SpotMe® Fee-Free Overdraft

Online banking with no overdraft fees¹

- Overdraft up to $200¹ without fees

- Get spotted on debit and credit card transactions, plus cash withdrawals

- Increase your SpotMe limit with Boosts^ from friends

Learn how we collect and use your information by visiting our Privacy Notice

What is overdraft coverage?

Overdraft coverage ensures you can withdraw cash or make purchases that exceed your available balance in your account without incurring expensive overdraft fees.

No overdraft fees.

Through Chime, no additional overdraft coverage is needed. We’ll spot you up to $200¹ on debit and credit card transactions and cash withdrawals with no overdraft fees.

You also have access to SpotMe when you use your Credit Builder card.

We apply your next deposit to your negative balance.

Boost each other.

Eligible members enjoy complimentary Boosts², which you can send to friends to increase their SpotMe limit by $5.

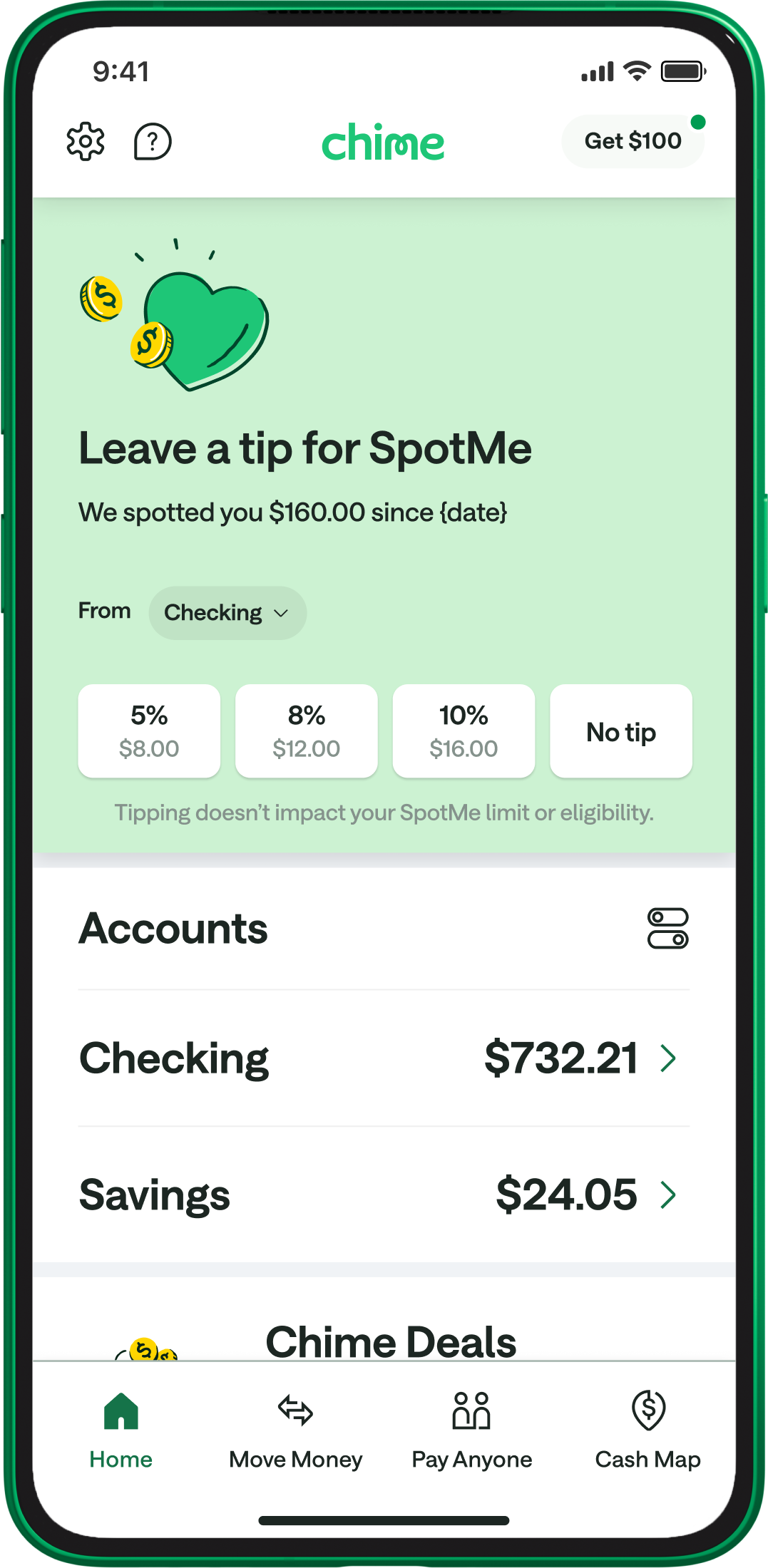

Pay it forward.

Optional tips* are invested back into the service to keep SpotMe fee-free for our members!

You’ll have the choice to tip after you’ve repaid your negative balance.

*Tipping or not tipping has no impact on your eligibility for SpotMe.

Billions saved inoverdraft fees.

Join millions of Chime members who enjoy fee-free overdrafts and peace of mind

Member testimonials.

Real members. Paid testimonials.

Chime® SpotMe vs. traditional overdraft fees.

Direct deposit unlocks SpotMe® and more, with Chime+

Unlock even more of Chime plus exclusive benefits, for free with your qualifying direct deposit‡.

FAQs

What is an overdraft fee?

An overdraft fee is a fee that a bank or credit union charges you when a purchase or other transaction exceeds the available balance in your checking account. Overdraft fees can be charged on in-store purchases, online shopping, bill payments, cash withdrawals, and other transactions. Learn more about overdraft fees on our blog.

How do I avoid overdraft fees?

Make sure to read your bank’s terms and conditions before choosing a bank account. While banks are no longer allowed to automatically charge overdraft fees without your consent, it’s possible to opt in for overdraft protection without realizing it

Read more about how to avoid overdraft fees on our blog.

Additionally, you can avoid overdraft fees by banking through Chime and opting into SpotMe to cover any debit or credit transactions or cash withdrawals that would result in a negative balance in your Checking Account or Credit Builder card.

Will I ever be charged an overdraft fee through Chime?

No. If you do not have sufficient funds in your Chime Checking Account or your Credit Builder Secured Deposit Account, or have reached your SpotMe limit (if enrolled), then your Chime Visa® Debit Card or Chime Credit Builder Card will be declined. There is no fee for declining transactions or for utilizing SpotMe.

What is Chime’s SpotMe?

SpotMe is a completely free service for eligible Chime members who overdraft their checking account or Credit Builder card.

Once you’re eligible, enroll in SpotMe (it’s fee-free!), and we’ve got your back when you overdraft your account by up to $200.¹

Who is eligible for SpotMe?

Any Chime members who currently have Chime+‡ and have activated their Chime debit card or Chime Credit Builder card are eligible for SpotMe.

How do I enroll in SpotMe on Chime?

- Activate your Chime Visa® Debit Card.

- Open the Settings tab in your Chime app to find out if you’re eligible for the SpotMe feature (make sure you have the latest version of the app).

- Once you agree to the SpotMe Terms and Conditions, you are officially enrolled in SpotMe!

Is there anything SpotMe does not cover?

You can use SpotMe for:

- Debit card transactions

- Credit card transactions

- Cash-back transactions

- ATM withdrawals

SpotMe does not cover:

- Pay Anyone transfers

- Direct debits, such as automatic bill payments, from your Checking Account

- Transfers to your Savings Account

- Transfers to apps like Venmo and Cash App

- Chime Checkbook transactions

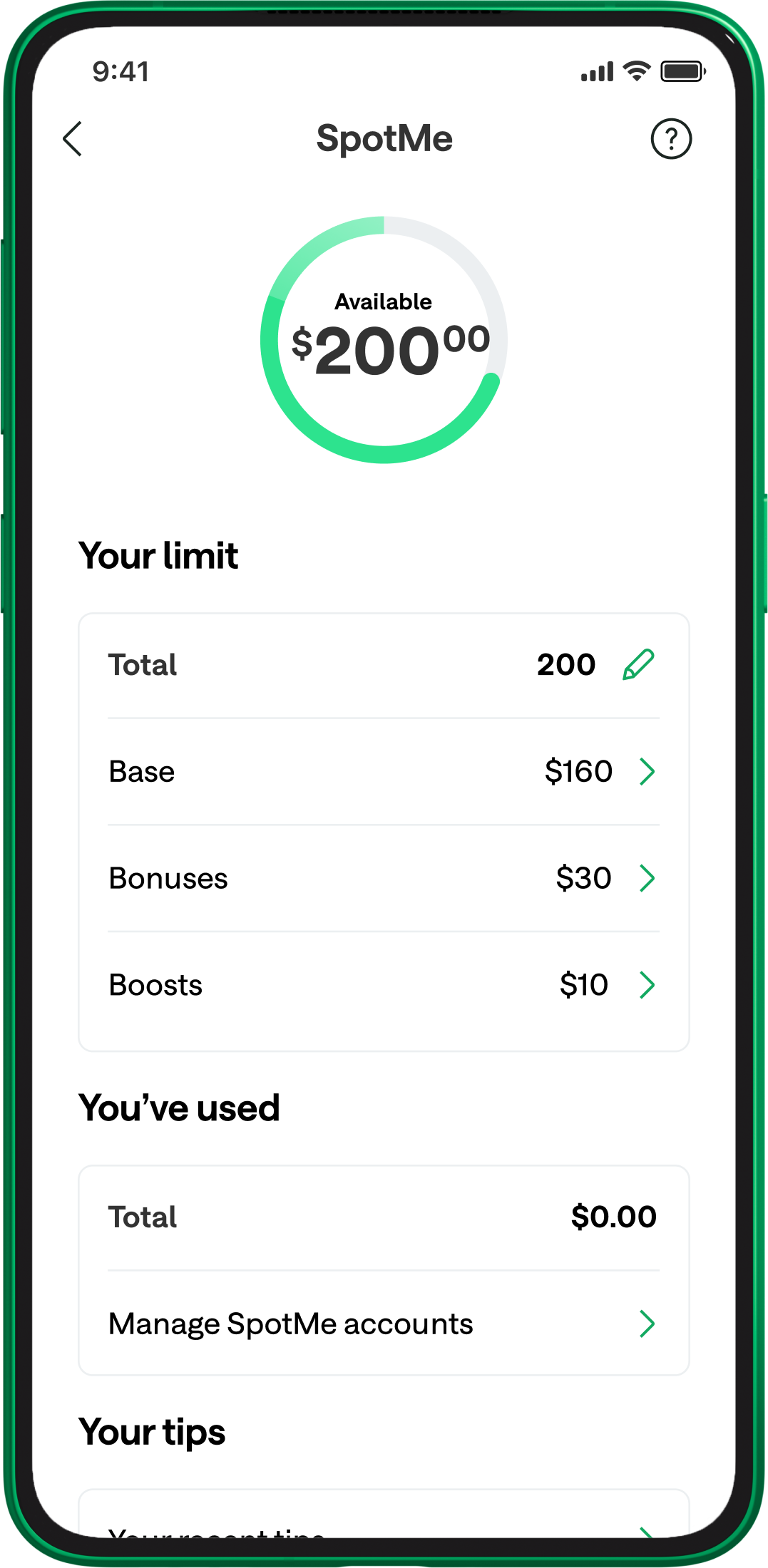

How much can I overdraft with SpotMe?

Your SpotMe limit starts at $20 and may go up to $200 depending on your account activity, history, and other risk factors. Receiving bonuses and Boosts² from friends with Chime can temporarily increase your SpotMe limit.

Note: Chime Member Service agents cannot increase your SpotMe limit for you.

How do I change my Chime SpotMe limit?

Your Chime SpotMe limit is set automatically by a variety of factors related to how you use your Chime account. This may include how long you’ve been a member, your account history, and how much you direct deposit per month. We’ll notify you if and when you qualify for a higher limit.

If you want to manually lower your limit to a personal max you can do so by opening your Chime app > Scrolling down in your Home feed > Tapping Settings > and adjusting your limit.

If SpotMe covers me, how do I pay it back?

The next time money is deposited into your Checking Account or Credit Builder secured deposit account, we’ll automatically apply it to your negative balance or owed amount. You’ll be in the clear, without having paid any overdraft fees.

Log in

Log in