When payday hits, do you know how much money you take home versus how much you earned? Understanding the difference between gross pay vs. net pay is helpful so you can anticipate how much money will go into your pocket and how much will go toward taxes and other deductions.

Here is a breakdown of what gross pay and net pay mean in terms of what you’ll see on your pay stub and how your paycheck is calculated.

What is gross pay?

Gross pay is the total amount of money you’ve earned before any deductions are made. Your gross pay starts with your hourly rate multiplied by the number of hours you worked during that pay period.

In addition to your salary or hourly rate, gross pay can include commissions, overtime, bonuses, and any other form of income that you receive.1

Your pay stub will also state your total gross pay for the year to date and your gross pay for that specific pay period.2

Calculating gross pay

Calculating gross pay will vary depending on whether you’re a salaried or hourly-paid worker. If you’re a salaried employee, your gross pay is your annual salary divided by the number of pay periods per year. So if you earn $60,000 annually and get paid biweekly, your gross pay per paycheck would be:

$60,000 / 26 (bi-weekly pay periods per year) = $2,307.69 per paycheck

To calculate gross pay for an hourly employee, you will multiply the number of hours worked for that pay period by your hourly rate. So, if you earn $23 per hour and work 80 hours per pay period, your gross pay will be $1,840: $23 per hour x 80 hours.

What is net pay?

Unlike gross pay, net pay is the amount of money that you actually take home after taxes and other deductions have been taken out. Your net pay is usually deposited into your checking account if you have direct deposit. Or, you’ll receive a paper check from your employer.

This amount is lower than your gross pay due to deductions like taxes and social security.

What affects net pay?

Several factors affect net pay, including federal taxes, state taxes, social security, healthcare benefits, and retirement contributions. Some of the items deducted from your gross income to create your net pay include:

- Federal tax: Federal taxes are deducted each pay period so that you don’t have to pay a large tax bill when you file your yearly taxes.

- State tax: Not all states have a state income tax, but if your state does, these taxes will also be deducted from your gross income.

- Social Security: Social Security taxes are withheld to provide benefits for government workers, people with disabilities, and seniors who qualify for social security benefits.3 The goal is to pay into the social security program during your working years and then receive your share of benefits when you reach retirement age.

- Medicare: Money for Medicare taxes are also deducted from your gross pay. Medicare is a federal health insurance program for individuals who are 65 or older, as well as some young people with disabilities.

- Health insurance: If you enrolled in a health insurance or dental insurance plan through your employer, your portion of the premium payment will also be deducted from your gross income before you receive your net pay. Enrolling in medical benefits is optional, and some employers even provide life insurance as an option.

- Retirement: 401(k) retirement contributions are another deduction to consider. You can talk to your employer to adjust how much you contribute per paycheck.

Other deductions that can impact your net pay include wage garnishment, child support payments, and voluntary deductions like job-related expenses.4 Retirement account contributions and health insurance benefits are also considered voluntary deductions since you are not required to sign up for these benefits.

Calculating net pay

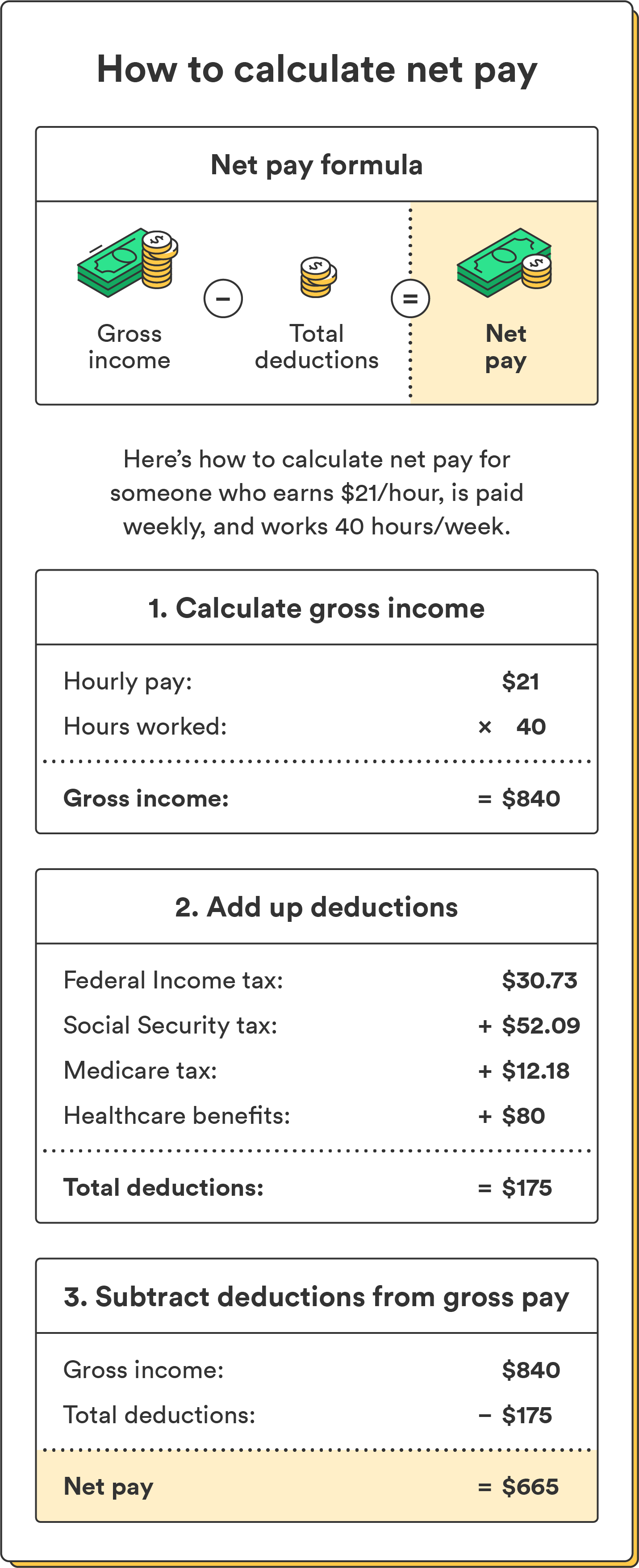

To calculate net pay, subtract all your deductions from your gross pay. This can be a bit difficult since there can be multiple deductions. You can use an online paycheck calculator to input your salary, deductions, and other details to determine your net pay for the week.

Let’s say you live in a state with no state income tax and earn $21 per hour while working 40 hours per week. You get paid weekly, so your gross income per paycheck is $840.

As an example, your deductions might be:

- Federal income tax: $30.73

- Social Security tax: $52.09

- Medicare tax: $12.18

- Healthcare benefits: $80

Total deductions: $175

Your net income would be $840 – $175, which is $665.

If you want to adjust how much federal income tax is withheld from your paycheck, you can ask your employer to update your W4 form. The IRS has a Tax Withholding Estimator to help you determine how much in federal taxes should be withheld from your paychecks.

If your net pay is sent to your bank account through direct deposit, you should still review your official pay stub to see what your deductions are and make sure everything adds up correctly.

Know where your money goes

It doesn’t take long to calculate your gross pay and net pay. Understanding the difference between gross vs. net pay can help you better manage your finances and make a budget more accurately.

While it may be disappointing to see a smaller amount of net pay compared to what you earned, you’re contributing to important programs and your own retirement and healthcare benefits.

Log in

Log in

One of the best ways to get your net pay quickly is through direct deposit. Find out how Chime can get you paid up to two days earlier when you set up direct deposit.