Chime® is a financial technology company, not an FDIC-insured bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. Deposit insurance covers the failure of an insured bank. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply.The Chime Visa® Debit Card and the secured Chime Credit Builder Visa® Credit Card are issued by The Bancorp Bank, N.A. or Stride Bank, N.A., pursuant to licenses from Visa U.S.A. Inc. and may be used everywhere Visa debit or credit cards are accepted. Please see back of your Card for its issuing bank.

Chime Checkbook: While Chime doesn’t issue personal checkbooks to write checks, Chime Checkbook gives you the freedom to send checks to anyone, anytime, from anywhere. See your issuing bank’s Deposit Account Agreement for full Chime Checkbook details.

By clicking on some of the links above, you will leave the Chime website and be directed to a third-party website. The privacy practices of those third parties may differ from those of Chime. We recommend you review the privacy statements of those third party websites, as Chime is not responsible for those third parties' privacy or security practices.

Third-party trademarks referenced for informational purposes only; no endorsements implied.

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. and Stride Bank, N.A. (“Banks”). Banks are not responsible for the accuracy of any content provided by author(s) or contributor(s).

This guide is for informational purposes only. Chime does not provide financial, legal, or tax advice. You should check with your legal, financial, or tax advisor for advice specific to your situation.

1 SpotMe® for Credit Builder is an optional, no interest/no fee overdraft line of credit tied to the Secured Deposit Account; SpotMe on Debit is an optional, no fee service attached to your Chime Checking Account (individually or collectively, “SpotMe”). Base Limit eligibility: You must have received a single deposit of $200 or more in Qualifying Direct Deposits into your Chime Checking Account over the preceding 34-day period.

Qualifying members will be allowed to overdraw their Chime Checking Account and/or their Secured Deposit Account up to $20 in total, but may be later eligible for a higher combined limit of up to $200 or more based on member’s Chime account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your SpotMe Limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your SpotMe Limit. SpotMe for Credit Builder and SpotMe on Debit share a single SpotMe limit. Your SpotMe Limit may change at any time, at Chime or its banking partners’ discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions or OTC cash withdrawal fees at retailers. SpotMe won't cover non card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. SpotMe Terms and Conditions.

2 Out-of-network ATM withdrawal and over the counter advance fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

3 Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

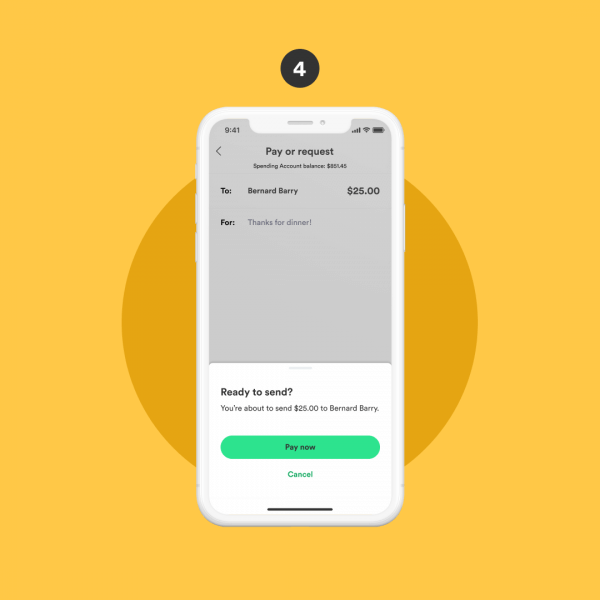

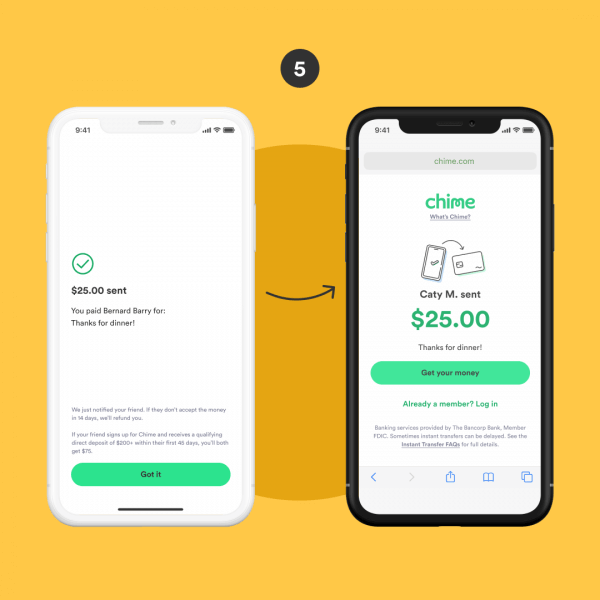

4 Funds are automatically debited from your Checking Account and typically deposited into the recipient’s Checking Account within seconds. Pay Anyone transactions will be monitored and may be held, delayed or blocked if the transfer could result in fraud or another form of financial harm. Sometimes instant transfers can be delayed.

~ Chime is recommended by more of its users in the 2024 Qualtrics® NPS study when compared to top national banks and select fintechs. THE #1 MOST LOVED BANKING APP is a Trademark of Chime Financial, Inc.

Address: 101 California Street, Floor 5, San Francisco, CA 94111, United States.

No customer support available at HQ. Customer support details available on the website.

© 2013-2025 Chime Financial, Inc. All rights reserved.

Log in

Log in