Key takeaways

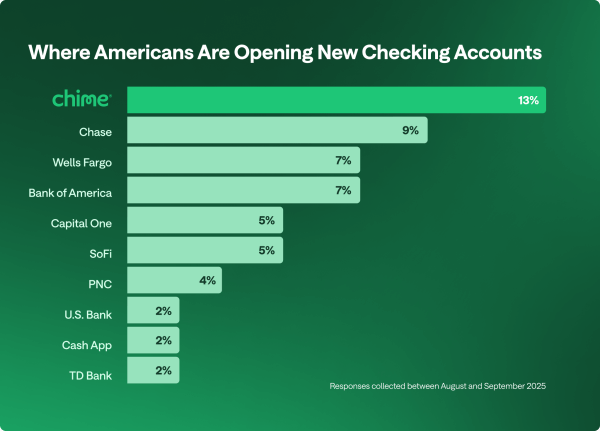

- A recent study from J.D. Power, a consumer intelligence and data analytics company, found that 13% of new checking accounts opened in the third quarter of 2025 were with Chime. That’s more than any other bank provider, including Chase (9%), Wells Fargo (7%), and Bank of America (7%).

- Customers listed convenience, reputation, and low or no fees as their top three reasons for switching to Chime.

- Chime offers a convenient banking app, reliable customer service, and fee-free checking,¹ making it a top choice for American customers.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC..

Source: J.D. Power Financial Services Churn Data and Analytics

According to J.D. Power’s quarterly Power Financial Services Churn Data and Analytics report, Chime ranked as the top destination for bank switchers, leading all traditional banks and financial technology companies (“fintechs”) in new checking account openings. The findings reveal how, quietly, consumers are shifting that trust to new providers who reflect their values.

The numbers tell a clear story: Chime is becoming America’s #1 new place to bank.

More people switch to Chime than Chase, Bank of America, or Wells Fargo

When you’re unhappy with something, it’s time for a change. But switching banks can be time-consuming and stressful. What if there was a better way?

Enter a new trend called “soft switching” — when a consumer opens a second checking, savings, or investment account and quietly redirects their finances to it. J.D. Power’s report is based on responses from more than 4,000 U.S. consumers surveyed between Aug. 19 and Sept. 30, 2025 — all of whom had opened a new checking account within the past 90 days. The study found that over half (52%) of these new accounts were additional, rather than replacement or first-time accounts.

And J.D. Power data shows that customers are overwhelmingly choosing Chime over other financial institutions. Among all providers, Chime captured the largest share (13%), beating out Chase (9%), Wells Fargo (7%), or Bank of America (7%).

These numbers signal a shift in how people choose where their everyday money lives. Consumers are moving away from traditional banks and are increasingly choosing digital-first, app-based financial services to manage their primary spending and deposits.

Why are Americans switching to Chime?

So, what is it about Chime that has Americans ditching their old financial institutions? J.D. Power asked new Chime customers their main reasons for choosing Chime for their new checking accounts.

The top three reasons were:

- Convenience: 41%

- Reputation: 35%

- Low or no fees: 34%

You can sign up for Chime in minutes and manage your banking online in a web browser or via a reliable, convenient app. Chime is also known for its transparent policies and consistent customer experience, which lends to a positive reputation in the banking community.

Finally, Chime’s fee-free banking1 philosophy means you won’t have required fees for:

- In-network ATM withdrawals2

- Monthly maintenance

- Cash deposits at more than 8,000 Walgreens locations3

- Overdraft protection up to $200 through SpotMe®4

- Instant payments to peers through Pay Anyone®5

- Accessing pay up to $500 when you need it through MyPay®6

There’s no need to research how to avoid bank fees. With Chime, you can rest easy knowing that you’ll never be charged a monthly maintenance fee.1

Start your fee-free banking journey with Chime

No-fee banking1 isn’t just a nice-to-have anymore. It’s becoming the baseline. And more people are making the move and enjoying the convenience and benefits of Chime membership.

Ready to make the switch? Learn how to open a Chime account online within minutes and start your journey toward healthier finances.

Log in

Log in