Key takeaways

- The secured Chime Visa® Card is the cash back credit card you can bank on, available in three colors: black, evergreen, and a premium titanium.

- Chime Card™ has the reliable Chime credit-building features plus 1.5% cash back rewards on rotating categories (with direct deposit) and access to cash at ATMs.

- Chime members can become Chime+ members through direct depositing to unlock SpotMe®, MyPay®, credit-building tools, a higher APY, and more.‡

- Members see a one balance view, so you can spend what you put in from either credit or checking.

Build credit safely with 0% interest,2 earn cash back rewards,1 and unlock the best of banking – all in one card.

Meet Chime Card: It’s got the safe credit-building features you love, access to over 47,000 fee-free ATMs,3 and 1.5% unlimited cash back rewards on rotating categories.1

But how does it work, and how can you get one?

What is Chime Card?

Chime Card™ is a secured credit card that helps you build credit4 while earning cash back rewards on your spending.2 Chime Card combines the best features of banking and credit into a single card that you can use anywhere Visa is accepted.

When you sign up for Chime Card, you get a Chime checking account, a secured deposit account (SDA), and a credit line account, which is your Chime Card. Money added to Chime Card goes to your Checking Account and is automatically transferred to your Chime Card Secured Deposit Account. There are many ways to fund your account, which we’ll cover below.

Here’s what you get with Chime Card:

- Cash back. You’ll earn unlimited 1.5% cash back on rotating purchase categories every three months when you enroll in direct deposit.1

- Build credit safely. Chime Card helps you to build credit history using your own money. There are no interest charges1 or annual fees, no minimum security deposit requirements,5 and no credit check needed to apply.

- Access to cash. If you need cash, Chime Card allows withdrawals at more than 47,000 fee-free ATMs nationwide.3

- One balance. Chime simplifies money management, with a single view of your money in the mobile app. You can spend with credit or debit.

You’ll unlock even more features when you direct deposit as a Chime+ member, and existing features get even better:

- Fee-free banking.6 Chime charges no monthly fees, overdraft fees, or foreign transaction fees.

- Smart credit tools. Build your score with free FICO® score7 tracking, Experian Boost®,8 and rent reporting9.

- MyPay®. Get up to $500 of your pay before payday,10 with no interest, credit check, or mandatory fees.11

- SpotMe®. SpotMe offers access to up to $200 in fee-free overdraft coverage.12

- High-yield savings. Grow your money at a competitive rate, with an APY of up to 3.75% on savings balances.13

- Member perks. Even more cash back opportunities with Chime Deals,14 friend referrals, and more.

- 24/7 support. Chime offers around-the-clock support from real people to answer your questions or provide help when you need it.

Deposits are FDIC insured up to $250,000 through The Bancorp Bank, N.A., or Stride Bank, N.A., ; Members FDIC15.

⁶Optional services and products may have fees or charges, such as outbound instant transfers, out-of-network transactions, and credit products. Learn more at chime.com/feesinfo.

How to get Chime Card

It‘s easy to get the cash back card you can bank on. Here’s how to get Chime Card.

- Sign up for Chime. You’ll need to have a Chime Checking account to get Chime Card.16 To open a Chime account, you need to share your personal details and verify your identity, download the Chime app, and set up direct deposit. Chime accounts are available to people 18 years and older who have a valid U.S. address.

- Choose Chime Card. Once you’ve signed up, you’ll choose Chime Card. There’s no credit check required. You can then choose between evergreen or black card colors, or upgrade to a premium titanium card for $50 plus applicable taxes.

- Wait for your Chime Card to arrive. It usually takes 7 to 10 business days for your physical Chime Card to arrive. In the meantime, you’ll have access to a virtual Chime Card and a virtual debit card that you can use to shop online.

- Fund your account. When you get Chime Card, you get a checking account and a Secured Deposit Account. The money you deposit acts as your card’s credit limit.17

- Enroll in direct deposit (Optional). Direct deposit helps you unlock the full benefits of Chime Card, including unlimited 1.5% cash back1 on rotating purchase categories. You can enroll in direct deposit through the Automatic Setup feature in the Chime app, but it is not required to get the card.

Switching to Chime Card from Credit Builder

We know our members are excited to start earning cash back and to keep building credit safely as you spend.4

Chime members can swap Credit Builder for Chime Card directly in the app! Check out our guide on how to switch to Chime Card for step-by-step instructions.

How do cash back rewards work with Chime?

Once you are enrolled in Chime+ with your direct deposit, you can start earning cash back on purchases with your Chime Card.

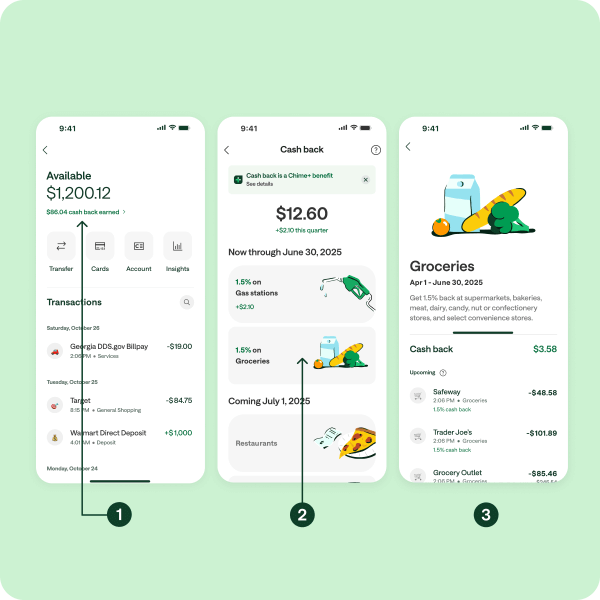

- You can earn unlimited 1.5% cash back1 on rotating categories every three months. So, if you spend $5,000 on eligible purchases, you could get $75 in cash back.

- The categories include everyday purchases like gas, groceries, restaurants, and utilities. Just navigate to “Deals” in the Rewards Hub of the Chime app to see the current categories.

- Rewards are distributed weekly, and you’ll get a monthly rewards statement that shows how much cash back you earned.

Cash back rewards earned with Chime Card are separate from rewards you earn with Chime Deals.14 That means you can stack cash back to pile up rewards even faster!

How to view your rewards

You can view your rewards and cash back calendar in the Chime mobile app Rewards Hub. Here’s how to check your rewards.

- Log in to the Chime app and navigate to the Rewards Hub.

- Under your account balance, you should see how much cash back you’ve earned for the quarter.

- Tap the cash back number to see the current quarter’s cash rotating categories. You can also view your transactions in those categories.

The Rewards Hub lets you stay connected to your cash back earnings and view current offers. You can also get a preview of what’s coming soon, which can help you plan future purchases for maximum cash back rewards.

How to use Chime Card

You can use your Chime Card to make purchases anywhere Visa is accepted, including in-person or online. To get started, you’ll first need to fund the card.

Fund your card

You can add funds to your account in a few ways:

- Set up direct deposit.

- Move money with Apple Pay®.

- Transfer money from a debit card (with no fees!)

- Send money using a payment app like PayPal® or Venmo®.

- Deposit cash18 at over 80,000 locations – just look in the Chime app.

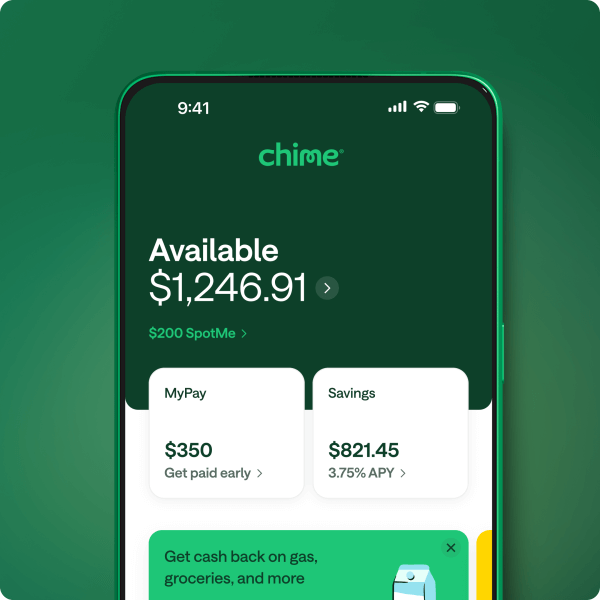

When you log in to the Chime app, you’ll see your single account balance view. This balance reflects the total money you have in your Chime account, which is the amount that’s available to spend with your Chime Card. For example, if your “Available” balance is $1,000, your available credit limit for Chime Card is also $1,000.

Your Available balance includes funds in your Secured Deposit Account that you can spend using your debit card or Chime Card¹⁸. It does not include balances in Savings accounts. Whenever you spend using your debit card or Chime Card, the transaction amount is deducted from the Available balance.

Chime Card only allows you to spend the money you have available, so staying within your “credit limit” is easy.

Spend to build credit

When you spend with Chime Card and make on-time payments, you also build credit.4 Chime Card allows you to spend your Available balance and then make payments against it. On-time payments allow you to build and improve your credit safely.

On-time payments are the most important factor for credit score calculations.

You can build credit with Chime Card when you:

- Use your card to make purchases.

- Pay your balance on time each month.

Turn on the Safer Credit Building feature in your app for automatic on-time payments.4 This way, your balance is paid on time each month without you needing to do anything.

Still confused about how Chime Card can help you get better credit scores? Check out our guides on how to build credit with Chime and how credit reporting works with Chime Card.

While your Chime Card works at any retailer that accepts Visa credit cards, you have options if you need to use a debit card. You can use your virtual debit card, for example, by adding it to Apple Wallet® or Google Wallet®, or request a physical debit card in the app. You can also pay with debit for online and in-person transactions.

More ways to help improve your credit with Chime

There’s a lot you can do with your Chime Card to help improve your credit, aside from using it to develop a positive payment history. Here are some other ways to take control of your credit with Chime.

- Check your credit scores for free. Log in to the mobile app to view your FICO® score7 and track your progress.

- Improve your credit scores with Experian Boost®.8 We’ve partnered with Experian® to help you improve your scores using bills you already pay through Chime.

- Build credit monthly with rent reporting9. If you rent, you will soon be able to use your on-time rent payments in the app to help raise your credit score.

- Get credit tips tailored to your journey. The Chime app delivers personalized tips and advice to help you navigate your finances as you work to build higher credit scores.

Set up direct deposit for cash back rewards and more

When you set up direct deposits of $200 or more, you unlock the best of banking with a Chime+ membership.‡

That means you can earn unlimited 1.5% cash back on quarterly rotating categories with your Chime Card.1 The cash back you earn can help you grow your savings, chip away at debt, or just create a little cushion in your Chime Checking Account.

Rewards aren’t the only thing you get as a Chime+ member. You also have access to MyPay®,10 SpotMe®,12 and up to a 3.75% APY13on your high-yield savings account.

Get your Chime Card today

Chime Card is a rewarding way to build credit4 and unlock financial progress™. Chime Card provides the tools you need to stay on top of your spending, savings, and budget.

It takes just a couple of minutes to get started and unlock the full benefits of Chime.

Frequently asked questions

How do I add money to my Chime Card?

When you set up your Chime Card, you’ll also get a Chime checking account and a Chime Secured Deposit Account. As you add money to your checking account, it’s automatically transferred to your Secured Deposit Account.17 Chime lets you add to your balance by moving money with Apple Pay, transferring funds from a debit card fee-free, sending money using a payment app like PayPal or Venmo, and cash deposits18 at over 100,000 locations.

Does Chime Card have a spending limit?

Your Chime Card spending limit is determined by your Available balance. You can log in to the Chime mobile app to view your available balance and add funds.

What ATMs are free to use with Chime Card?

You can use your Chime Card to withdraw cash at more than 47,000 fee-free ATMs3 nationwide. Chime’s ATM network includes Allpoint, Visa Plus Alliance, and MoneyPass ATMs. You can log in to the Chime mobile app to find a fee-free ATM near you. A $2.50 fee applies to make withdrawals at out-of-network ATMs.

Is Chime Card a credit card?

Yes! Chime Card is a secured credit card that doesn’t require a credit check. The money in your Chime secured deposit account determines how much you can spend with your card.5 Payment activity is reported to the credit bureaus to help you build or rebuild your credit.4

Can I use my Chime Card as a debit card?

The physical Chime Card cannot be used as a debit card for POS transactions. If you choose Chime Card when opening a Chime account, you get a physical card that functions like a credit card. However, you also get a virtual debit card that you can use online. You can add your virtual debit card to Apple Wallet or Google Wallet to pay with debit in stores.

How is Chime Card different than other credit cards?

Chime Card is a secured credit card that doesn’t require a credit check or minimum security deposit to open. You can only spend the funds available in your secure deposit account.17 When you pay your balance, your payment history is reported to the credit bureaus. Chime Card helps you avoid overspending. There’s no interest2 on balances and no annual fees.

Chime Card is unique because it also allows you to use traditional checking features like accessing cash fee-free at an ATM,3 fee-free overdraft,12 and accessing your pay ahead of payday with MyPay.10 To open Chime Card, we create three accounts for you: a Chime checking account, a secured deposit account, and a credit line account, which is your Chime Card.

Does SpotMe work on Chime Card?

SpotMe works with Chime Card and your debit card. SpotMe covers purchases and cash withdrawals made with your cards up to your SpotMe limit, if you’re eligible and have the feature enabled in your app. Your SpotMe limit is shared between your Chime Card and your virtual or physical debit card12.

When should I use my Chime Card and when should I use my virtual debit card?

You’ll get the most benefit from using your Chime Card for purchases that earn unlimited 1.5% cash back each quarter.3 However, it’s also useful any time you need to shop in person, withdraw cash, or send payments to friends and family. Your debit card, meanwhile, is better for some online transactions like payments made using money transfer apps.

How long does it take for my Chime Card to arrive?

After you enroll, which takes just a couple of minutes, your Chime Card will be on its way. Typically, it takes 7-10 business days on average for your card to arrive.

How and when do I pay off the card?

You can pay off your Chime Card in three ways:

When you turn on Safer Credit Building,4 we will automatically pay your Chime Card balance with funds set aside in your Secured Deposit Account.17 This will help you avoid late payments and outstanding balances.

If Safer Credit Building is not turned on, manual payments can still be made at any time by going to Settings → Safer Credit Building → Make a Payment. Payments can be made from your Secured Deposit Account or from another bank account.

ACH Payments can be made from any bank by using Chime Card’s account and routing numbers. To find them, go to Settings → Safer Credit Building → Make a Payment → Paying with another bank.

What happens if I miss a payment on my Chime Card?

There are no late fees or interest2 for missing Chime Card payments. But if you don’t pay your Chime Card statement balance within 24 days of the due date, you won’t be able to use your card again until the balance is paid in full. Late or missed payments, or defaulted accounts, could also be reported to the credit bureaus, which could hurt your credit scores.

How is Chime Card different from Credit Builder?

Chime Card is the next generation of The secured Credit Builder Visa® Credit Card. You get the same outstanding credit-building4 capability, with built-in banking access and a chance to earn cash back rewards. You still use your own money to build credit safely, with added features that make the card even better.

Can I add Chime Card to Apple Wallet or Google Wallet?

Yes, you can add Chime Card to Apple Wallet or Google Wallet. You can also add your virtual debit card for even more convenient spending.

Can I get both cash back rewards and Chime Deals cash back?

Yes, you can get cash back rewards with Chime Card and earn cash back with Chime Deals14. You can use both types of cash back rewards – they don’t limit one another.

How many accounts do you get when you sign up for Chime Card?

Three: a Chime Card credit account, A checking account, and a secured deposit account. These three accounts work seamlessly together to help you build credit safely4 with your own money. As you add money to your CHECKING account, it’s automatically transferred to your secured deposit account. What you’ll see in the app is a single account view of your “Available” balance in the SDA.5 The amount of money in your SDA acts as your spending limit on your Chime Card.17

Log in

Log in