If it’s your first time filing taxes, you might be understandably nervous. Whether you’re expecting a tax refund or owe taxes, our step-by-step guide breaks down exactly how to file taxes for the first time so you can file with confidence.

1. Gather your necessary tax documents

Before filing your taxes, gather all the required tax documents to ensure things go smoothly. Keep in mind that important forms may not be sent to you until mid-February, so make sure you’ve received everything before you file.¹

Some key documents you may need include:

| Form: | Who it’s for: | When to use: |

|---|---|---|

| W-2 Form | Employees | To report income earned, including wages and tips |

| 1099-MISC | Freelancers or independent contractors | If you received $600 or more in payments from a client during the year² |

| 1099-INT | Anyone with interest-earning bank accounts | If you earned over $10 in interest during the year on an interest-bearing account (e.g., savings account, certificates of deposits, or money market accounts)³ |

| 1099-DIV | Shareholders of corporations | If you own stocks or investments and received dividend payments totaling $10 or more⁴ |

| 1099-G | Anyone who received government payments | If you received unemployment benefits or a state tax refund during the year⁵ |

In addition to income forms, collect documents for any deductions or credits you plan to claim, like Form 1098-T for tuition payments or Form 1098 for mortgage interest.

Don’t forget your personal information, like your Social Security number (SSN) or individual taxpayer identification number (ITIN), a valid photo ID, and your bank account details if you’re opting for direct deposit.

Any major life changes this past year that could impact your taxes, like changing jobs, selling investments, or paying tuition. Missing documents could lead to needing to amend your return later, so make sure everything is in order before you file.

For a full breakdown of the forms and documents you might need, check out this tax document checklist.

2. Figure out your filing status and dependency status

Your filing status affects your tax rates, how you report your income, and the credits and deductions you can claim.

Also, knowing whether your parents can claim you as a dependent on their tax return can significantly impact your filing status.

What is my filing status?

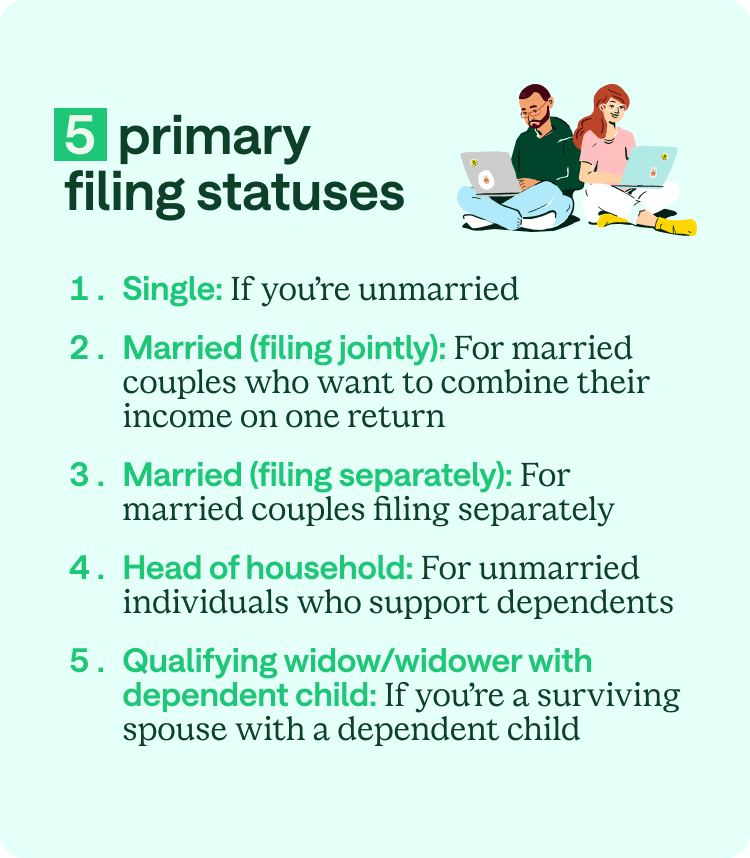

There are five primary filing statuses:

- Single: If you’re unmarried.

- Married (filing jointly): For married couples who want to combine their income on one return.

- Married (filing separately): For married couples filing separately.

- Head of household: For unmarried individuals who support dependents.

- Qualifying widow/widower with dependent child: If you’re a surviving spouse with a dependent child.

When you file your taxes, include the appropriate filing status on your forms.

Can I be claimed as a dependent (or claim a dependent)?

If you still live with or receive financial support from your parents, they may be able to claim you as a dependent. Even if you’re filing your own taxes, ask your parents or guardians if they plan to claim you as a dependent on their tax return. This way, your parents can take advantage of the tax benefits of having a dependent.

What happens if I’m claimed as a dependent?

You can’t claim a personal exemption on your tax return if someone claims you as a dependent. However, it can provide certain tax benefits for the person claiming you, like qualifying for head of household status or eligibility for certain tax credits.

3. Take the tax deductions and credits you can

Tax deductions and credits can help reduce your tax bill or increase your tax refund, so you want to find out if you qualify for any before you file.

Below are some common tax deductions and credits that you may qualify for. Review the available credits and deductions on the IRS website to see if you qualify.

Family credits and deductions

- Child Tax Credit: A credit that provides financial relief to parents by reducing their tax liability for each qualifying child.

- Child and Dependent Care Credit: This credit helps offset the cost of childcare and dependent care expenses.

- Earned Income Tax Credit (EITC): This refundable credit, designed to supplement earnings, is geared toward low—to moderate-income individuals and families.

- Adoption Credit: A credit that assists with the costs associated with adopting a child, including adoption fees, court costs, and travel expenses.

Education credits and deductions

- American Opportunity Credit: This credit supports the cost of qualified higher education expenses during the first four years of post-secondary education.

- Lifetime Learning Credit: A credit that helps cover the costs of post-secondary education, including tuition and related expenses, for eligible students.

- Student loan interest deduction: This deduction allows you to deduct the interest paid on qualified student loans.

- Educational expenses deduction: This deduction covers certain educational expenses.

Homeowner credits and deductions

- Home Energy Tax Credits: A credit for homeowners who make qualifying energy-efficient home upgrades.

- Energy Efficient Home Improvement Credit: A credit for homeowners investing in energy-efficient home improvements.

4. Options to file your taxes

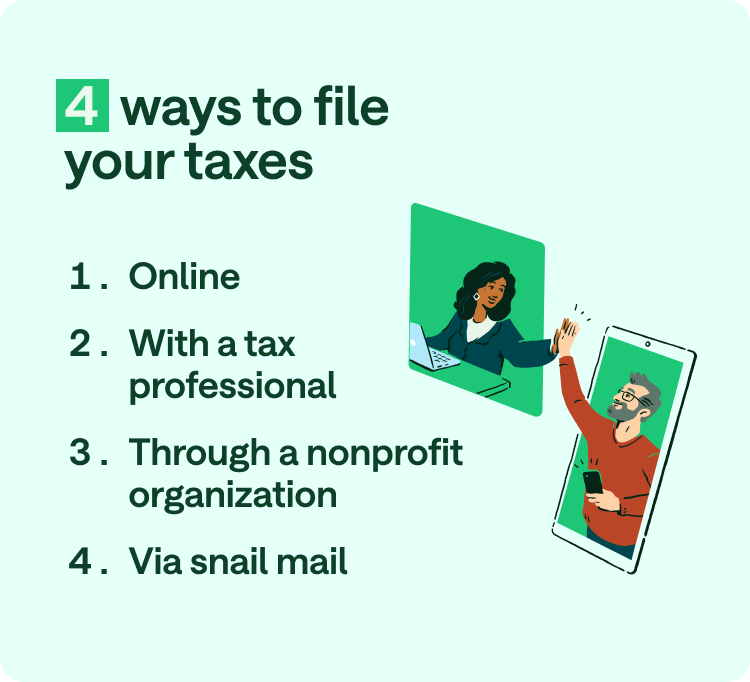

Once you’ve gathered your necessary documents and understand your filing status, it’s time to decide where and how you want to file your taxes. Here are some options to consider:

Filing online

Perhaps the most convenient and popular method, filing your taxes online is a straightforward process. There are a variety of online platforms to choose from, and many of them are free.

You can even file your taxes directly through the Chime app – it’s 100% free!~ The IRS also has its own option, IRS Free File.⁶

Filing with a tax professional

If your tax situation is complex or if you’re more of a tax beginner, you can choose to work with a tax professional like a certified public accountant (CPA) or an enrolled agent. This option may come with a fee, and the total cost depends on the tax preparer and how complex your tax situation is.

Filing through nonprofit organizations

Nonprofit options like the Volunteer Income Tax Assistance (VITA) program and the Tax Counseling for the Elderly (TCE) program can help you prepare your taxes for free if you qualify. Check with local organizations or visit the IRS website to find a VITA or TCE near you.

Paper filing

While less common today, you can still file your taxes on paper by obtaining the necessary tax forms and mailing them to the IRS. Filing your taxes by hand is typically more time-consuming and may delay your tax refund, but it’s an option if you prefer a traditional method.

Chime members will also be able to file their taxes through the Chime app completely free starting on January 6, 2025.

5. How to pay your taxes

If you owe taxes after filing, there are a few ways to make your payment. Whether you prefer paying in full or setting up installments, here’s how you can handle your tax bill.

After filing your taxes, you’ll either receive a tax refund or a notice of the amount you owe to the IRS. If you end up owing money, you may not have withheld enough taxes from your paycheck throughout the year.

In this case, you’ll need to know how to pay what you owe. You have a few options:

1. Paying with your bank account

The simplest, fee-free option is to use IRS Direct Pay to pay directly from your bank account.⁷ This method is quick, secure, and ensures the IRS has your account details for future refunds or payments like stimulus checks.

2. Paying with a card

You can also pay your taxes using a credit or debit card, though this method does come with fees. If you choose to use a credit card, make sure to pay off the balance promptly to avoid any interest charges.

3. Apply for a payment plan

If you can’t pay the full amount upfront, the IRS offers payment plans.⁸ While you’ll incur interest, these plans allow you to pay your tax bill in manageable installments over time.

Whichever method you choose, pay what you owe on time to avoid any penalties.

Conquer your first tax season

Whether you expect a refund or owe taxes, be proactive for a smooth tax season. Take the time to gather your documents, understand your filing status, and explore deductions and credits that can maximize your refund.

Remember to set up direct deposit through Chime to get your federal tax refund up to 6 days early.^

Before you file your taxes, learn how to find out what tax bracket you’re in.

FAQs

How early can I file taxes?

You can file taxes starting in January when the IRS begins accepting returns. Filing early can help you get your refund sooner and avoid last-minute issues before the April deadline.

How do tax credits and deductions reduce my tax bill?

Tax credits directly reduce the amount of taxes you owe, while deductions lower your taxable income. Common credits include the Child Tax Credit, the Earned Income Tax Credit, and education-related credits like the American Opportunity Credit. Deductions can include student loan interest, home energy improvements, and more.

What happens if I don’t file my taxes on time?

If you miss the April deadline, the IRS may charge late filing and payment penalties, plus interest on any taxes owed. Filing an extension gives you more time to submit your return but not to pay what you owe.⁹

Do I need to file taxes if I made very little income?

Even if you made very little income, you may still need to file taxes, depending on your filing status, age, and type of income. However, if you had federal taxes withheld from your paycheck, filing a return could help you get a refund, even if you’re not required to file. It’s worth checking the IRS income thresholds to know for sure.

Log in

Log in