifying direct deposits of $200 or more.

Don’t have a Chime Checking Account? Apply for one in under two minutes!

Will it require a hard credit check to apply?

No way! We think everyone deserves a chance to build credit, so we don’t check your credit score when you apply.

Do I need to have a Chime Checking Account to use Credit Builder or Cash Rewards?

Yes. We designed Credit Builder and Cash Rewards to work with the Chime Checking Account so you can move money instantly—across your Chime accounts!

Does Chime charge any recurring fees for using Credit Builder or Cash Rewards?

Nope! We do not charge recurring fees; no annual fees, maintenance fees, international fees, and no interest. Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

How can Credit Builder or Cash Rewards help my credit scores?

Credit Builder and Cash Rewards offer features that help you stay on top of key factors that impact your credit score. Consistent use of Credit Builder or Cash Rewards can help you build on-time payment history, increase the length of your credit history over time, and more. We report to the major credit bureaus – TransUnion®, Experian®, and Equifax®.

Learn more about Chime and building credit.

What makes Credit Builder or Cash Rewards different from traditional credit cards?

Unlike traditional credit cards, Credit Builder and Cash Rewards help you build credit with no annual fees and no interest – and there’s no credit check to apply!

As a secured credit card, the money you move into your card’s secured account is the amount you can spend on the card. Unlike other secured credit cards, that money can be used to pay off your monthly balances. Since both Credit Builder and Cash Rewards don’t have a pre-set limit, spending up to the amount you added won’t contribute to a high-utilization record on your credit history.

Is Cash Rewards a secured credit card?

Yes, both Credit Builder and Cash Rewards are secured credit cards. The money you move to your card’s secured account is how much you can spend with the card. This amount is often referred to by other secured credit cards as the security deposit. Like other secured credit cards, Credit Builder and Cash Rewards also both report to the major credit bureaus to help you build credit history over time.

However, for most secured credit cards, security deposits are unavailable to you, the consumer, until you close the account. With Credit Builder and Cash Rewards, you can use your deposit to pay for monthly charges. Plus, both cards charge no annual fees and no interest, and no minimum security deposit is required!

What is the credit limit?

Credit Builder and Cash Rewards don’t have a pre-set credit limit. Instead, the money you move into your secured account sets your spending limit on the card.

With traditional credit cards, using a high percentage of your available credit limit could negatively impact your credit score. You don’t have to worry about that with Credit Builder and Cash Rewards because Chime does not report credit utilization. On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score.

How much you can spend is shown to you as Available to Spend in the Chime app.

If I use all the money I add to my card, will Credit Builder/Cash Rewards report high utilization and hurt my credit score?

Nope. We don’t report percent utilization to the major credit bureaus because both Credit Builder and Cash Rewards don’t have pre-set limits. That means spending up to the amount you added will not show a high-utilization card on your credit history. So rest assured to use Credit Builder or Cash Rewards for your everyday purchases and let them count towards credit building!

Can I apply for Cash Rewards if I’m an existing Chime member?

This product is not yet widely available, but learn how Credit Builder can help you build credit on everyday purchases. If you’re interested in increasing your chances of being included in new offers, try the following:

- Monitor and boost your FICO® Score with Experian Boost®. Learn more at: https://www.chime.com/blog/new-grow-your-fico-score-inside-the-chime-app/

- Build credit with everyday purchases using our Chime Credit Builder Visa® Credit Card*. Learn more at: https://www.chime.com/credit-builder/

How long does it take for my Credit Builder or Cash Rewards card to arrive?

After you enroll and complete a qualifying direct deposit of $200+, it’ll take on average 5-7 business days for your card to arrive.

How do I activate my new Credit Builder or Cash Rewards card?

It’s easy! Just go to the Chime app > Settings > Credit Builder > Activate Card.

What can I use my Credit Builder or Cash Rewards card for?

You can use the Credit Builder or Cash Rewards card anywhere Visa® credit cards are accepted.

For Cash Rewards, you’ll earn 1.5% cash back on rotating categories like gas

Can I move money into my Credit Builder or Cash Rewards secured account from another bank?

No, you cannot move money from other banks to your card’s secured account. You can only do that from your Chime Checking Account.

How long does it take to move money between my Checking Account and my Credit Builder or Cash Rewards secured account?

Moving money between Chime Checking Account and Credit Builder or Cash Rewards takes ~60 seconds! Once the transfer is complete, your transaction history will reflect the change and your Available to Spend will update.

What is Safer Credit Building?

Safer Credit Building is a feature that allows you to automatically pay your monthly balance with the money in your card’s secured account. Turn it on, so your monthly balances are always paid on time! Learn more about how it works for both Credit Builder and Cash Rewards here.

What is Move My Pay?

Move My Pay is an optional feature that allows you to automatically move a set amount from your Checking Account to Credit Builder or Cash Rewards whenever you get paid. You can always make changes or move money between your Chime accounts at any time.

How and when do I pay off the card?

You can pay off your Credit Builder or Cash Rewards charges in 3 ways:

Our recommendation is to turn on Safer Credit Building. When you make a purchase, the money you spent is put on hold in your secured account. Safer Credit Building uses that money to automatically pay your monthly balance. This will help you avoid late payments and outstanding balances.

If Safer Credit Building is not turned on, Manual Payments can still be made at any time by going to Settings → Safer Credit Building → Make a Payment.

ACH Payments can be made from any bank by using Credit Builder’s account and routing numbers. To find them, go to Settings → Safer Credit Building → Make a Payment → Paying with another bank

Credit Builder or Cash Rewards statements are available by the 28th of each month and due on the 23rd of the following month.

What happens if I miss a payment?

If you miss a payment, we’ll disable your Credit Builder or Cash Rewards card and ask you to pay your overdue balance. See “How and when do I pay off the card?” on how to make a payment.

If your balance due isn’t paid in full after 30 days, we may report information about your account to the major credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected on your credit report.

Where can I find more information on Credit Builder or Cash Rewards policies?

For the Credit Builder or Cash Rewards Visa Credit Card Agreement, please visit: https://www.chime.com/chime-credit-builder-visa-credit-card-agreement/

For the Credit Builder and Cash Rewards Application Disclosure and Secured Account Agreement, please visit: https://www.chime.com/chime-credit-builder-application-disclosure-and-secured-account-agreement

For the Chime Cash Rewards Visa Credit Card Rewards Program Addendum, please visit: https://www.chime.com/chime-cash-rewards-addendum

Can I use my Credit Builder or Cash Rewards card to withdraw money?

Yes! You can use your Credit Builder or Cash Rewards card to get cash fee-free at any in-network ATM, just like your Chime debit card. You can withdraw cash from any atm, but there’s a $2.50 fee for out-of-network withdrawals. To avoid out-of-network fees⁵, we recommend using one of the 60,000+ in-network ATMs found in stores you love like Walgreens, 7-eleven, and more. Go into your Chime app and use the ATM Map to find one closest to you

Can I overdraft my Chime Credit Builder or Cash Rewards card?

No, Credit Builder and Cash Rewards do not currently provide overdraft services.

Log in

Log in