Direct deposit makes getting your paycheck more secure and convenient than ever. Still, you might wonder: “What time does direct deposit hit my bank account?”

The short answer is that you’ll typically be able to access a direct deposit by 9 a.m. on the morning of your payday and sometimes as early as midnight.¹ That said, the exact timing of when direct deposit hits can vary.

How long does direct deposit take?

The exact timing to receive your direct deposit depends on two main factors: your bank and your employer’s payroll software. There’s also the role of the Automated Clearing House (ACH), the electronic funds-transfer system that facilitates transactions in the U.S.

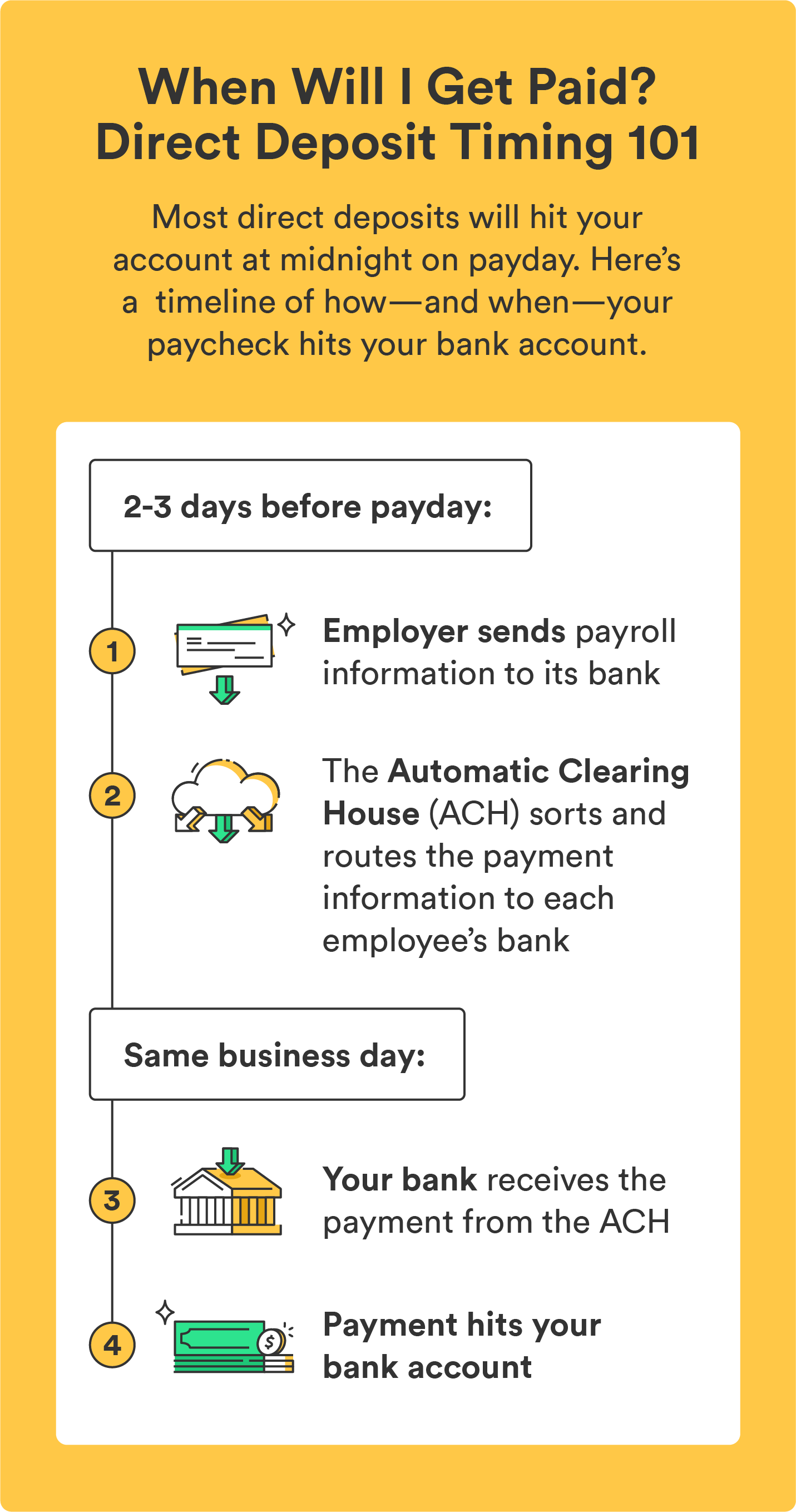

Here’s a step-by-step breakdown of how direct deposit works and how long it takes:

- Your employer sends payroll instructions to their bank. Before payday, your employer sends a payroll file to its bank containing employees’ bank account details and paycheck amounts.

- The ACH processes the payroll file. An ACH operator reviews the payroll file for accuracy and ensures all payments are properly routed.

- Payment information is sent to your bank. The ACH sends your payment file to your bank to be processed.

- Payment arrives in your bank account. Once your bank receives your payment information, your payment is processed and credited to your account.

While the ACH plays a role in this process, your employer and bank largely determine when you receive your paycheck. That’s because it’s up to your employer to prepare and send employees’ payroll information ahead of payday – and if they don’t, your direct deposit may be delayed.

How soon your money is available also depends on the bank you use. By law, banks are required to make direct deposits available by the next business day following the day your bank receives the money from the ACH.²

Average direct deposit times

Exact direct deposit times will vary no matter where you bank, but some banks offer better direct deposit programs than others. If getting your paycheck early is important, research different banks to find out which ones offer early direct deposit.

If you’re currently with a traditional, big-name bank, you might consider online banking options (like Chime!) to get additional perks beyond early direct deposit, such as no minimum balance or monthly maintenance fees.

Myths about direct deposit

Although direct deposit times vary, don’t be fooled by popular myths.

For example, one common myth is that the ACH network runs 24/7. However, this isn’t true because it doesn’t settle payments on weekends (or holidays).²

Another common myth is that you won’t receive your direct deposit if your payday is on a Friday. However, depending on your bank, your deposit could hit your account by 9 a.m. on Friday.

Some people confuse paycheck and direct deposit. A paycheck is a physical check processed through the check collection system, while a direct deposit is an electronic transfer processed through the ACH network.

Reasons your direct deposit hasn't hit

The time your direct deposit hits largely depends on your bank and employer since they’re responsible for submitting payroll information in time for it to be processed as scheduled.

That said, if you haven’t received your direct deposit, it could be for several reasons:

- Your employer entered an incorrect date when processing your payroll.

- Processing is taking longer than usual due to holidays (payday falling on a bank holiday often delays direct deposits).

- The direct deposit request was accidentally submitted after business hours.

- Your bank has a specific time window for receiving electronic fund transfers, and your employer missed the cutoff.

Whatever the reason, the best thing to do is contact your employer’s payroll department. You can ask them to confirm whether or not you sent your payment information in time for processing and confirm that the bank account information they’re using to route your paycheck is accurate.

How to get direct deposit faster

Direct deposit gives you immediate access to your hard-earned cash, but many banks now offer early direct deposit up to two days ahead of your scheduled payday.

Online banks often offer an early direct deposit feature, which allows you to get paid up to two days early.

Once you get your direct deposit up and running, consider automatically depositing a portion of your paycheck directly into a savings account. Chime’s Save When I Get Paid feature makes it simple to save money from your paycheck every month. Just set up direct deposit with Chime, and when you get paid, Chime automatically transfers 10% of your deposit of $500 or more into your Savings Account.³

FAQs about what time direct deposit hits

Does direct deposit go through on weekends?

The ACH network does not settle payments on weekends (or holidays) when the Federal Reserve system is closed. If your payday falls on a Saturday or Sunday, it won’t post until Monday.

Can direct deposit arrive at any time of day?

Yes, your direct deposit can arrive at different times during the day, depending on your financial institution and payroll provider.

What should I do if my direct deposit is late?

If your direct deposit is late, contact your employer to confirm you submitted the correct deposit account information. And if everything checks out, then contact your bank to see if there’s a problem on their end.

What time does Chime early direct deposit hit?

When you set up a direct deposit with Chime, you can receive funds up to two days early. However, the exact time your direct deposit will hit your account varies, depending on when your employer sends your funds.

Can you use direct deposit without a bank account?

You may be able to set up direct deposit without a bank account by getting a prepaid debit card through your employer. Your employer can use this reloadable card to send electronic funds directly to you – instead of being deposited into a checking account, it’s deposited directly onto your prepaid card.

How do I set up direct deposit?

To set up direct deposit, ask your employer for a direct deposit form. Fill In your bank information, including your routing and bank account numbers, and choose a deposit amount (select 100% if you want your entire paycheck deposited to a single account). Submit your form and get paid!

What time do credit unions post direct deposits?

Similar to banks, deposit times for credit unions vary.

Log in

Log in