Inflation is no joke. Even just a few items at the grocery store or the cost of takeout and gas for your car can add up quickly and make it hard to get ahead financially.

Enter underconsumption.

Underconsumption, or “underconsumption core,” as it’s commonly known, is the latest trend on TikTok. Instead of “living large,” it’s about spending mindfully and buying only what you need.

Unlike other money strategies that have gone viral, it can help you live within your budget. Let’s go over what it is, how it’s different than overconsumption, and how you can make the most of underconsumption to boost your finances:

What is underconsumption?

Underconsumption core is the idea that you don’t need to flash tons of cash and indulge in purchases to be happy. Instead, it’s about only buying what you need or what adds the most value to your life.

Besides curbing your spending, you can reuse items or buy secondhand and reduce waste. For example, 92 billion tons of garments and textile waste end up in landfills each year, and that number is expected to increase to 134 billion tons by 2030.¹ By consuming less, you use fewer resources, which also helps the environment and can combat climate change.

Plus, by spending less, you’ll keep more of your money, which means you may be able to afford items that cost more than they did before. In turn, you won’t feel the sting of inflation as much.

Underconsumption versus overconsumption

Underconsumption and overconsumption are opposites. While underconsumption is about spending mindfully and staying within your means, overconsumption is about spending in excess or without intention.

Here are some signs that you might be overconsuming:

- Rack up a balance on your credit card with unnecessary purchases

- Spend when you’re bored or anxious, or to please others

- End up forgetting what you buy, or have a lot of stuff you don’t use

- See your bank balance go into low or negative numbers

- Feel regret or shame about where your money goes

- Conveniently forget about big purchases

- Avoid looking at your bank balance and credit card statements

Focus on your why

Before you jump into the practical steps of underconsumption, it’s a good idea to focus on your personal “why” for spending less.

To get there, start by journaling, or talking it out with trusted friends or family. Maybe you’ve had a history of feeling financially stretched thin, or recently suffered a setback or job loss. Or maybe you’d like to feel good about what you do with your money.

Whatever your reasons, spend time exploring this. It’ll help you stick to this path during the challenging times.

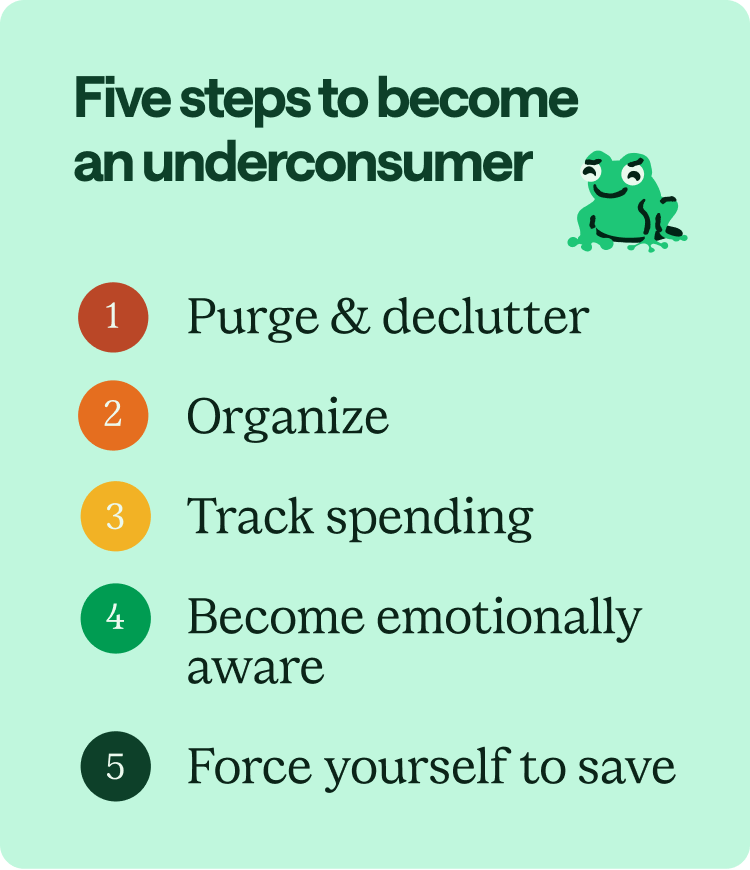

How to get started with underconsumption core

Ready to jump on the underconsumption bandwagon? Here are the steps to take:

Purge

To take stock of what you already have, declutter. You can try the KonMari Method, where you go through your belongings and only keep what “sparks joy.”² Other methods include grouping items into categories – like going through all your shirts, kitchen items, and toiletries – and purging what you don’t use.

Decluttering can also reveal your spending habits. You might learn you buy more than you actually need or use.

Organize your belongings

When taking inventory of your items, putting your belongings in their proper place makes it easy to find what you’re looking for. Plus, you won’t accidentally buy another tube of toothpaste when you already have a few in your medicine cabinet.

Track your spending

Check your spending and balance on your mobile banking app to see where your money is going. This can help you pinpoint areas of excess and overconsumption.

Weigh your emotions

The ultimate goal is to feel good about your purchases. While it might be a no-brainer that you dread paying rent and that spending on hobbies makes you happy, what about those gray-area buys?

Being aware of your emotions when you spend in excess or buy items you don’t actually need or enjoy can help you curb your spending.

Put that savings to use

Once you embrace underconsumption, you’ll see your savings start to grow. Just like you’re intentional about your spending, you can be deliberate about your savings. That money saved can go toward your emergency savings, pay off debt, or toward a life milestone – like a wedding or down payment on a house.

Auto-save

Automating your savings helps you put the money saved to good use. If you stash the money into a high-yield savings account, you can grow your money even faster by earning more interest.

The less you spend, the more empowered you feel

Hopping on the underconsumption bandwagon can improve your finances. When your budget has more wiggle room, you can enjoy greater freedom about your money choices.