We know you’ve heard of budgeting. In fact, you might think a strict budget is the only way to meet your financial goals.

While budgeting has benefits, it also focuses on restricting your spending, which can be unsustainable over time. After all, who wants to give up their favorite oat milk latte for the rest of their lives? Enter “conscious spending.”

What is conscious spending?

Conscious spending is an alternative way to reach your financial goals without limiting yourself in the areas that matter to you. Rather than cutting out fancy coffee forever, conscious spending is making coffee at home during the week and keeping your standing weekly coffee date with friends on a Saturday morning.

Conscious spending can help you save for the future without removing all the joy from your present.

How conscious spending can save you money

Conscious spending doesn’t give you a free pass to spend money on whatever social media ad grabs your attention (hello, personalized portrait of your dog as a king).

But it does take the guilt away from “fun” purchases by earmarking money from each paycheck for the things that make you happy.

Developing a conscious spending plan still lets you save the money you need for your short or long-term financial goals. But it changes how you think about those other purchases. After all, who wants to spend 30 years of their life depriving themselves?

Conscious spending also empowers you to think mindfully about your purchases. Before clicking “purchase” on that limited-edition rainbow tie-dye workout set, think about whether owning it will actually make you exercise more. If the answer is “yes,” that’s what the guilt-free portion of your budget is for! If not, empty your cart and save that money for something worthwhile.

How to practice conscious spending

Ready to put conscious spending into action? Follow these steps to get started.

1. Review your spending

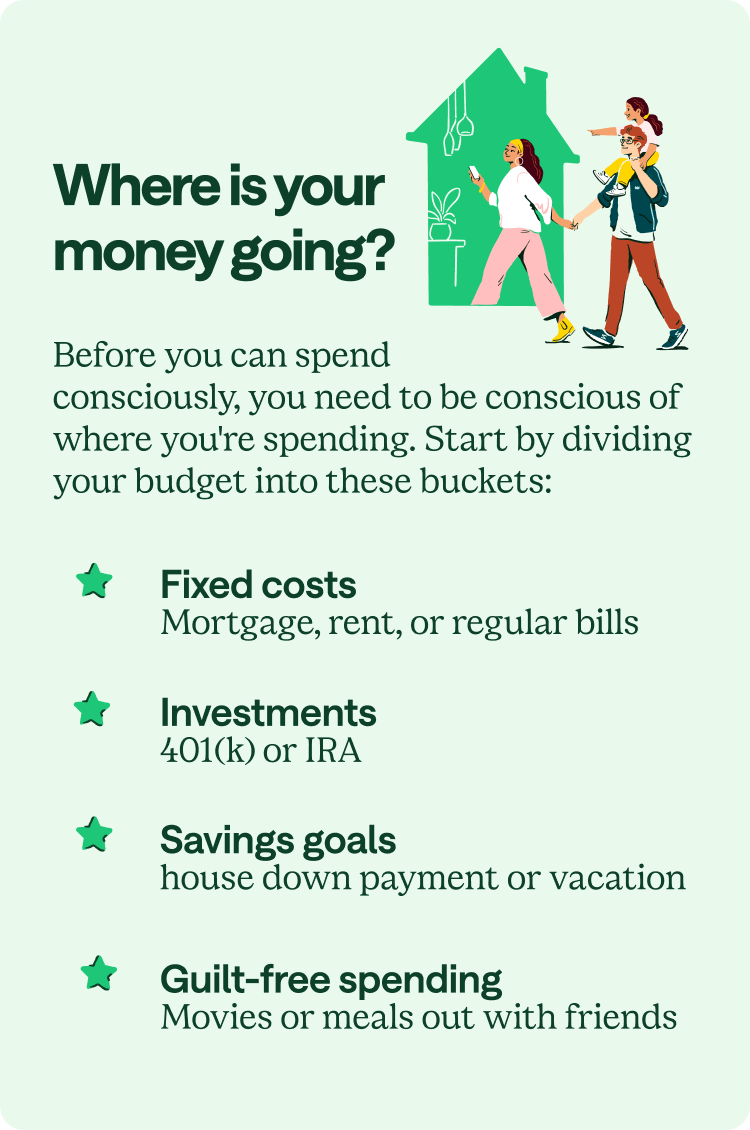

Take a look at how you’re currently spending money. Use a spreadsheet or app to break down your spending into the following categories:

- Fixed costs, like your mortgage, rent, or recurring bills

- Investments, like your 401(k) or IRA

- Savings goals, like saving for a house down payment or a vacation

- Guilt-free spending, like going to the movies or for meals with friends

Now, determine how much of your income should go toward each category. You might choose 50% for fixed costs, 20% for savings and investments, and 30% for everything else. Of course, you can tweak the percentages as needed – the goal of conscious spending is to make it work for you.

2. Automate where possible

Automating your finances makes it easier to stick to the spending percentages you’ve decided on.

- Consider setting up automatic transfers for your savings so you won’t have to remember to add part of your paycheck to your savings each month.

- Set up auto-pay on bills where possible.

- You could open a separate account for your guilt-free spending money so you don’t accidentally spend funds you don’t have.

Keep track of your spending

Whether you use traditional budgeting or engage in conscious spending, managing your money is essential.

Consider downloading an app that breaks your spending into buckets to see where your money goes. If you prefer, you can track your spending in a spreadsheet.

Save money while splurging on what matters

Are you tired of budgets that leave you feeling restricted? Conscious spending could be the solution you’re looking for. Try it out for a month and enjoy indulging in that large oat milk latte and avocado toast with none of the guilt.

Want to radically cut back on spending? Learn about underconsumption and if it’s the right fit for your lifestyle.

Log in

Log in