A financial advisor is a professional who can help you move toward reaching your financial goals. But you might wonder, “Do I need a financial advisor?”.

The answer is: It depends. Sometimes, a financial situation might be too complex to tackle on your own, and you’d be better off consulting an expert.

If you’re on the fence about hiring a financial advisor or unsure when to start considering one, we’ll cover what you need to know below.

What does a financial advisor do?

A financial advisor is a professional who helps manage your money and creates strategies to help you achieve your financial goals. They provide services like planning for retirement, creating a life insurance plan, or managing your investment portfolio.

Financial advisors can help with various aspects of your financial life, including:

- Investing and portfolio management: This includes creating an investment strategy that aligns with your goals and timeline and helping you choose the right investments according to your risk tolerance.

- Debt management: If you need support managing, reducing, or consolidating debt, an advisor can suggest strategies to pay down loans or other debts efficiently.

- Retirement planning: This includes planning for a secure retirement by estimating your retirement needs, creating savings strategies, and recommending the best retirement accounts for your situation, like IRAs or 401(k)s.

- Tax planning: This involves tax preparation and developing tax-efficient strategies to reduce your tax liabilities, potentially saving you money on taxes over time.

- Insurance guidance: Financial advisors can assess your insurance needs and recommend policies that are right for you.

- Estate planning: An advisor can help you create a well-structured estate plan, including wills and trusts, to streamline transferring assets to beneficiaries and minimize estate taxes.

Signs you might need a financial advisor

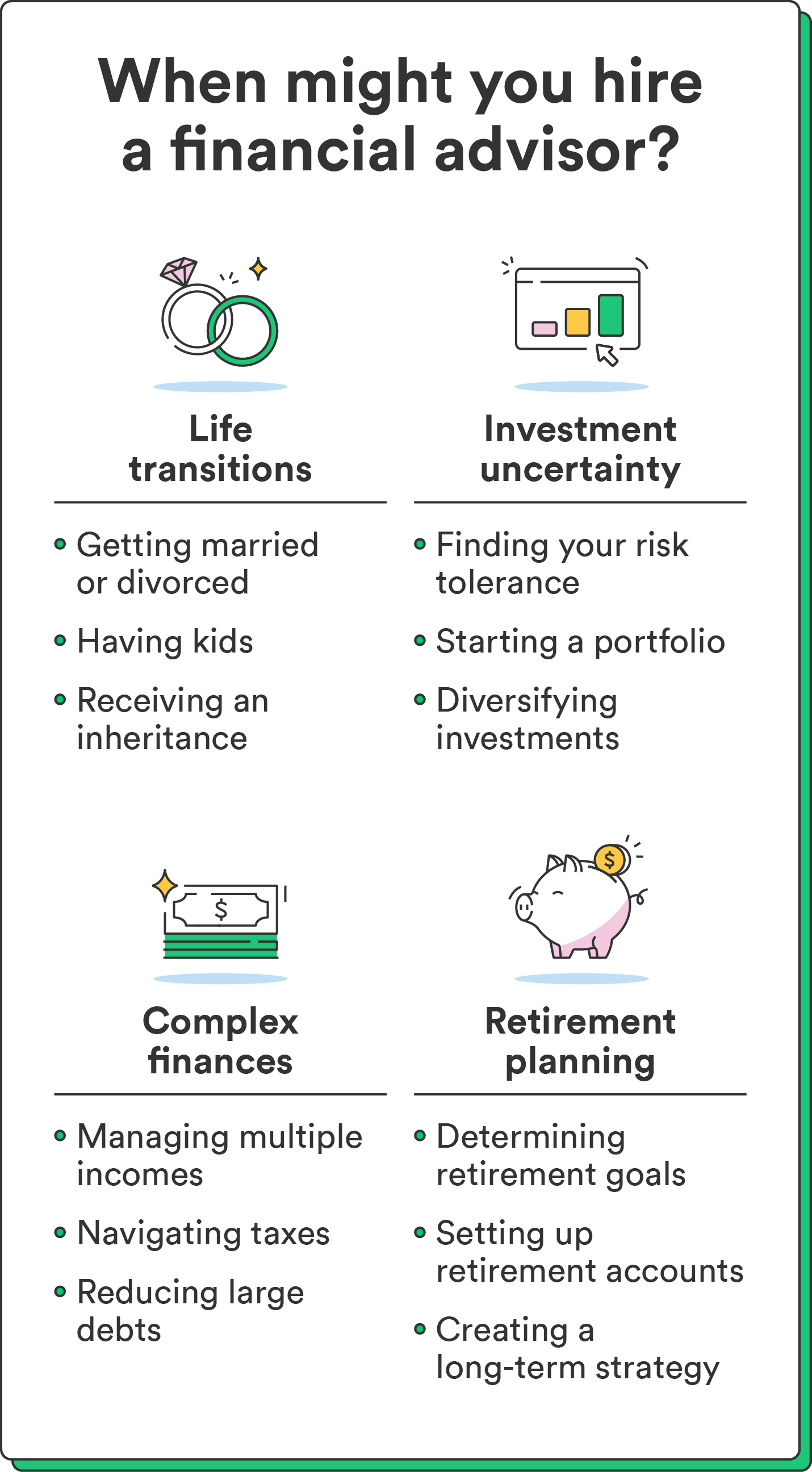

Hiring a professional is best when your financial situation feels too complex to navigate. Consider the following scenarios if you’re wondering when to hire a financial advisor.

Significant life changes

Certain circumstances, like changing your budgeting strategy or updating your retirement accounts, can affect your finances. The following life events may call for professional financial advice:

- Marriage

- Divorce

- Having kids

- Receiving an inheritance

- Starting or selling a business

These transitions often have complex financial implications, like tax status changes, insurance needs, and long-term financial goals.

Setting up or managing your first investment portfolio

Investing builds wealth and helps you reach long-term goals, but it can feel overwhelming without proper knowledge. A financial advisor can help if you’re ready to start investing but don’t know where to start. They can assess your risk tolerance, financial goals, and time horizon, then create a diversified investment strategy that aligns with your unique circumstances.

If you already have an investment portfolio, a financial advisor can also help you spread your investments around to avoid volatility and prevent your investments from fluctuating too much.

For example, if your portfolio is heavy on riskier industries, your financial advisor can help move some investments to decrease your risk of major dips.

Complex finances

Bringing in a financial advisor can be smart when your financial situation gets tricky. Scenarios like juggling multiple income streams, running a business, co-managing finances, or tackling confusing tax matters can call for advanced financial planning.

A financial advisor can steer you in the right direction, craft custom financial plans, and fine-tune your finances to boost your wealth and keep risks and taxes in check.

Specific financial goals

If you have specific financial goals, like becoming a homeowner, retiring early, or starting a business, you may need a financial advisor.

Achieving these goals can require a well-structured financial plan based on your unique circumstances. A financial advisor can help you make the right financial decisions and stay on track to reach your specific milestones.

Pros and cons of hiring a financial advisor

Like any financial decision, hiring a financial advisor has both pros and cons. We’ll dive into each below.

Here are the main benefits of hiring a financial advisor:

- Expertise and guidance: Financial advisors bring in-depth knowledge, offering expert advice and strategies tailored to your circumstances.

- Goal achievement: Financial advisors can help lay out an action plan, whether you know your financial goals but struggle to reach them or need help setting the right ones.

- Efficiency: A financial advisor already knows the ins and outs of different finance topics and can cut through the clutter, helping you find the right solutions sooner.

On the other hand, be mindful of the potential drawbacks:

- Costs: Financial advisors charge fees, which can eat into your returns or financial gains.

- Quality varies: The quality of financial advice can vary, and not all advisors may provide the same level of service or expertise.

- No guarantees: There are no guarantees in financial markets, and advisors cannot ensure your investments will always perform well. They can help you get up and running with the right portfolio plan or financial goals, but you’ll have to see that plan through.

When deciding whether to hire a financial advisor, weigh these pros and cons to determine if their services align with your financial needs and goals.

How to choose the right financial advisor

Hiring your first financial advisor can feel overwhelming, but we’ll guide you through the essential steps of choosing the right advisor. To make the best choice, consider the type of advisor that best aligns with your financial needs and goals. We’ll cover both below.

1. Clarify your financial needs and goals

When searching for a financial advisor, clarify your financial objectives and goals. Here are some personal considerations to help you narrow your search:

- Financial goals: Define your short-term and long-term financial goals, whether those are retirement planning, debt reduction, wealth accumulation, or something else.

- Risk tolerance: If you’re hiring a financial advisor for investment advice, determine your risk level beforehand, as different advisors may cater to different risk profiles.

- Budget and fees: Decide how much you can pay for financial advice and whether you prefer fee-only or fee-based advisors.

- Complexity: Consider how complicated your financial situation is between multiple income streams, business ownership, or intricate taxes.

- Communication style: Consider your preferred communication style – whether you want regular in-person meetings, phone calls, or virtual video-based support.

Clarifying your personal goals and preferences will streamline your search for an advisor who can provide the financial support you need.

2. Determine the type of financial advisor you need

There are many types of financial advisors, and the type you choose will depend on your goals. Regardless, look for one who operates under a fiduciary duty, meaning they are legally obligated to put your best interests first.

There are also commission-based advisors who may earn money for recommending certain financial products.

Here are the broad categories of financial advisors:

- Certified financial planner (CFP): CFPs are qualified professionals offering comprehensive financial planning advice on retirement, taxes, and investments. CFPs work under a fiduciary duty and tend to be fee-based or fee-only.

- Wealth manager: Wealth managers typically offer holistic financial services to high-net-worth individuals, including investment management and estate planning.

- Registered investment advisor (RIA): RIAs offer personalized investment advice and portfolio management. They typically charge a fee based on a percentage of your investments.

- Robo-advisor: Robo-advisors offer virtual portfolio and investment support without you interacting with an advisor face-to-face. They use algorithms to create and manage investment portfolios and are a low-cost, automated option for investors seeking support on a budget.

3. Prepare your questions to ask a financial advisor

As you search for a financial advisor, you can vet prospects by asking a few key questions:

- Are you a fiduciary? Start by confirming that the financial advisor is a fiduciary, legally bound to act in your best interest. This way, you know they’ll prioritize your financial well-being over their commissions or fees.

- What are your qualifications and credentials? Ask any potential advisor about their professional qualifications. Common qualifications include CERTIFIED FINANCIAL PLANNER™ (CFP®)¹, Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA). These certifications reflect their expertise and commitment to ethical standards.

- How do you get paid? Learn whether a potential advisor’s fee structure is fee-only, fee-based, or commission-based. A fee-only financial advisor is typically your best bet since they don’t receive payment to promote products or services.

- What is your investment philosophy? Discuss their investment approach and philosophy to ensure it lines up with your risk tolerance and financial goals. If you’re not interested in investments like crypto and NFTs, for example, you wouldn’t want to hire someone who focuses on this area of investing.

- What services do you offer? Determine whether the advisor offers the specific services you need: retirement planning, tax planning, estate planning, or investment management.

These questions will reveal the financial advisor’s expertise, ethics, and if they’re a match for you. This way, you can make a smart and informed decision.

4. Review the agreement before committing

As you get closer to choosing a financial advisor, always look at the agreement before making a final decision. Here’s a simple checklist of things to keep an eye on when reviewing the agreement:

- Services and scope: Clearly understand the advisor’s services and the scope of their responsibilities.

- Compensation: Review the fee structure and payment terms. Look for potential conflicts of interest, like commissions from product sales.

- Duration: Check the agreement’s duration or termination clauses to understand the commitment period, terms, and how you can exit the agreement if necessary.

- Reporting and communication: Clarify how often you’ll receive updates and reports on your financial progress and how they’ll share this information with you.

- Client responsibility: Understand any responsibilities or actions they expect from you to help you get the most out of the partnership.

Take your time reading the agreement, don’t hesitate to ask questions or suggest changes, and keep a copy for your records. A careful once-over and discussing any concerns will allow you to move forward with confidence and mutual trust.

Do I really need a financial advisor?

There’s no one-size-fits-all answer – the decision depends on your personal goals, the complexity of your financial situation, and how comfortable you are making decisions about your finances.

You may benefit from a DIY approach if your financial situation is straightforward and you can manage it effectively. However, calling in a professional may be a smart move if your finances are complex or too difficult to manage on your own.

Reach your money goals with the help of a financial advisor

Before hiring a financial advisor, take the time to evaluate your goals, understand your financial abilities, and consider how you could benefit from professional assistance. This way, you’ll make an informed choice that empowers you to take control of your financial future – whether you opt for a DIY approach or hire a trusted financial advisor.

As you consider hiring a financial advisor, read more about creating a financial plan.

FAQs about financial advisors

Still have questions about hiring a financial advisor? Find answers below.

What’s the difference between a financial advisor and a financial planner?

People sometimes use “financial advisor” and “financial planner” interchangeably because they both offer services related to investments, taxes, or other similar financial topics.

The difference is that financial advisors tend to focus more on portfolio management and investing guidance, while financial planners typically focus on comprehensive financial planning, covering areas like retirement, taxes, estate planning, and insurance, in addition to investment guidance. Many professionals hold both titles and offer a range of financial services. The distinction can vary among individuals.

How much does a financial advisor cost?

Financial advisor fees can vary but typically fall into three categories: fee-only, fee-based, or commission-based. Fee-only advisors charge a flat fee or a percentage of the assets they manage for you, while fee-based advisors may charge fees and earn commissions. Discuss fees upfront with potential advisors to ensure their pricing structure aligns with your financial situation.

How can I find a reputable financial advisor that aligns with my financial goals?

To find a reputable financial advisor, seek recommendations from trusted friends, family, or colleagues. Also, research online reviews, check their credentials, and schedule initial meetings to discuss whether it’s a compatible fit. A reputable advisor should have a transparent fee structure and be willing to provide references from their current clients.

How can I improve my financial knowledge and literacy without a financial advisor?

There are many ways to boost your financial literacy without a financial advisor. You can read personal finance books, listen to finance podcasts, attend local workshops or webinars, and explore online courses.

Consider using budgeting and financial tracking tools to understand your financial habits and progress better. Plenty of resources are available to help you make informed financial decisions independently.

Log in

Log in