A high-yield savings account, or HYSA, is a type of savings account that pays a significantly higher interest rate than a traditional savings account. A high-yield savings account can be a powerful tool if you want to make your money work harder and grow your savings more efficiently. But how do they work? Let’s dive in.

What is a high-yield savings account?

Unlike standard savings accounts, which tend to offer modest interest rates, high-yield savings accounts allow you to earn more in interest on your savings.

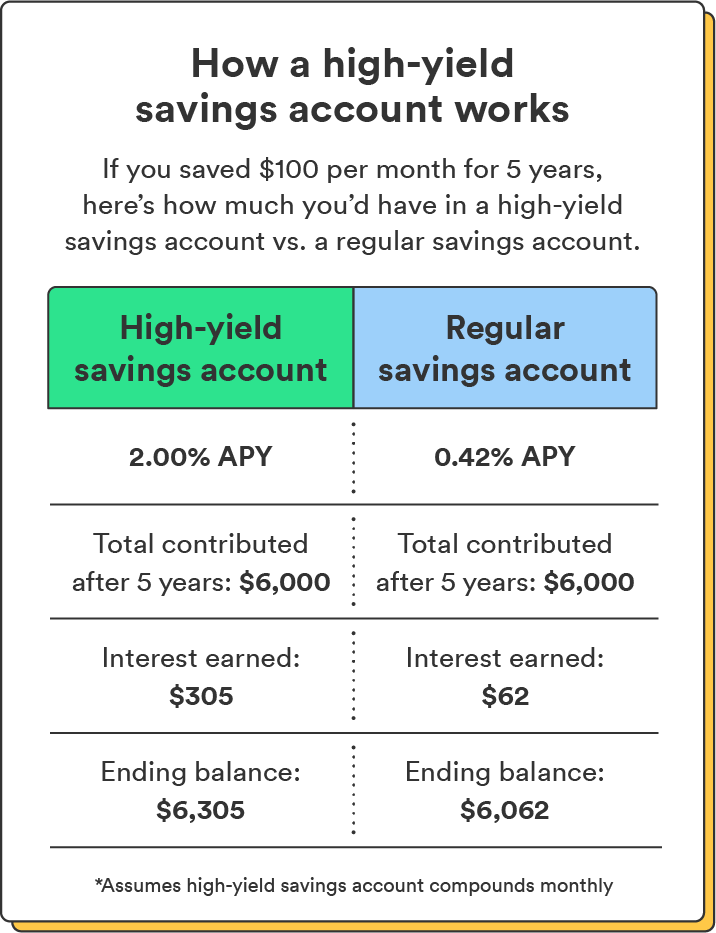

The current national average interest rate for a standard savings account is 0.42%¹, but you can find high-yield savings accounts that earn anywhere from 2-5% – far more than the national average. Over time, your funds will accumulate more interest, allowing your savings to grow more rapidly.

These accounts are typically offered by online banks or financial institutions that operate with lower overhead costs, allowing them to pass on the benefits to their customers through higher interest rates.

You may need to open a high-yield savings account at a separate institution from where you have a checking account, but modern technology like Electronic Funds Transfer (EFT) makes it simple to transfer funds between accounts.

Why open a high-yield savings account?

A high-yield savings account can help expedite reaching your short-term savings goals, whether that’s building an emergency fund or saving for a vacation.

Here’s why opening a high-yield savings account is a smart move:

- High interest rates: High-yield savings accounts let you earn competitive interest on your money for no extra effort.

- Accelerated savings growth: Thanks to compound interest, high-yield savings accounts help you reach your savings goals faster than with a standard savings account.

- Safe and secure: High-yield savings accounts are FDIC-insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA). This insurance protects your deposits up to the maximum allowable limit, ensuring your funds are safe even during economic uncertainty.

- Low-risk investment opportunity: High-yield savings accounts are considered low-risk, unlike stocks or other higher-risk assets. You earn interest on top of your principal, making this an excellent option for risk-averse investors.

High-yield savings accounts offer many advantages for maximizing your savings, particularly for reaching short-term savings goals.

That said, high-yield savings accounts can also come with some drawbacks:

- Not ideal for long-term savings goals: While high-yield savings accounts are excellent for short-term and emergency funds, they might not be the best choice for long-term wealth building due to the relatively lower interest rates compared to long-term investments.

- May have more requirements to open: Because of their competitive interest rate, high-yield savings accounts may come with a higher initial deposit amount or minimum balance than a regular savings account. Chime’s high-yield savings account requires no minimum balance or initial deposit and comes with no maintenance fees.

- Withdrawal limits: Financial institutions may restrict the number of monthly withdrawals allowed on high-yield savings accounts. Withdrawal limits are designed to deter you from dipping into the account too often since it’s a savings vehicle rather than an everyday spending account.

How does a high-yield savings account work?

Now that you know the benefits of a high-yield savings account, let’s break down the mechanics of how they work. Below is a brief overview of how high-yield savings accounts compare to other types of accounts:

APY

APY represents the total interest earned over a year, expressed as a percentage of your initial balance. For instance, if your high-yield savings account has an APY of 2.5%, it means that, with compounding interest, your savings would grow by approximately 2.5% over a year (assuming no additional contributions were made during that year). The higher the APY, the more rapidly your savings will grow.

Compound interest

Compound interest is the magic behind the growth of your savings in a high-yield savings account. It’s the concept of earning interest not only on your initial deposit but also on the interest accumulating over time.

The more frequently interest is compounded, such as daily or monthly, the faster your savings will grow. With each compounding period, the interest is added to your balance, increasing the amount on which future interest calculations are based. As a result, your savings will grow faster than with simple interest, where you only earn interest on your initial deposit.

To maximize the benefits of compound interest, leave your money in a high-yield savings account and avoid frequent withdrawals. The longer your money remains in the account, the more time it has to compound, resulting in greater overall growth.

Withdrawals and transfers

High-yield saving accounts sometimes limit you to six withdrawals or transfers per month, and some institutions may charge fees for excessive withdrawals. If you open a high-yield savings account at the same institution as your checking account, you can link your existing accounts and make transfers or withdrawals online like you would with any other account.

If your high-yield savings account is with a different bank from your checking account, transferring money between the two may take longer (typically 1-3 business days). You’ll need to initiate the transfer through your savings account’s online platform, providing your checking account details.

6 things to look for in a high-yield savings account

If you’re ready to open a high-yield savings account, there are many options available to choose from. Each has varying interest rates, terms, fees, and limitations, so carefully evaluate your options based on the factors below.

Interest rate

The interest rate is one of the main things to consider when choosing a high-yield savings account. Even seemingly small differences in interest rates can significantly impact your savings over time. Look for accounts that consistently offer competitive rates, and remember that some banks may offer promotional rates that change after an introductory period.

Chime tip: In addition to checking for promotional rates that may change after an introductory period, also check if you’re required to maintain a certain minimum balance to qualify for the advertised rate.

Initial deposit requirements

Consider the initial deposit required to open a high-yield savings account. Some accounts may have no minimum deposit, while others might require a significant amount. Assess your financial situation and choose an account that fits your budget. If you’re just building your savings, look for accounts with a lower initial deposit requirement.

Minimum balance requirements

In addition to the initial deposit, some high-yield savings accounts have minimum balance requirements. You must maintain a certain amount in the account to avoid fees or a reduction in the interest rate. Be aware of these requirements, and choose an account that consistently matches your ability to maintain the minimum balance.

Compounding method

The compounding method can significantly impact the growth of your savings. Some high-yield savings accounts compound interest daily, while others may compound it monthly or even quarterly. The more frequent the compounding, the faster your savings will grow. Opt for an account that compounds interest daily to maximize how much interest you can earn.

Fees

Review the fees associated with the high-yield savings account. Common fees include monthly maintenance, excessive transaction, and wire transfer fees. Look for accounts with minimal fees, and review the requirements for avoiding them (such as keeping your account balance above a minimum balance requirement).

Withdrawal limits

High-yield savings accounts can come with withdrawal limits to encourage saving. Ensure you understand the monthly transaction limitations for withdrawals and transfers. If you anticipate needing frequent access to your funds, consider an account with more flexible withdrawal limits.

How to open a high-yield savings account

Most high-yield savings accounts are available through online institutions, but some banks with physical branches also offer them. Consider your priorities to determine if in-person service is important to you or not to help you narrow down your options. From there, the process of opening the account is straightforward. You’ll likely need the following documentation:

- Your Social Security number.

- A valid form of identification (like your driver’s license or passport).

- Personal information (like your address and phone number).

Gather the required documentation, then fill out and submit your application.

Some high-yield savings accounts may require an initial deposit to open the account. If yours does, transfer the desired amount from your checking account or another funding source to complete the account opening process.

Chime tip: Consider setting up automatic deposits to your high-yield savings account to help your savings grow on autopilot.

Grow your savings faster with a high-yield savings account

A high-yield savings account offers many financial benefits without many drawbacks. If you don’t have a savings account to grow your money, consider opening a high-yield savings account to start building up your savings.

If you have a regular savings account, see how much interest it’s earning. If it isn’t making you much money, take the time to check out current rates for some high-yield savings accounts – and make the switch.

Ready to make moves towards your savings goals? Learn more about how much to save each month based on your budget.

FAQs

Still have questions about high-yield savings accounts? Find answers below.

Can you withdraw money from a high-yield savings account?

Yes, you can withdraw money from a high-yield savings account. However, these accounts often limit the number of withdrawals allowed per month to encourage saving. Exceeding the monthly withdrawal limit may result in fees or other penalties.

Can you lose money in a high-yield savings account?

High-yield savings accounts are typically low-risk, meaning your initial deposit is generally safe and secure. However, while your savings will grow over time with interest, the returns may not always outpace inflation. The purchasing power of your savings may be affected, resulting in a potential loss in real value.

How do you calculate interest on a high-yield savings account?

Interest on a high-yield savings account is typically calculated using the following formula: A = P(1 + r/n)^(nt). Where:

- A = the future value of the investment/loan, including interest

- P = the principal amount (initial investment or loan amount)

- r = the annual interest rate (expressed as a decimal)

- n = the number of times that interest is compounded per year

- t = the number of years the money is invested or borrowed for

This formula is used to calculate the total amount of money accrued through compound interest over time.

How much will $1,000 make in a high-yield savings account?

The amount $1,000 will make in a high-yield savings account depends on the interest rate and the length of time the money stays in the account. To calculate the total amount, you would need to know the annual interest rate, the number of times the interest is compounded in a year, and the duration the money will be invested. With that information, you can use the compound interest formula A = P(1 + r/n)^(nt) to determine the final amount.

Are high-yield savings accounts safe?

High-yield savings accounts are generally considered safe. Most reputable financial institutions offering these accounts are insured by the FDIC or NCUA, protecting deposits up to the maximum allowable limit. This insurance safeguards your funds in a bank failure or financial downturn.

How much will $1,000 make in a high-yield savings account?

The amount $1,000 will make in a high-yield savings account depends on the interest rate and the length of time the money stays in the account. Using the simple interest formula, Interest = Principal × Interest Rate × Time, you can calculate the earnings based on the interest rate and time period.

What is the best way to use a high-yield savings account?

A high-yield savings account is best for short-term savings goals, such as building an emergency fund, saving for a down payment, or funding a vacation. It offers a secure and accessible place to grow your money with higher interest rates than a regular savings account.

What are some alternatives to a high-yield savings account?

Alternatives to a high-yield savings account include certificates of deposit (CDs), money market accounts, and various investment options like mutual funds and stocks. Each alternative has its own risk and return profile, so consider your financial goals and risk tolerance when choosing the best option.