Overdraft fees can be costly, especially when some banks charge multiple daily fees. Learn how to get an overdraft fee refunded and avoid the charges moving forward.

Can you get overdraft fees refunded?

Getting overdraft fees refunded depends on your bank’s policies – but it’s possible. Many financial institutions refund overdraft fees on a case-by-case basis, especially if it’s your first time or you have a valid reason.

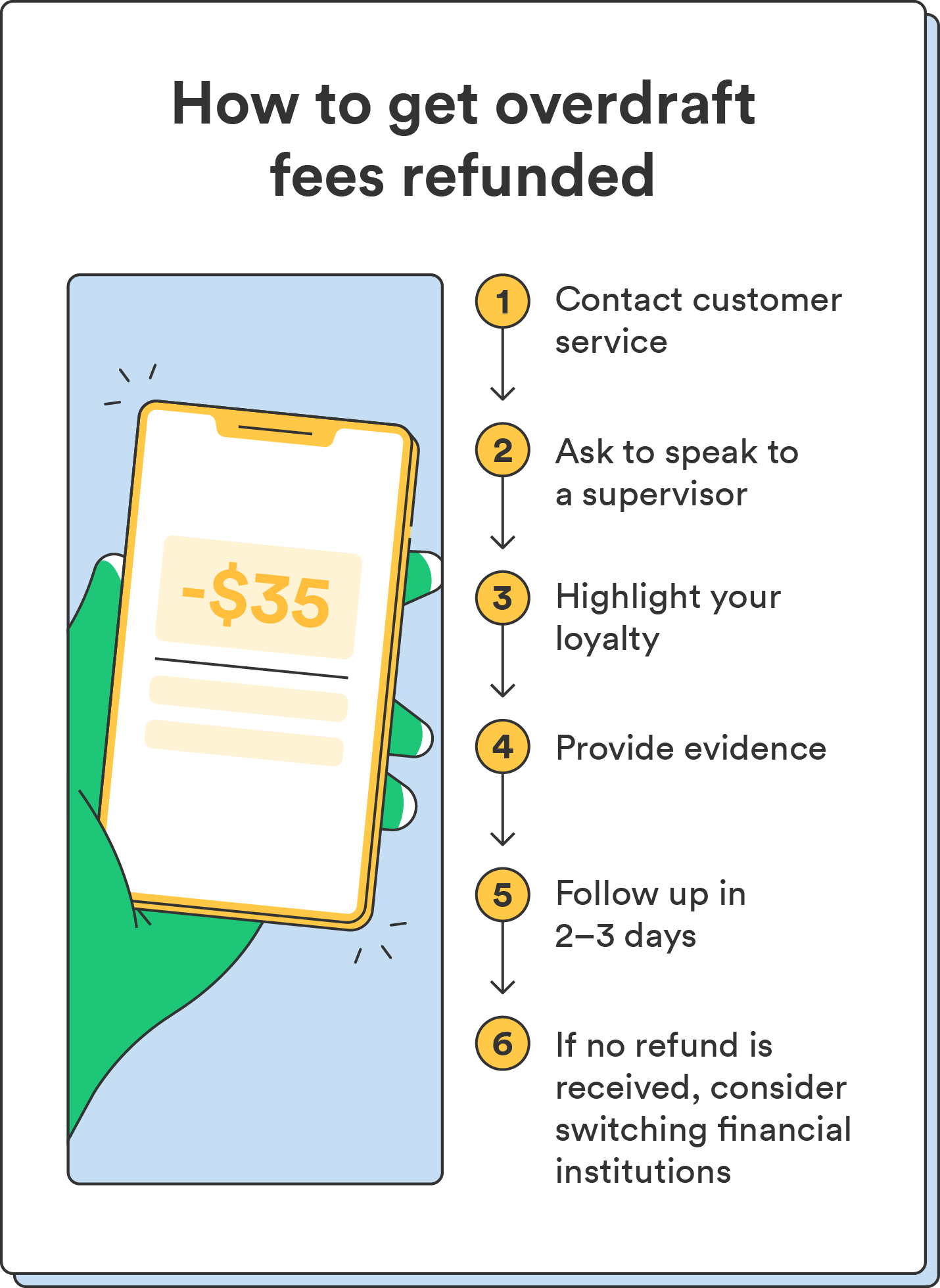

How to get overdraft fees refunded: step-by-step

Requesting a refund for overdraft fees is straightforward and starts with contacting your bank’s customer service. The steps below walk you through the process.

1. Contact customer service

Contact customer service as soon as you notice the overdraft. You can also speak with a teller in person if your financial institution has a physical location. Be prepared to provide your:

- Account details

- Information about the transaction(s) in question

- Explanation of what led to the refund request

2. Ask to speak to a supervisor

Politely ask to speak to a supervisor or manager if the customer service representative can’t help you refund overdraft fees. When discussing your situation, be respectful and patient yet persistent. Here are some tips and prompts to help you do this:

- Maintain a respectful tone: “I understand that you’re doing your best to assist me, and I really appreciate your help. Could you please connect me with a supervisor to discuss my situation further?”

- Acknowledge their efforts: “I know you’re busy, and I’m grateful for your assistance. Speaking with a supervisor might help us resolve this more effectively. Could you kindly transfer me?”

- Be persistent without adding pressure: “I’ve been trying to resolve this issue for a while, and I believe a supervisor’s input could be valuable. If possible, could you help me reach someone higher up?”

3. Highlight your loyalty

If you’ve been a long-time customer, highlight your loyalty during the refund request process. Mention how long you’ve been a member and point out your history of responsible account management. Consider mentioning any of the following:

- You’re a loyal customer

- How long you’ve been with them

- That you have multiple accounts (if applicable)

- Your regular deposits (if applicable)

Most companies recognize the value of loyal customers and may be more likely to help once they know your history.

4. Provide evidence

Prepare to share any documents to support your request. This evidence could include transaction records, receipts, or any other information that proves why they should refund your overdraft fees, like:

- The amount they charged you in overdraft fees

- The date and time the charges appeared

- The transactions that caused the overdraft fees

Clear and well-organized evidence may help them decide in your favor.

5. Follow up in 2-3 days

After making your request, follow up with your bank by phone after two to three days. Ask about the status of your refund request and whether they need anything else from you.

If you’re following up by email or mail, you can edit this template as you draft your message:

Subject line: Follow-Up on Request for Overdraft Fee Refund

Dear [Bank name],

I hope you’re doing well. I am writing to follow up on my recent request for a refund of overdraft fees on my account, which I discussed with [Name of Initial Representative/Supervisor] on [Date of Initial Contact].

Could you please share an update on the status of my refund request? If there are any updates or if further action is required on my part, please do not hesitate to let me know. I value my relationship with [Bank Name] and look forward to a positive resolution.

Thank you for your time and assistance in addressing this matter. I look forward to hearing from you soon.

Sincerely,

[Your Full Name]

[Your Contact Information]

6. Consider switching financial institutions

If you’ve followed these steps and your bank still won’t refund the overdraft fees, consider switching to a new financial institution altogether. Plenty of places offer more lenient overdraft fee policies or, even better, none at all (like Chime’s checking account).

How much do overdraft fees cost?

Overdraft fees are usually about $15 per transaction,¹ but the exact cost varies.

| Wells Fargo² | $35 |

| Bank of America³ | $10 |

| Capital One4 | None |

| Chase5 | $34 |

| Citibank6 | None |

| Chime7 | None |

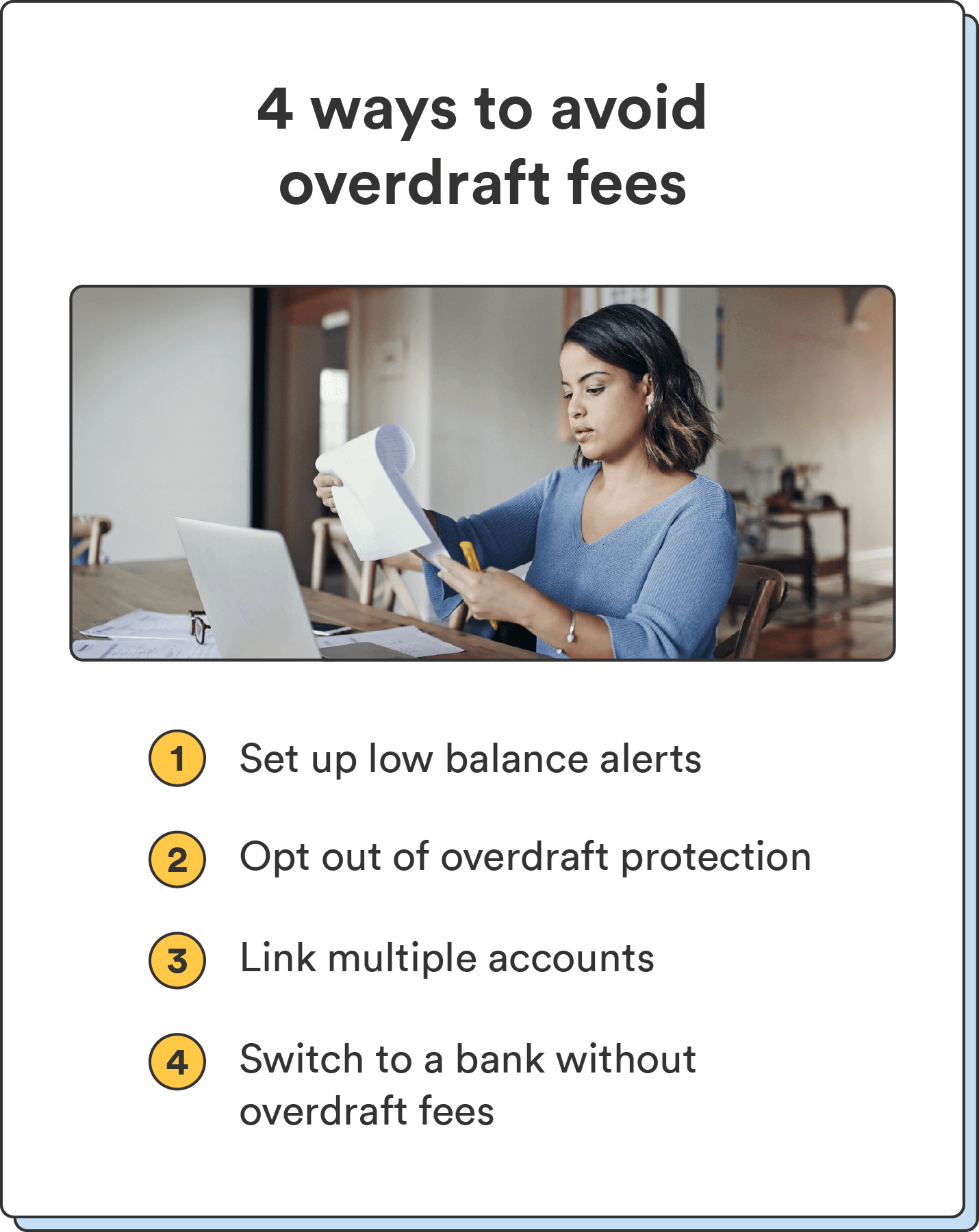

How to avoid overdraft fees in the future

While financial institutions might work with you to get overdraft fees refunded, follow the tips below to avoid overdraft fees in the first place.

- Set up alerts: Sign up for notifications to know when your account balance drops below a certain amount. This way, you can protect yourself from overdraft fees ahead of time.

- Opt out of overdraft protection: While overdraft protection can help you cover transactions you don’t have the funds to cover yourself, this can also lead to more fees. Opting out means you can’t make transactions that would overdraw your account and trigger fees.

- Link multiple accounts: If your financial institution allows it, consider linking your checking account to a secondary account or a savings account. Note that some financial institutions may charge a fee for this service. If you link accounts, automatic transfers can cover insufficient funds and avoid overdraft fees.

- Switch to a financial institution without overdraft fees: Some financial institutions have accounts that don’t charge overdraft fees. Research and consider switching to a financial institution that aligns with your financial goals and offers more favorable terms.

Put a stop to costly overdraft fees

While overdraft fees can be frustrating, they are avoidable in many cases. You can increase your chances of getting a refund and avoiding future fees by following the steps outlined above, including contacting customer service and considering a switch.

Read more about which bank has the best overdraft limit.

Log in

Log in