Key takeaways

- Bank statements include all your transactions from a specified period (usually monthly), as well as your ending balance.

- Digital and physical paper bank statements contain the same information and account details.

- Bank statements help track your income and spending habits, identify fraudulent transactions, and review other details related to your bank account

A bank statement is an important document sent from your bank, either by mail or electronically. It provides recent information about your bank account, such as your account details, balance, and recent transactions.

Let’s break down how bank statements work and how you can use them to better manage your money.

How bank statements work

Every time money is deposited into or withdrawn from your bank account, your bank keeps track. You can always view your latest transactions using online or mobile banking. Bank statements just provide a clear picture of all activity for a given period, typically a calendar month, in one place.

Reviewing your bank statements can help you better understand your finances and monthly cash flow. They’re also helpful for finding errors or fraud, reviewing bank fees, and building a realistic spending plan for future months.

Individuals and families with shared bank accounts can use their monthly statements to verify their transactions and compare the bank’s records with their own expected transactions. If you see something you don’t recognize, you can work with your bank to figure out what happened and if it was legitimate.

Tip: If you see transactions that might be fraudulent, contact your financial institution right away to prevent future fraud and potentially recover lost money.

What are bank statements used for?

Bank statements are commonly used for:

- Account reconciliation: You can compare your expected starting balances, receipts, and ending balances to ensure your accounts are accurate. That’s called account reconciliation.

- Budgeting and financial planning: You can use bank statements to track your income and expenses to plan for future months.

- Detecting fraud: Unrecognized transactions may be legitimate, or they may be made by criminals attempting to commit fraudulent withdrawals. Contact your bank immediately if you find suspected fraud.

- Tax preparation: You can use bank, credit card, loan, and other financial statements to support your tax preparation, ensuring you submit an accurate tax return each year. They’re also additional evidence of your transactions if you get audited by the IRS.1

- Loan applications: Lenders, notably mortgage lenders, typically review bank statements to verify income and assess regular living expenses before approving a new loan.

Reviewing your bank statements in detail can help you make more informed financial decisions and keep your finances on track for your long-term goals.

Types of bank statements

Bank statements may arrive in your mailbox or email inbox. In either case, they’re official bank documents with the same information.

Paper bank statements

Paper statements are a traditional way of receiving bank statements. Some banking customers like to sit down and review paper statements with a pen, pencil, or highlighter to ensure every transaction is accurate.

Some banks no longer offer paper statements, and others charge an additional fee if you prefer to receive a statement by mail. They’re worse for the environment than electronic statements, and if someone steals your statement from your mailbox, it puts you at risk of fraud or identity theft.2

Electronic bank statements

Electronic statements typically come from your bank’s website or mobile app. You can log in and download a copy of your statement, usually as a PDF file. You can print out a copy if needed or review on your computer or smartphone.

They’re better for the environment and more secure than paper.2 If you’re handling your finances online, remember to follow cybersecurity best practices. That includes using unique passwords for every website and app, keeping your operating system and apps up to date, and using a VPN when connecting to the internet from a public network or away from home.

How to get a bank statement

With most checking accounts, you’ll get a new statement every month. In some cases, sometimes with savings accounts, you’ll get a new statement every three months. You should get bank statements automatically.3

You should receive an email notification when electronic statements are available, or you can check your mailbox for physical paper statements. Even if you get paper statements in the mail, you should be able to find past statements in your online banking account or through the bank’s mobile app.

According to government regulations, financial institutions are required to send you a statement if you have at least one transaction.3 That includes ATM transactions, debit card transactions, online bill payments, and direct deposits.

If you want to switch from paper to electronic statements, you can usually do so using online banking or by calling your bank’s customer service.

How to read a bank statement

If you don’t know what to look for on a bank statement, it can feel overwhelming. Fortunately, you don’t have to be a finance expert to decode your bank statement and understand what it’s telling you.

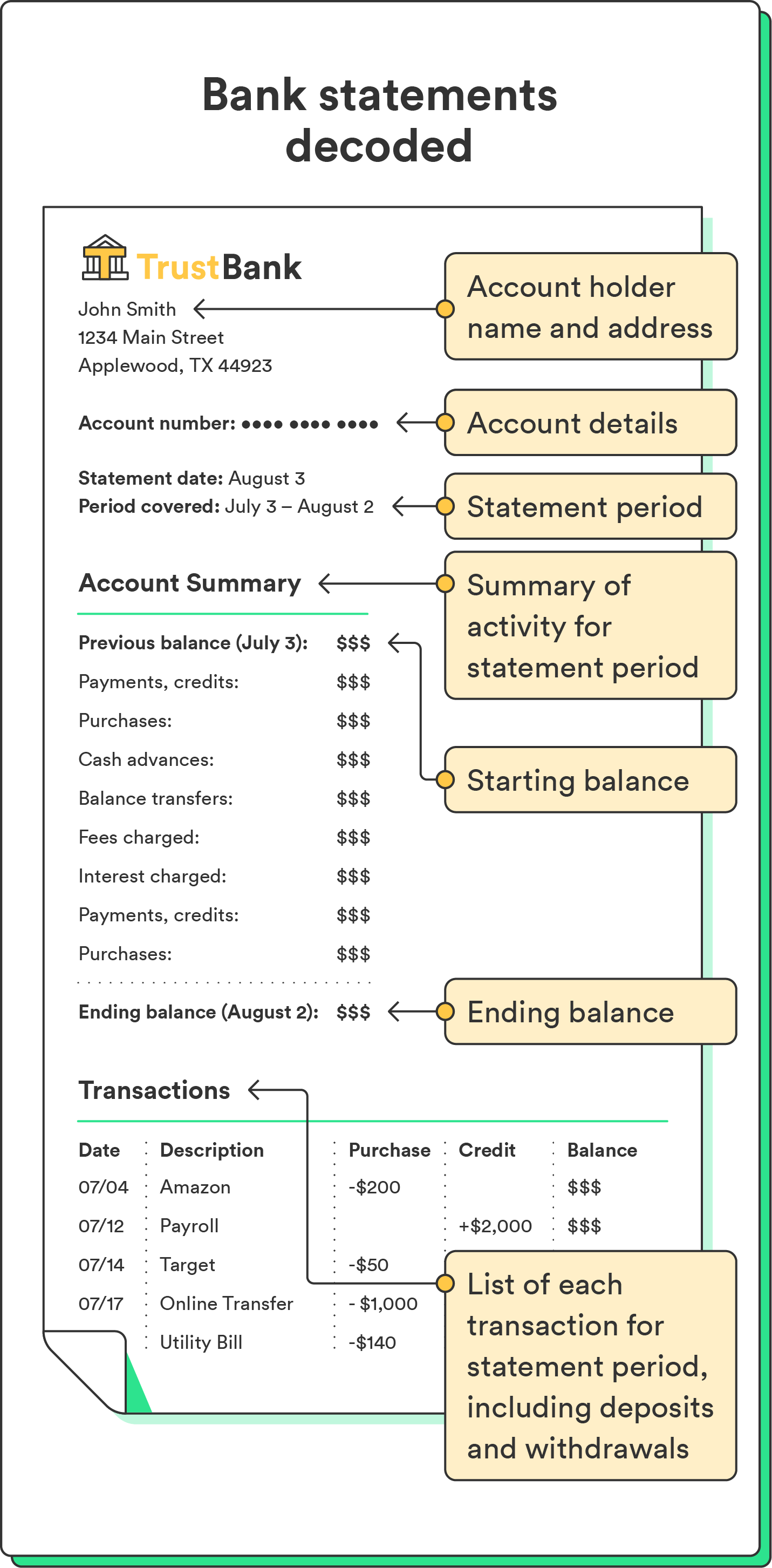

Bank statements typically include account and statement details so you know what you’re looking at. Those include:4

- Account details: Information like your account number, name, and account type.

- Bank information: Your bank’s contact information, including the address and phone number.

- Statement date: The date the statement was generated.

- Statement period: The length of time the statement covers or the period’s starting and ending dates.

- Beginning and end balance: Your account balance at the start and end of the statement period.

Then you can look for your list of individual transactions. They may all be listed together in order by date, or they may be separated by transaction type.

- Deposits: This includes funds added to your account, like your paycheck or electronic transfers into your account.

- Withdrawals: This includes funds paid or transferred from your account, like ATM withdrawals, electronic payments, debit card purchases, and bill payments.

- Checks paid: You’ll typically see the check number and amount, as well as, in some cases, recipient details or even a check image.

- Fees and service charges: These include service charges and other fees charged by your bank. Chime doesn’t charge any monthly fees, minimum balance fees, foreign transaction fees, or overdraft fees.

- Interest earned: If you have an interest-bearing account (such as a high-yield savings account), this includes the amount of interest earned for the specified period.

If you notice any mistakes or unfamiliar transactions on your statement, call the bank’s phone number listed on your statement to resolve them and keep your account in good standing. You may get statements on different schedules for different types of bank accounts.

Benefits of bank statements

Bank statements offer several important benefits:

- Track your spending: Seeing where your money goes each month can help you understand your spending habits and spot areas for improvement.

- Catch errors or fraud: Quickly identifying unauthorized charges allows you to report them right away.

- Stay on top of account balances: You may be able to avoid overdraft fees or declined transactions by keeping an eye on your available funds.

- Support budgeting: When working on your budget, you can use your bank statement as a tool to compare actual spending against your spending plan.

- Provide proof of income or expenses: Bank statements may be required for loan applications, rentals, or tax documentation.

Bank statements are an important financial tool

Understanding what a bank statement is and how it works can empower you to take charge of your finances.

It’s easy to ignore emails or push your bank statements aside, but that’s not a wise financial strategy. Savvy individuals and households review their statements and transactions every month (or quarterly) to ensure their finances are working as expected.

If you review your bank statement and see fees and charges you don’t like, you may want to know how to switch banks. It’s easier than most people think!

Frequently asked questions

What is the difference between a bank statement and a transaction history?

A bank statement is an official, periodic summary of your account activity, while a transaction history is a real-time list of all your account transactions.

What is an official bank statement?

An official bank statement is a document issued directly by the bank that displays a comprehensive summary of your account activities during a specific period. It is considered an authentic and verified record of your financial transactions.

How long should you keep bank statements?

For tax purposes, it’s a good idea to keep bank statements for at least seven years.5 Your banking provider is required by law to keep statements for at least five years, but many keep them for seven years or longer.6

How often should you check your bank statements?

You may want to review your bank statement when you receive a new one. Regularly reviewing your transactions helps you stay on top of your finances, identify potential issues, and ensure your account is accurate and up-to-date.

Log in

Log in