Emergency Fund Calculator

Monthly expenses total:

$6,000

To create a

If you continue to save

$200/month

You'll need to save

$800

Saving the full amount will take

XX months

This calculator is for educational purposes only. It calculates estimates based on the information you provide, and your ideal emergency fund amount may change if any of the information varies. You should enter figures that are appropriate to your individual situation. This calculator is not intended to offer any tax, legal, financial or investment advice.

How to use the emergency fund calculator

To use this calculator, input your approximate monthly expenses. The calculator will show you a breakdown of how long it will take you to save $1,000, or between three to nine months of funds to fill up your emergency fund account.

- Rent or mortgage payments: Enter your monthly rent or mortgage payment.

- Debt payments: Enter how much you pay on credit cards and all loans (except your mortgage and car payment) every month.

- Utility payments: Enter the combined amount you pay for gas, water, electricity, garbage, or other utilities each month.

- Phone and internet payments: Enter the combined monthly total of your phone, internet, cable, streaming services, and any other similar payments.

- Insurance payments: Enter the combined monthly total of car, health, life, and home insurance payments as well as other insurance payments that aren’t deducted from your paycheck by your employer.

- Transportation expenses: Enter the combined monthly total of your car payment, fuel, and public transportation costs.

- Grocery expenses: Enter the combined monthly amount you spend on groceries.

- Other expenses: Enter the combined monthly total of any other expenses. Include the cost of prescription medications, gym memberships, clothes, etc.

- Amount you can save each month: Enter the amount of money you can comfortably save each month.

- Current amount saved: Enter the total amount of money you’ve already saved for your emergency fund.

Simply input your details into the emergency fund calculator and hit “calculate” to see your results.

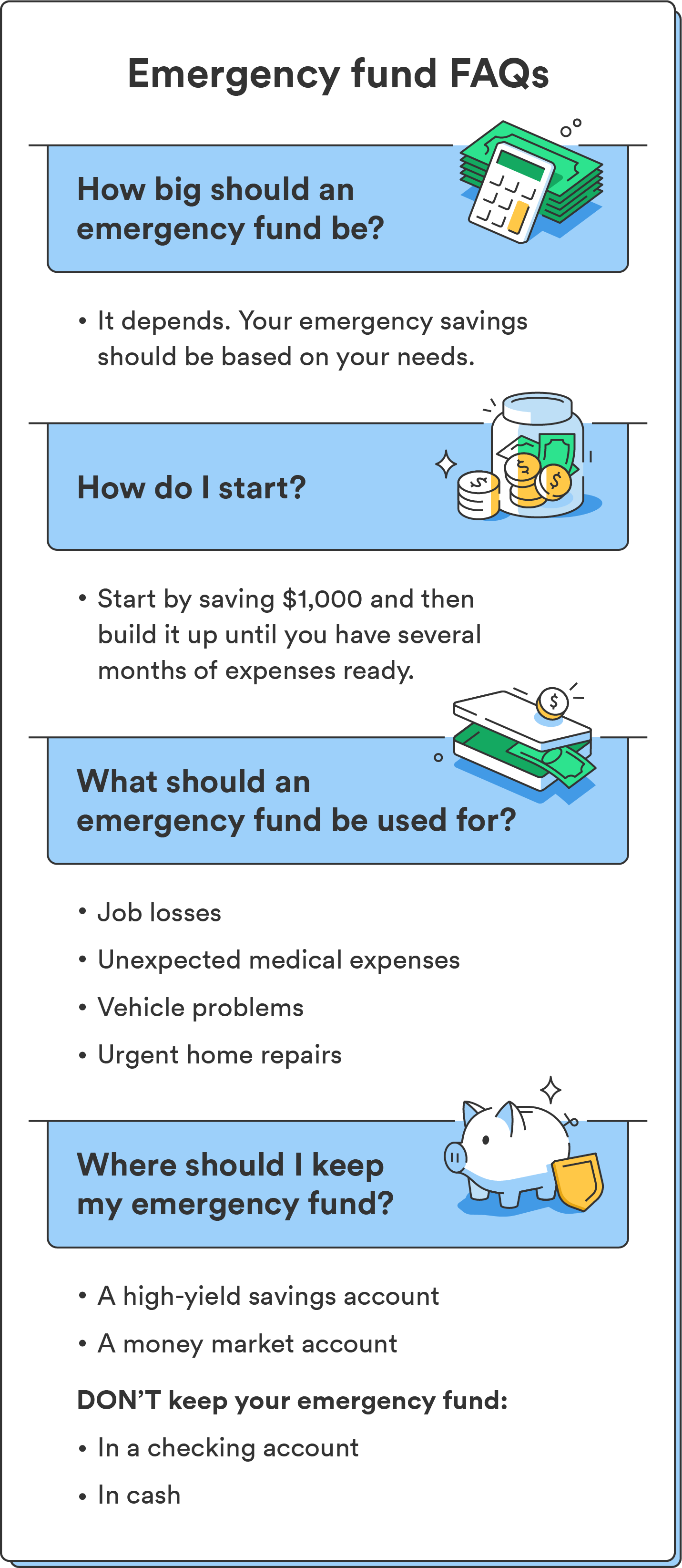

How much should I have in an emergency fund?

If you’ve ever thought about building an emergency fund, but you weren’t sure how much you need or how to start saving, you aren’t alone. In a 2022 survey, more than one in five Americans listed difficulties saving for emergencies as one of their top financial challenges.¹

The answer to how much money you should have saved for an emergency is not a one-answer-fits-all question. Because everyone’s financial situation is different, everyone’s emergency fund is different.

Some factors that can increase the amount of emergency cash you’ll want on hand include:

- Family size: A young couple with no children won’t need as much in the bank as a family of six.

- Number of adults working: If you and your significant other both work, your combined emergency fund can be smaller than if only one of you was working.

- Medical conditions: If you or a family member has existing medical conditions that you spend money on regularly, having some extra savings can help alleviate financial stress.

- Mortgage: Keeping a roof over your head is one of life’s most important priorities. Saving a sizable chunk of change when you have a mortgage isn’t always easy, but being able to cover it if you lose your job will make it worthwhile.

- Income size: If you’re on a fixed or tight income, having extra savings can provide extra breathing room.

- Income fluctuations: If you or anyone in your family works freelance, you know that sometimes the paying gigs aren’t as regular. Saving more to cover a less-stable income can set you up for success.

- Pets: Sometimes, your pets need medical attention, too. If you want to be able to pay for their care, add extra money to your emergency account.

Keep reading to learn about a few options while trying to find out how much you’ll need to save.

How to determine how much to save in an emergency fund [4 options]

Depending on how many people there are in your family, how much money you make, and other variables, a good emergency fund could be as small as $1,000 to $20,000 or more.

While it would be convenient if everyone could follow the 50/20/30 rule, putting 20% of your paycheck into a savings account isn’t always possible. The information below will provide a few ways to think about your emergency fund and how much you should have to stay afloat in case of a crisis.

1. Start by saving $1,000

While $1,000 is still a big number, it’s achievable. For example, you can reach this goal in less than a year if you manage to stash away $100 per month. And, by then, one surprise bill may not be able to throw your whole budget off track.

There are multiple options to reach this $1,000. For example, you could move $25 from your checking account to your emergency fund each week. By doing so, you’ll “pay yourself first” – and remove one major psychological roadblock to saving.

If you have a Chime Checking Account and Chime Savings Account*, you can turn on Round Ups to work on your savings. Round Ups transfer money from your checking account to your savings account every time you make a purchase or pay a bill with your Chime Visa® Debit Card. The transaction is rounded up to the next dollar and the difference is moved to your Chime Savings Account automatically.² It might not sound like much, but these small deposits add up over time.

Lastly, you can set up an automatic transfer so that a percentage of your paycheck deposits into your savings account each time you get paid. Turn on Save When I Get Paid in your Chime settings to automatically transfer 10% of deposits totaling $500 or more into your Savings Account.

2. Set aside several months’ worth of living expenses

Having several months of your expenses covered by an emergency fund can cushion you and your family in case of a job loss or another big financial hit. Having more savings lets you feel secure and provides breathing room to find another job.

Having the time to look for a job that will pay enough and provide you with the benefits you need will be better long-term than simply taking the first opportunity that comes along.

Chime tip: Don’t keep your emergency fund in your checking or investment accounts. Because you may need to access it quickly, keep it in a high-yield savings account or a money market account.

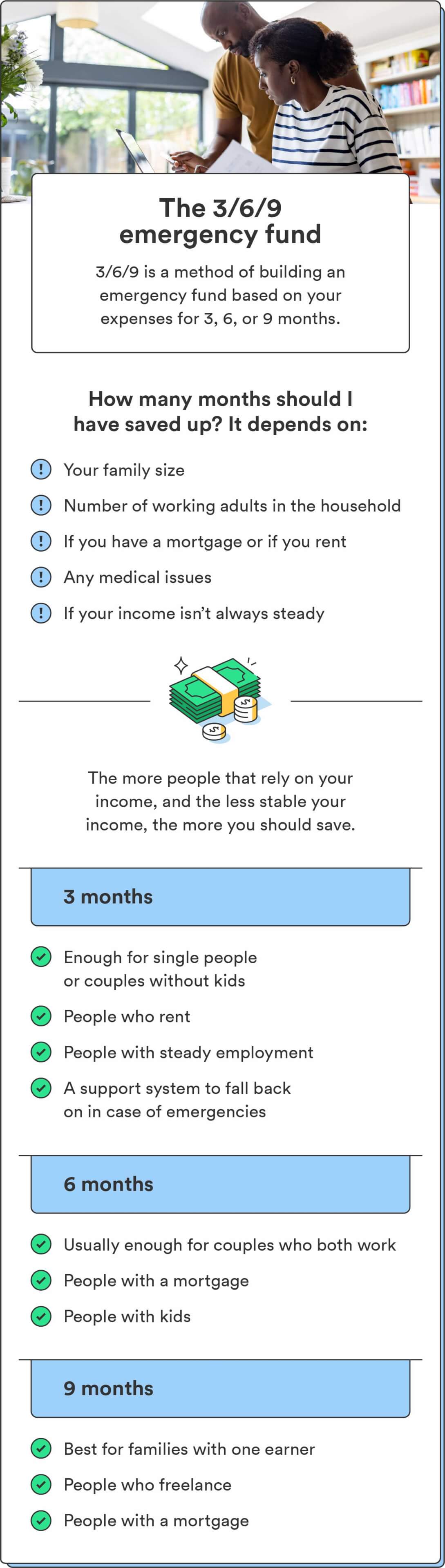

3. Use the 3/6/9 rule

The answer to the question of how much you should save each month can be tricky, but if you use the 3/6/9 rule, you’ll have a better idea of how much you should have stashed away for an emergency.

The 3/6/9 rule provides a basic breakdown of who should have three months of expenses saved up, who should have six, and who should have nine. It comes down to how much risk you and your family have of not having money to get by.

- Three months: For a single person or married couple with no kids and no dependents (and for those who would be able to move in with family members if needed), three months of savings is usually good enough to help them through a tough patch.

- Six months: For committed couples who are both working steadily with a mortgage and kids, six months of savings should provide enough for your family to get through a job loss, medical emergency, or another expensive, unplanned occurrence.

- Nine months: When you’re the sole earner in your family, or you have irregular income (like from freelancing), nine months of expenses will help sustain your household between jobs or in case of an emergency.

4. Use Chime’s emergency fund calculator

Chime’s emergency fund calculator was designed to make the process of figuring out what your emergency fund should look like as simple as possible.

Enter your monthly expenses, how much you’re already saving each month, and how much you have in savings to see how long it could take you to reach your goal.

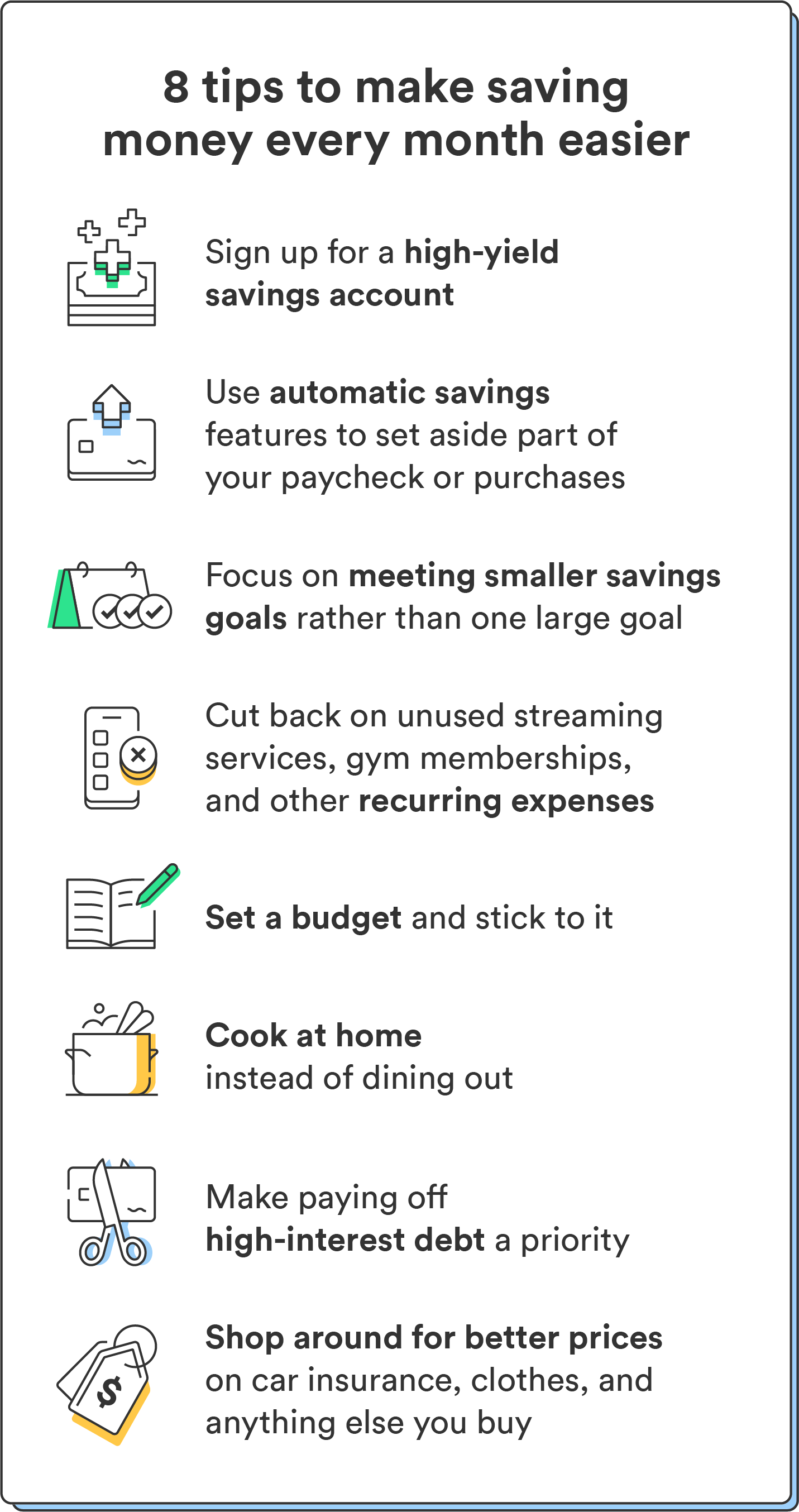

How to save more each month for your emergency fund

Creating regular savings practices and using a few money-saving hacks will help establish saving as a habit, which makes it easier to do over time. Saving can also have a nice snowball effect – once you see how possible it is to save a little, you’ll start looking for other opportunities to save more.

Cut down on expenses

The most effective way to save money is probably the most difficult: reducing your expenses. It’s easy to pay a little extra for a gym membership each month, or add another streaming service to catch the latest show, or stop to pick up food on your way home from work instead of cooking. But these expenses can chip away from your emergency fund.

Start by looking at your recurring monthly payments. Separate them into required and nonrequired categories. For all of the non-required expenses, weigh them to see which are important to you even if they aren’t essential, and which ones you won’t miss. Saving money on streaming services alone can add up, and so can cooking at home. You don’t have to eliminate everything on the nonessential list – even a few cuts can give you some breathing room.

Use automated savings tools

If saving money is often an afterthought, automatic savings features and apps might help you save without completely changing the way you handle your finances. These tools work by taking a certain amount of money from your account or paycheck and automatically moving it into a savings account. Some of these features will round up each purchase to the nearest dollar and put the extra into savings, while others move a set amount at certain times of the month.

Pairing automated savings with a high-yield savings account is worth it – not only will you make progress toward building an emergency savings fund, but you’ll also get higher interest rates, which further improves your savings.

Set smaller goals

Whether your total emergency fund needs to be $1,000 or significantly larger, trying to save all of that money all at once can be daunting. One way to make the journey feel shorter and more manageable is to break it up into smaller goals. Break down the amounts you’re contributing into:

- Yearly contributions

- Monthly contributions

- Weekly contributions

- Daily contributions

As the amounts get smaller, it feels easier, doesn’t it? These smaller goals also mean more changes to celebrate your successes. It could be as simple as sharing the goal with your partner or treating yourself to something small to stay on track to protect your family’s financial health.

Consider finding ways to pay off debt faster

Paying off debt means you can save more money. If you’re stuck paying off high-interest credit cards, you may not have the cash you need to start a good emergency fund.

One way to tackle high-interest debt is to consider a consolidation loan or balance-transfer credit card. Personal loans usually have lower interest rates than credit cards, and many credit cards that offer balance transfers will do so at a 0% or lower fixed rate (for a set time).

Protect yourself in case of emergencies

Successfully managing your personal finances isn’t always easy. But when it could make the difference between being able to handle a surprise expense without digging a hole you can’t get out of and being precariously perched over real financial hardship, you can do it.

At Chime, our high-yield savings account can help your money grow faster. There are no monthly account fees, and it even has automatic savings features to make saving easier than ever.

FAQ about emergency fund calculators

Still have questions about the emergency fund calculator? Find answers below.

What is a realistic emergency fund amount?

A realistic emergency fund amount depends on many factors, like your family size, how much you make, and how much you can save. Even having $1,000 in savings can be a big help in an emergency, so try to start by saving at least $1,000.

How much do most Americans have in emergency savings?

The median amount in American savings accounts is $1,200, according to a July 2023 survey.3

Log in

Log in