Updated: November 2025 — The IRS has not yet published its 2025 filing updates. This page will be refreshed as soon as new guidance is released.

A tax audit is when the IRS reviews your tax return to make sure it’s accurate and compliant with all tax laws. Knowing how they work can give you peace of mind.

While there’s no surefire way to avoid a tax audit, you can take steps to ensure your tax return doesn’t raise any red flags: accurate reporting, keeping your records organized, and filling out your tax return accurately and honestly.

Whether you’re filing taxes for the first time or have a complicated tax situation, learn how to avoid a tax audit with the tips below.

How to avoid a tax audit

The IRS uses various methods for choosing who to audit. While some factors are beyond your control, there are proactive steps you can take to reduce their chances of selecting you.

1. Check (and double-check) your tax return for accuracy

One of the easiest things you can do to prevent a tax audit is making sure there are no errors on your tax return. Any inconsistencies or mistakes can raise red flags during tax audits, so double-check that your financial information, including income, deductions, and credits, are correct when you file your taxes.

2. Document your deductions

Be sure to maintain detailed documentation for any deductions. You’ll need organized records of all relevant receipts, invoices, or other supporting documents. Categorize your expenses and thoroughly document each deduction you claim on your tax return.

3. Opt for E-filing

E-file your tax return instead of filling out a paper return. E-filing is convenient and reduces the chance of errors on your return. 20% of paper tax returns have mistakes on them, compared to just 1% of tax returns prepared electronically.1 E-filing can also help you get your tax return sooner (just be sure to set up direct deposit with the IRS when you file your return) if you’re owed one.

Free Online Tax Filing: File 100% for free, max out your tax refund guaranteed^, and get your federal tax refund up to 5 days early* when you direct deposit it with Chime.

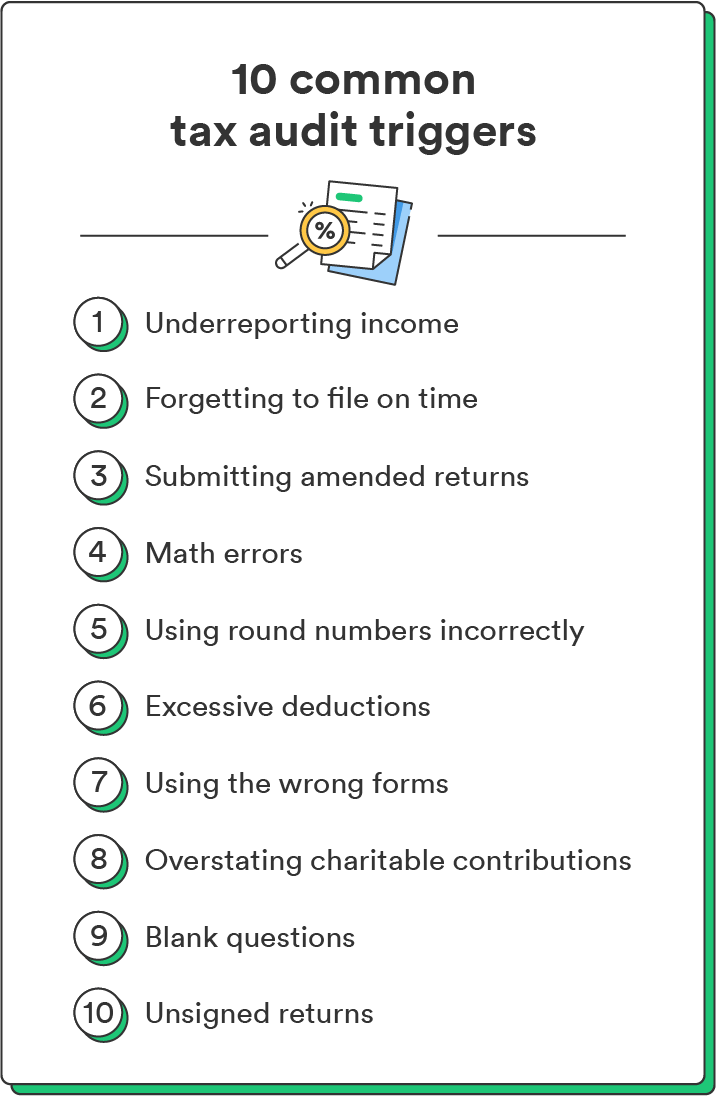

10 common tax audit causes

If you’ve ever wondered what can lead to a tax audit, below are 10 of the most common causes.

1. Under-reporting income

You must report all the income you earned throughout the year on your tax return. Underreporting your income is a common trigger for tax audits. Examples include consistently reporting a net loss or a significant decrease in income without any clear explanation.

2. Forgetting to file on time

Routinely filing taxes late can raise the IRS’s eyebrows. Consistently submitting your tax return on time helps build a positive track record, which can reduce the chances of an audit.

If you’ve ever wondered what can lead to a tax audit, below are 10 of the most common causes.

3. Submitting amended returns

The only way to correct errors on your tax return is by submitting an amended return. This won’t automatically trigger a tax audit unless you’re requesting significant changes without any documentation to back them up.

4. Multiple math errors

Math errors are some of the most common tax return mistakes taxpayers make. In 2021, the IRS corrected roughly 9 million math errors on filed tax returns.³ Miscalculations could happen on anything from your deduction amounts to the amount you list for your total income.

While it’s a common mistake, multiple math errors could increase the risk of an audit. Always check your calculations before submitting your return to avoid simple errors. Another easy way to avoid mistakes is by filing your taxes online instead of by hand.

5. Using round numbers incorrectly

The IRS wants the most accurate information possible on your tax return. Excessively rounding up your financial numbers (like rounding up by tens or even hundreds of dollars to get a cleaner number) can raise suspicion.

The IRS allows you to round off cents to whole dollars, but you have to drop cent amounts under 50 cents and increase cent amounts over 49 cents to the next dollar (i.e., $1.29 becomes $1.00, and $1.59 becomes $2.00).4 If you choose to round your numbers, be sure you round all numbers in the same way for consistency.

6. Unrealistic or excessive deductions

Honesty is the best policy with tax returns – especially with tax deductions (the same is true for tax credits). While deductions are a legitimate way to reduce your taxable income, be sure they’re accurate and you have documentation like receipts to verify them.

For example, you should be able to prove how much you spent on your home office and list this number on the return – don’t estimate.

7. Using the wrong forms

Completing the wrong forms in your tax filing could trigger a tax audit, as inaccurate forms can lead to discrepancies in the financial information you provide to the IRS.

For example, you’ll typically fill out a W-2 form to report your income if you’re a salaried employee. But, small business owners or freelancers should fill out Form Schedule C to report income.

Using the correct form is crucial to accurate tax filing – and minimizing the chances of an audit. You can review the available forms on the IRS website and determine which ones apply to you.

8. Overestimating charitable contributions

Overestimating or inflating your charitable contributions (a type of tax write-off) is a quick way to trigger an audit – and if you get caught, the IRS can penalize you with the Accuracy-Related Penalty.

This penalty is 20% of the part of your taxes that you underpaid due to exaggerating your charitable contributions.5

Have your receipts or statements readily available when claiming any charitable donations you made during the tax year. You can attach them to your return as additional supporting documents for credibility.

9. Blank questions

Leaving fields on your tax return blank can lead to unnecessary scrutiny, even if you have nothing to report. If you have $0 to report in a field, write that on your form. Filling out every section can help you avoid problems.

10. Unsigned returns

Forgetting to sign your tax return is more common than you’d think. Unfortunately, unsigned tax returns aren’t considered valid. Always check that you’ve signed and dated where required before you submit your return.

This simple (but crucial) step will reduce any chances of being flagged for an audit – and help you avoid the hassle of resubmitting your return. Bonus: It’ll also ensure you get your tax refund quickly.

How to deal with a tax audit

If you find out the IRS is auditing you, don’t panic – your tax return is simply under review to ensure it meets tax laws. You’ll generally receive a notice from the IRS outlining which parts of your tax return are under review. It should also specify the documents and information you’ll need to provide.

Once you’ve received notice of an audit, the best thing to do is follow the instructions provided and be honest throughout the process. The following tips can help you along the way:

- Stay calm and cooperative: Being audited doesn’t mean the IRS is accusing you of anything – it just means your return is under review for accuracy. Approach the audit with a calm and cooperative attitude for a smoother process.

- Organize your records: Keep your financial records organized and readily accessible to answer the auditor’s requests more efficiently. Keep copies of any requested documents for your own records.

- Understand the process: Familiarize yourself with the audit process and the issues under review. Read through IRS Publication 1 (Taxpayer’s Bill of Rights) beforehand to understand your rights and what to expect.

- Respond promptly: Respond to audit requests promptly and provide any requested documents within the specified timelines. Also, only provide documents that the IRS has specifically requested.

- Seek professional advice if needed: If the audit is complex, consider hiring a tax professional or attorney to help you. You can contact the auditor to clarify any questions you have before submitting your materials.

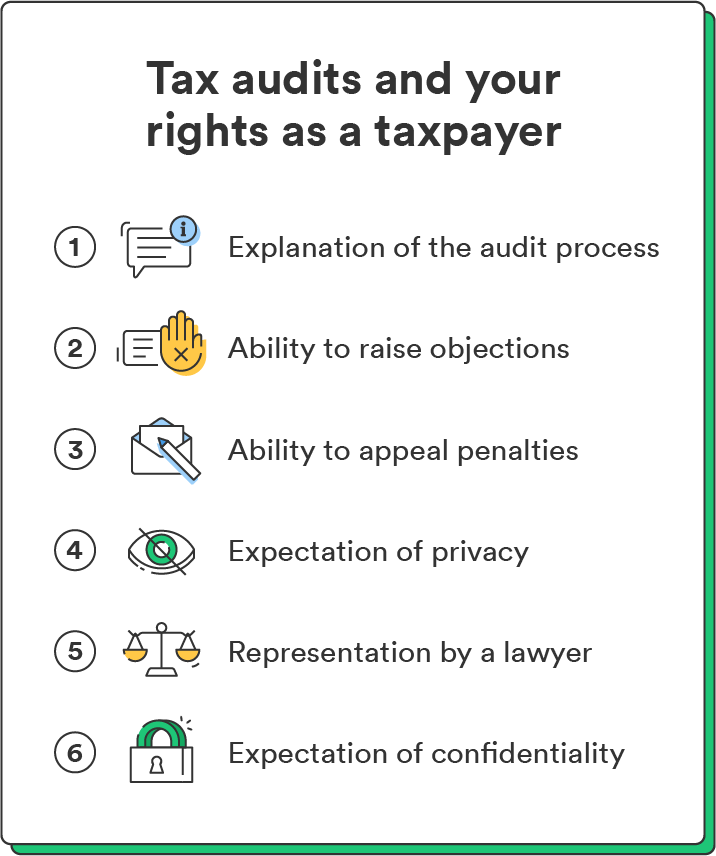

Your rights during an audit

Knowing your rights as a taxpayer during a tax audit empowers you to navigate the audit confidently while ensuring the IRS reviews your tax return fairly. The IRS outlines a full list of taxpayer rights in IRS Publication 1: Your Rights as a Taxpayer on the IRS website.

Some of your key rights include:

- The right to professional and courteous treatment

- The right to privacy and confidentiality

- The right to a clear explanation of the audit findings

- The right to appeal decisions made by the IRS

Remember that you have the right to challenge the IRS’s findings throughout the audit – you’ll just have to provide additional documentation or clear explanations for the items in question. If you’re unsure about any portion of the audit or have concerns about the process, seek professional advice or consult a tax lawyer.

Audits can be challenging, but being prepared and cooperative can help ease the process.

To avoid any mistakes on your tax return, read our comprehensive tax prep checklist and get ahead for tax season.

FAQs about how to avoid a tax audit

Still have questions about how to avoid a tax audit? Find answers below.

What is the best way to avoid a tax audit?

The best way to avoid a tax audit is to be accurate and honest on your tax return. Carefully document your income, deductions, and tax credits; stay informed about tax laws; and consider seeking professional advice if your tax situation is complex.

Can you refuse a tax audit?

You cannot refuse a tax audit if the IRS selects your return for review. However, you can cooperate with the audit process and provide the necessary documentation to address flagged concerns.

How do I get out of a tax audit?

There’s no way to “get out” of a tax audit. The best approach is to cooperate fully, respond promptly to requests, and provide accurate documentation when requested. A tax professional can also help navigate the audit process more effectively if you’re unsure about anything or have a complex situation.

Log in

Log in