People frequently make financial decisions based on Instagram reels and Whatsapp forwards. Some even hand over money to their seemingly ‘financially literate” friend for investing.

For credible financial advice, we often turn to people we trust in real life and online. But when it comes to online financial advice, there is a lot of clutter hiding the truly terrific content. It’s almost like finding a needle in a haystack, but harder.

We compiled a list of reliable X influencers to follow. We based our choices on each influencer’s qualifications, engagement with their audience, and brand of content (on over a year’s worth of tweets, no less).

By the end of this list, you’ll know who to turn to with questions like:

- How do you build sustainable financial habits?

- What do you need to know about the stock market and investments?

- Is early retirement possible for someone in your profession? If yes, how?

- Can you make more money by doing less work?

- What do changes in public financial policies mean?

But first,

How does X work? Explained

X is a short-form social media platform. Prominent people from different walks of life use it to share ideas, insights, and trends. It’s often referred to as a microblogging platform.

X is ideal for the attention-deficit crowd, and its 260-character limit forces people to be clear and concise.

Following the right people on the platform can elevate your understanding of the financial world.

To sign up on X, enter your email or contact number, and choose a username. Once you do this, select the topics you’re interested in (finance, in this case), and X will give you recommendations.

Financial influencers you should follow on X

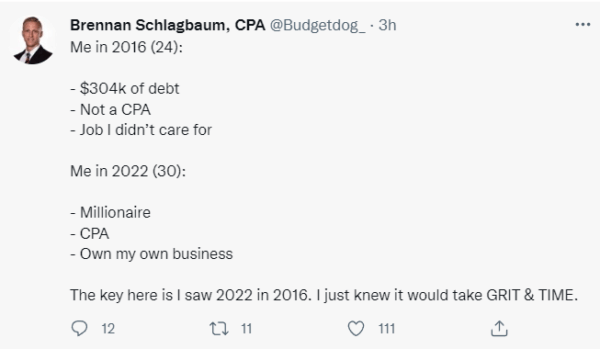

1. Brennan Schlagbaum — @Budgetdog_

Brennan is a CPA (Certified Public Accountant) who quit his 9-5 job to create a personal finance brand — and is now a millionaire.

He’s the person to consult for budgeting, investing, and debt elimination. Brennan’s X profile is not generic advice like “invest early” or “take on low-interest debt.” He breaks down numbers and draws from his experience working off $304K in debt.

For people interested in digging even deeper, Brennan’s personal coaching program helps students save ~$20K/year.

His account also occasionally mentions saving habits and his take on recent trends.

Brennan’s audience is a mix of finance coaches, corporate workers in the finance and fintech sectors, and industry newbies.

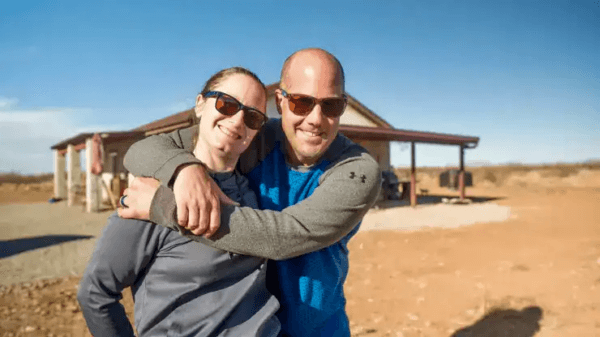

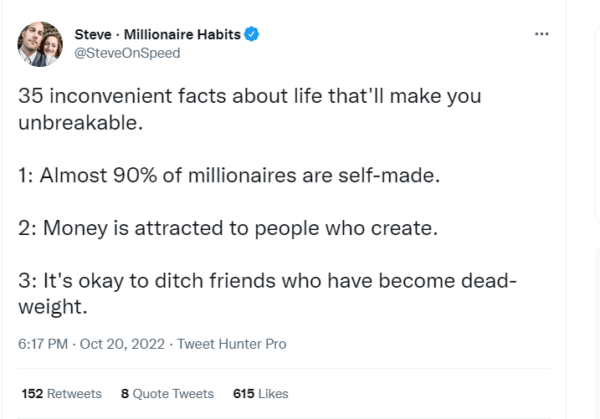

2. Steve | Millionaire Habits — @steveonspeed

Steve is a financial advisor featured on CNBC, MarketWatch, and Business Insider. He tells you how to build simple financial habits and become a millionaire. Steve became one at 35 without side hustles or an inheritance.

Read the entire thread here.

His profile is a helpful starting point if you want to learn how to build wealth. Interestingly, his posts generate a lot of debate, so you can listen in on both sides of the argument.

Steve’s tweets are a mix of personal finance, early retirement, and his personal journey. He even gives away a free roadmap to $1M in his bio.

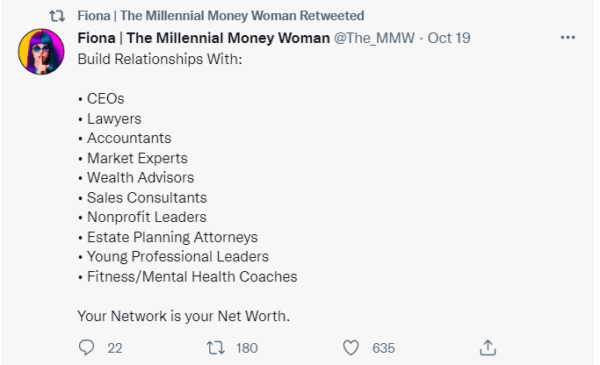

3. Fiona | The Millennial Money Woman — @The_MMW

Fiona, the Millennial Money Woman, is the author of “How to Get Rich from Nothing” and is frequently featured on Forbes, Oberlo, and FinCon. She’s also the co-founder of a local non-profit community for financial literacy.

Drawing from her Master’s degree in Personal Financial Planning, Fiona tweets tips and tricks on financial freedom for millennials. Her advice is peppered with personal anecdotes, often shared as blogs and Youtube videos.

Her tweets are a mix of passive income, money management, and investment.

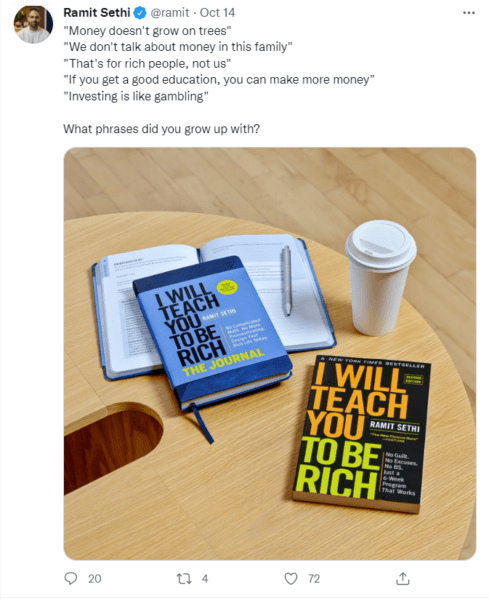

4. Ramit Sethi — @ramit

Ramit is the author of the New York Times Best Seller “I Will Teach You How To Be Rich.” He’s been featured on ABC News, CNN, and the Wall Street Journal.

Unlike most other influencers on this list, Ramit has been in the industry since 2004 – long before “influencer” was a household term.

His content focuses on money and psychology.

Ramit’s content includes opinions on inflation, saving, and personal anecdotes from his early life. Testimonials about the methods outlined in his book occasionally appear on his timeline.

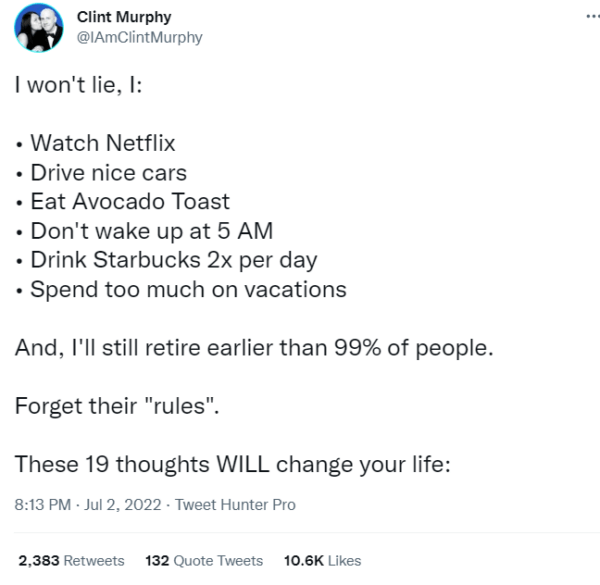

5. Clint Murphy — @IAMClintMurphy

Clint is CPA who has worked at KPMG. In 2010, he turned to finance and became a CFO (Chief Financial Officer) in the real estate industry. He also runs a weekly newsletter, “The Growth Guide” for financial transformation.

His threads are rife with analogies, recordings, and anecdotes.

Clint tweets about wealth psychology and its role in financial success.

He reshares financial advice from authors and millionaires like Warren Buffet and breaks them down for a more comprehensive understanding. He also includes book recommendations to expand your outlook on wealth and success.

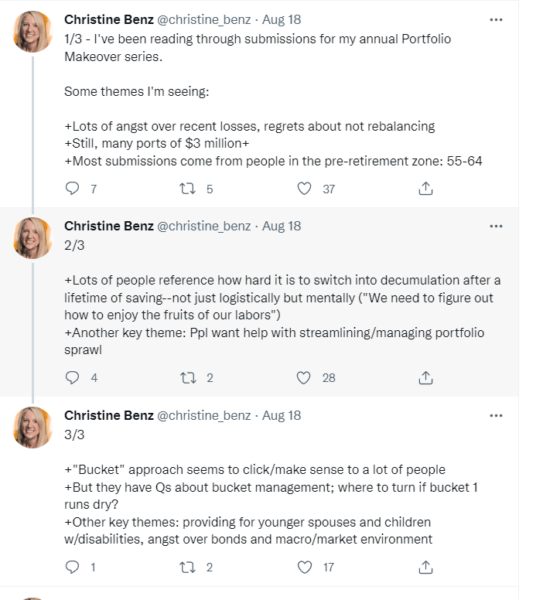

6. Christine Benz —@christine_benz

Christine Benz is Morningstar’s Director of personal finance and retirement planning and a co-host on The Long View podcast. She talks about bonds and retirement spending on her account.

Her threads focus on retirement spending and are a refreshing point of view.

Her tweets are speculative, current, and relevant in rapidly-changing (and challenging) financial times.

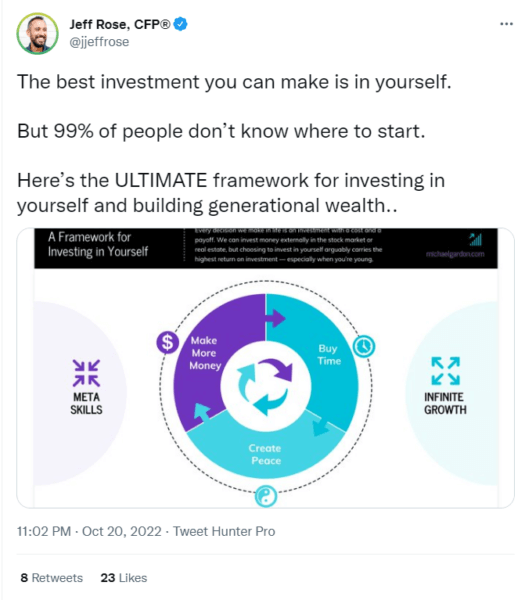

7. Jeff Rose — @jjeffrose

Jeff is a CFP (Certified Financial Planner), the owner of the newsletter “Wealth Hack Wednesday,” and the founder of “Good Financial Cents.”

Jeff’s threads have infographics, charts, flywheels, and everything else you need to understand finance more easily. His content is straightforward, concise, and actionable. It revolves around wealth hacking, income acceleration, online business, and entrepreneurship.

8. Kenny, Accent Investing — @AccentInvesting

Kenny is an investor with a master’s degree in finance and accounting. He’s been featured on FinancialAlien and Buzz Chronicles.

His insightful one-liners encourage evaluating finance in terms of tangible assets, such as land, equity, and real estate.

Kenny talks about money management for people between the ages of 20 and 40. He also shares stories about loans he’s paying back and how debt affects families.

9. Josh Brown — @downtown

Josh Brown is the owner of Ritholtz Wealth, an investment advisory for retirement plans, insurance, tax reviews, and socially-responsible investing.

His tweets discuss current inflation levels, pandemic after-effects, liquidation, and trends in the stock market. He doesn’t post often, but when he does, it’s insightful and well-researched.

10. Sharon Epperson — @sharon_epperson

Sharon Emily Epperson is the Senior Personal Finance Correspondent for CNBC. She also appears on NBC News, Today, and NBC Nightly News. She teaches at Columbia.

She posts about policies that impact personal finance and the education system.

Read the thread here.

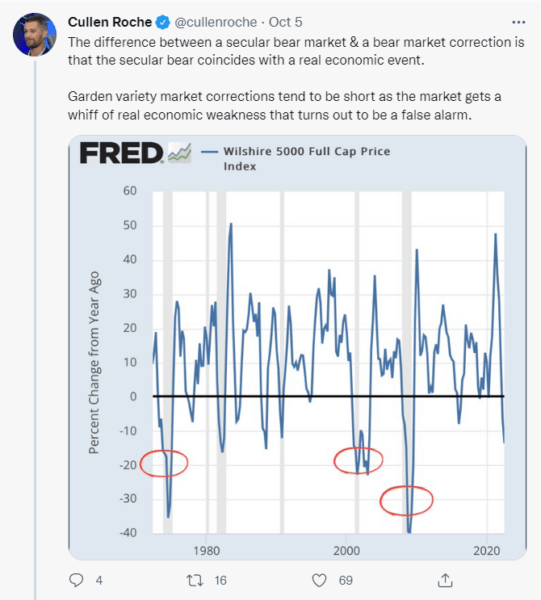

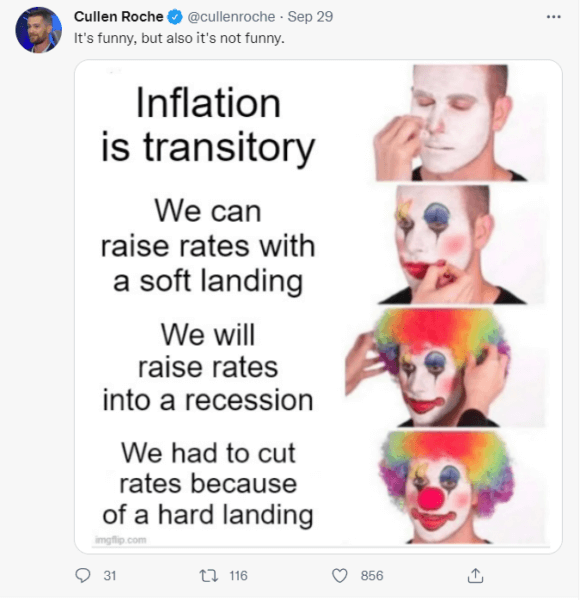

11. Cullen Roche — @cullenroche

Cullen Roche helps people make smarter financial decisions. He is the CIO (Chief Investment Officer) of Discipline Funds, founder of Orcamgroup, and author of “Pragmatic Capitalism.” He shares retirement and investment advice on X.

Cullen’s tools of choice are memes and charts. He breaks down complex financial topics into easy-to-follow bar charts and analogies.

Mortgage rates and federal funds in the U.S. frequently feature on Cullen’s timeline.

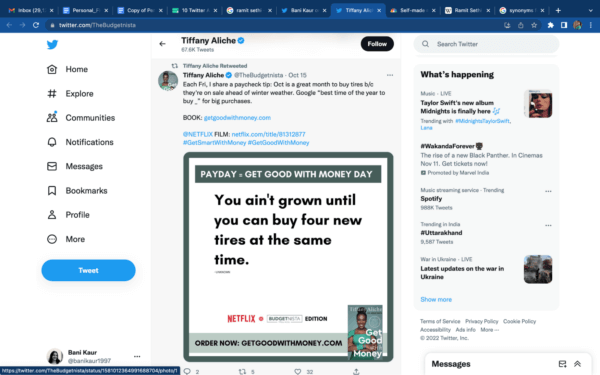

12. Tiffany Aliche — @TheBudgetnista

Tiffany is a Financial Educator and New York Times Bestselling author of “Get Good with Money.”

While many of her posts are updates about talks and guest appearances, she shares a paycheck tip each Friday.

She’s committed to amplifying people of color in finance.

Tiffany’s personal brand is collaborative, empowering, and honest. Follow her for advice on personal finance, tackling debt, and saving for the future.

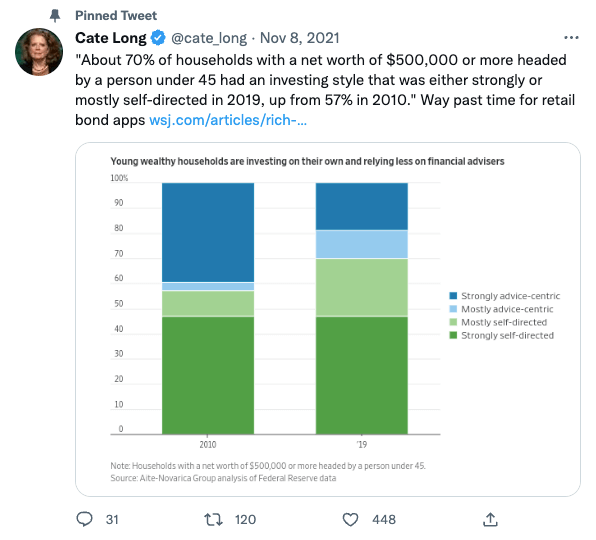

13. Cate Long — @cate_long

Cate Long leads a service for bondholders in Puerto Rico.

She is a former contributor to Reuters and discusses bonds as investment vehicles.

She also focuses heavily on environmentally-sustainable projects.

14. Michelle Singletary — @SingletaryM

Michelle Singletary is a personal finance columnist for the Washington Post and a 2022 Lifetime Achievement Loeb Awards winner. She is also the author of “What To Do With Your Money When the Crisis Hits.”

She tweets about loan forgiveness, credit card debt, and taxes.

Michelle keeps her audience apprised of deadline dates and what new policies mean for debt repayment.

She reshares her Washington Post blogs with a breakdown of how people can solve their financial problems. Her tweets focus on debt and money crisis solutions.

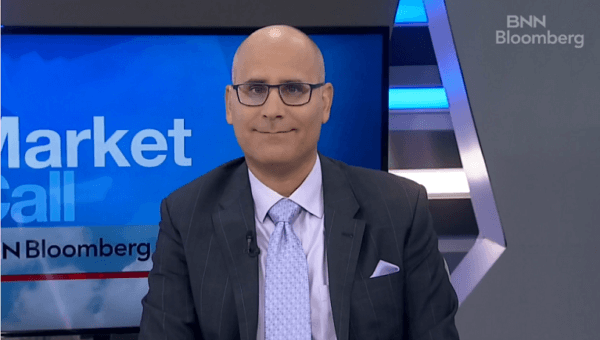

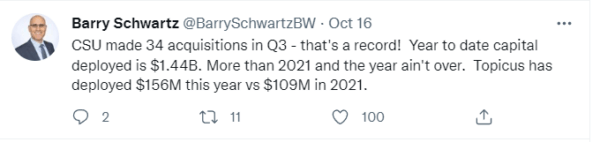

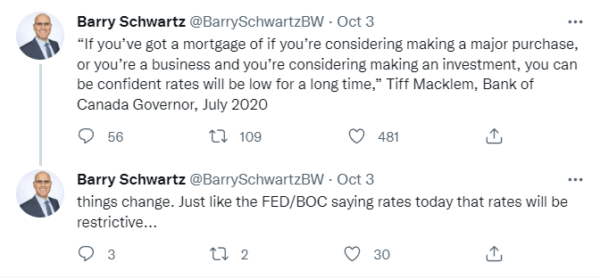

15. Barry Schwartz — @BarrySchwartzBW

Barry Schwartz is a CIO at Baskin Wealth Management.

His audience includes investors and capital knowledge enthusiasts.

His personal investment tweets detail how to make the most of stocks, bonds, and similar financial instruments.

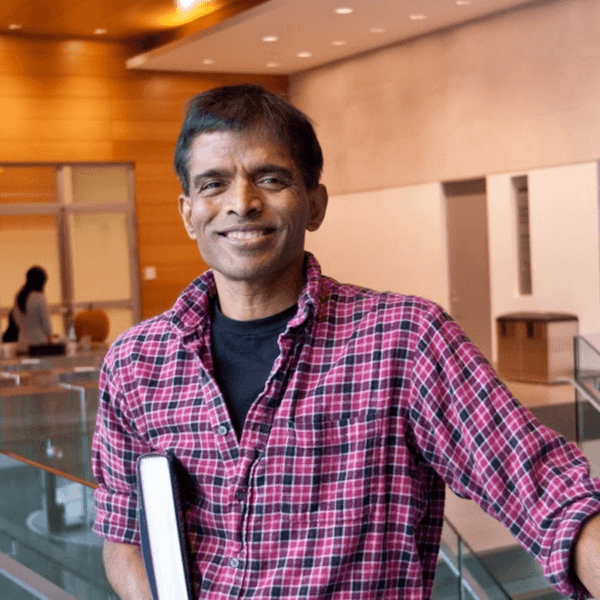

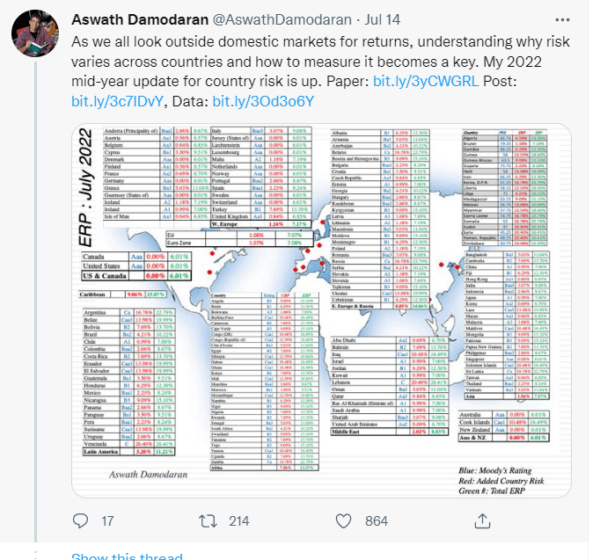

16. Aswatch Damodaran — @AswathDamodaran

Aswath Damodaran is a Professor of Finance at the Stern School of Business at New York University, where he teaches corporate finance and equity valuation. He tweets about personal finance, stocks, and returns.

His tweets have charts to explain the stock market and S&P 500 index, trends, and financial advice for people in the early years of saving and investment.

He also talks about how different financial strategies play out in the market.

His threads interlink to his blog to untangle all the questions that may cross your mind while reading his tweets.

Make your money work for you

These X accounts can all provide fresh perspectives and insights on investing, saving, and managing your finances.

Consider these tweets a starting point for a detailed discussion with a financial advisor. Almost all of them have resources you can dig into for more answers.

Up your personal finance game – find out how to make money on TikTok.

Log in

Log in