A student loan allows you to pay for college and other related education costs. How do student loans work? Student loans help you with financing your education costs while you’re in school so you can pay them off after the loan’s period ends.

There are two main types of student loans: federal and private. Since the type of loan you get informs your interest rate and repayment options, it’s essential to learn about and understand both before making a choice either way. Below, we’ll dive deeper into the student loan process.

Student loan process overview

When you apply for and receive student loans, a lender gives you the money you need to pay for school. You agree to pay that money back to the lender with interest.

Here is a general overview of how student loans work from start to finish.

- Research loan options: Choose between federal and private loans.

- Apply for a student loan: Fill out online application forms.

- Understand loan interest: Factor interest into your payment plan.

- Make regular loan payments: Pay off your loan within the loan term.

- Explore loan relief options: Consider refinancing student loans or using a student loan debt forgiveness program to help you pay off the debt.

Typically, the money from a student loan is sent directly to your school. The school will apply the loan funds to your educational expenses and give you any leftover funds. You generally don’t have to repay student loans while enrolled in school. Once you graduate, you may have a grace period before you begin making regular payments.

Types of student loans

There are two main categories of student loans: federal and private student loans. Whether you choose one or the other – or a combination of the two – depends on how much money you need to pay for school. Here’s more on how the different types of student loans compare.

Federal student loans

The U.S. Department of Education administers federal student loan programs such as¹:

- Direct Subsidized Loans: The government subsidizes or pays the interest on your loans while in school, during your grace period, and when you’re on deferment.

- Direct Unsubsidized Loans: The government does not cover interest charges at any time. Unlike subsidized loans, approval for unsubsidized loans is not based on financial need.

- Direct PLUS Loans (for graduate and professional students): Direct PLUS loans allow graduate and professional students to borrow money for college. A credit check is required for approval.

- Direct PLUS Loans (for parents): Parents can also take out PLUS loans to help pay for eligible students’ higher education

- Direct Consolidation Loans: A Direct Consolidation Loan allows you to consolidate other eligible federal student loans together to streamline monthly payments.

The government no longer offers Federal Perkins Loans to new borrowers, but these loans may be eligible for Public Service Loan Forgiveness.

Let’s take a look at the pros and cons of federal student loans:

| Pros | Cons |

|---|---|

| Student loan interest may be tax-deductible² | Federal loan borrowing limits may not be enough to cover attendance costs |

Fixed federal interest rates allow for predictable monthly payments | Could pay more in interest if you choose an income-based repayment option |

| Choose from standard or income-driven repayment plan options | Qualifying for federal student loan forgiveness can be difficult |

| You may qualify for federal Public Service Loan Forgiveness (PSLF) | — |

| You can defer loan payments while in school and during the grace period | — |

Private student loans

A private student loan is a student loan that you receive through a private lender. Banks can offer private student loans along with other products. Some companies also specialize exclusively in providing private student loans.

Some private student loans may offer a deferment period while you’re in school, so you won’t need to make any payments while you’re enrolled. After graduation, your lender may also offer the grace period mentioned above to give you time to plan your student loan repayment budget.

Let’s take a look at the pros and cons of private student loans:

| Pros | Cons |

|---|---|

| Student loan interest may be tax-deductible² | Not eligible for federal student loan benefits |

| Fixed or variable rates can offer flexibility | May need a co-signer if you have poor credit |

| Lenders can offer higher borrowing limits compared to federal student loans | Prepayment penalties may apply if you pay loans off early |

| Good credit can help you qualify for lower rates on private student loans | You may have to make payments while you’re in school, depending on the lender |

How much money do student loans give you on average?

The average total student loan debt per borrower is $37,853.³

Lenders generally determine loan amounts based on your cost of attendance (COA), student aid index (formerly expected family contribution, or EFC), and other forms of financial aid.

When determining how much money you will be offered, the loan administrator:

- Examines the cost of attendance (COA) at your school

- Considers your expected student aid index (SAI)* from your completed FAFSA

- Subtracts your SAI* and supplementary financial aid from your COA

For the 2024-25 FAFSA and beyond, lenders will use your SAI.

This process helps lenders determine your financial need and the amount of need-based aid you qualify for.⁴

How does student loan interest work?

The interest rate on your student loan represents the percentage of your loan balance that you are charged over time in addition to the loan itself; these rates are either fixed or variable.

Federal student loan interest

Federal student loan interest rates are typically fixed and remain constant each year. Here are the student loan interest rates for federal student loans disbursed on or after July 1, 2024, and before July 1, 2025:⁵

- Direct subsidized and unsubsidized undergraduate loans: 6.53%

- Direct unsubsidized graduate loans: 8.08%

- Direct PLUS loans (for parents or graduate and professional students): 9.08%

Private student loan interest

In contrast, your credit score often influences private loan rates significantly. Private loan interest can be fixed or variable, so the rate can change over time.⁵

How to calculate student loan interest

When you receive a student loan, you’ll make payments that combine the principal and interest rate. The principal is the initial amount borrowed for a student loan, and the interest rate is the percentage charged on the remaining balance as a cost of borrowing.

Using a simple loan payoff calculator can help you determine your interest costs. But how much you might pay in interest can vary based on whether you have fixed- or variable-rate loans. See the general formula and an example below:

Student loan interest = Principal x Interest rate x Time

| Steps | Example |

|---|---|

| 1. Gather your loan details | Principal: $10,000 Annual Interest Rate: 5% Time: 2 years |

| 2. Plug value into the formula | Interest = ($10,000 x 0.05) x 2 |

| 3. Calculate the interest | Interest = $1,000 |

Steps to apply for student loans

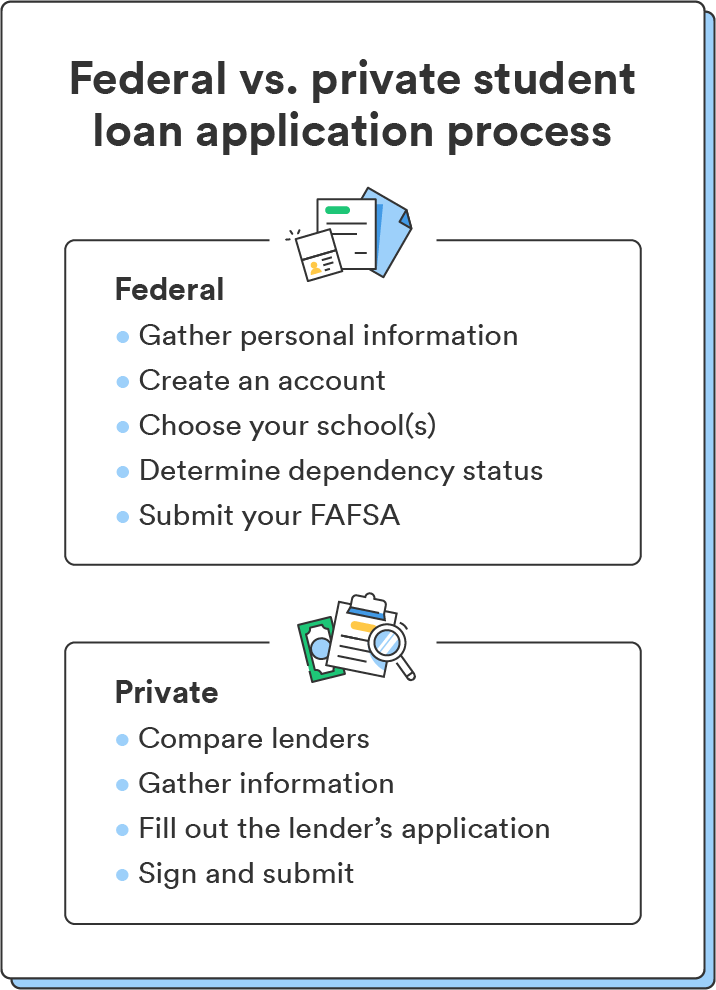

The process of getting student loans is different for federal and private lenders. While a federal student loan has straightforward steps, the loan process for private loans may vary by lender. Here is how to apply for both federal and private loans.

How to apply for federal student loans

You can fill out your FAFSA (the Free Application for Federal Student Aid) in six steps:

- Gather personal information: Have your driver’s license number, taxable income, and financial records handy. Dependent students will need their parents’ Social Security number(s) and federal tax information.

- Create an account: Log on to fafsa.gov to create an application account and obtain a FAFSA ID to resume your application process later. Parents and all other contributors will need their own accounts.

- Choose your school(s): You must select at least one institution to receive your funding.

- Determine dependency status: Share whether you’re a dependent or independent student.

- Share financial information: Independent students will share their tax history and account balances, while dependents may need to share their parent’s financial information.

- Submit your FAFSA: Once your application is complete, you’ll sign and submit your FAFSA.

The Department of Education encourages you to get your application in as soon as possible since individual schools can set their deadlines for completing the form.

Based on your FAFSA, schools will send you financial aid offers, including federal student loans.

How to apply for private student loans

Although the loan application process for private student loans can vary, the format is generally the same. Here is how you apply for private student loans:

- Compare lenders: Consider factors like credit score requirements, co-signer protocols, loan limits, loan repayment terms, interest rates, and fees.

- Gather information: Have your driver’s license number, taxable income, and financial records available. Once again, dependent students will need their parents’ Social Security number(s) and federal tax information.

- Fill out the lender’s application: Pay special attention to policies regarding deferment periods or grace periods while you’re enrolled or after you graduate.

- Sign and submit: Depending on your lender, you may need to pay a fee upon submission.

If your credit score prevents you from getting approved, a co-signer can help. Having a co-signer with a good credit history can help you get approved for private loans at favorable rates. But there’s a catch.

Both you and the co-signer are legally responsible for the debt. So, if you fail to make payments and default on your loans, your credit scores could take a hit. And the lender could pursue debt collection actions against both of you.

Understanding the cost of student loans

Like most other loans, student loans have associated costs, like interest rates and, in the case of private loans, potentially an origination fee or late fees. How much a student loan costs over the life of the loan depends on the interest rate (and whether it’s fixed or variable) and fees charged by the lender.

The more money you borrow, the more money you’ll owe in interest.

Understandably, it isn’t easy to pinpoint the average cost of a student loan. Several variables, like the loan term (how long the loan lasts) and its interest rate, can all impact how much you spend.

That said, recent data suggests the average monthly cost of a student loan is:⁶

- $208 for an associate degree

- $302 for a bachelor’s degree

- $688 for a master’s degree

What can I use student loans for?

You can use student loans for the following educational costs⁷:

- Tuition and fees: All expenses related to the cost of enrollment.

- Books and supplies: The course materials and any additional supplies necessary for your studies.

- School meal plans and groceries: Expenses for on-campus meal plans and the cost of groceries for students who prepare their own meals.

- Room and board: The cost of housing in on-campus dormitories, off-campus apartments, and utility bills.

- Technology expenses: Computers and software you need to complete coursework.

- Transportation costs: Expenses related to commuting to and from class, whether you’re driving or using public transportation.

Note that student loans don’t typically cover recreational expenses or costs unrelated to your academics.

How student loan repayment works

How you’ll repay your student loans depends on whether it’s a federal or private loan.

Repaying federal student loans

Consider how much you can afford to pay when creating your student loan repayment plan. Let’s look at the amounts and payment timelines of federal student loans⁸:

- Standard repayment means you’ll pay your loan within 10 years of graduating.

- Income-based repayment (IBR) allows for monthly payments of 10% to 15% of discretionary income, with forgiveness after 20 or 25 years, depending on the borrowing date.

- Income-contingent repayment (ICR) entails monthly payments at 20% of discretionary income or the fixed 12-year plan amount, with forgiveness after 25 years.

- Pay As You Earn (PAYE) caps monthly payments at 10% of discretionary income, and the remaining balances are forgiven after 20 years.

- Saving on a Valuable Education (SAVE) involves monthly payments at 10% of discretionary income, with potential forgiveness after 20 or 25 years. Formerly known as Revised Pay As You Earn (REPAYE).

You may be automatically enrolled in the standard repayment plan if you have federal student loans.⁸ Ask your financial advisor about your eligibility for enrolling in alternative payment plans.

Repaying private student loans

Private student loan lenders may offer standard, interest-only, or graduated payment plans, but they aren’t required to base your payments on income. With private student loans, calculating monthly payments can depend on how much you borrow, your interest rate, and your loan term.

But you should calculate payments before your grace period ends to make sure they work for your budget. Otherwise, you might suddenly have to try to qualify for a deferment period to get your finances in shape.

What if you can’t repay your student loans?

Student loan default happens when you fail to pay your student loan for an extended period. A default can damage your credit score and cause additional financial penalties and legal action.

If your loan is at risk of defaulting, here are potential student loan relief options:

- Forbearance is a temporary pause or reduction in student loan payments granted by the lender. Interest may continue to accrue during this period.

- Deferment allows borrowers to postpone student loan payments due to hardship. Depending on the type of loan, interest may not accrue during this period.

- Loan forgiveness programs eliminate a portion or the entirety of a borrower’s student loan debt. It’s typically in exchange for fulfilling certain criteria, like making qualifying payments under income-driven repayment plans.

- Refinancing involves obtaining a new loan with different terms to replace an existing student loan, often to secure a lower interest rate, adjust the repayment term, or combine multiple loans into a single loan.

Although paying your loan off within your agreed-upon terms is ideal, these student loan relief options can help you get back on track.

Navigate student loans with confidence

We started by asking, “How do student loans work?” The answer may be complicated, but if you take the time to understand the financing options available to you, you should hopefully walk away with an idea of how you can finance an education and what options are available to you.

If student loan debt is something you’d like to avoid, use our college savings calculator to estimate how much you need to budget for your degree.

FAQ

Still have questions about student loans? Find answers below.

Is it worth it to get a student loan?

The decision to take out a student loan depends on various factors, including the potential return on investment of career opportunities and earning potential. Before opting for a student loan, consider the long-term financial implications, interest rates, and repayment terms.

What happens to student loan debt when you die?

For federal student loans, if the primary borrower passes away, the loans will be forgiven. While many private student loan lenders may discharge the debt upon the primary borrower’s death, you should verify your lender’s specific policy for accurate information.

How long does it take to pay off student loans on average?

The amount of time it takes to pay off your student loan depends on the loan terms. Federal student loans typically follow a 10-year standard repayment schedule, though alternative plans offer extended periods of 20, 25, or 30 years.

Private student loan terms vary among lenders, with options ranging from five to 20 years. Opting for shorter repayment periods often entails lower interest rates, thus reducing your overall payment amounts.

How do student loans impact your credit?

Student loans can impact your credit by influencing factors such as your credit history, payment behavior, and overall debt load. While timely payments can positively impact you, late payments can adversely affect your credit score.

For a better idea of how student loans can impact your credit, check out our guide to the factors that affect your credit score.

Log in

Log in