Chime Credit Builder Secured Visa® Credit Card

Credit building starts right now.

- No annual fee or interest¹

- No credit check to apply

- No minimum security deposit required²

Learn how we collect and use your information by visiting our Privacy Notice

Member testimonials.

Real members. Sponsored content.

What's important to you for a credit card?

Direct deposit and get Chime+ for free.

Unlock even more Chime benefits when youset up a qualifying direct deposit‡.

Still have questions about Credit Builder?

Over 1 million

5-star reviews.

Credit Builder FAQs

Here's what you need to know about the Credit Builder Credit Card.

What do I need to apply for a Credit Builder?

All you need is a Chime Checking Account to start.

Don’t have a Chime Checking Account? Apply for one in under two minutes!

Does Chime charge any fees for using Credit Builder?

We don’t believe in annual fees or profiting from our members’ misfortune. We have no fees to apply, no annual fee or interest¹, and no fee to replace your card. Out-of-network ATM fees may be applied if you use your card at an ATM that is not a part of the fee-free network of 50,000+ ATMs⁶.

How can Credit Builder help my credit score?

Credit Builder offers features that help you stay on top of key factors that impact your credit score. Consistent use of Credit Builder can help you build credit with on-time payments and increase the length of your credit history over time. We report monthly to the major credit bureaus – TransUnion®, Experian®, and Equifax®.

Learn more about credit building with Credit Builder.

What makes Credit Builder different from traditional credit cards?

Unlike most traditional credit cards, Credit Builder helps you build credit with no annual fees or interest. There’s also no credit check to apply.

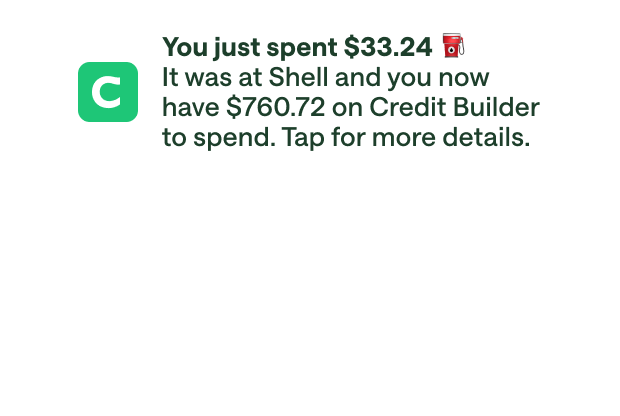

Credit Builder is a secured credit card. The money you move into Credit Builder’s secured account is the amount you can spend on the card. Unlike other secured credit cards, that money can be used to pay off your monthly balances. Since Credit Builder doesn’t have a pre-set limit, spending up to the amount you added won’t contribute to a high-utilization record on your credit history.

Learn more about how Credit Builder works.

Is Credit Builder a secured credit card?

Yes, Credit Builder is a secured credit card. The money you move to the Credit Builder secured account is how much you can spend with the card. This amount is often referred to by other secured credit cards as the security deposit. Like other secured credit cards, Credit Builder also reports to the major credit bureaus to help you build your credit history over time.

For most secured credit cards, security deposits are unavailable to you, the consumer, until you close the account. With Credit Builder, however, you can use your deposit to pay for monthly charges. Plus, Credit Builder charges no annual fees or interest¹, and no minimum security deposit is required²!

What is the credit limit?

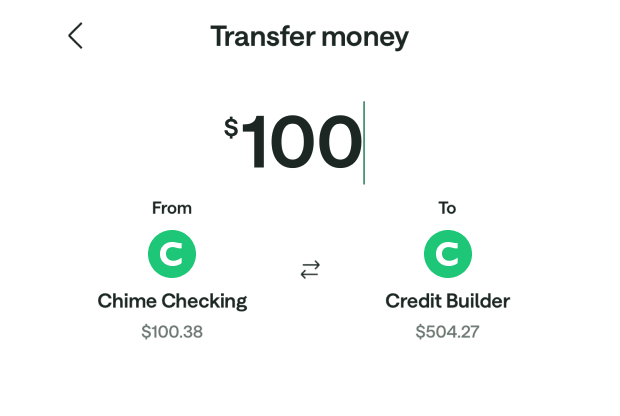

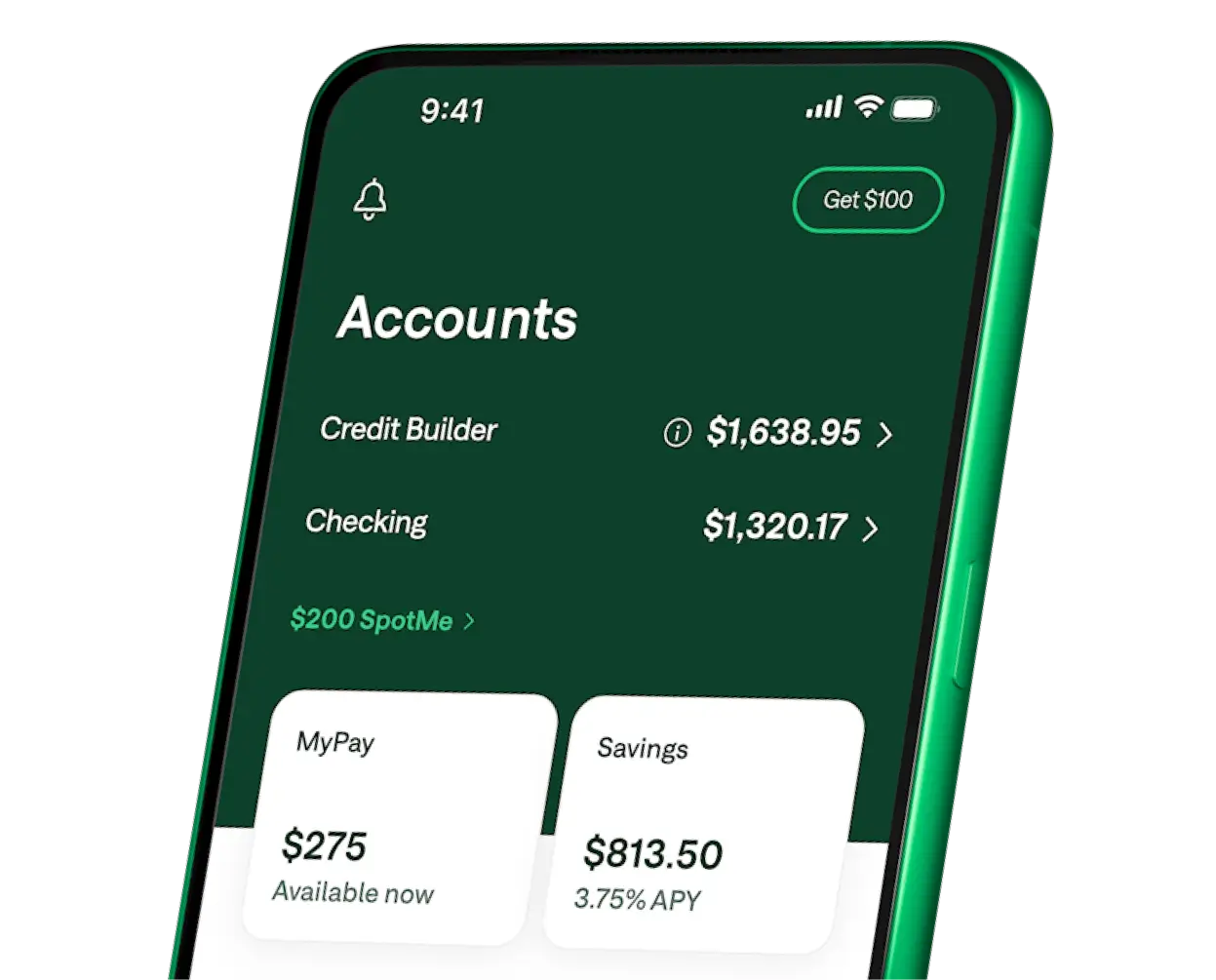

Credit Builder doesn’t have a pre-set credit limit. Instead, the money you move into your Credit Builder secured account sets your spending limit on the card.

With traditional credit cards, using a high percentage of your available credit limit could negatively impact your credit score. You don’t have to worry about that with Credit Builder because Chime does not report credit utilization. On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score.

How much you can spend with Credit Builder is shown as “Available to Spend” in the Chime app.

If I use all the money I add into Credit Builder, will Credit Builder report high utilization and hurt my credit score?

Nope. Credit Builder doesn’t report percent utilization to the major credit bureaus because it has no pre-set credit limit. That means spending up to the amount you added will not show a high-utilization card on your credit history. So you can use Credit Builder for your everyday purchases and let them count toward credit building when you make on-time payments!

Can I move money into my Credit Builder secured account from another bank?

No, you cannot move money from other banks to your Credit Builder secured account. You can only do that from your Chime Checking Account.

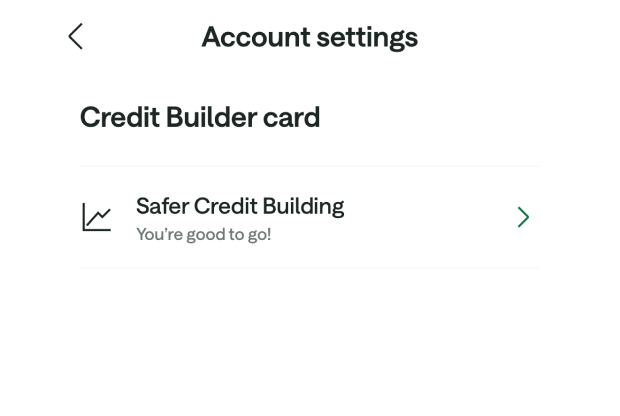

What is Safer Credit Building?

Safer Credit Building⁴ is a feature that allows you to automatically pay your monthly balance with the money in your Credit Builder secured account. Turn it on, so your monthly balances are always paid on time! Learn more about how it works.

What is Move My Pay?

Chime allows you to automatically split your paycheck across multiple Chime accounts. This feature has changed as of February 25th, 2025. If you currently have a percentage of your pay automatically being moved to your Credit Builder account, no action is needed. To make any future changes, you can go to your direct deposit setup in the settings tab and select “Split your pay” in the Chime mobile app.

How and when do I pay off the card?

You can pay off your Credit Builder charges in 3 ways:

- One option is to turn on Safer Credit Building. When you make a purchase, the money you spend is put on hold in your secured account. Safer Credit Building uses the money you transferred to your secured account to automatically pay your monthly balance. This will help you avoid late payments and outstanding balances.

- If Safer Credit Building is not turned on, Manual Payments can still be made at any time by going to Settings → Safer Credit Building → Make a Payment.

- ACH Payments can be made from any bank by using Credit Builder’s account number. To find them, go to Settings → Safer Credit Building → Make a Payment → Paying with another bank

Credit Builder statements are available by the 28th of each month and are due on the 23rd of the following month.

What happens if I miss a payment?

If you miss a payment, we’ll disable your Credit Builder card and ask you to pay your overdue balance. See “How and when do I pay off the card?” on how to make a payment.

If your balance due isn’t paid in full after 30 days, we may report information about your account to the major credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected on your credit report.

Can you withdraw cash from the Chime Credit Builder Credit Card?

Yes! You can withdraw cash using your Credit Builder Card. Get cash fee-free⁶ at 50,000+ ATMs found in stores you love like Walgreens, 7-Eleven, CVS, and more!

Do I get fee-free SpotMe on my Chime Credit Builder Card?

Yes! SpotMe® on Credit Builder is now available. Get covered up to $200 when you need it fee-free.³

Why is building credit important?

Building credit not only improves your eligibility for loans and lines of credit, but it’s also key to building a healthy financial history. Building credit and maintaining a good credit score empowers you to make informed financial decisions. Higher credit scores can potentially help you qualify for better interest rates and larger lines of credit.

What is a secured credit card?

While traditional credit cards have a set credit limit that can be borrowed from the credit card issuer, secured cards do not. They are designed specifically to help people with little or bad credit history build their credit score.

Instead of being approved for a set credit limit, people who use secured credit cards will make a security deposit that acts as the collateral for their card. In a way, the “credit limit” is the money you put into the deposit. This can help you make on-time payments and avoid overspending, which can slowly build your credit.

What is a good credit score?

Generally, a good credit score could be anywhere from 670 to 850. Scores in this range indicate to lenders that a person is likely to be a reliable borrower, giving them access to more favorable interest rates and loan terms. On the other hand, scores below 670 could make it more difficult to be approved for a loan or find low interest rates.

How can I build credit?

Building credit involves several key steps, such as obtaining a credit card and using it responsibly by making timely payments. Additionally, keeping credit card balances low, paying off credit balances, and diversifying credit types can positively impact credit scores. It’s also important to monitor your credit reports to ensure it remains accurate.

How long does it take to rebuild bad credit?

The time it takes to rebuild your credit score will depend on your individual circumstances and the severity of your past credit issues. Consistently paying your bills on time and reducing any outstanding debts can begin to improve your credit score within just a few months to a year. However, larger improvements may take several years of responsible financial behavior to achieve.

What happens if you have no credit?

A good credit score means you have experience managing your finances and being responsible with payments. By contrast, having no credit score signifies to lenders that you have no experience at all in this area. This could make them hesitant to approve you for anything from a high credit limit to a home or auto loan. Establishing a good credit history can alleviate some of these problems.

Is a credit builder card better than a credit builder loan?

Both a secured card for building credit and an installment loan designed to help you build credit history can help improve credit over time, but they’re distinctly different. A “credit builder” loan requires you to borrow money, but it’s great if you want to stick to a fixed repayment plan. On the other hand, secured “credit builder” cards offer flexibility in making everyday purchases and can have a more immediate impact on your credit score. Which one is better depends on you and your financial circumstances.

How do I check my credit report?

You can review a summary of your credit report directly in the Chime app. Through the app, you can monitor your FICO® credit score. If you want access to your full report, submit a request to one of the three major credit bureaus for your free annual copy.

Log in

Log in