Key takeaways

- A routing number is a nine-digit code that identifies your financial institution for transactions.

- You can usually find it at the bottom-left corner of any paper check, as the first set of numbers.

- If you don’t have a check, you can find your routing number through your bank’s mobile app, online banking portal, or on a bank statement.

- The routing number is different from your account number, which identifies your specific account.

Have you ever looked at the string of numbers at the bottom of a check and wondered what they all mean? Whether you’re setting up direct deposit or sending money, those numbers are important to understand and protect.

You’ll want to make sure you know how to find your routing number for day-to-day transactions like sending money online. Learn what a routing number is, how it’s different from your account number, and exactly where to find it – even if you don’t have a checkbook handy.

What is a routing number?

A routing number, also known as an “ABA number” or “routing transit number,” is a nine-digit code that acts like an address for your bank or financial institution. The American Bankers Association (ABA) originally developed this system in 1910 to make sure transactions go to the right place.1

Your routing number is used to identify the specific bank or credit union during transactions like wire transfers and automatic bill payments. You may need your routing number to confirm your account details when setting up direct deposit for a new job or receiving a tax refund.

A routing number identifies the institution itself, not your individual account—that’s what your account number is for.

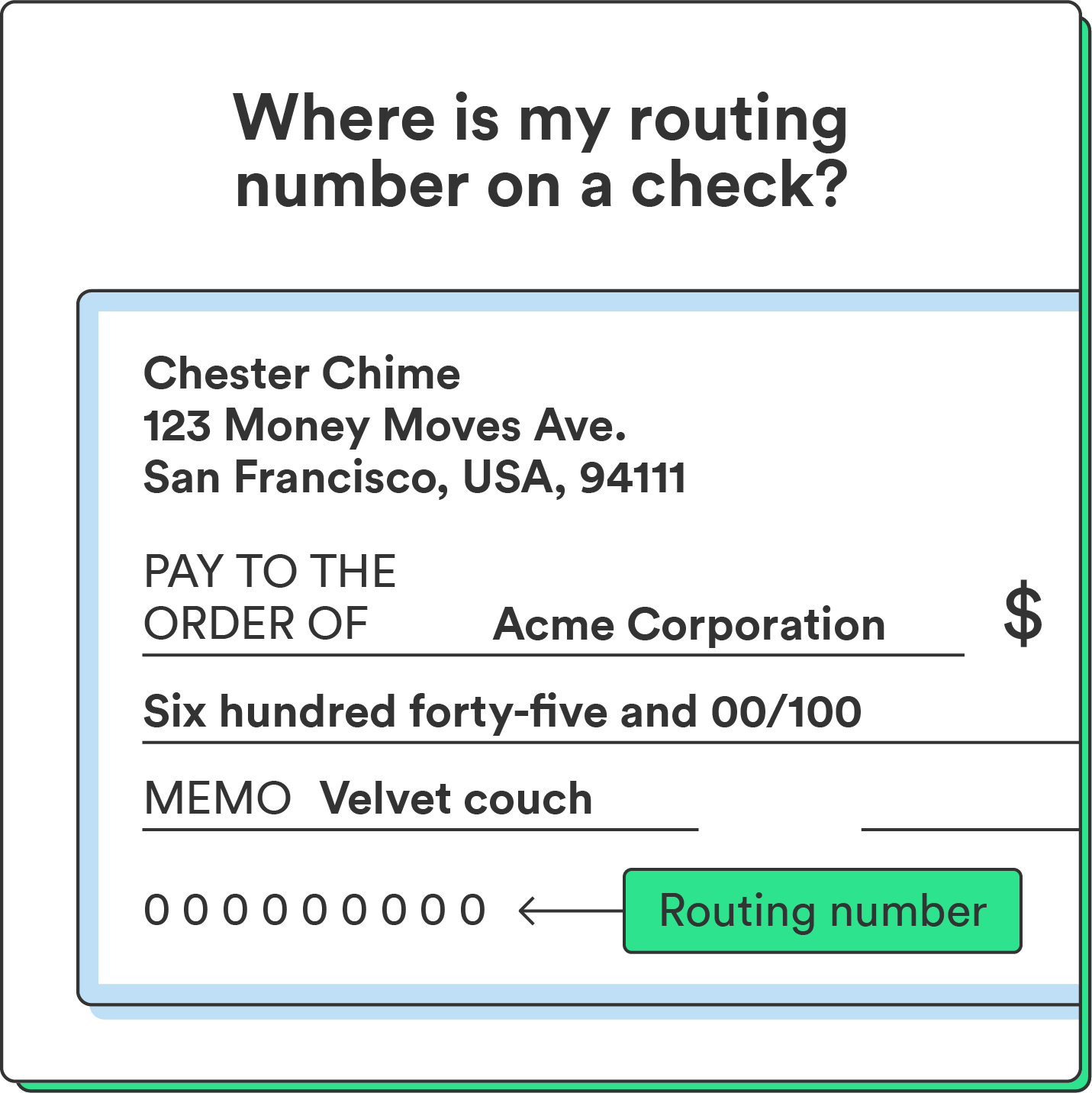

How to find the routing number on a check

The quickest way to find your routing number is by looking at a paper check.

You’ll see three sets of numbers at the bottom. The routing number is usually the first set of nine digits on the far left. Your check’s layout or format may differ slightly, but the routing number is always the first set of nine digits.

How to find your routing number without a check

Don’t have a checkbook? No problem. You can still find your routing number in a few other places:

- Your financial institution’s website or mobile app: Log in to your mobile banking app or online account. You can usually find your routing and account numbers in the account details or summary section.

- Your bank statement: Your routing number is typically printed on your monthly paper or digital bank statements.

- Call your bank:If you can’t find it online, you can always call your bank’s customer support. They can provide your routing number after you verify your identity.

Routing number vs. account number vs. check number

It’s easy to get the numbers on a check mixed up. Here’s a quick guide to what’s what:

- Routing number: The routing number is the 9-digit number on the bottom left of the check. It identifies your bank.

- Account number: Your account number is the number directly next to the routing number, usually 9-12 digits long. It identifies your specific account.

- Check number: The check number is often on the top right or bottom right of the check. It numbers that specific check to help you with record-keeping.

Finding your routing number is simple

Knowing how to find your routing number is a basic but essential part of managing your money. Whether it’s on a check, your financial institution’s app, or a statement, keep track of your routing number to make sure your payments and deposits go to the right place.

Got a check that you’re ready to cash? Check out our Chime mobile check deposit guide

Frequently asked questions

Is a routing number the same as an ABA number?

Yes, they are essentially the same thing. The term ‘ABA number’ comes from the American Bankers Association, which created the routing number system.

Can a bank have more than one routing number?

Yes. Larger banks that have merged with other banks over the years may have multiple routing numbers, often based on the state or region where you opened your account.

Is it safe to give out my routing number?

Generally, yes. Your routing number is considered public information and is needed for many common transactions like setting up direct deposit or ACH payments. While it’s safe to share for these purposes, you should always be careful with your account number.

Think of it this way: the routing number gets a payment to the right financial institution, but your account number directs it to your specific account. The combination of the two can be used to withdraw money, so protect your account number carefully.

Log in

Log in