Easy Savings

With automatic savings tools and a high-yield savings account,1 your small habits can make big strides when you bank through Chime.

Explore products

High-Yield Savings

Get 3.00% APY.3

No minimum balance, and 3.00% Annual Percentage Yield (APY)—that’s 7x the national average.4 Direct deposit to get this best rate with Chime+.5

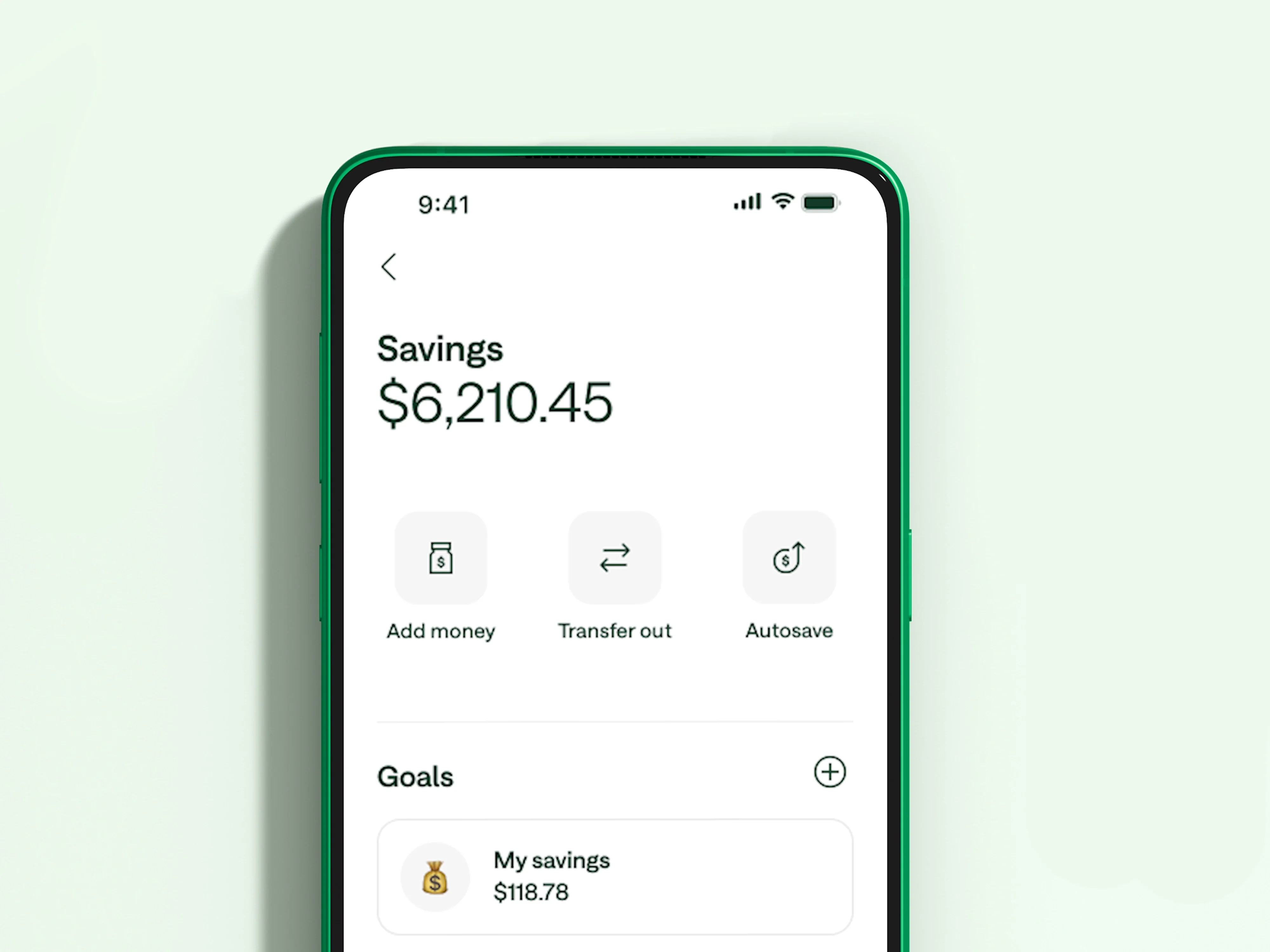

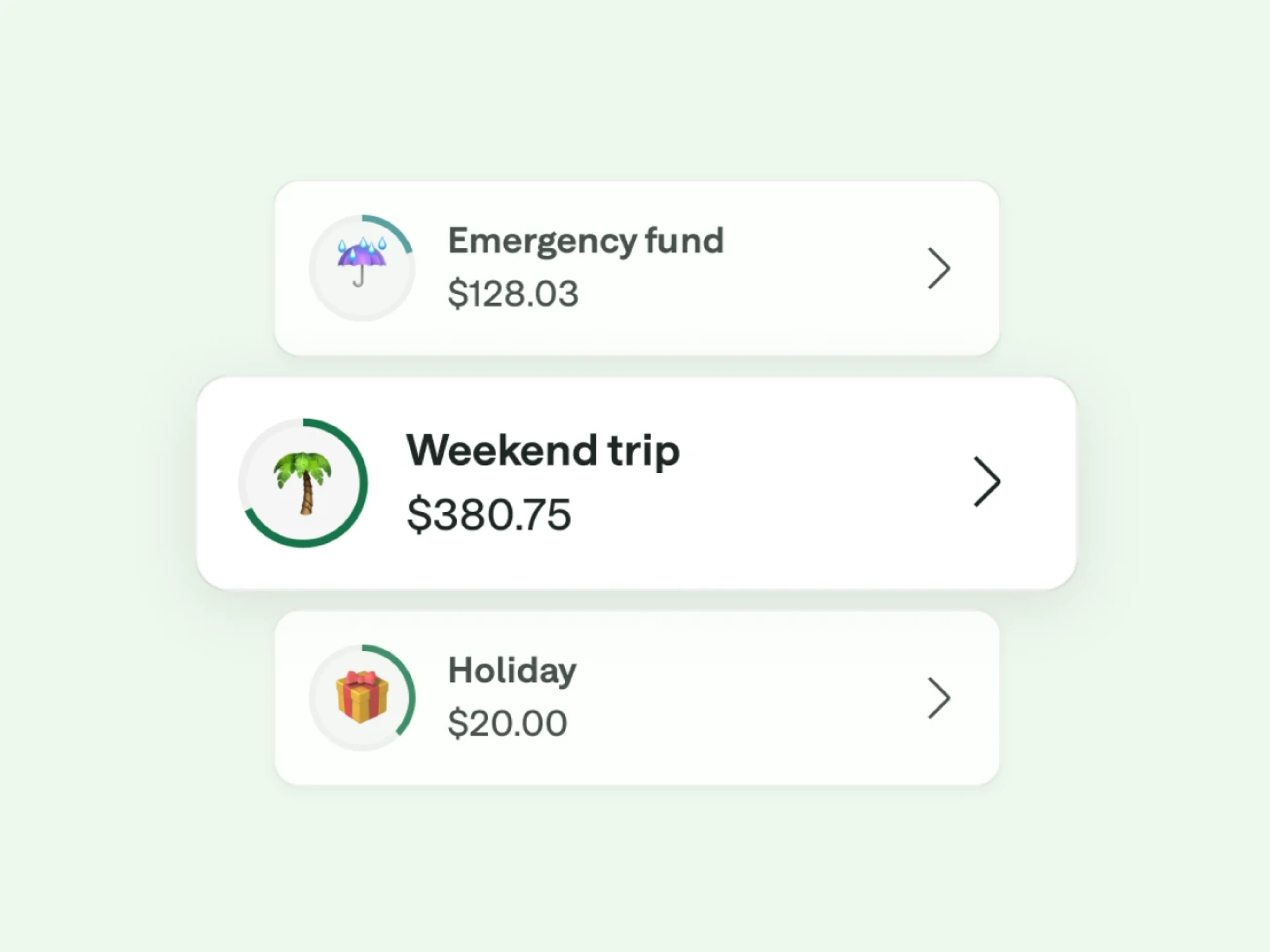

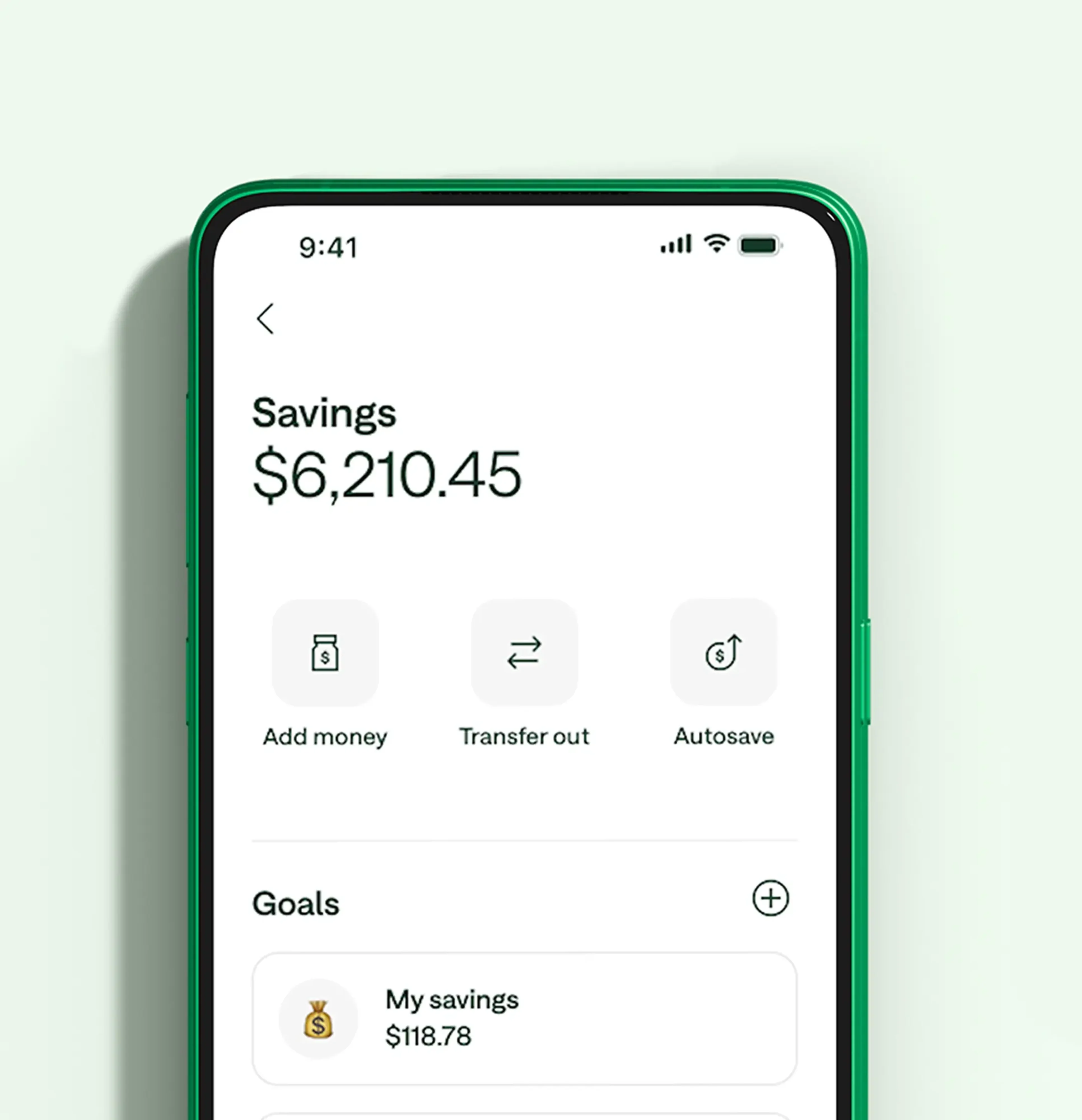

Savings Goals

Savings goals to help you stay on track.

Create unlimited custom savings goals and watch your nest egg grow.

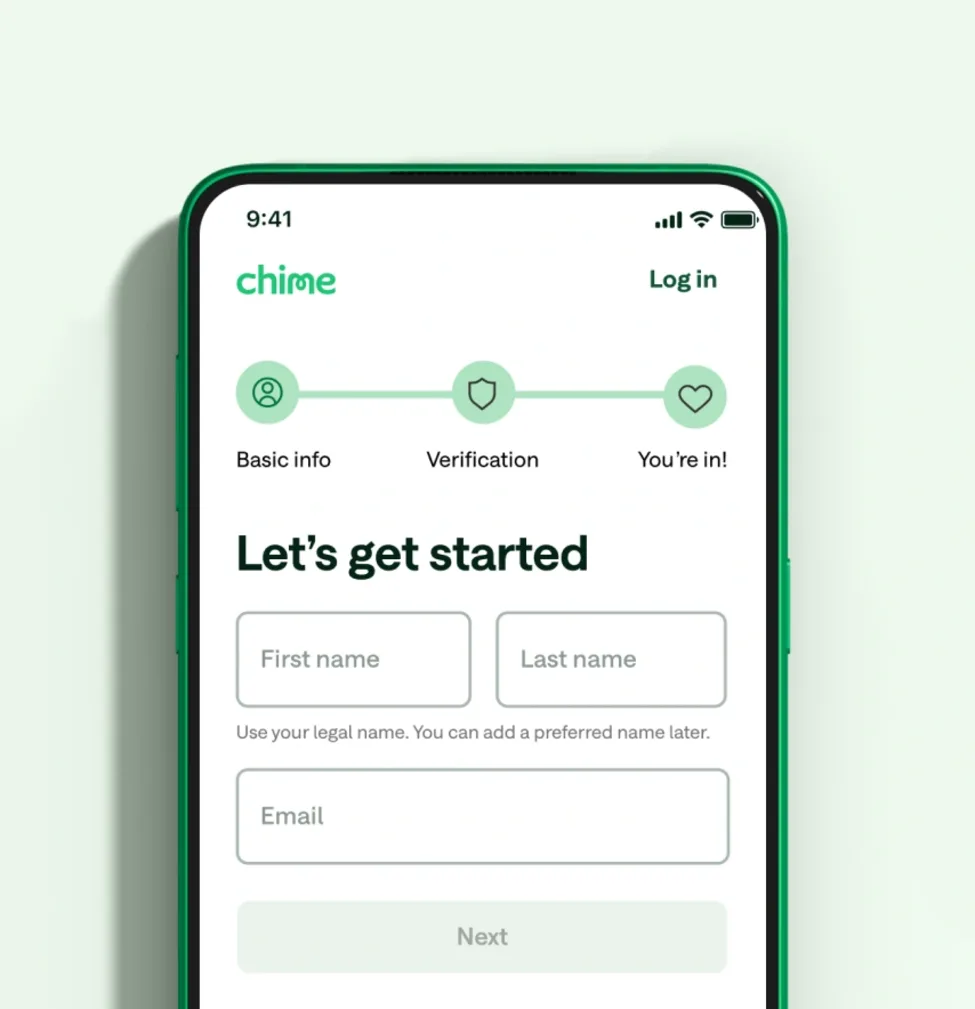

How to open a Chime Savings Account.

Open a Chime Checking Account.

Visit chime.com and enter your personal info to open a Checking Account.

Enroll in the Savings Account.

While opening the Checking Account, you’ll have the option to open a high-yield Savings Account at the same time.

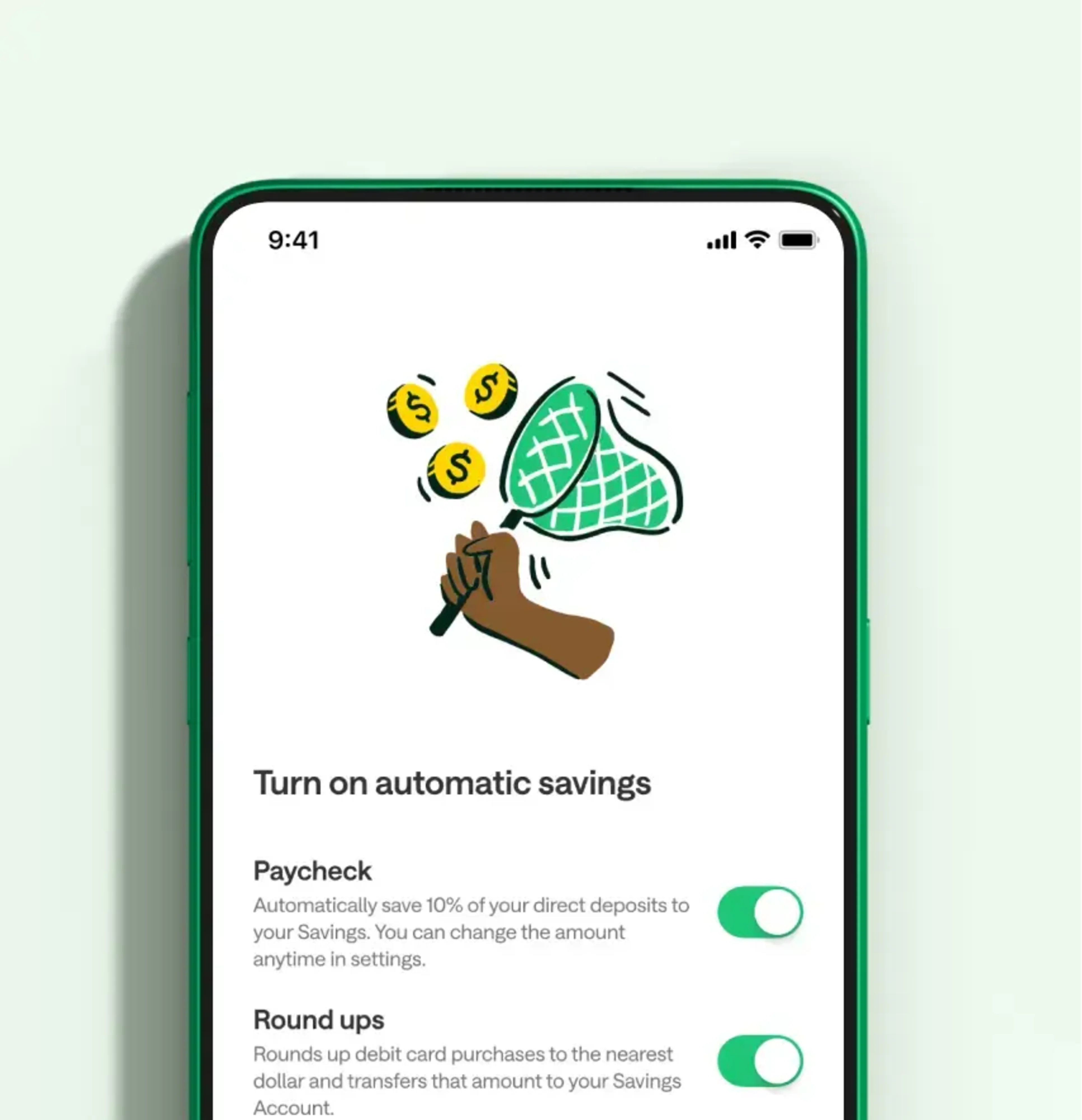

Set up your savings.

We’ll ask if you want to turn on automatic savings. Opt in, download the Chime app, and let the stacking begin!

Why members love us.

Not only is Chime The Most Loved Banking App®, but we’ve made a real and lasting impact on our members’ lives. Don’t take our word for it—we’ll let the numbers speak for themselves.

Financial progress for 97%

Percentage of members who say Chime has helped them make financial progress7

Financial progress for 97%

Financial progress for 97%

Percentage of members who say Chime has helped them make financial progress7

More than 40%

Chime members are >40% more likely to say that Chime helped them save for a rainy day vs. members at traditional banks8

More than 40%

More than 40%

Chime members are >40% more likely to say that Chime helped them save for a rainy day vs. members at traditional banks8

$18B in saving accounts

Amount saved in Chime high-yield savings accounts in 2023

$18B in saving accounts

$18B in saving accounts

Amount saved in Chime high-yield savings accounts in 2023

7x national average APY

Get 3.00% APY on your Savings Account with Chime+, and 0.75% on day one3

7x national average APY

7x national average APY

Get 3.00% APY on your Savings Account with Chime+, and 0.75% on day one3

Chime+

Unlock Chime+ for free with direct deposit.

Chime+ gives you access to even more of our products, and it’s free when you set up a qualifying direct deposit.5

FAQs

Is Chime checking or savings?

Chime offers both a checking and a high-yield savings account. The Chime Checking Account comes with a Visa® debit card and has no monthly service fees. You’ll need to open a checking account with Chime before you can open a Chime Savings Account and take advantage of Chime’s Automatic Savings features.

Does Chime have a minimum balance requirement?

No, Chime does not have a minimum balance requirement. As long as you have a balance of at least $0.01 in your Chime Savings Account, you’ll earn interest.

Many traditional banks require a minimum balance to earn interest or even to open your account.

How much are Chime’s monthly fees?

Chime’s high-yield savings account is a no-fee savings account.9 That means you’ll never pay a monthly fee, no matter your balance.

How do I open a Chime high-yield savings account?

To open a Chime Savings Account, you first need to open a Chime Checking Account online. During the enrollment process, you’ll have the option to open a savings account at the same time. But don’t worry if you miss that step – Chime Checking Account members can launch their mobile app, head to the Savings screen, and open a savings account at any time. No minimum balance required!

How do Chime Round Ups work?

Opt into Round Ups2 when signing up for your Chime Savings Account or at any time in the Chime mobile app. Each time you make a purchase or pay a bill with your Chime Visa® Debit Card, Round Ups will automatically round up transactions to the nearest dollar and transfer the spare change from your checking account into your high-yield savings account.

Is Chime savings safe?

Chime is a safe option for a savings account. Chime uses encryption and secure processes to ensure your money is protected. Plus, all your funds are held at FDIC-insured banks.10 Learn how the Chime Savings Account works.

Is a Chime Savings Account worth it?

The high-yield savings account with Chime is a great choice for building your savings. The account offers you a competitive variable Annual Percentage Yield (APY)3, and there’s no minimum balance requirement. On top of that, Chime’s Automatic Savings features help you grow your savings faster:

Round Ups2

Save money every time you make a purchase or pay a bill with your Chime Visa® Debit Card. Round Ups will automatically round up transactions to the nearest dollar and transfer the spare change from your Checking Account into your Savings Account.

Save When You Get Paid6

Chime makes it easy to automatically start saving money with every paycheck so you can achieve your financial goals faster.

How does a savings account work?

A savings account is a place where you can deposit money, and you can earn interest on the money you deposit over time.

When you deposit money with a bank, they can then use this money to lend to other people for a period of time. However, you can still access the money based on your account limitations. Most savings accounts are insured up to $250,000 through the FDIC, per depositor, per insured bank.

What is a high-yield savings account?

A high-yield savings account is a savings account that pays interest at a higher rate than traditional savings accounts. With savings accounts, interest is typically expressed as an APY, which is how much interest you could earn over a year if funds are not added or withdrawn. APY accounts for compound interest, which is essentially making money on your money.

What is APY?

The Annual Percentage Yield, or "APY," is a percentage rate reflecting the total amount of interest paid on an account. This is based on the interest rate and how often interest compounds (interest on the amount you contributed plus any interest you already earned).

APY gives you an idea of what you can earn in a year if you keep a steady balance in your account. What you actually earn will depend on the balance in your account, but the APY can help you compare rates between accounts.

Before opening a savings account, compare APYs, and look for an account with one that’s higher than the national average.

What is a variable rate?

A variable rate is a rate that may change from time to time. It depends on a few factors, including changes in market rates and conditions. Chime does not take rate changes lightly, so we will always do what we can to provide you with the best rate.

What is the best high-yield savings account?

The best high-yield savings account is the one that works for you, but when searching for a savings account, consider prioritizing online banking, low monthly fees, and, above all else, a high APY.

Because banks and credit unions routinely change their APYs, it’s difficult to name the single best high-yield savings account, but online banks have consistently provided higher APYs compared to traditional brick-and-mortar financial institutions. When you choose to bank through Chime, for instance, you gain access to a savings account that’s regularly among the best with a high APY, online banking capabilities, helpful tools to make it easier to save, and no monthly fees.9

Can I open a savings account online?

Many financial institutions and financial technology companies allow you to open a savings account online. Online banking has become an important way for people to manage personal finance, with many financial institutions offering a full online suite of services. Chime, for example, makes it easy to manage your savings online and in the mobile app.

Do savings accounts have routing numbers?

Yes, savings accounts have routing numbers, just like checking accounts. The routing number corresponds to the financial institution where you have your account. To find your savings account routing number, look for a 9-digit code on a deposit slip, or just reference your account statement online.

Checking vs. savings account: What’s the difference?

The main difference between checking and savings accounts is how you spend and save your money. Because checking accounts make your money more easily accessible – with checks, ATMs, debit cards, and online bill pay – you’ll typically use a checking account to pay for goods and services, like groceries, rent, concert tickets, and streaming services. Savings accounts generally earn interest compared to checking accounts; you should open a savings account to store money you don’t regularly need access to. Instead, the money can stay in the savings account to earn interest over time. Checking and savings accounts typically offer an added benefit over cash: They’re usually insured by the FDIC (or NCUA at credit unions) for up to $250,000 for deposits held at FDIC-insured banks.

Do savings accounts earn interest?

Yes, savings accounts earn interest, though some may have minimum balance requirements to earn that interest. With most savings accounts, you earn interest every day, but the financial institution may not pay it until the end of the month.

How much should I have in savings?

How much money you should have in your savings account depends on your income, monthly expenses, and personal goals.

According to a survey conducted by The Motley Fool Ascent in July 2023, the median savings account balance among Americans is just $1,200.11

It’s a good idea to build an emergency savings fund as soon as you can; experts recommend that an emergency savings fund should be able to cover three to six months’ worth of expenses for you and your family.

After you’ve built your emergency savings, you can decide the best path for you: paying down debt; saving for other things, like a house, wedding, or vacation; or even investing.

Where can I find a no-fee savings account?

Many savings accounts tout themselves as fee-free, but when you read the fine print, you’ll see that there are strings attached. Some banks might require regular deposits to avoid fees, while others might charge a fee if your average account balance dips below a certain threshold. Read all fine print carefully before signing up for any no-fee savings account. If you’re looking for a savings account that truly charges no monthly fees, check out the high-yield savings account with Chime.9

How much money should I keep in checking vs savings?

Some experts recommend having enough money in your checking account to cover one or two months of expenses, plus a 30% buffer for additional expenses.

The amount you need to put in your savings account depends on your lifestyle and what you can realistically save. Some experts recommend saving three to six months’ worth of expenses for an emergency fund.

Why are there two different APY rates for Chime?

Chime offers a starting APY of 0.75%, and an even higher APY of 3.00%3 as a benefit of Chime+. You can direct deposit to get Chime+ for free,5 and when you do, your savings account will automatically upgrade to 3.00% APY.