Key takeaways

- Chime is a legitimate financial technology company with FDIC-insured accounts through our partner banks, but scammers impersonate us to steal your information.

- Fraud happens without your permission and may be refunded, while scams involve you being tricked into authorizing payments that are harder to recover.

- Common red flags include urgent requests, demands for passwords or PINs, and contact from non-official numbers or emails.

- If you’ve been scammed, freeze your card immediately, change your password, and contact Chime support through official channels.

Scammers love to target popular financial apps like Chime®, and they’re getting more creative every day. Whether it’s a fake text claiming your account is locked or a social media message saying you’ve won money, these scams can feel convincing.

In this guide, you’ll learn how to spot common Chime scams, protect your account, and what to do if you’ve been targeted.

Is Chime a scam?

No, Chime is not a scam – we’re a legitimate financial technology company serving millions of members. Our banking services are provided by FDIC-insured partner banks, The Bancorp Bank, N.A., and Stride Bank, N.A., Members FDIC.*

Scammers sometimes pretend to be us to trick you because we’re a popular app. Knowing the difference between the real Chime and an imposter is key to keeping your money safe.

Fraud vs. scams: what's the difference and why it matters

Understanding the difference between fraud and a scam affects whether you can get your money back. Here’s how they differ:

- Fraud: Someone uses your account without your permission, like stealing your card number. You’re often protected against fraud by policies like Visa® Zero Liability.+

- Scams: You’re tricked into authorizing a payment or sharing your information. Because you approved the transaction, recovering your money is much harder.

Spotting scam warning signs early is your best defense.

Common scams targeting Chime members on social media

Scammers love to use social media for their own gain. Here are the main types of scams you might see across social platforms.

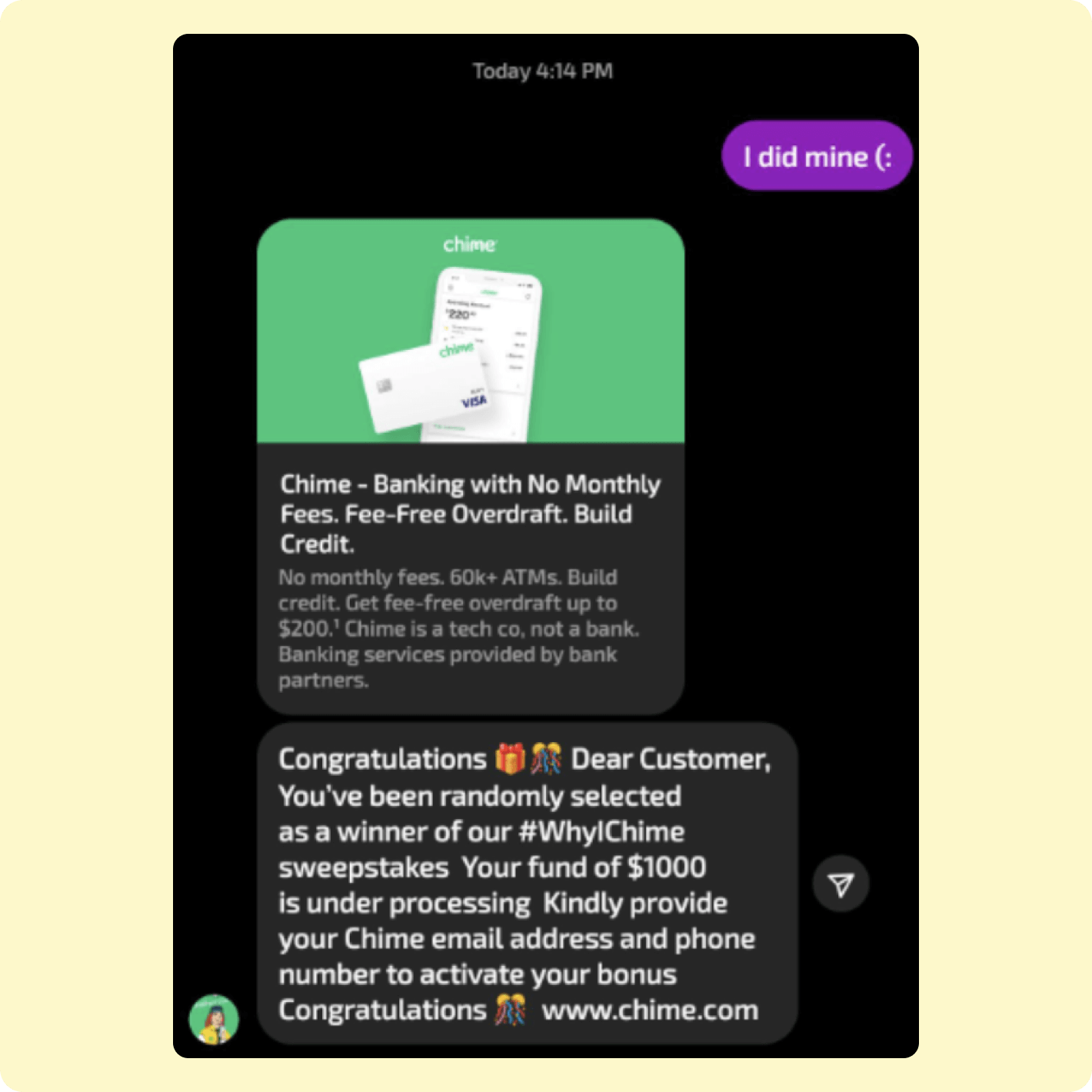

Sweepstakes scams

Scammers exploit people’s love for free prizes to steal personal information. Here’s how to spot fake sweepstakes:

- Real Chime sweepstakes: You’ll automatically see winnings in your account if you’re a member. Non-members will need to open an account to be eligible.

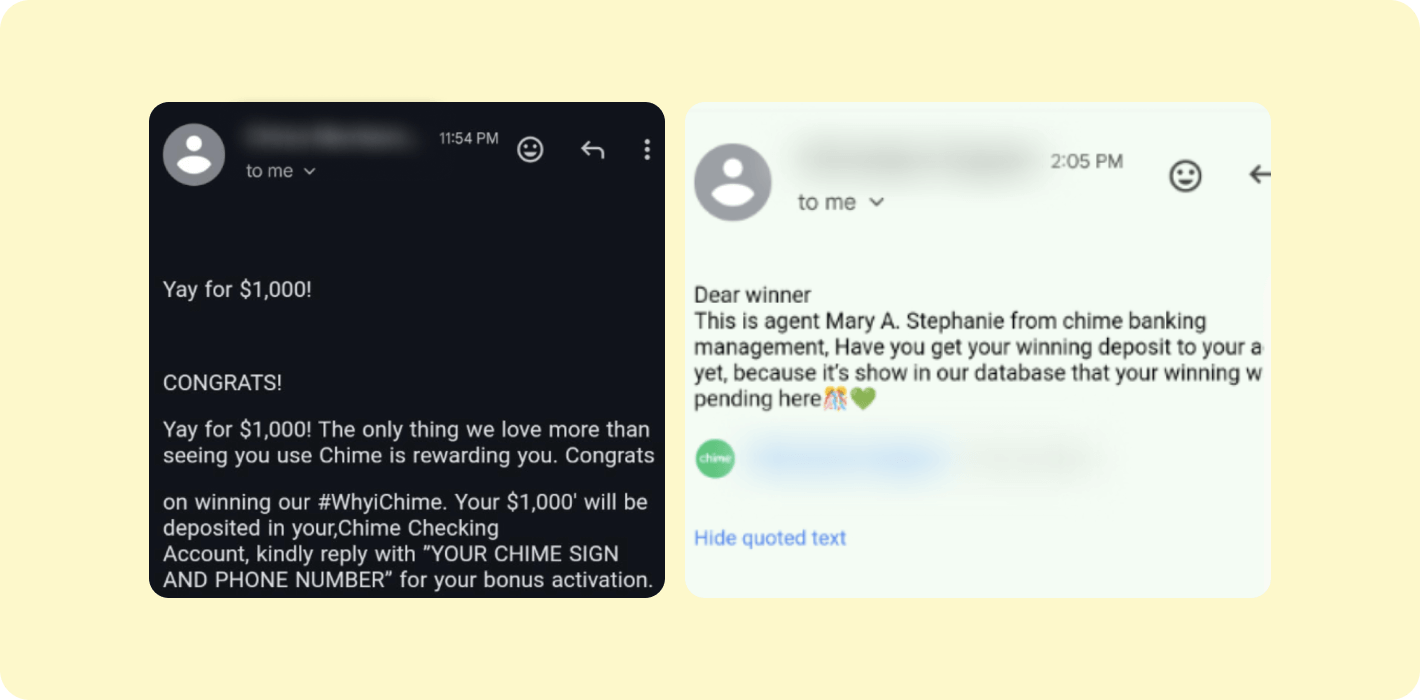

- Fake sweepstakes: Messages claiming “You’ve won!” and asking you to verify your email, log into third-party platforms, or share passwords.

- “Chime glitch” scams: Claims that Chime is giving away free money due to a system error.

Our verified handles are @Chime and @ChimeHelps. Authentic sweepstakes are only advertised on our official social media platforms.

Second-party fraud

Second-party fraud happens when you willingly share your personal information with fraudsters for illegal activities. Unlike traditional identity theft, you’re knowingly participating – often lured by promises of easy money on social media.

This can include selling your account details for money laundering or fraudulent loans. Participating can lead to serious legal and financial consequences, so report suspicious messages immediately.

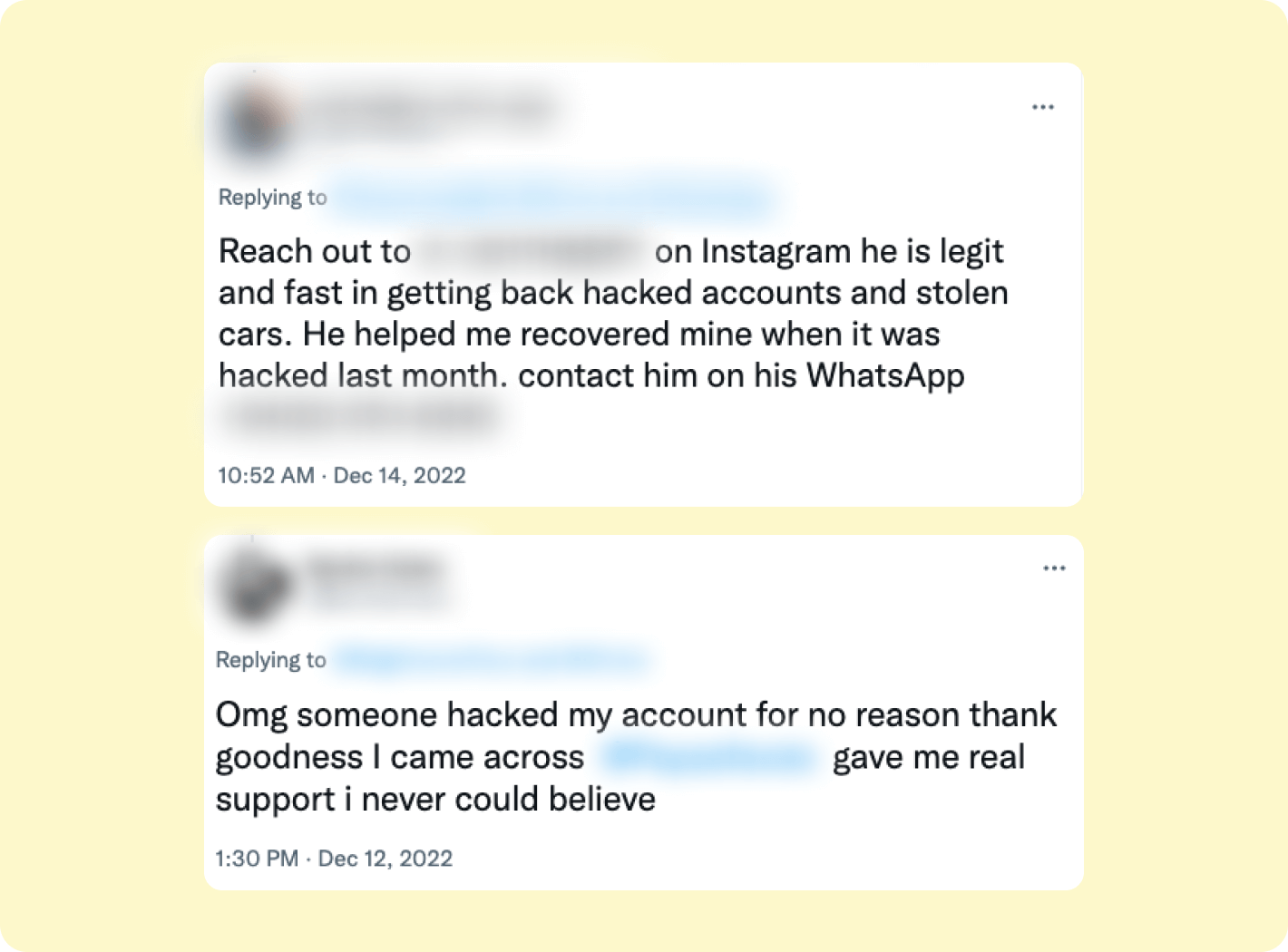

Fake customer support scams

Scammers create fake profiles, websites, and emails pretending to be Chime customer support. They’ll ask for sensitive information, like passwords and Social Security numbers.

Here’s how to identify real Chime support:

- Verified social handles: Look for the verification badge on our only official handles, @Chime and @ChimeHelps.

- Official email: Emails ending in @chime.com.

- Support channels: 24/7 live chat in the app or phone support.

- What we don’t have: Customer service “ambassadors” or “representatives” on social media.

If you’re ever in doubt, you can verify our official accounts by visiting our homepage and clicking the social media icons.

Chime tip: contact @ChimeHelps to avoid customer support scams

Our @ChimeHelps handle on the platform X (formerly Twitter) gives our members a centralized, trustworthy place to get customer service questions answered. With our verified handle, you can trust that you’re speaking to a real Chime team member.

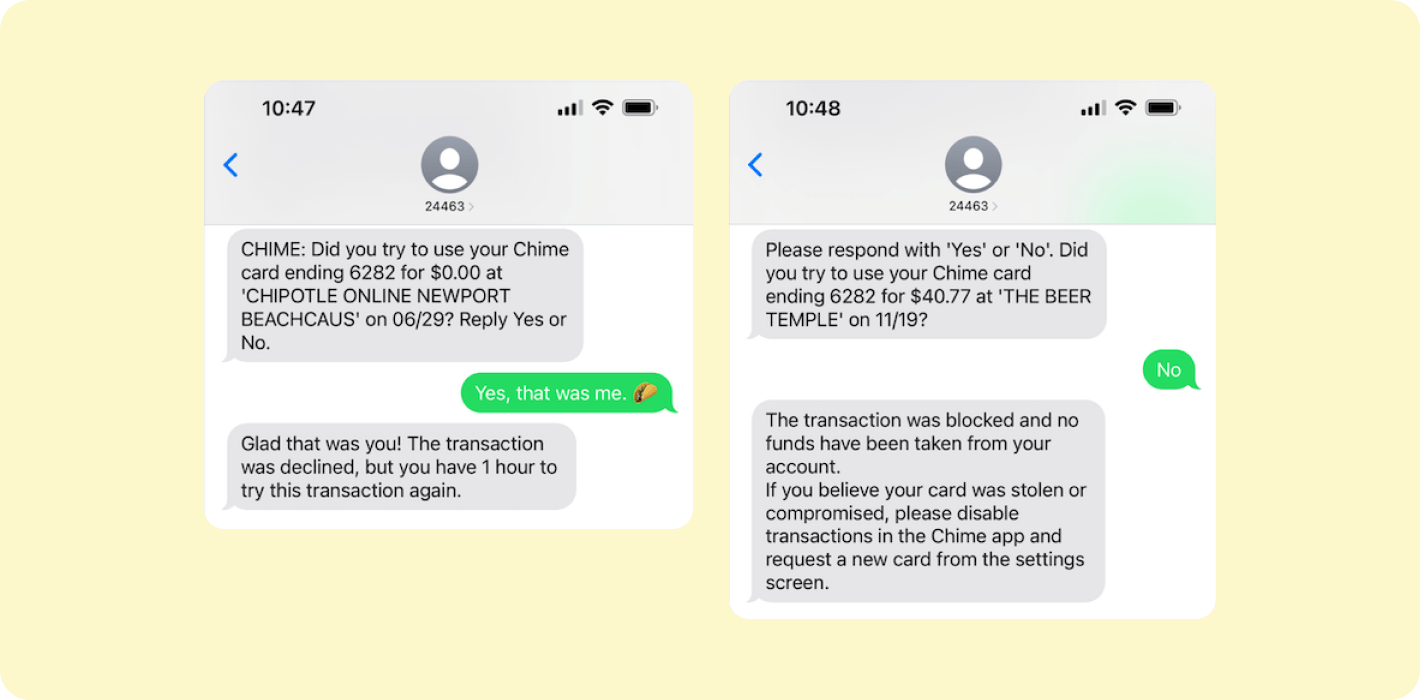

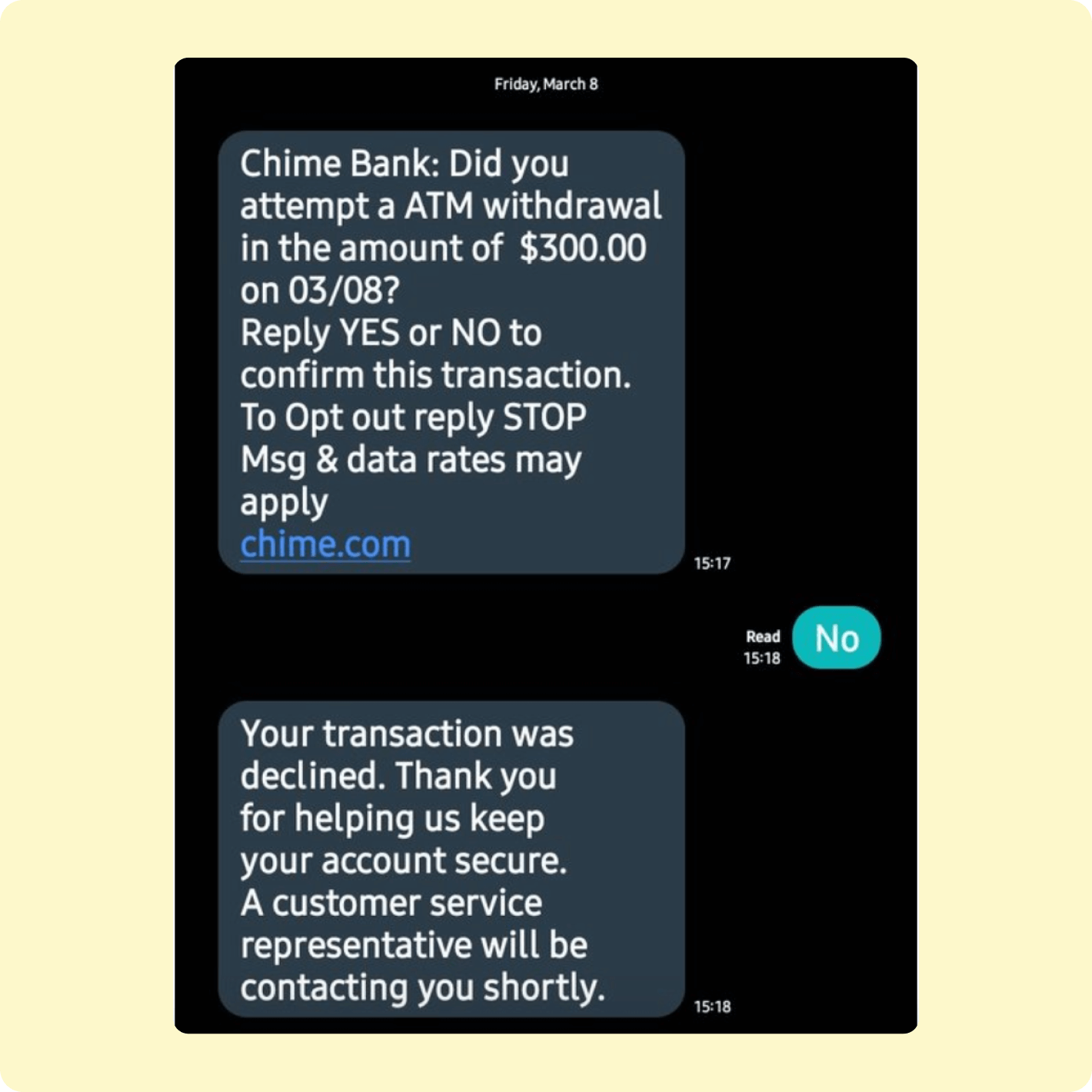

Phone and text scams

Phone scams happen when scammers call or text claiming there’s been unauthorized activity on your account. They’ll ask you to verify your account details, share personal information, or download an app that gives them access to your account.

If we suspect fraud on your account, here’s what really happens:

- We might decline the transaction and send you an SMS asking you to confirm it.

- The text will look like this: “Did you try to use your Chime card ending [LAST 4] for $[AMOUNT] at [MERCHANT] on [DATE]? Reply Yes or No.”

- If you reply “YES”: We’ll unlock your card for one hour so you can retry the transaction.

- If you reply “NO” or don’t reply: We continue declining transactions, and you’ll need to contact us to replace your card.

- For other declines: You’ll get a push notification or email explaining the reason, such as insufficient funds.

Keep an eye out for SMS messages using fake names like “Chime Bank” or “Chime Bancorp” and scammy follow-up calls too, pretending to be from “Chime Banking.” See examples below. Remember, Chime is not a bank, so the word “bank” is a big red flag.

You could very rarely receive a call from Chime. We do have options to schedule a call back when receiving support in-app. However, you won’t receive surprise phone calls from Chime urging you to send funds through a service like Pay Anyone or share sensitive information like your Social Security number.

Email scams

Scammers send emails claiming you have “late” payments or need to claim prizes. These phishing scam emails try to trick you into sharing personal information.

Here’s how to spot a fake Chime email:

- Suspicious sender: Email addresses with odd letters or numbers, or domains that aren’t @chime.com

- Urgent requests: Demanding immediate action or threatening consequences

- Asks for sensitive info: Requesting passwords, Social Security numbers, or account details

Chime will never ask for sensitive information via email. If you’re updating your name or performing similar actions, we’ll provide protected cloud links for document uploads. When in doubt, verify through the app or contact our support team directly.

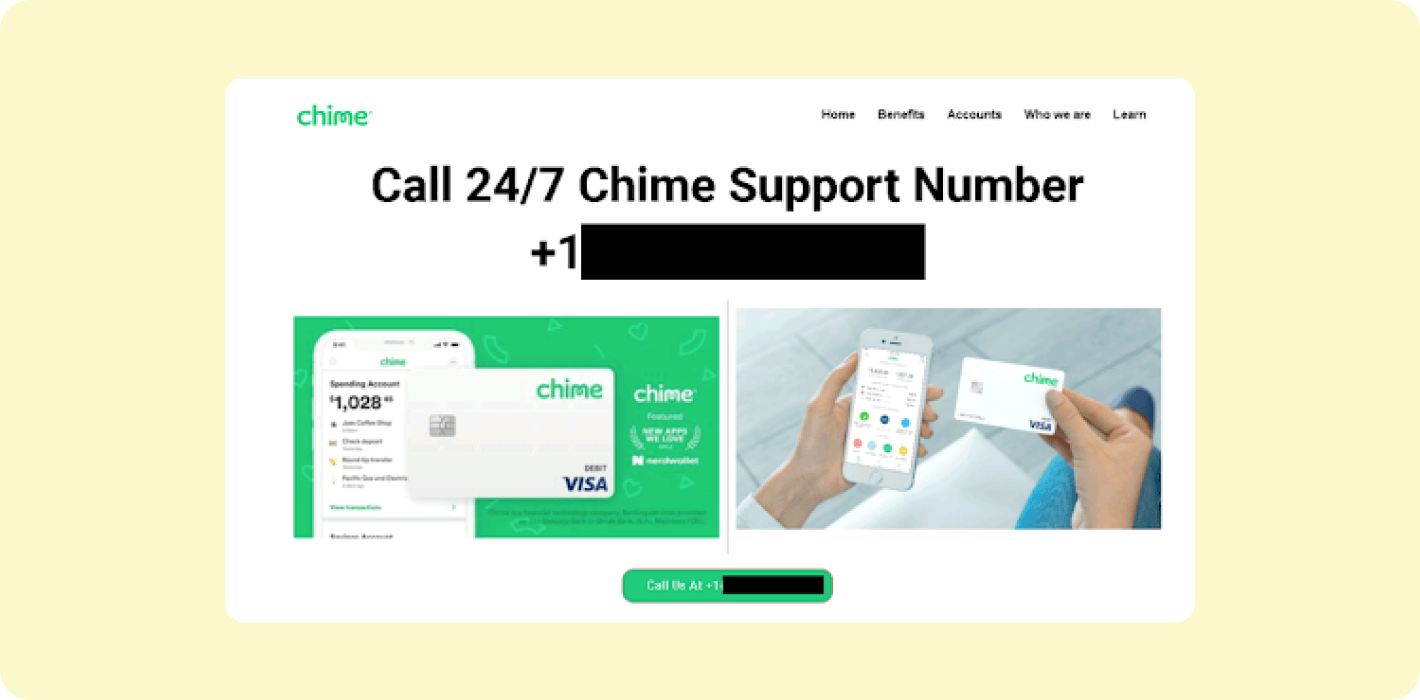

Search engine ad scams

Scammers create fake sponsored ads that look like Chime ads when you search online. These ads send you to phishing sites that steal your information or infect your device with malware.

The real Chime customer service number is 1-844-244-6363. Chime team members will never ask you to download apps or send money through Pay Anyone.¹ If you see an ad suggesting this, it’s a scam.

If you have any doubt, use the contact number on the back of your Chime card or reach out through the app.

Payment service scams

Scammers exploit payment apps like Venmo, Zelle, and Chime’s Pay Anyone1 to steal money. Here are common P2P scam tactics:

- Fake prize scams: You’ve won money, but need to pay a fee to claim it.

- Imposter scams: Someone claims to be from the IRS or IT support and demands payment.

- Romance scams: Someone builds a fake online relationship and asks for money.

Only use Pay Anyone1 to send money to people you already know and trust. Chime will never request that you send us funds through Pay Anyone¹ under any circumstances.

How to spot a scam: red flags to watch for

Scammers use different stories, but they often rely on the same tricks. If you notice these red flags, stop and double-check before taking any action:

- Urgency: They pressure you to act immediately, saying your account is locked or you’ll lose money if you don’t hurry.

- Secrecy: They tell you not to trust your bank or not to tell anyone else what you’re doing.

- Sensitive requests: They ask for your password, PIN, or one-time login code. Chime will never ask for these.

- Suspicious contact: They call or text from a standard 10-digit number but claim to be Chime support.

- Too good to be true: They promise free money or a prize, but you have to pay a fee to get it.

How to protect yourself from scams

Now you know how to recognize a scam, here are some ways you can protect yourself:

- Never write any identifying information, especially your PIN, on your debit card.

- Never share your personal information with strangers or on unsecured websites. This includes your account number, username, password, your full Social Security number or even its last 4 digits, and the last 4 digits of your payment card.

- Enable additional security features, such as a PIN or passcode, biometric authentication (e.g., fingerprint or facial recognition), and other multi-factor authentication on your smartphone and P2P payment apps.

- Enable push notifications in the Chime app so you’re immediately alerted to suspicious activity.

- When you’re not planning to use your card, you can even block all debit and Chime Card transactions. All it takes is a quick toggle in the Chime app.

- Watch out for increased scammer activity during the holidays and tax season.

- If you think your information has been compromised, change your password immediately.

- If you think you’ve been a victim of a scam, we’ve outlined a few steps you should take to protect yourself.

What to do if you've been scammed

If you’ve been targeted, don’t panic – but act fast. Here’s what to do:

- Contact us immediately: Use the Chime app or call 1-844-244-6363.

- Freeze your card: Toggle “Allow transactions” off in your app settings to stop new charges.

- Change your password: Update your Chime password and turn on two-factor authentication.

- Report it: File a report with the FTC at reportfraud.ftc.gov.

- Monitor your account: Watch for unauthorized transactions and report anything suspicious.

We investigate every report, but we can’t always reverse authorized transactions. Reporting scams helps protect our entire community.

How to report suspected scams and fraud to Chime

Although we strive to shut down fake accounts as quickly as possible, new ones continue to appear. We encourage you to guard your personal information carefully – and if you see a scam, let us know ASAP.

You can report suspected scams by contacting us directly through live chat, phone, or social media with the @Chime or @ChimeHelps handle.

Stay one step ahead of scammers

Chime will never call, email, or text you to ask for your password or personal information. If you receive a suspicious message, don’t respond – contact us directly through the app or by calling 1-844-244-6363.

Want more peace of mind? Learn about how your money is protected with FDIC insurance.

FAQs

Is Chime legit and safe?

Yes, Chime is a legitimate financial technology company with FDIC-insured accounts through our partner banks. However, scammers impersonate us, so always verify who you’re talking to.

Will Chime refund my money if I was scammed?

It depends – if someone stole your card without your permission, which is fraud, you’re typically protected. If you were tricked into authorizing a payment, which is a scam, recovery is much harder and not guaranteed.

How can I tell if I'm really talking to Chime customer service?

Real Chime support comes through our app chat, 1-844-244-6363, or verified handles @Chime and @ChimeHelps. We’ll never ask for your password, PIN, or ask you to download third-party apps.

What should I do immediately if I think I'm being scammed right now?

Stop communicating, freeze your card in the app, and contact our support team directly. Don’t send money or share any codes.

Can scammers steal money from my Chime account without my permission?

Scammers can’t access your account unless they get your login details or card information. Never share your password, PIN, or one-time codes with anyone.

Log in

Log in