Third-party brands and companies are mentioned for informational purposes only. Chime does not sponsor, endorse, or partner with any of these brands or companies, and they do not sponsor or endorse Chime.

Since the artificial intelligence chatbot’s debut, people have been using ChatGPT for just about anything—writing cover letters for jobs, composing music, solving math problems, summarizing presentations, and even checking for bugs in code.¹

And guess what? ChatGPT may be able to help you manage your finances, too. Here’s how.

Creating a personalized budget plan

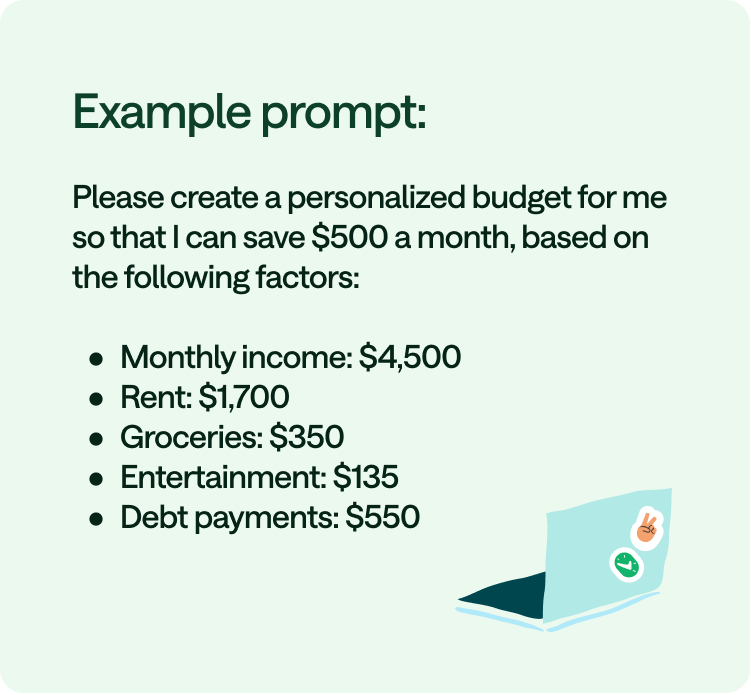

One of the first steps to mastering your finances is creating a budget and knowing where your money goes each month. If you have zero clue where to start, use ChatGPT to help you out.

The more specific and detailed you are when telling ChatGPT about your financial situation, the better it can craft a budget tailored to your life.

Example prompt: “Given my income and expenses, can you create a budget plan for me to follow?

- Monthly income: $4,500

- Expenses: Rent ($1,500), Utilities ($120), Groceries ($350), Transportation ($220), Entertainment ($110), Debt payments ($500)

My goal is to save at least $500 a month and start contributing to my retirement accounts.”

ChatGPT responded to the prompt by suggesting we allocate $800 toward a high-yield savings account or emergency fund, $400 toward investments and retirement, $300 extra toward debt payments to tackle it faster, and $200 toward miscellaneous expenses.

Note that ChatGPT’s answers aren’t always accurate or one-size-fits-all, so take it with a grain of salt. For example, in this case, ChatGPT’s recommendation to set aside a total of $1,900 toward savings and debt repayment may not be realistic if you have kids or other financial responsibilities.

You can still use it as a starting point to help you create a personalized budget, but be sure to review and adjust the plan according to your financial situation.

Tracking and analyzing expenses

ChatGPT can also be used for tracking your expenses and keeping your cash flow under control. Simply download your transaction history from your bank and upload it into ChatGPT. Then, ask it to analyze your expenses and where you could cut back.

Example prompt: “Here are my last 30 days of bank transactions. Could you please go through it and categorize my expenses into different categories? Then, please create a spreadsheet with the totals for each category and provide some insights on where I could cut back or reallocate funds. Thank you!”

After uploading a sample bank statement to ChatGPT, it went through the expenses, categorized them, and provided the totals for each category. It then suggested that we set a stricter budget for dining out, consider a shopping freeze for a month, and switch to a less expensive gym membership.

Meal planning

If you’re ready to get rid of your ordering-out addiction and start whipping up meals at home to save money, ChatGPT can help.

Let’s say you’ve already got some groceries lying around, but you’re not sure what to make. You can ask ChatGPT to come up with recipe ideas for the ingredients you have.

Example prompt: “I have some leftover rice, tofu, spinach, tortillas, green beans, tuna, blueberries, frozen mixed vegetables, curry cubes, and cheese in my fridge. What can I make for dinner tonight? By the way, I’m cooking for just one person.”

After feeding ChatGPT this prompt, we were given three recipe ideas: Curry tofu and spinach wrap, fried rice with vegetables and tuna, and cheesy spinach and tofu quesadilla. Each recipe also came with fairly detailed step-by-step instructions.

Grocery shopping

Grocery shopping can be overwhelming when you’re trying to stay within your budget while still getting all the nutrition you need. With ChatGPT, you can simplify this process by asking it to create a customized meal plan and shopping list tailored to your dietary needs, likes and dislikes, and budget.

Example prompt: “Hi, ChatGPT! I’m a vegetarian who loves spicy Thai or Mexican food. My grocery budget is around $80 a week, and my dietary goal is to eat at least 50 grams of protein and 1900 calories a day. Could you please help me come up with a monthly meal plan, a grocery list with prices from Trader Joe’s or Aldi’s website, and the quantities of the ingredients I need? Thank you!”

ChatGPT responded to the prompt by providing a detailed weekly meal plan with several breakfast, lunch, dinner, and snack options, plus a breakdown of protein and calorie counts. It also included a grocery list with estimated prices for each item, totaling $80.25 a week — right on target with the $80 budget.

ChatGPT is a tool, not a financial advisor

ChatGPT can be super helpful as long as you give it enough context, what you want it to do, and how you want the output to look.

But remember, though ChatGPT is helpful for tasks like creating a monthly budget or keeping your grocery bills under control, it can’t replace advice from a professional. For anything related to taxes, investing, or more complicated financial topics, it’s best to chat with a certified financial advisor in person.

Log in

Log in