Investing in the stock market can help you grow your money for retirement. But when you invest, do you know where your money goes?

What if you’re supporting an oil company when you’re passionate about environmental sustainability? Or are you buying shares in a company that opposes equality for under-represented communities?

That’s where ethical investing comes in. This type of investing can help you make purposeful money moves that align with your values. Read on to learn about ethical investing and how to start your journey.

What is ethical investing?

“Ethical investing” means investing your money in ways that line up with with your moral, religious, or social values. The idea is to grow your money while supporting the causes you care about.

The acronym “ESG,” which was coined in 2004 by the United Nations, stands for Environmental, Social, and Governance. It refers to a set of standards ethical investors can use to decide how to invest.¹,² Here’s how it breaks down:

- Environmental: Consider a company’s approach toward energy use, conservation practices, waste management, and energy efficiency.

- Social: Consider how a company approaches customer satisfaction, gender and diversity, human rights, labor standards, employee engagement, and community relations.

- Governance: Consider a company’s ethics regarding political contributions, lobbying, corruption, executive compensation, and board composition.

The U.S. Securities and Exchange Commission (SEC) requires companies to disclose climate-related information to investors in their annual reports.³

How to invest ethically

Ready to start investing your money ethically? Here’s how to get started.

1. Consider your values

First, consider your core values. Are you concerned about the environment and want to support clean energy companies? Do you want to ensure you’re not investing money in companies that oppose racial or gender equality? Are you worried you might invest in companies supporting poor worker conditions?

Writing down and ranking your values can help you decide how to invest your money.

2. Decide your level of risk

When you start investing, you’ll need to decide on the types of asset classes you want to invest in. The most common asset classes are:

- Stocks

- Bonds

- Fixed income

- Cash or cash equivalents

Each class has a different risk level. For example, stocks are considered riskier investments but can yield higher returns. Bonds are considered low-risk, but their return potential is also lower.

Typically, your risk level is based on age. In your 20s, 30s, and 40s, your portfolio might be aggressive and consist of more stocks and fewer bonds, but as you near retirement, that mix should change to be more conservative.

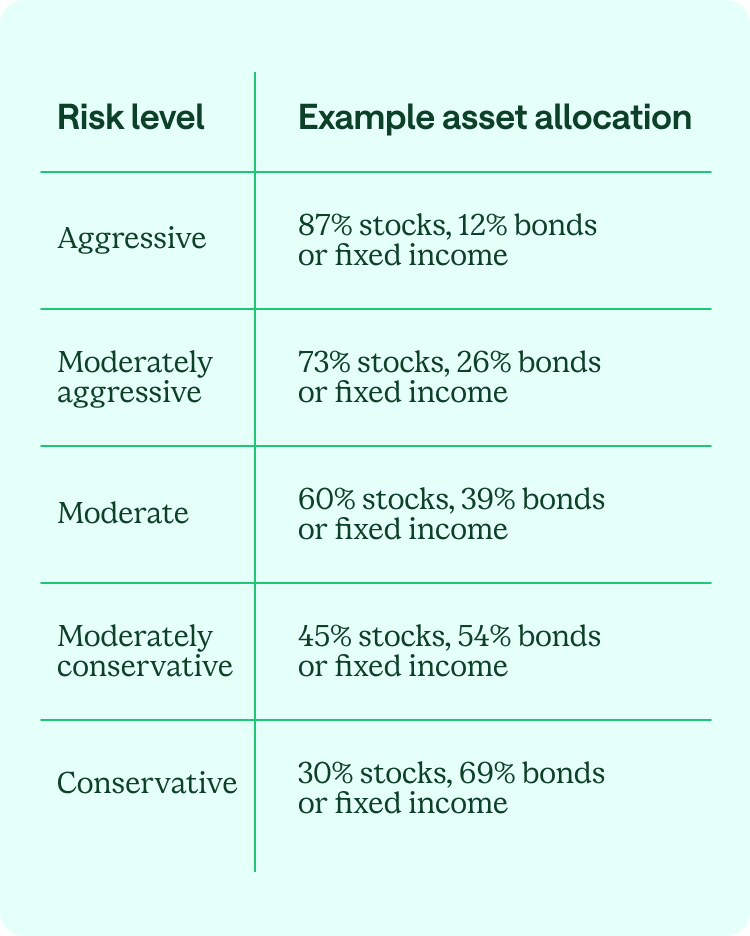

Here’s an example of asset allocation based on your risk level, with 1% cash equivalents for each example.⁴

| Risk level | Example asset allocation |

|---|---|

| Aggressive | 87% stocks, 12% bonds or fixed income |

| Moderately aggressive | 73% stocks, 26% bonds or fixed income |

| Moderate | 60% stocks, 39% bonds or fixed income |

| Moderately conservative | 45% stocks, 54% bonds or fixed income |

| Conservative | 30% stocks, 69% bonds or fixed income |

3. Decide how involved you want to be

When it comes to ethical investing, you can be as involved or hands-off as you like.

If you understand how investing works and want to get your hands dirty, you can pick your investments or find a mutual fund or exchange-traded fund (ETF) that fits your morals and values.

However, if you feel intimidated by the stock market, you can work with a financial advisor to choose funds that fit your requirements. Communicate your values and goals for ethical investments so your financial advisor can make informed decisions that align with your personal beliefs.

4. Beware of greenwashing

“Greenwashing” is a practice where companies claim to be following eco-friendly practices when they might not be.⁵

In 2009, one of the best-known examples of greenwashing occurred when the U.S Environmental Protection Agency (EPA) found that German car manufacturer Volkswagen had violated the Clean Air Act.⁶ The carmaker did so by selling around 590,000 diesel vehicles equipped with software that mislead federal emissions tests while emitting up to 40 times the legal limit of nitrogen oxide emissions.⁷

Research your investments to avoid investing in companies that engage in greenwashing. Several sources can help you.

For example, on FossilFreeFunds.org, you can look up mutual funds and ETFs by name, ticker, or manager to determine how much money the funds invest in major fossil fuel companies. Other sources let you search for gender equality funds, tobacco-free funds, deforestation-free funds, and more.⁸

Pros and cons of ethical investing

Like any type of investing, ethical investing has its benefits and downsides. Here’s a glance at the main pros and cons of this type of investment strategy.⁵

| Pros | Cons |

|---|---|

| Alignment with values | Limited opportunities for investment |

| Contribution to positive social impact | Lower short-term returns |

| Potential for long-term gains | Subjectivity around what is “ethical” |

| ESG companies could have a lower risk of legal issues or penalties | Risk of greenwashing |

Ethical investing aligns your values with your investments, while giving you real potential for long-term gains. However, short-term returns are often low, and you’re more limited on where to invest your money.

Stick to your values while growing your money

Ethical investing is a solid strategy for growing your investments while supporting causes you care about. Although there may be more limited investment opportunities, the long-term gain potential of ethical investments is high.

Ready to start investing? Learn how to choose a financial advisor who can help maximize your returns while sticking to your values.

Log in

Log in