As tax season approaches, employers start sending out IRS Form W-2 to their employees. The W-2 form, also known as a Wage and Tax Statement, reports your earnings from the previous year and how much tax your employer withheld.

You’ll need this form to file your taxes and hopefully get a tax refund from the government. Whether you’re waiting for yours to hit your mailbox or you’ve already received your W-2, here’s what to know about how to read a W-2.

What is a W-2?

A W-2 is an IRS form that states your wages earned and tax withheld in the prior year. It also contains the amounts you paid for health insurance premiums, retirement plans, and other benefits offered by your employer.

Note that W-2s only go to employees whose employers withheld taxes from their pay. If you’re an independent contractor or freelancer who works with clients, you’ll get Form 1099, rather than Form W-2.

If you have multiple employers, you’ll get a W-2 from each one, provided they paid you at least $600 over the year.¹

How to read a W-2

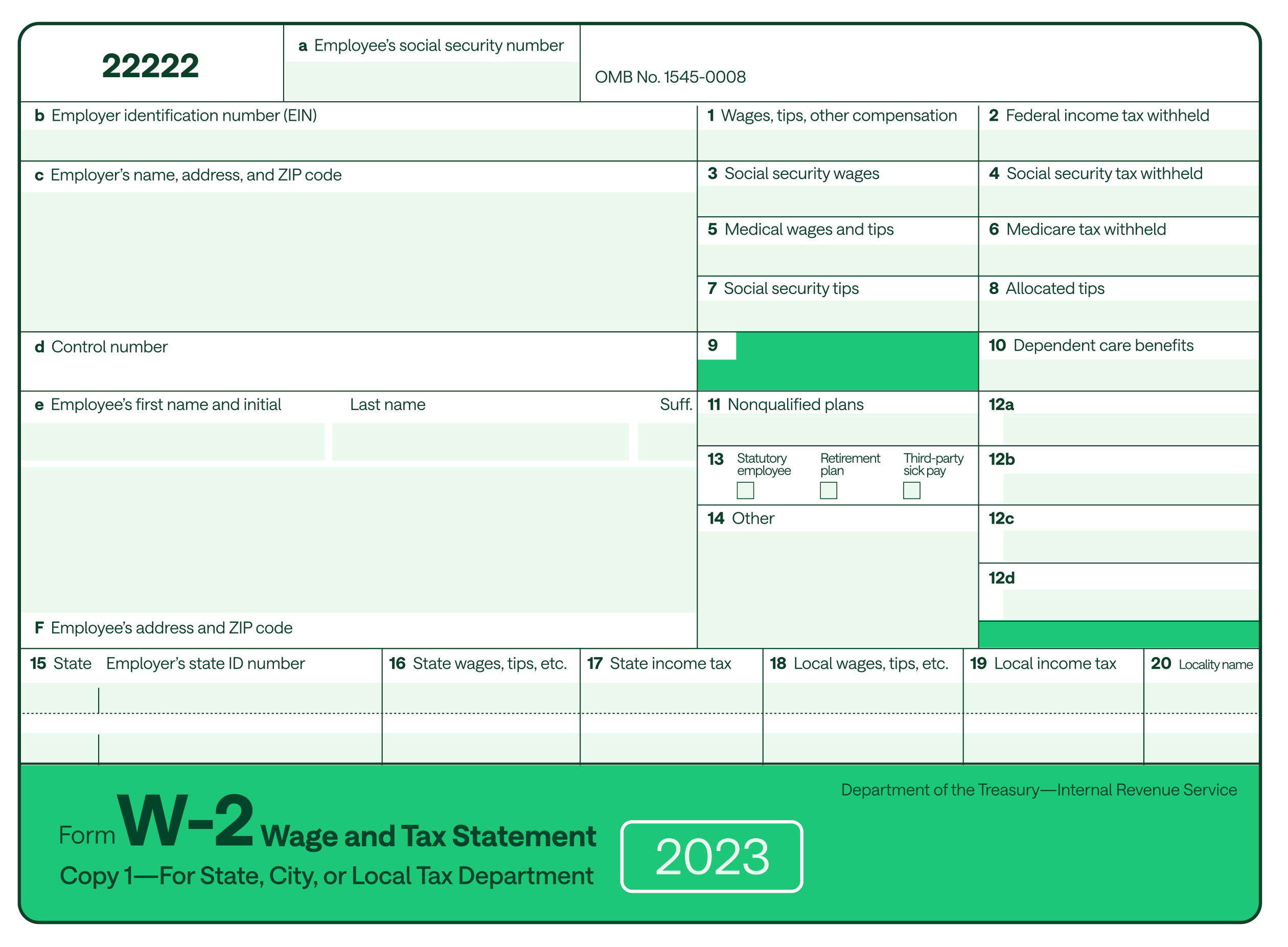

The IRS has a standard form for issuing W-2s. This form has a series of lettered and numbered boxes where your relevant tax information is entered. Here’s what a sample W-2 looks like:²

If you’re wondering, “How do I read my W-2?” here’s a breakdown of the information you’ll see in each box on this form.

Boxes a – f: Taxpayer information

- Box a: Your Social Security Number (SSN)

- Box b: Your employer’s Employer Identification Number (EIN)

- Box c: Your employer’s name and address

- Box d: A control number that some employers use. This box will be blank if your employer doesn’t use one.

- Box e: Your first and last name

- Box f: Your address and zip code

Boxes 1 – 14: Wages, taxes withheld, and benefits

- Box 1: Wages, tips, and other compensation. This total will not include retirement plan contributions or pre-tax benefits, so the amount may be lower than what you see in boxes 3 and 5.

- Box 2: Federal income tax withheld. When you started your job, you filled out Form W-4 to indicate how much tax your employer should withhold.³

- Box 3: Social Security wages. This is the amount of wages you earned that are subject to Social Security tax.

- Box 4: Social Security tax withheld. Typically, 6.2% of your wages are withheld for Social Security taxes.⁴

- Box 5: Medicare wages and tips. This is the amount you earned that was subject to Medicare taxes.

- Box 6: Medicare tax withheld. Typically, 1.45% of wages are withheld for Medicare taxes.⁵

- Boxes 7 and 8: Social Security tips & Allocated tips. Unless tips were reported to or allocated by your employer, these boxes will be blank.

- Box 9: Verification code. Some W-2s contain a 16-digit verification code you can enter when you file your taxes online. It’s not a problem if this box is blank, though — you can still file your taxes.

- Box 10: Dependent care benefits. This reports any paid benefits you received from an employer’s dependent care assistance program.

- Box 11: Non-qualified plans. This reports any money you got from your employer’s non-qualified deferred compensation plan. This box may be blank.

- Box 12a-d: Codes. You may see codes in box 12 if you received income from other sources, like a 401(k) matching benefit, health savings account contributions from your employer, or moving costs your employer reimbursed.

- Box 13: Statutory employee, retirement plan, third-party sick pay. You may see information here if you received sick pay from your state’s disability insurance program.

- Box 14: Other. This is another box that might be blank for you. However, it could contain information if you had non-taxable income, a health insurance premium deduction, or anything else that didn’t fit in the other boxes.

Boxes 15 – 20: State and local tax reporting

- Box 15: State and Employer’s state ID number. This box will be blank if your state doesn’t collect income tax.

- Box 16: State, wages, tips, etc. This is your wages that are subject to state income taxes.

- Box 17: State income tax. This is the amount of state tax that was withheld on your state-taxable income.

- Box 18: Local wages, tips, etc. Wages that are subject to local or city taxes will be here.

- Box 19: Local income tax. This is the amount of local taxes withheld from your wages.

- Box 20: Locality name. This names the city or locality that withheld local taxes from your wages.

Not every box on your W-2 will apply to you, so don’t worry if some of the boxes are blank.⁶

When will I get my W-2?

The IRS requires employers to mail copies of W-2s to their employees by January 31st each year.⁷ You should receive yours by mid-February. Some employers let you access your W-2 form online. If you ask for your W-2 earlier, your employer should get it to you within 30 days.⁸

A copy of your W-2 will also go to the IRS so it can cross-check that your information is accurate when you file your taxes.

What to do if you don’t have your W-2

While employers are required to send out W-2s at the end of January, things don’t always go like clockwork. For example, your W-2 could get lost in the mail. Or, your employer may be behind on getting forms out.

If you haven’t received your W-2 by mid-February, reach out to your company’s payroll, human resources, or accounting department to request it. This can get the ball rolling on filing your taxes. Your employer may also instruct you on how to access your W-2 form online.

If your employer can’t help you, calling the IRS is also an option.⁹ Even if you don’t have your W-2, you’re required to file your taxes, which you could do with an estimate of the wages you earned and amount of taxes withheld.

The failure-to-file penalty is 5% for each month your return is delayed. And if you owe taxes, you’ll be charged a separate failure-to-pay penalty, not to mention interest on what you owe.¹⁰

Bottom line? File your tax return on time, or submit Form 4868 to request a tax extension.¹¹

How to fix errors on a W-2

When reading your W-2 to file taxes, the first thing you should do is make sure all the information is correct, including your name, Social Security number, and total wages.

If you spot an error, reach out to your employer right away about correcting it. After all, a mistake in your wage or tax withholding information could lead to an unfair tax bill.

Your employer is required to correct any wrong information. You can also file a complaint with the IRS, which will send a letter to your employer demanding that it send you a corrected W-2 within 10 days.⁹

Are you ready to file your taxes?

Filing taxes can be intimidating, but reviewing your W-2 ahead of time can help the process go smoothly.

Whether you choose to file your own taxes with tax software or get help from a tax pro, make sure to submit your tax return before the April deadline.¹²

If you do get a tax refund, plan ahead for how you’ll use it, whether that’s to pay off debt or build an emergency fund.

Log in

Log in