Spoiler alert: Exercise is good for you. Regular physical activity can reduce your risk for disease, boost your mood, and improve your sex life – and that’s just the start.¹

But even good things can be bad if you overdo them – or overspend on them. And these days, some people are paying a lot of money to stay in shape.

How much is too much?

How much does it cost to stay in shape?

It doesn’t cost a penny to hold plank position for a minute or go for a run – although fancy sneakers can be pretty costly.²

But there are plenty of spendy ways to sweat. Many boutique fitness studios offering spin or barre classes charge $150 or more per month for unlimited access.³,⁴ At some ultra-high-end gyms, monthly membership could set you back as much as $405.⁵

And that’s before you add in the possible expenses of paying a personal trainer or buying expensive sporting equipment, for example.

Younger generations are spending more on fitness

While costlier forms of exercise are available to everyone, younger generations may be more willing to pony up for pilates – sometimes to their financial peril.

Mikala Jamison, the writer behind the bestselling Substack Body Type (who has worked as a fitness instructor), reported on this trend for the Washington Post.⁶ In a phone interview, she told Chime she was inspired to investigate after noticing how much fitness-related spending went on in her own circles.

Among Jamison’s interviewees was a tech employee who spends about $18,000 per year on fitness-related expenses. As a high earner, that five-figure sum amounts to a fairly reasonable 10% of that source’s total income.

Others Jamison talked to put themselves in more precarious financial positions, spending nearly their last penny on membership fees or even going into debt in the pursuit of fitness.

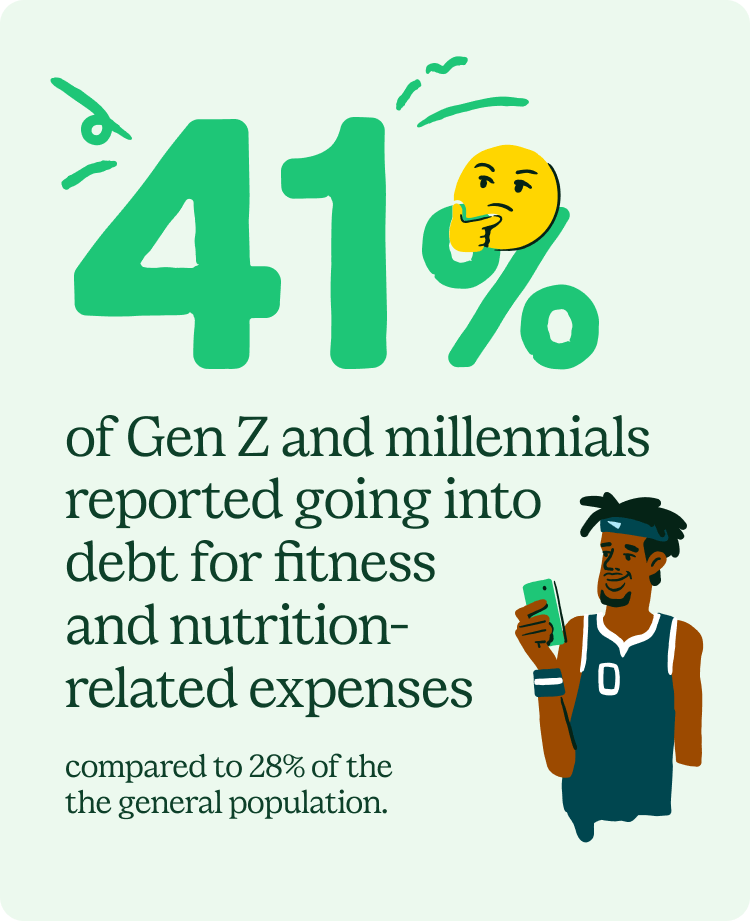

According to one survey, 41% of Gen Z and 38% of millennial respondents reported going into debt for fitness and nutrition-related expenses – compared to 28% of the general population.⁷

The gym is about more than exercise

Several factors have incentivized gym spending for younger generations.

For starters, Gen Zers and millennials are more likely to be heavily active on social media platforms.⁸ Those photo-heavy feeds lend themselves to social comparison, causing some users to hit the gym in pursuit of a “better” body – sometimes to an unhealthy degree. ⁹, ¹⁰

Many members of younger generations are also putting off major financial commitments like buying a home or having children, which may free up more of their income to focus on fitness.¹¹, ¹², ¹³

But steeped in her research and first-hand experience, Jamison has her own hypotheses: that the gym is an important “third space” to enjoy outside of home and work. (It’s possible our craving for such spaces has been amplified as the work-from-home revolution has reduced day-to-day life to just one locale for many.)

In other words, suggested Jamison, it’s not all about crafting the perfect bikini body to show off on the feeds – it’s about the opportunity to socialize and to feel like part of something bigger than yourself.

“If you’re searching for some kind of connection – to yourself, to other people, or to some greater sense of purpose – that’s what really any kind of habitual hobby can be,” Jamison said.

How much should you be spending on fitness?

Don’t get us wrong: Exercise is important. Jamison, who suffered an eating disorder in her college years, says strength training “helped me love my body more and stop abusing it.” Finding a better relationship with yourself, along with the physical benefits listed above, is definitely a goal worth investing in.

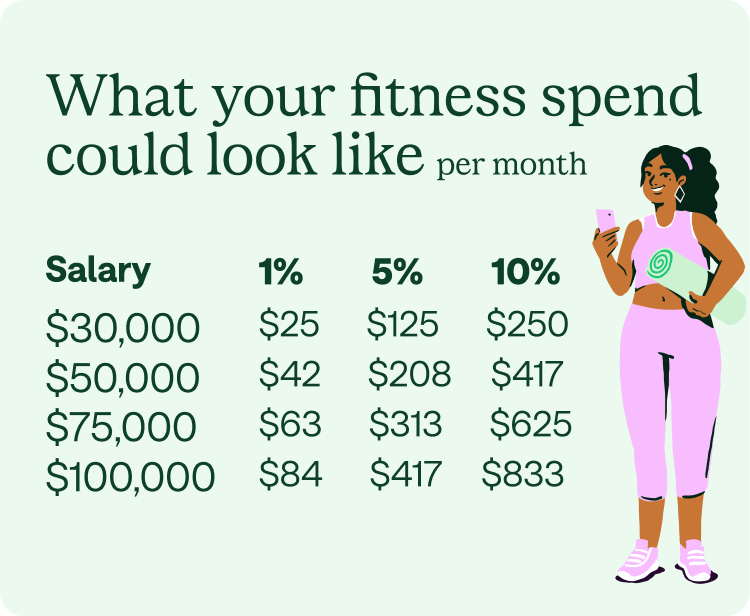

For her WaPo piece, Jamison interviewed Gen Z #fintok star Taylor Price, who recommended keeping fitness spending in the range of 5% to 10% – which some might think is quite high. For a comparison point, in 2023, U.S. consumers spent only a little more than the high end of that range, 11.2% of their disposable income, on food.¹⁴

In reality, there’s no rule about how much is too much to spend on fitness – so long as it’s not wreaking havoc on the rest of your budget. Even the best spin class in the world probably isn’t worth going into high-interest credit card debt for.

But if fitness is a priority for you, finding ways to afford your favorite activities might be worthwhile, even if it means dropping a streaming service or eating out less often.

Still not sure? Here’s a quick breakdown of what you might be able to afford, fitness-wise, no matter your earnings – or how much of them you want to put toward your sweat sessions.

With a $30,000 annual salary

1%: $25 per month or $300 per year

This is enough to get you a basic membership at a bargain gym, like Planet Fitness, where monthly rates start at $15.¹⁵ (Keep in mind that you may still need to pay, and budget for, additional start-up or annual fees.)¹⁶

You could also buy a really great pair of running shoes and hit the streets for free.

5%: $125 per month or $1,500 per year

At this level, you could buy into a fancier gym membership – or pool the funds to purchase some high-quality hiking gear.

10%: $250 per month or $3,000 per year

At $250 per month, you could attend a boutique fitness studio and still have some money left over. (However, 10% of your budget might feel proportionately higher if your earnings are on the lower side.)

With a $50,000 annual salary

1%: $41.67 per month or $500 per year

Many basic gym memberships are available for $50 per month or less – some with additional perks like access to multiple locations, tanning, or pool access.¹⁷

5%: $208.34 per month or $2,500 per year

This level of budgeting could buy you a membership at a more upscale gym – or two or three sessions per month with a personal trainer.¹⁷

10%: $416.67 per month or $5,000 per year

At this level, you could have all-gym access at Equinox – or a membership at a more basic gym and money to spend on prepared healthy meals.¹⁸ Again, though, 10% of your income is a lot of money, so this option may be best left to those with serious fitness pursuits or who are training for a specific sport.

With a $75,000 annual salary

1%: $62.50 per month or $750 per year

If your earnings approximately match the national median household income level, you can afford a substantial fitness habit even at a low percentage of your salary.¹⁹ A little over $60 per month or $750 per year could easily buy you a gym membership and a pair of running shoes for outdoor cardio sessions.

5%: $312.50 per month or $3,750 per year

Spending 5% of your income on fitness is within the realm of reason – and for earners at this level, it already adds up to quite a bit of budget per month. Enjoy a climbing gym membership and also perhaps a trip to a favorite outdoor location.²⁰

10%: $625 per month or $7,500 per year

For those willing to set aside a tenth of their $75,000 income, the fitness world is basically your oyster. You can easily stack personal training sessions on top of a gym membership at this level – or travel to take part in an Ironman triathlon, even with an entry fee of almost $1000.²¹

With a $100,000 annual salary

1%: $83.34 per month or $1,000 per year

High earners are lucky in that even a small fraction of their income turns out to be a decent amount of money. About $1,000 per year can certainly support a basic gym habit, though more serious hobbyists might want to budget for more.

5%: $416.67 per month or $5,000 per year

Just over $400 per month gets you gym access and at least a couple of personal training sessions – or you could spend the $5,000 on a tricked-out set of SCUBA gear (and possibly a dive, too).²²

10%: $833.34 per month or $10,000 per year

If you’re budgeting 10% of your $100,000 per year income, congratulations: You can pursue pretty much any fitness activity you want. (Of course, if you want to take on the ultimate mountaineering challenge and climb Mount Everest, you may still need to save up for a few years to do so.²³)

Fitness can be accessible, no matter your income

There’s always something you can do to get moving, no matter your income. As Jamison puts it, “It really depends on what your current goals and your purpose with exercise is.”

The main thing is to take care of your body and spend smartly as you do so. Just don’t fall into the trap of financial fawning – pursue fitness because you want to!

Log in

Log in