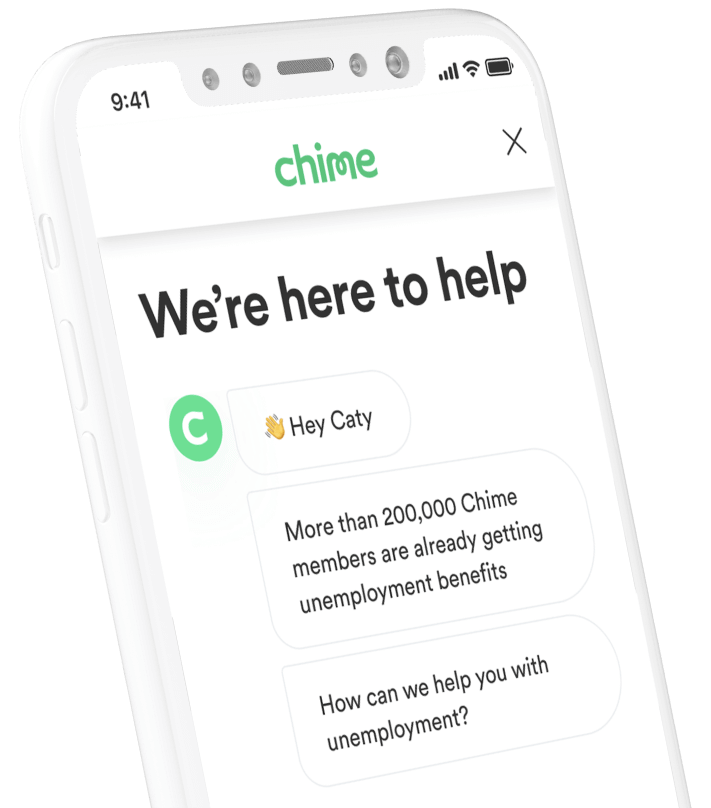

Understanding unemployment: your guide to getting benefits

If filing for unemployment has you feeling confused, you’re not alone. We’ve put together a guide to help you learn how to file for unemployment, as well as understand changes you might see in the wake of COVID-19 (Coronavirus). Things are changing fast, and we’re doing our best to stay up to date.

This guide is for informational purposes only. Chime does not provide financial, legal, or tax advice. You should check with your legal, financial, or tax advisor for advice specific to your situation. Your state or local unemployment agency is responsible for making all determinations on your eligibility for unemployment benefits. Please contact your state or local unemployment agency if you have questions.

What is unemployment?

Unemployment Insurance (or unemployment) is a program that provides money to eligible workers who have lost their jobs. Each state sets the guidelines and is responsible for running its own program.

Who is eligible?

Usually, unemployment benefits are available to people who have lost their jobs by no fault of their own. But now, more people than ever are eligible for unemployment benefits with the C.A.R.E.S. Act (Coronavirus Aid, Relief, and Economic Security Act) if you or your job has been affected by the coronavirus.

It’s up to each state to adopt these new coverages, but the C.A.R.E.S. Act helps many more people than are normally eligible for unemployment benefits, such as:

- Part-time workers

- Self-employed and gig workers

- Workers who are quarantined but expect to return to work after quarantine ends

- An employee who leaves work due to risk of infection or to care for a family member

Each state’s unemployment policies are changing frequently in response to COVID-19. You’ll want to check in with your state’s unemployment department for updates.

How much can you get?

How much you can receive in unemployment benefits depends on your state and your income. Find your state on the interactive menu below to see the maximum amount you may be eligible for. If you’re approved for less than the weekly max, you may qualify for additional benefits if you support a dependent.

Benefits stated below do not include any additional benefits that you may be eligible for under the C.A.R.E.S. Act.

How to file for unemployment

Each state handles its own unemployment insurance program. Find your state in the Department Of Labor’s website to get started.

Pro-tip: Before you file, make sure you have at least the following handy:

- Your Social Security number

- Your driver’s license or state ID card number (if you have one)

- Your mailing address

- Your phone number

- Your previous employment information (like how much you made and your previous employer’s contact number)

Benefits of receiving unemployment through direct deposit

Once you’ve successfully filed for unemployment, you might want to set up your payments through direct deposit, where possible. It’s usually the quickest way to get your money.

Timing

Many states offer unemployment benefits to be paid out through a prepaid card. Using a prepaid card could mean you’re stuck waiting for it to arrive in the mail. It could even get lost in transit all together.

Avoid potential fees

There may be fees these unemployment prepaid cards charge:

- Common fees include: out of network ATM fees, card replacement fees, expedited shipment fees, and customer service inquiry fees.

- Some states have additional restrictions around bill payments / transfers between accounts

Direct deposit Unemployment with Chime

Direct deposit unemployment into a Chime Checking Account and you’ll receive:

No hidden fees¹

No overdraft, minimum balance, monthly fees, or foreign transaction fees. Use your card at 38,000+ fee-free MoneyPass® and Visa Plus Alliance ATMs.

Grow your savings automatically²

With Round Ups, you save the change on every purchase. And Save When I Get Paid helps you automatically save a percentage of every paycheck.

Fee-free overdraft³

We’ll spot you on debit card purchases with no overdraft fees when you use SpotMe. Eligibility requirements apply.

FAQ

We know this can be a confusing process, and we’re here to help. If you have additional questions about unemployment, see our list of FAQ’s below.

Do unemployment benefits apply to reduced hours, gig workers, and self-employed individuals?

The new C.A.R.E.S. Act (Coronavirus Aid, Relief, and Economic Security Act) has extended $600 per week of unemployment benefits to many who previously weren’t eligible through July 31, 2020. You might be eligible if you are:

- Self-employed

- 1099 Contract workers

- Gig economy workers

- Individuals whose hours have been reduced

The application process is different by state, check with your state’s unemployment website to find out more.

How do I apply for the extended unemployment benefits under C.A.R.E.S. Act (Pandemic Unemployment Assistance)?

The additional unemployment benefits are released through individual states. Check with your state to find out how you can apply/receive it.

I’ve reached the maximum length of unemployment benefit with my state, what can I do now?

Good news! Under the CARES Act, states are permitted to extend unemployment benefits by up to 13 weeks for anyone who’ve exhausted their unemployment from July 2019 – December 2020. Check with your state to learn more about whether you can take advantage of it.

What does it mean that my application is pending?

There could be many reasons depending on your state and your situation. Common reasons include:

- state is still in the process of verifying information

- more information is needed (you will be contacted if this is the case)

I’ve applied, when will I receive my unemployment benefit?

It typically takes 2-3 weeks for the government to process your application. Given the large amount of unemployment claims filed, many states are experiencing delays. If you have the option, we recommend direct depositing your unemployment benefits, so you won’t be stuck otherwise waiting for the unemployment prepaid card to arrive in the mail.

How come I don’t see direct deposit as an option with my state?

Unfortunately, at the moment, the following states do not have direct deposit options:

- Maryland

- Nevada

- California (you can direct deposit payments from the prepaid card after the first payment)

- Oklahoma (you can direct deposit payments from the prepaid card after the first payment)

- Arizona (unless you mail in an original voided check from your bank account)

Once you receive your unemployment benefits, you can always transfer the money into your Chime Checking Account via your Chime app. This may help you avoid potential prepaid card fees and take advantage of the Chime app along with our automatic savings features.

How can I get my unemployment directly deposited into my Chime Checking Account?

For most states, direct depositing your unemployment is easy, even if you are already receiving unemployment benefits via prepaid card. Make sure the name on the payment matches the name on the bank account.

Information you’ll need differs by state but generally it includes:

- Bank Account Number

- Routing Number

- Social Security Number

You’ll need to log into your state’s unemployment website and enter your Chime Checking Account and routing numbers, which can be found in your Chime app under “Settings.”

If you live in Tennessee, New Jersey, and New Mexico, you might be experiencing issues depositing your unemployment with Chime. We are actively working with these states to have this problem resolved ASAP.

How long does it take to switch my unemployment to direct deposit?

Switching time varies from state to state. We’ve seen it range from 48 hours to over a week. Check with your state for more details and be sure to keep your unemployment prepaid card in the meantime.

Are my unemployment benefits taxable?

Yes, unemployment benefits may be taxable. You may have to pay federal income taxes and state income taxes, depending on your state.

States that currently waive income taxes on unemployment include California, Montana, New Jersey, Oregon, Pennsylvania and Virginia. Additionally, seven states —Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming — do not levy any state income taxes. Check with your state to find out more details.

Could I use my Chime Checking Account to receive unemployment benefits for a loved one or someone else besides me?

No. As with all direct deposits, the name on the payment must match the name on the account. This means you cannot receive unemployment benefits deposits to your account on behalf of someone else.

If your family or loved ones aren’t Chime members, they can open a Chime Checking Account today! Once they open a Chime Checking Account, they can then directly deposit their unemployment benefits.

Can my unemployment benefits be garnished?

Your unemployment benefits will be exempt from garnishment more times than not, but court orders aren’t required in instances of owing child support, back taxes, and student loans.

How will I know when my deposit arrives?

If you have notifications enabled in the Settings screen of your Chime app, we will send you a push notification as soon as a deposit arrives!

Log in

Log in