Saving for your child’s college education may seem like a daunting task, but with the right strategy, it’s more achievable than you think.

If you’re unsure where to start, we’ll help you get familiar with some common college savings accounts and how they work. Once you know the pros and cons of each and know the cost of your child’s school, you can decide which savings strategy is right for your child’s future.

When should you start saving for college?

Generally, the best time to start saving for college is as soon as you can. While college might feel like a distant event if your child is still young, saving a small sum each month over an extended period is more manageable than attempting to catch up later.

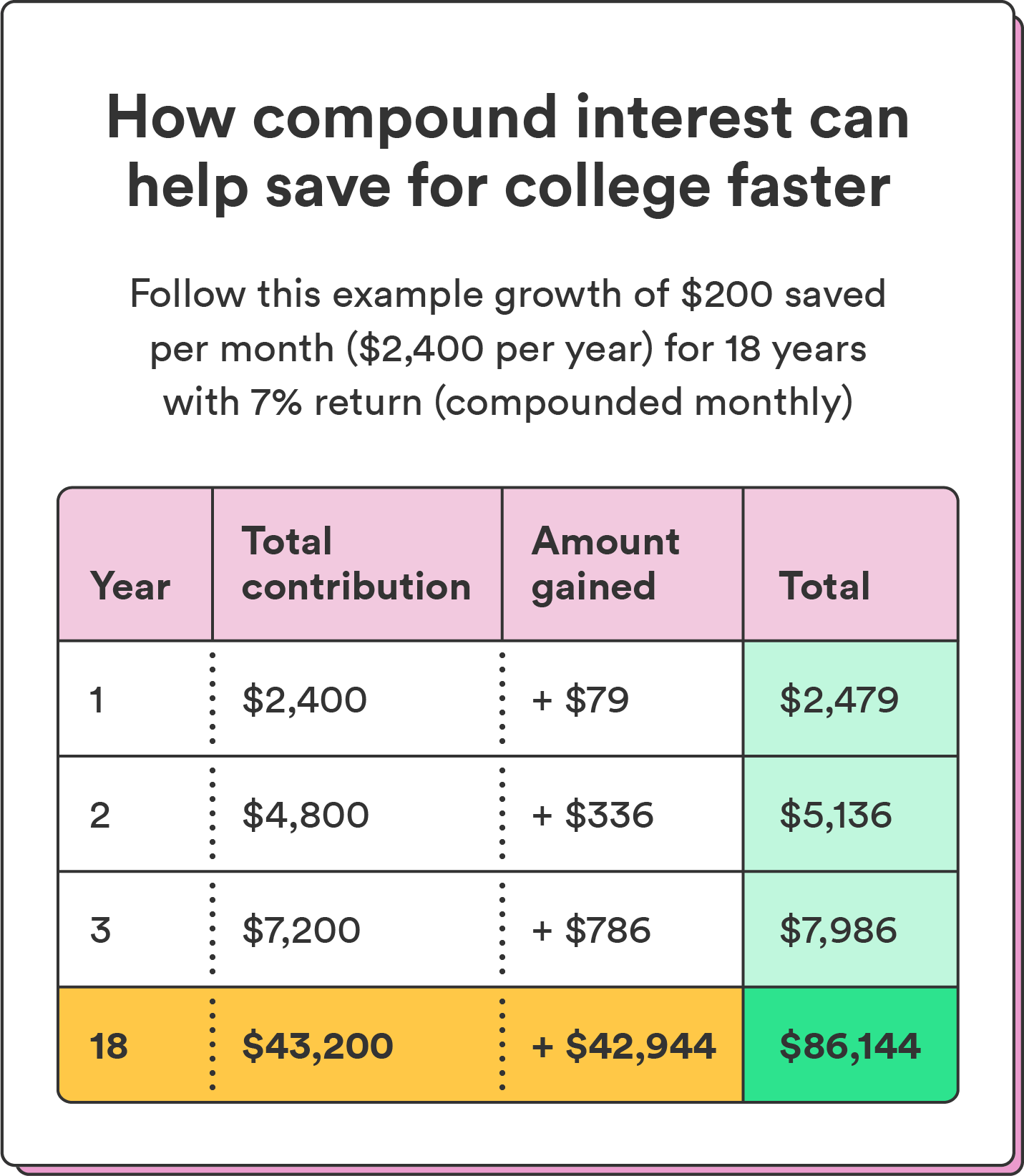

By starting early, you can also take advantage of compound interest. When you invest in a college savings account, for example, you earn interest on the money you save and the interest it accrues. Even if you contribute small amounts regularly, the long time horizon allows your money to snowball into a much larger sum when your child is ready for college.

While starting early is ideal, the most crucial aspect is to take that first step toward building a college fund, regardless of when it happens. Life can be unpredictable, and financial circumstances vary from family to family. Don’t stress about when you start saving; just make a plan and start saving when you can.

How much money should you save for college?

The first step in determining how much to save for college is calculating the total amount you’ll need to cover your child’s education expenses. Various factors influence this amount, including:

- Your child’s age: The younger your child is, the longer you have to save, which can work in your favor due to the potential for your investment to compound over time.

- Type of college: The cost of attending college can vary greatly depending on whether your child plans to attend a public in-state university, a private college, or an out-of-state institution. Research the current tuition and expenses for the specific colleges your child is interested in to get a realistic estimate.

- Expected additional costs: Consider not just tuition but also other expenses such as room and board, textbooks, transportation, and any additional fees. Consider potential future increases in college costs, as they tend to rise over time.

For further context, the chart below outlines a range of college costs for the 2022-2023 school year for different types of schools, according to College Board.

| Type of college | Tuition and fees | Room and board | Total (tuition and fees and room and board) | Total cost |

|---|---|---|---|---|

| Public, Two-Year College | $3,860 | $9,610 | $13,470 | $26,940 |

| Public, Four-Year, In-State College | $10,940 | $12,310 | $23,250 | $93,000 |

| Public, Four-Year, Out-of-State College | $28,240 | $12,310 | $40,550 | $162,200 |

| Private, Four-Year College | $39,400 | $14,030 | $53,430 | $213,720 |

While aiming to cover the full cost of college is ideal, it might only be feasible for some. Many families combine savings, financial aid, scholarships, and student loans to bridge the gap between their savings and the total college expenses. We’ll outline some of those options below.

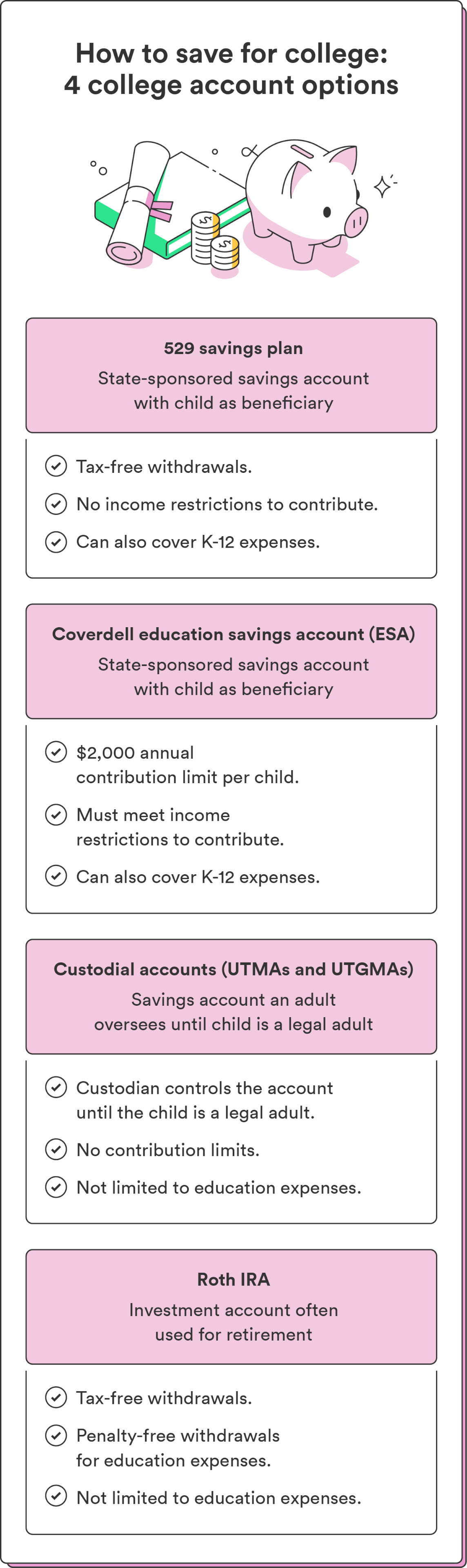

4 common ways to save for college

There are numerous ways to save for college, each with benefits and advantages. Below are some common college savings funds to consider.

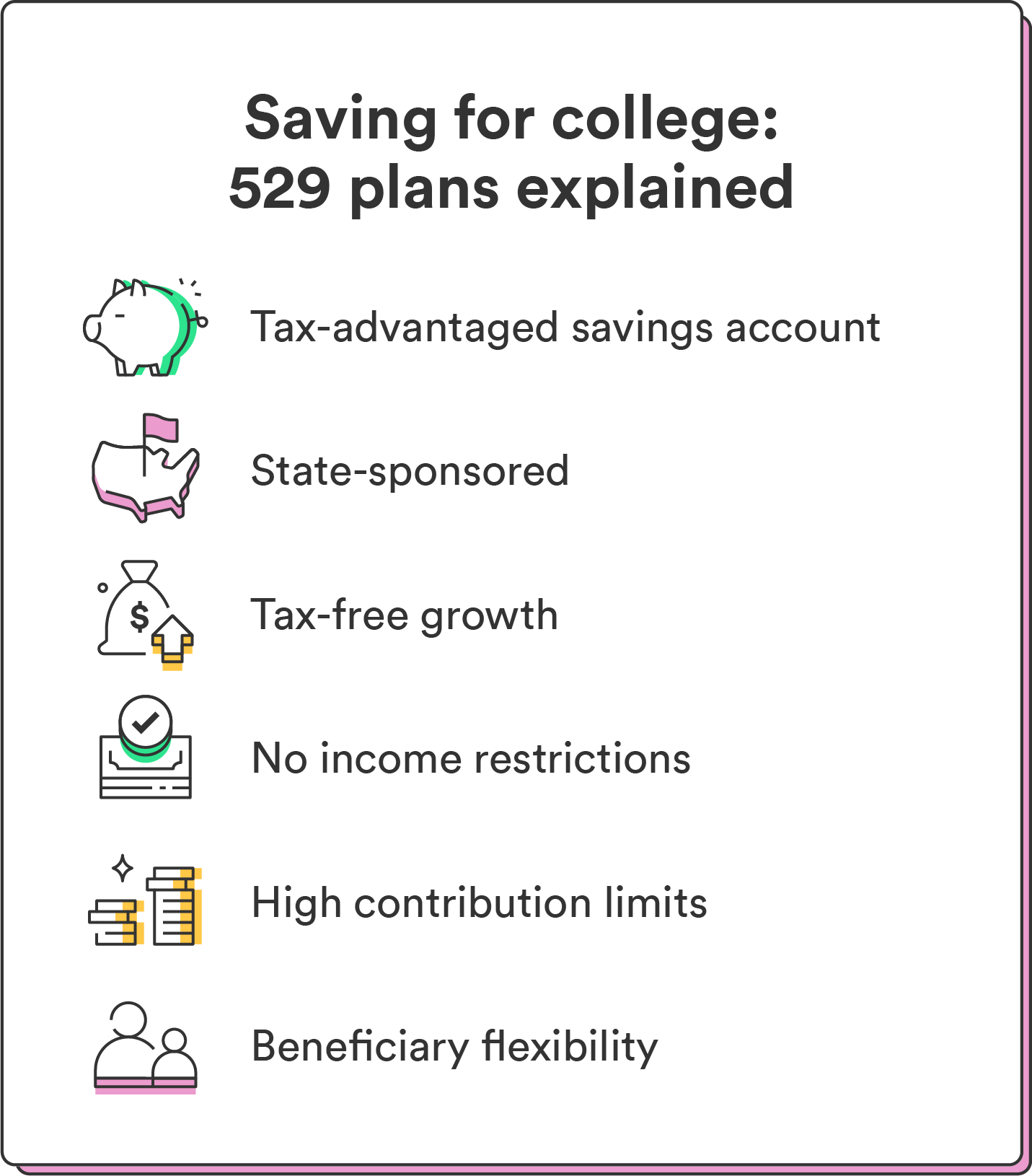

1. 529 plans

Best for: Individuals looking for tax-advantaged savings to cover higher education expenses for a designated beneficiary

A 529 plan is a type of tax-advantaged college savings fund. The earnings and withdrawals on your contributions grow tax-free for qualified educational expenses.² For a 529, that includes higher education or professional certificates and kindergarten through grade 12 education, making them a flexible fund option.²

The funds you put in a 529 go toward various investments, like mutual funds or ETFs. How they’re invested depends on the 529 plan you choose: a prepaid tuition plan or a savings plan.

In a prepaid tuition plan, the investments in your 529 fund are fixed, meaning you can’t adjust your portfolio once it’s set. This option is less flexible than the 529 savings plan, which lets you select your specific investments and change them as you please.³

529 plans generally have high contribution limits, but the exact limit varies by state. Check your state’s 529 limits to determine yours. They also allow you to transfer your beneficiary to another family member if your child doesn’t go to college.² When it’s time to pay for college, you can withdraw money tax-free.

| Pros | Cons |

|---|---|

| Tax advantages and higher contribution limits (vary by state) | Investment options limited by your state |

| No income limit to qualify | Penalties for non-qualified withdrawals |

| Can cover K-12 expenses | Restrictions can apply if you transfer beneficiaries |

2. Coverdell education savings account (ESA)

Best for: Those seeking tax-free growth on contributions and who meet the income limit to qualify

An ESA is a type of college savings account that works similarly to a 529 plan. It also allows your money to grow tax-free, lets you select the specific investments in your fund, and allows beneficiary transfers if needed. Unlike a 529 plan, ESAs have lower contribution and income limits, so you must be below the income limit to qualify.

The income limit for an ESA is $110,00 for individuals or $220,000 for couples filing jointly.2 The contribution limit for an ESA for 2023 is $2,0002 – that’s roughly $167 a month. If you contributed $2,000 per year over 18 years, you’d have $36,000 saved by the time your child goes to college.

Like a 529, parents or guardians can open an ESA for any child below the age of 18.2 The balance in an ESA account has to be distributed by the time the beneficiary reaches age 30.2 If you make less than $$110,00 a year (or $220,000 for couples) or can only contribute $2,000 annually to your child’s fund, consider an ESA.

| Pros | Cons |

|---|---|

| Tax-free growth | Low contribution limits compared to 529 plans |

| Variety of investment choices | Income restrictions to contribute |

| Transferable beneficiary | Funds must be used before beneficiary turns 30 |

3. Custodial accounts (UTMA or UGMA)

Best for: Parents who want to gift assets to minors and transfer control of the account to the child at the age of maturity

While 529 plans and ESAs are set up and owned in a parent’s name on the child’s behalf, custodial accounts like Uniform Transfers To Minors Act (UTMAs) or Uniform Gifts to Minors Act (UGMAs) are a bit different. The account is in the child’s name – the parent (the custodian) only manages them. Once they turn 18 (or 21, depending on your state), they gain full control over the funds in the account.4

Funds saved in custodial accounts also aren’t restricted to educational expenses. Once your child reaches the required age in your state, they can legally spend the funds however they choose. You’re also unable to change the beneficiary once you’ve set it, so you won’t be able to transfer these funds to another child.4

UTMAs or UGMAs don’t offer the same tax advantages as 529 plans or ESAs, and contributions are made with after-tax dollars. Also, earnings in the account totaling more than $2,300 are subject to a specific tax rate set by the IRS.5 That said, custodial accounts can appeal to those looking for more flexibility in spending the funds and don’t want to restrict beneficiaries to college expenses.

| Pros4 | Cons5 |

|---|---|

| Allows transfer of assets to the child without the need for a trust | Beneficiary can’t be changed once selected |

| Funds not limited to college expenses | No control over how the child spends the funds once they turn 18-21 |

| Easy to open at most financial institutions | Few tax advantages |

4. Roth IRA

Best for: Parents aiming to jump-start their child’s retirement savings while also having the flexibility to use the funds for educational expenses.

While not specifically designed for college, Roth IRAs are another account you can use to grow your college savings fund. They allow you to contribute after-tax income and grow your earnings tax-free.

Since they’re technically a retirement account, there’s a 10% penalty for withdrawing any earnings on your funds before the age of 59 ½. But if you want to use your Roth IRA as a college fund, you’re in luck, as you can make penalty-free withdrawals on your contributions for qualified education expenses – but you’ll still have to pay income taxes.6

Roth IRAs also have contribution limits. For 2023, the limit is $6,500 (or $7,500 if you’re age 50 or older). Remember that Roth IRA withdrawals are considered part of your income when calculating your child’s financial aid eligibility, which may impact your child’s eligibility.6

| Pros6 | Cons6 |

|---|---|

| Tax-free growth | Lower contribution limits than 529 plan |

| Penalty-free withdrawals for qualified education expenses | Must pay income tax on withdrawals for education expenses |

| Not limited to education expenses | May impact financial aid |

More ways to boost your college savings

Estimating your kids’ college expenses and researching college savings accounts take time. But once you set up your chosen account and start saving, you’re well on your way to building up your fund. From there, use the following tips to maximize your college savings:

- Automate savings: Set up automatic contributions to your college savings fund. Automating your savings ensures consistent deposits without remembering to do it manually each month. You can also help your child set up a savings account of their own – or become a joint account holder if they’re still under 18.

- Apply for scholarships and grants: Scholarships can help cover part of your college costs with no strings attached. Encourage your kids to seek out and apply for scholarships – even small amounts can add up to a significant amount.

- Apply for financial aid: When it comes time for your child to apply to college, be sure they also submit a Free Application for Federal Student Aid (FAFSA). Schools use this form to determine how much financial aid your child is eligible for. It includes various types of federal aid, grants, and scholarships.

- Encourage your child to get a part-time job: Instilling money-saving habits early on will only help your college-saving efforts for you and your future student. Encourage your child to take up a part-time job so they can contribute to their education expenses.

Regardless of your strategies, small, consistent efforts over time have a big payoff. And involving your child in the process can boost your savings efforts while empowering them to take ownership of their academic future.

Don't wait to start saving for college

You don’t need a ton of extra income to make a meaningful contribution to your child’s college education – even small monthly contributions over time go a long way. By starting early, comparing your college savings options, and setting realistic goals, you can build a solid financial foundation to support your child’s academic aspirations – and reduce the stress of the process.

FAQs about how to save for college

Still have questions about how to save for college? Find answers below.

What is the best way to start saving for college?

The best way to start saving for college is to begin early and open a tax-advantaged college savings account like a 529 plan or an Education Savings Account (ESA). These accounts offer tax benefits and flexible investment options to grow your savings, providing a strong financial foundation for your child’s future education.

What happens to the money in a 529 plan if my child doesn’t go to college?

If your child doesn’t go to college or receives a scholarship, you have several options for the funds in a 529 plan. You can change the beneficiary to another family member, use the funds for qualified education expenses later, or withdraw the money for non-qualified expenses (subject to taxes and penalties on the earnings portion).

What is the benefit of saving for college early?

Starting early allows your investments to grow and accumulate over time, potentially providing more funds for your child’s college education. Additionally, you’ll have more flexibility to adjust your financial plan and adapt to changes in your family’s financial situation.

Log in

Log in