If you were offered the opportunity to double your money or pay it forward and change the life of a stranger, what would you do?

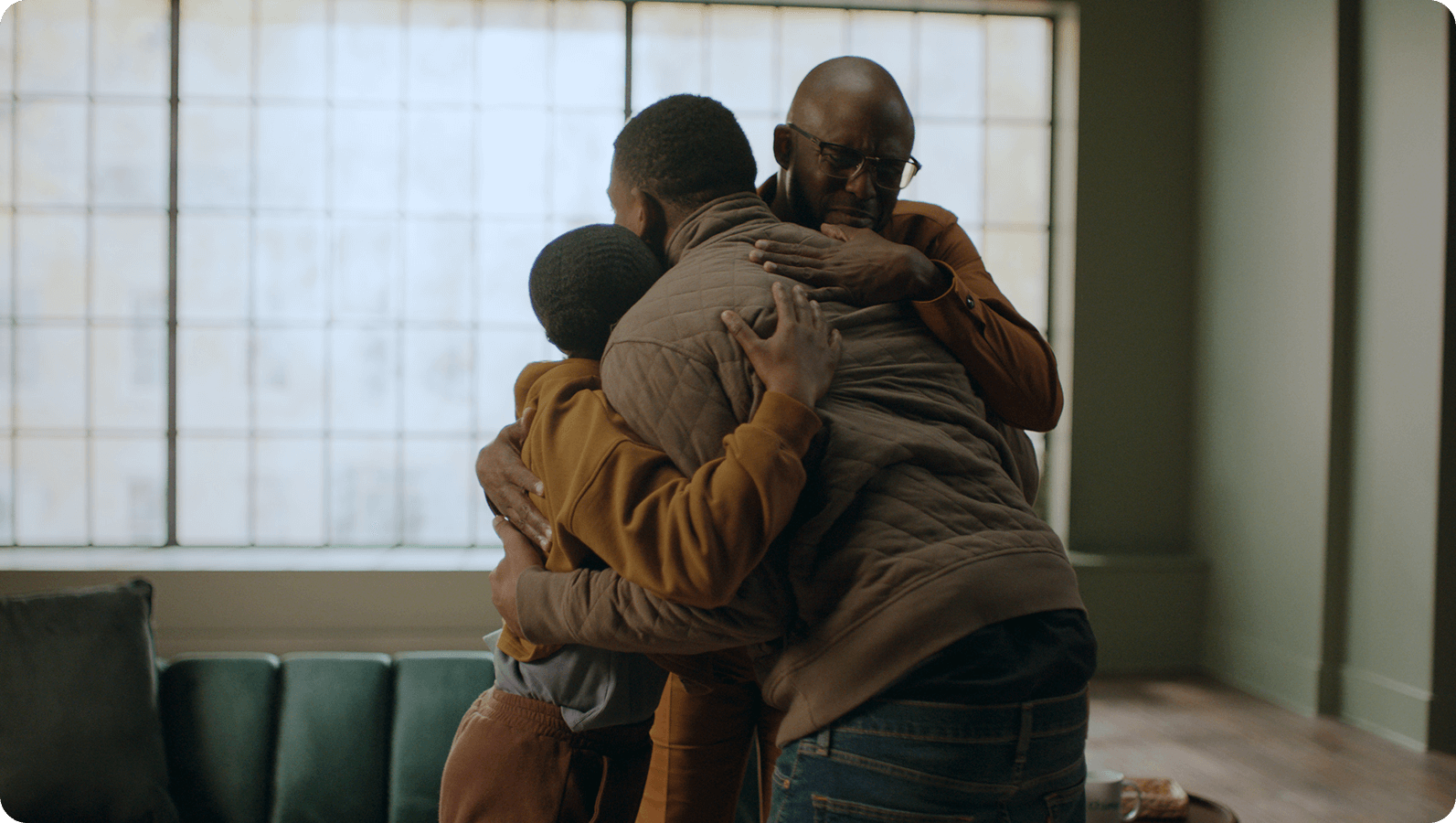

Chime decided to take a bet on the generosity and kindness of strangers by offering 10 people the opportunity to unlock financial progress™ in the new film “Pay Progress Forward.” Each participant had their own ambitions and goals, and their paths forward looked different. Chime connected the participants with a financial educator to help them understand the tools and the amount of money they would need to reach those goals – but also gave them the opportunity to Pay Progress Forward.

A recent survey from OnePoll on behalf of Chime found that 72% of Americans consider themselves generous, even though 42% feel the rest of the country may not be generous. Inspired by this finding, Chime decided to take a bet on people’s generosity. Chime’s short film, “Pay Progress Forward,” shows how approaching financial ambitions through a “generosity mindset” toward others can be the catalyst for good, for everyone.

What is Pay Progress Forward™?

Charitable giving declined 13.4% last year,¹ but Chime believes people are inherently generous and as a community, we can start a positive movement. In “Pay Progress Forward,” participants are presented with a dilemma: would you choose to reach your own financial goals faster, or, as we say, pay progress forward to others?

Each participant thinks they are coming in for professional advice from financial educator and author Tiffany Aliche to get their financial goals on track. What they get? So much more.

After talking through their situations with Tiffany, the participants learn from celebrity host Wayne Brady that Chime is offering each participant the money to reach their short-term goals – and the opportunity to double that money. Participants can either keep the entire sum or pay it forward by giving half to a secondary participant with a similar background and need.

What they don’t know: By agreeing to pay it forward, they’ll unlock $1 million to split between all 10 participants — but only if all five primary participants agree to share the money.

Will they choose to keep the money or be generous and pay it forward to others in need? Watch the film to find out.

Our hosts' financial progress journey

“Pay Progress Forward” host Wayne Brady, beloved cast member of “Whose Line Is It Anyway?” and the current host of “Let’s Make a Deal,” makes a living giving money away to contestants. He deeply understands the stress that money can cause, which drew him to Chime’s Pay Progress Forward experiment.

“I can recall to this day when I used to sleep and dream about the things I need to pay off and the stress I was under,” Wayne tells contestant Johnathan Chriest in “Pay Progress Forward.” “It’s because we come from environments like that that we tend to be generous.”

Tiffany Aliche — also known as The Budgetnista — is a personal financial educator, author of the New York Times Best Seller “Get Good With Money,” and star of the Netflix® documentary “Get Smart With Money.” Through the Live Richer Movement, Tiffany has helped more than 2 million women save, manage, and pay off hundreds of millions of dollars.

“I used to be a school teacher for 10 years, and because my school closed, I lost my house. I lost my car,” explains Tiffany during her conversation with Pay Progress Forward participant Calvin Stevens. “I know the feeling — when you lose your home, they still want you to pay for it. [At] one point, I was so much in debt — mortgage debt, credit card debt, [and] student debt.”

Both Wayne and Tiffany are partnering with Chime to help real people unlock financial progress.

Meet our participants

Our Pay Progress Forward participants come from diverse backgrounds and have different financial goals, but they all share the desire to help others and be generous while unlocking their financial progress.

Skye

Skye is an entrepreneur who works as a creator, artist, writer, and Uber® driver. Her side gigs help her make money while allowing her time to work on her art. Skye wants to pay three months of rent and pay off some of her student loan debt. Eventually, she dreams of buying land in the Dominican Republic for her family.

Calvin

Calvin works in a temp-to-hire role and dreams of developing long-term financial stability and forward momentum. Calvin relocated from Atlanta to LA to be immersed in a “hustle” environment, and his optimism and positive attitude keep him moving toward his goals. In the short term, Calvin wants to be able to get his own home.

Tiffany

Tiffany is a mom of two who aspires to become a judge. The first step toward her goal is enrolling in a paralegal course. Tiffany wanted an advisor to talk through how to pay for her course and continuing education, leveling up her financial know-how so that she could pass her knowledge on to her children.

Johnathan

Johnathan was raised by a single mother on welfare. To unlock his own progress, he learned how to code and found a job — but his job was recently eliminated around the same time his van’s transmission and engine failed. Short term, he wants to pay off his credit card debt and save enough money to fix his van.

Porsha

Porsha is a foster mom who has cared for 17 children and adopted two. Her ever-changing family dynamic means she has to put extra focus on managing her finances while also finding time to have fun with her kids. With many mouths to feed, Porsha shops in bulk weekly and wants to pay off her store credit card balance and some housing debt. Long-term, Porsha and her husband dream of opening their own group home.

Tips to unlock your financial progress

Like our Chime members, the Pay Progress Forward participants have concrete financial goals.

Learn how to unlock your financial progress:

- Save when you can. Tiffany Aliche calls it “saving like a squirrel.” Some months, you’ll be able to save plenty of money for an emergency fund, and other months you might be dipping into that fund to make rent payments. Go easy on yourself and do the best you can.

- Your credit score determines how easy it will be to borrow money when needed. Consider a secured credit card like the secured Chime Credit Builder Visa® Credit Card² to help build financial responsibility and work on your credit history, especially if you’re just starting out.

- Many people want to own a house, but it is a big milestone. Understand how to get a mortgage and how much you need to save to buy a house.

- For many Americans, cars are a necessity — but they can also be expensive to maintain. Budgeting for car maintenance can help you avoid unexpected repair costs.

- A budget helps you understand where your money goes each month, allowing you to make necessary cuts to reach your financial goals. Use our budget calculator to take control of your finances.

Pay Progress Forward with Chime

Generosity is a core value that isn’t always visible. But when given the chance to help others, most people will step up and pay it forward. Chime strongly believes in the power of community, and the idea that we can collectively unlock financial progress.

Log in

Log in