A checking account provides a secure way to receive your paycheck, make purchases with a debit card, and pay bills. Using a checking account can also help you better manage expenses since you can track purchases with online banking.

Choosing the right checking account can help you manage your finances effectively. But with so many account types to choose from, it can be overwhelming to pick the right one for you. From student accounts to interest-bearing accounts, we’ll help you understand what each type of checking account offers.

10 types of checking accounts

So what are the types of checking accounts? If you’re considering opening a new account, there are several checking account options. Some financial institutions have special names for checking accounts, but most will fall under these checking account examples.

1. Student accounts

Student checking accounts are specifically designed for students who are 18 or older. These accounts generally come with low or no monthly fees and minimum deposit requirements and often offer perks like free checks, in-network ATM access, and rewards for good grades.

These accounts are a smart option for students who don’t have much money to manage. Students under 18 must have a co-signer who will be responsible for them.

2. Traditional accounts

Traditional checking accounts are the most common type of account. The best checking account options have no minimum balance requirements, low monthly fees, and provide easy access to your money.

These accounts may also come with overdraft protection, the ability to write checks, and free in-network ATM withdrawals. These accounts can be a fit for people who want a no-frills, basic checking account.

3. Premium accounts

Premium checking accounts offer more benefits than traditional accounts, but they often come with higher fees and more minimum balance requirements. They can include features like unlimited ATM fee reimbursements, interest rates, and rewards programs. Premium accounts could be helpful for people looking for more perks and willing to pay higher fees.

4. Senior accounts

Banks often offer special checking accounts to senior citizens. These accounts usually have enhanced features like higher interest rates, reduced fees, free checks, and ATM access. These accounts make sense for seniors who want to save money and have all the benefits of traditional accounts.

5. Business accounts

Business checking accounts are designed for those who own or operate a business. They come with features tailored to the business’s specific needs, like higher account limits, mobile banking, electronic bill payment, and overdraft protection.

To open a business checking account, you need an Employer Identification Number (EIN) or a social security number if you’re a sole proprietor, along with your business formation documents and business license if applicable.1

6. Interest-bearing accounts

Interest-bearing checking accounts are excellent for people who want to earn interest on their deposits without investing in the stock market and other securities. However, some of these accounts come with larger opening deposit requirements and monthly maintenance fees. Also, the interest rate can change at any time. Nevertheless, high interest checking accounts offer a higher earning potential and can help your money grow while sitting in your checking account.

Some common examples of interest-bearing accounts include money market accounts and certificates of deposit (CDs). CDs have an early withdrawal penalty, but with a money market account, you can withdraw your funds at any time, just like with a regular checking account.

7. Private bank accounts

A private bank checking account is offered to individuals with deposits and or investments totaling a minimum amount, usually ranging from $250,000 to $1 million. These accounts typically come with exclusive access to advisors, credit cards, and other benefits not found with regular accounts.

They also offer higher interest rates, customized loan products, and other perks that fit the needs of high-income individuals.

8. Rewards accounts

Reward checking accounts come with various perks like cash back on specific purchases, free ATM usage, and bonus points that can be redeemed for merchandise, discounts, and travel. These types of checking accounts come with higher fees and stricter requirements. If you meet the account conditions, you could benefit from the rewards.

9. Second-chance accounts

Second-chance bank accounts are designed for those with financial issues or a low credit score and cannot open a regular account. Most banks and credit unions use ChexSystems to review your recent banking activities and see if you’ve had any negative unpaid balances or involuntary account closures.2

A negative ChexSystems report could cause the bank to deny your application to a traditional bank account, but the bank may offer you a second-chance account instead. These accounts usually have more restrictions, higher fees, and lower debit card limits. However, they are an option for those trying to rebuild their financial history and still want to open a bank account somewhere.

10. Checkless accounts

Checkless accounts are also known as “noninterest-bearing accounts.” They are similar to traditional checking accounts but do not allow check-writing. These accounts come with lower fees and a lower balance requirement. However, they may not provide as much flexibility as checkable accounts.

Pros and cons of checking accounts

Carefully consider the pros and cons of different types of accounts before choosing one that best fits your needs. While all checking accounts aren’t the same, they do keep your money safe with FDIC insurance, which limits the risk of losing money in the event of a bank failure.

These pros and cons can help you know what to look for in your next checking account, including any potential fees you could waive or avoid.

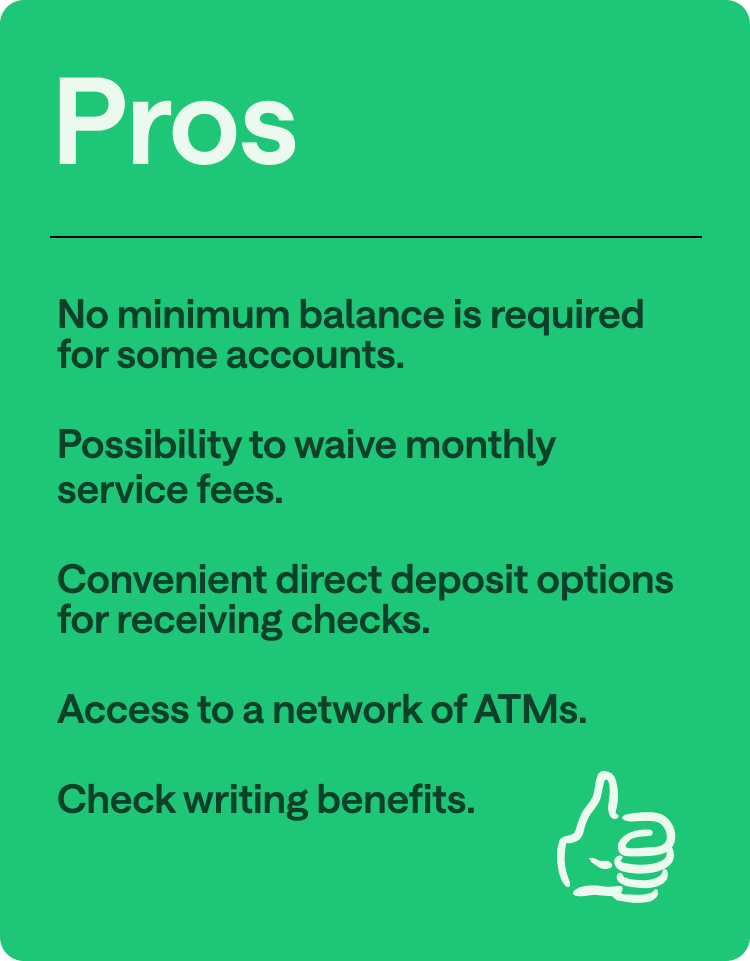

Pros

- No minimum balance is required for some accounts. Some traditional checking accounts may not require an opening deposit or minimum balance each month, meaning they won’t charge fees in this area.

- Possibility to waive monthly service fees. Other checking accounts have monthly service fees but allow you to waive them if you meet minimum balance requirements each month or set up direct deposit. If you can meet the terms, you won’t have to worry about monthly account fees.

- Convenient direct deposit options for receiving checks. With a checking account, you can set up direct deposit to receive your paychecks automatically. This cuts down on check cashing fees and the extra time needed to stop by a bank or a currency exchange to cash your check.

- Access to a network of ATMs. Having a checking account often means access to a network of ATMs with little to no fees. This can save you money and provide convenience when withdrawing cash or making deposits.

- Check writing benefits. Certain checking accounts may offer additional benefits, such as providing checks for you to use. This can be especially helpful for paying bills or making purchases requiring a physical payment.

- Additional services. Some checking accounts offer additional services like free overdraft protection and ATM fee reimbursement for out-of-network ATM withdrawals.

Cons

- Certain banks may require a minimum balance in your account. While some checking accounts do not require a minimum balance, others may have this requirement set by the bank, especially if the account earns rewards or pays interest. This means you may need to maintain a certain amount in your account at all times, which could limit your spending or savings.

- Additional fees. Depending on the bank or financial institution, checking accounts can come with various fees, including monthly maintenance fees, overdraft fees, check fees, and stop payment fees. Some of these fees are harder to avoid.3

- Little to no interest. Most checking accounts don’t pay interest, and the interest rate for a money market account can vary, so you may not get much of a return. A high-yield savings account could be a better alternative if you want to earn interest on your account balance.

Steps for choosing a checking account

Choosing a checking account involves many factors based on your unique situation. Do you need online access? ATM availability? Mobile banking? Are you interested in interest-bearing accounts? To help you make an informed decision, here are some steps to follow when choosing a checking account.

1. Determine your needs and priorities

When looking for a checking account, narrow down what you’re looking for. Consider how often you use your account, what you’ll need it for (bill payment, online shopping, or in-person purchases), and how much money you’ll typically keep in the account. These factors will help you determine the features you need in your checking account.

2. Consider monthly balance requirements

Many banks have monthly average balance requirements. You may be charged a monthly maintenance fee if you fall below this threshold. A basic or traditional checking account may be a better option if you don’t expect to keep a steady balance.

If your account balance tends to get low during certain times of the month, you may want to look for a checking account that has overdraft protection or doesn’t charge overdraft fees just to be safe.

3. Compare checking account fees

Many banks charge monthly maintenance fees or per-item overdraft fees, so make sure you aren’t being charged unnecessarily.

Even if the checking account is advertised as ‘fee free’ or ‘no fees,’ dig a little deeper and look at the account holder agreement or the disclosures at the bottom of the website in small print to ensure you’re not missing any hidden fees.

4. Evaluate interest-bearing checking rates if interested

If you’re interested in an interest-bearing checking account, make sure you can meet the minimum balances or specific transactions. Also, research interest rates and how they are calculated – tiered or flat rate.

A tiered rate means you earn a different interest rate depending on your balance amount – such as a higher interest rate on a larger balance that exceeds a certain threshold. On the other hand, with a flat rate, you’ll receive the same interest rate regardless of your balance amount.

5. Choose an account

Select a checking account type that aligns with your main use based on your research and banking habits. For example, checking accounts with no foreign transaction fees or ATM rebates may be a good fit if you’re a frequent traveler.

If you’re looking to manage your money better, an account that has a fast mobile app or monthly reporting tools may be ideal. Or, if you have a lifestyle requiring you to withdraw cash from your account regularly, you should steer toward a checking account with a large network of fee-free ATMs.

There's a checking account option for everyone

There are many checking account options, from traditional and premium accounts to rewards and second-chance accounts. However, narrowing down the right choice can save you time, money, and future headaches.

Remember to compare fees, features, and benefits, and don’t be afraid to ask questions about anything that doesn’t make sense before you agree to the terms and open an account. Doing so lets you choose the best account type to suit your needs and make the most of your banking experience. Learn more about how to open a checking account in this step-by-step guide.

Log in

Log in