Mastering budgeting is your key to financial freedom, whether you’re new to managing money or refining your skills. This guide will teach you how to make a budget and empower you to manage your money, reduce stress, and reach your financial goals. Let’s get started!

1. Figure out your net income

Every budget starts with your income – or the amount of money you receive in a month. That includes regular paychecks and additional income sources (like a side hustle).

Your net income, often called your take-home pay or net pay, is how much you earn after taxes and deductions. This figure provides a clear starting point when you’re learning how to make a budget. You can find your net income by checking your pay stubs or your employer’s online payroll platform.

Chime tip: If you don’t receive income regularly, calculate how much you’ve earned each month for the last three to six months and use the lowest amount for this month’s budget. You can update it later if you end up earning more.

2. Calculate your monthly expenses

Next, determine where all your money goes each month. Calculating your monthly expenses will give you a comprehensive picture of your spending across different categories.

The three main categories are essential expenses, nonessential expenses, and savings and debt payments. Here are some examples of expenses that fall within each category.

| Essential Expenses | Nonessential Expenses | Savings and debt paydown |

|---|---|---|

| Housing | Entertainment | Emergency Fund |

| Basic utilities | Dining out | Retirement savings |

| Groceries | Travel | Debt payments above the minimum requirements |

| Transportation | Personal purchases | |

| Healthcare | Clothing | |

| Insurance | Gifts | |

| Minimum loan and credit card payments | ||

| Childcare |

Essential expenses (necessities)

First, list your nonnegotiable fixed expenses. These are regular monthly expenses, like rent, mortgage, groceries, utilities, or transportation. After each category, add a line or subcategory beneath each with your specific expenses.

Following the 50/30/20 rule, 50% of your income should go toward these necessities.

Nonessential expenses (wants)

Next, list your nonessential expenses. These are wants, not needs, and include discretionary spending like eating out, entertainment, travel, or other personal purchases. Following the 50/30/20 rule, you would put 30% of your income toward your wants.

Savings and debt payments

The last category is for savings and debt payments, which should take up 20% of your income based on the 50/30/20 method. Dedicate this part of your budget to preparing for the future, reaching savings goals, and creating a financial cushion for emergencies. If you have debt, you can also fit additional payments above the minimum requirement in this category.

Chime tip: Use our loan payoff calculator to calculate how soon you can pay off existing loans.

Once you list all your monthly expenses, add them up and subtract that number from your net income. If it’s positive, you have extra funds after covering your expenses. If it’s negative, you’re spending more than you make, so you’ll want to adjust accordingly.

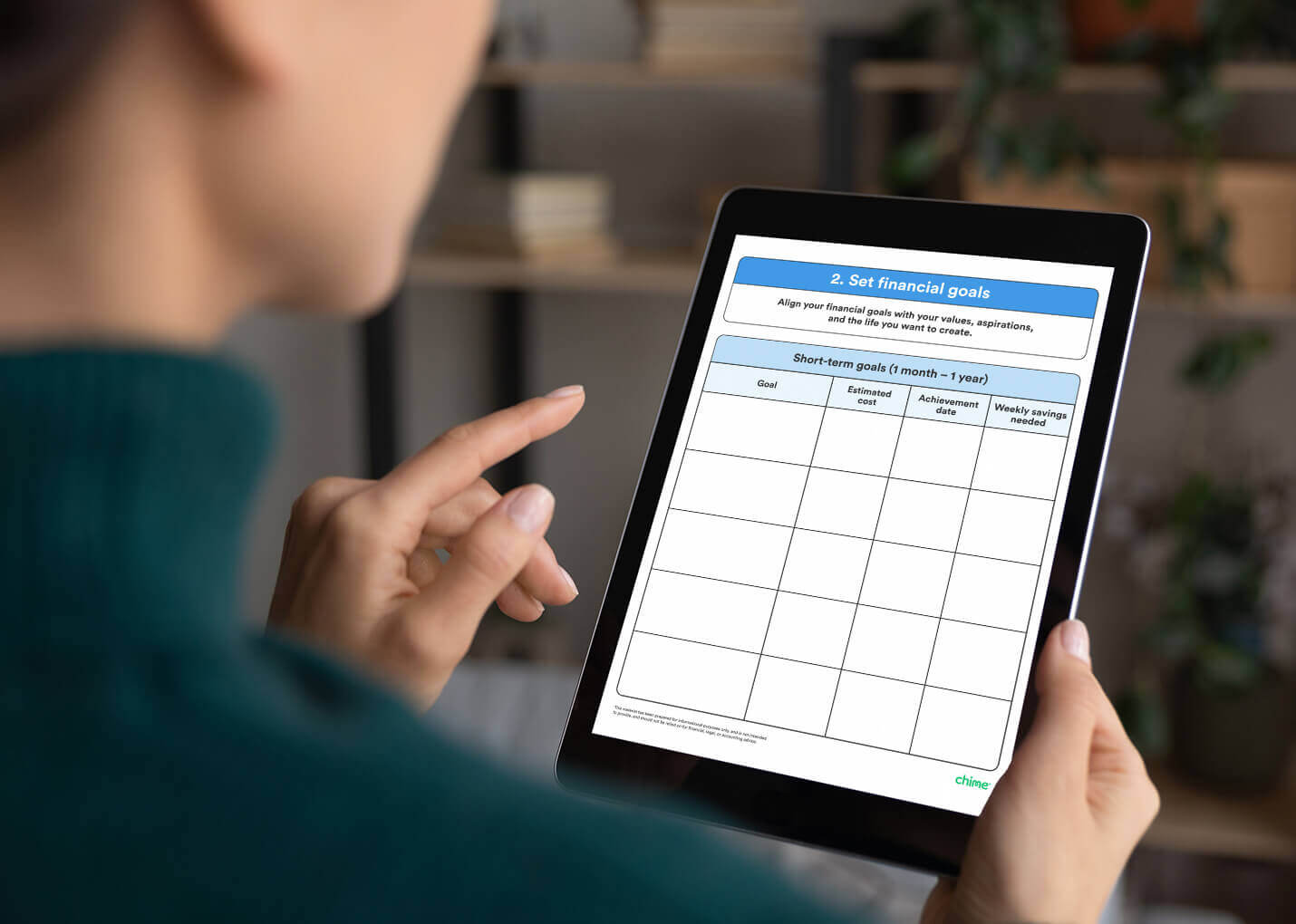

3. Set realistic financial goals

The next step is to set your financial goals. Aligning your budget with your goals helps you see it as a means to achieve your dreams rather than thinking of it as restricting.

To set your financial goals, assess where you are now and where you want to be in the future. You can break this down into short-term and long-term goals:

- Short-term goals include building an emergency fund, paying off credit card debt, or saving for a vacation.

- Long-term goals include retirement planning, homeownership, or funding your child’s education.

Once you have a list of goals, be specific about how much money you need and the timeline you want to achieve it. For example, if you plan to pay off $5,000 in credit card debt within a year, you’ll know how much to set aside each month.

4. Choose a budgeting method

When you’re researching how to make a budget, you’ll learn that there are several budgeting methods you can follow. It doesn’t matter which you choose as long as it includes your expenses, income, savings, and debts. Choose one that feels manageable and allows you to be consistent. Here are some common methods to make a budget:

- 50/30/20 budget: The 50/30/20 budget rule divides your income into three categories: 50% goes to necessities, 30% goes to wants, and 20% goes to savings and debt payments. This method is a simple way to get started if you don’t know what percentage of your income to spend across different budget categories.

- The envelope method: The envelope method is a cash-based approach ideal for anyone who overspends or wants to avoid debt. First, you set a spending limit for each expense category, such as groceries or eating out. Then, you put your cash for each expense category into separate envelopes. Once the envelope is empty, you stop spending in that category for the month.

- Zero-based budget: With the zero-based budget model, you assign a purpose for every dollar of your income. It requires careful planning and tracking cash flow, but you’ll budget each dollar more intentionally.

Finding a sustainable method based on your spending habits, lifestyle, and goals may take trial and error.

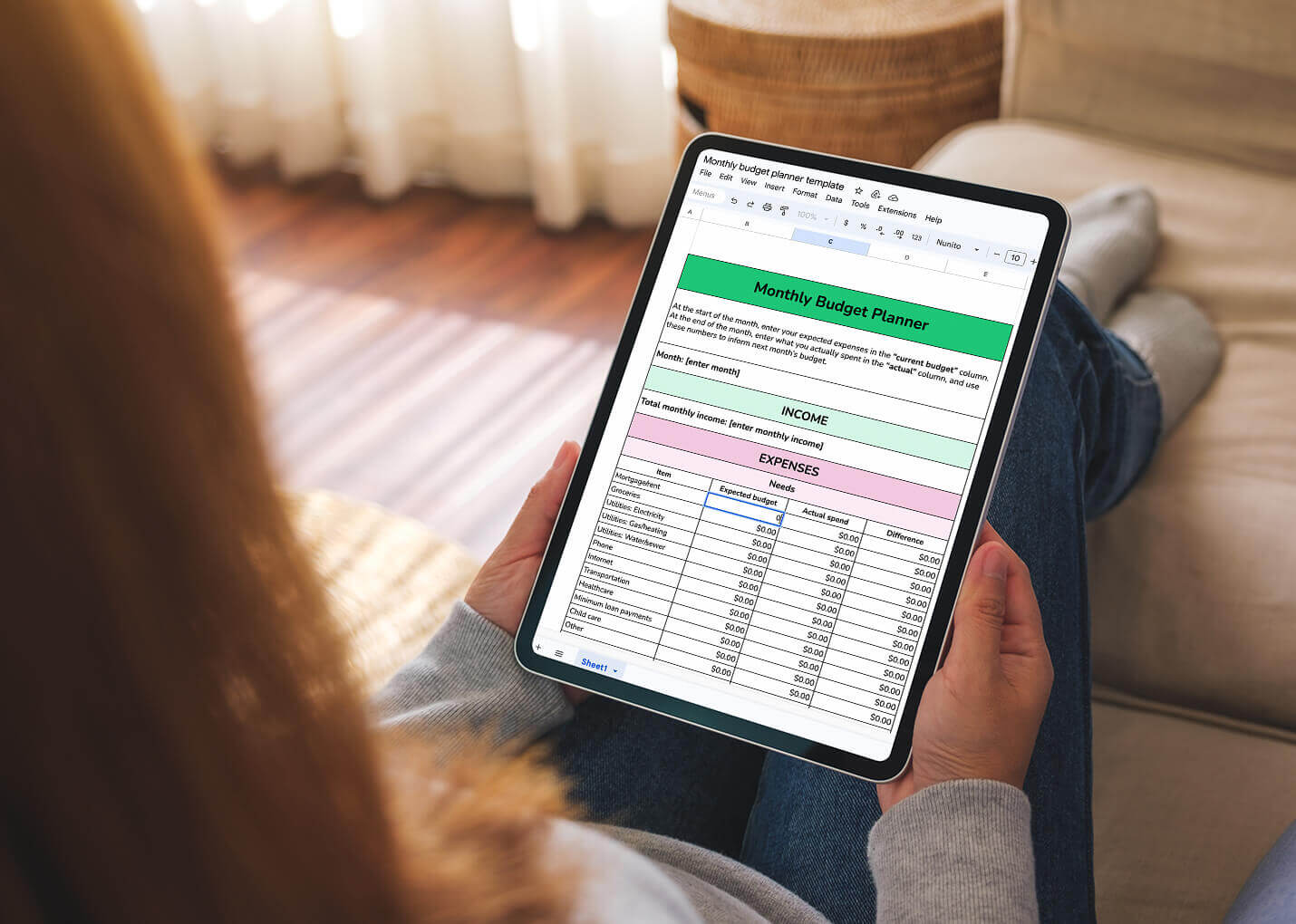

Need a jump start? Use the templates below to set up your budget. Download and edit them from your computer, or print them out if you prefer a hands-on approach. You can also keep it handy as you work through the rest of the steps below.

5. Review and adjust your spending

Now that you have a clear view of your income and expenses, you can adjust your budget to align with the 50/30/20 rule. The tips below can highlight where you stand and potential changes:

- Examine each expense: Go through your list of expenses. Are there areas where you can stop spending money? Identify any items you can pull back on in your “wants” section.

- Prioritize financial goals: Revisit your financial goals. Are you investing enough in them to achieve them? Adjust your budget to prioritize your most important goals, like building an emergency fund, saving for retirement, or paying off high-interest debt.

- Analyze spending patterns: Look at your spending patterns over the past few months. If you’re overspending in specific categories, adjust your budget accordingly.

- Be strategic with leftover funds: If you have leftover money, don’t leave it hanging – give it a purpose that aligns with your current goals. That could mean increasing your monthly savings, putting more toward lingering debts, or increasing your investments for retirement.

By reviewing your current spending and making adjustments that align with your financial priorities, you put yourself in the driver’s seat of your financial future.

6. Track your budget regularly

Congratulations on creating your budget! Now, let’s make it work for you. Regularly reviewing your budget throughout the month is the secret sauce. Here’s how:

- Daily or weekly updates: Dedicate some time each day or week to update your budget with your latest transactions. This practice keeps you aware of how much you’re spending on needs, wants, and savings.

- Stay flexible: Your budget isn’t static, so don’t be afraid to tweak it. If your energy bill spikes, tweak another part of your budget to balance it out. Being proactive ensures you cover all essentials, preventing last-minute surprises.

Your budget is a tool that evolves with your life, so keep it up to date and watch your financial control grow.

7. Keep up with best practices for successful budgeting

As you continue reviewing and updating your budget, consider the following milestones to work toward.

Build an emergency fund

An emergency fund is your financial safety cushion for unexpected expenses or emergencies. To stay financially secure, save enough to cover at least three to six months of living expenses.

Get the employer match on your 401(k)

Take full advantage of your employer’s 401(k) match (if they offer one). Contribute enough to snag the maximum employer match to maximize your savings. Doing so builds your retirement nest egg and gives you valuable tax benefits.

Tackle high-interest debt

Paying off high-interest debt should be a priority in your budgeting game plan. Find ways to fit debt payments into your budget and use extra cash to reduce that balance faster.

Once those high-interest debts are under control, you can redirect that money to savings or other financial goals.

Save at least 20% of your income

Save at least 20% of your income to build a sturdy financial foundation and prepare for the future. This includes funding your retirement accounts and emergency fund and stashing away money for other savings goals. Adjust your budget to make it happen as your income grows.

A budget can help you control your financial life

Learning how to make a monthly budget is a significant first step toward gaining control of your finances. A successful budget will help you determine how to reach your financial goals without forcing you to completely cut back on extras like dinners with friends or your monthly gym membership.

Want to take your budget to the next level? Learn how to make a financial plan that helps you build wealth and long-term financial stability.

FAQs

Are budgeting apps safe?

In general, budgeting apps are safe to use for managing your money. The best budgeting apps include security protection to encrypt your data. You can take additional steps by choosing unique passwords, enabling multi-factor authentication, and only logging in using secure WiFi.

Are budgeting apps worth it?

Budgeting apps are generally worth it if you don’t spend more than you can afford. Tracking your budget can create positive change and better financial habits, which can pay off over the long term.

How do I budget better?

Learning how to budget better can take time but choosing the right budgeting app can be a good place to start. You can use a budgeting app to review your spending and see where your money goes. This can give you insight into where you might be wasting cash each month. You can also use a budgeting app to track your bills to see how your expenses may increase or decrease over time.

YNAB vs Mint: What are the pros and cons?

Mint is shutting down and officially recommends that users switch to CreditKarma. In terms of the differences between YNAB vs. CreditKarma, cost and function are largely what set them apart. YNAB requires a monthly or yearly fee while CreditKarma doesn’t. YNAB uses spreadsheets to manage your budget on a forward-looking basis, which could work well for you if you’re spreadsheet-savvy. CreditKarma, on the other hand, is an app that makes it easier to manage your current monthly budget from your mobile device.

Log in

Log in