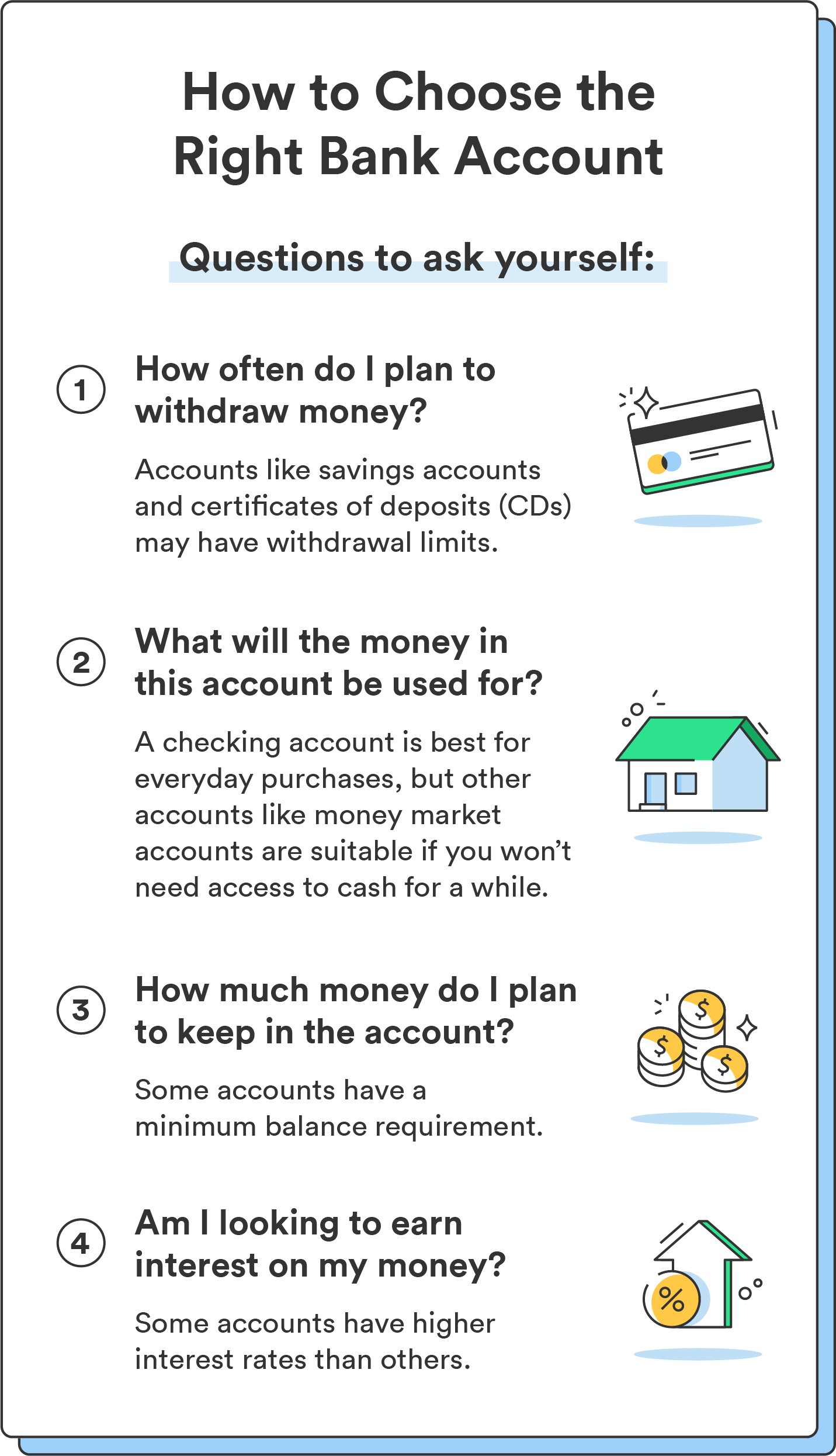

Bank accounts offer a convenient and secure place to store cash or build savings. For most, they’re a standard part of managing everyday finances. That said, there are different types of bank accounts available that can accommodate specific needs.

Knowing how each type of bank account works can help you choose the one that best serves your lifestyle and financial goals – and that’s where our roundup of different types of bank accounts comes in.

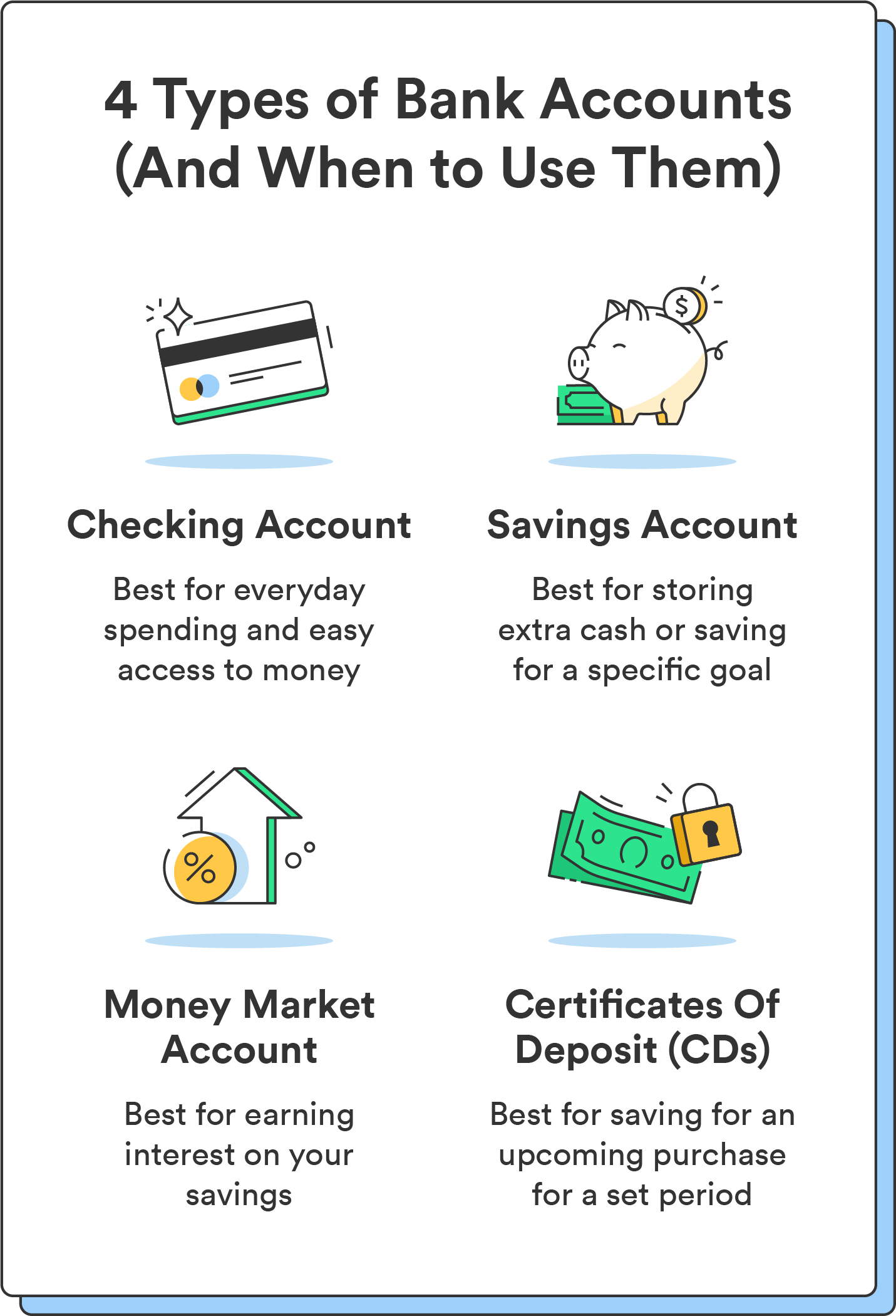

| Account type | What it’s best for |

|---|---|

| Checking account | Everyday transactions and easy access to your money |

| Savings account | Building an emergency fund or saving for a specific goal |

| Money market deposit account | Earning higher interest rates while maintaining access to your money |

| Certificate of deposit (CD) | Earning higher interest rates on a fixed sum of money over a set period |

Checking account

Who should open one: Anyone who wants quick and easy access to money for everyday expenses

A checking account is a type of bank account that allows you to deposit and withdraw money easily. It’s where you’ll deposit paychecks, pay bills, and store funds for quick access. A checking account operates similarly to cash, except you use a debit card (or checks) to make transactions.

Most people rely on checking accounts for automatic bill payments, budget tracking, and paycheck deposits. You could easily open a checking account at a bank branch, credit union, or through an online bank.

Here are some key features of a checking account:

- Deposits and withdrawals: Checking accounts are designed for easy access to your money. You can make deposits and withdrawals at a bank branch, ATM, or online.

- Debit card: Checking accounts come with a debit card, which allows you to make purchases or withdraw cash at ATMs. You can also use debit cards for online shopping and other transactions.

- Check writing: Many still use checks to pay bills or make larger purchases. A checking account typically comes with a checkbook and allows you to write checks that draw from your account.

- Low interest rates: Unlike savings accounts, checking accounts typically have low interest rates and won’t earn much interest on the money you keep in your account.

- Fees: Some checking accounts come with monthly maintenance fees, ATM fees, or other charges. Read the fine print and understand what fees may apply to your account.

Financial institutions can also offer multiple checking account options to fit different needs, including:

- Teen checking

- Student checking

- Senior checking

- Interest checking

Checking accounts may come with monthly maintenance fees, but some banks require no minimum account balances. Typically you just need to keep enough money in your account to cover spending and avoid overdraft fees.

How to choose the right checking account

If you’re ready to open a checking account, you have the options of a traditional bank (think brick and mortar) or an online bank. You’ll want to choose one that best suits your lifestyle. If you don’t often visit the branch in person, an online checking account offers the benefit of being able to do your banking from anywhere.

Next, consider any features you may want in a checking account and the factors to be aware of when choosing an account:

- Fees: Be sure to review any fees associated with an account, like overdraft fees, ATM fees, and foreign transaction fees.

- Minimum balance requirements: Make sure you meet any minimum balance requirements for the account you’re considering.

- ATM access: If ATM access is important to you, find out how many are available with the account you’re considering and their locations.

- Overdraft protection: Some checking accounts offer overdraft protection, while others don’t. If you’re concerned about overdrawing your account, look for an account that offers this service.

- Rewards: Some checking accounts come with rewards programs, like earning cash back or other benefits tied to the account. Compare rewards program offerings for accounts you’re considering (and be sure to check for any associated fees or requirements).

Consider a no-fee checking account or an account that offers fee waivers based on certain conditions, like maintaining a minimum balance or making a certain number of monthly transactions.

Savings account

Who should open one: Those who want to save money for a specific goal or have a place to keep extra money

A savings account is a type of bank account that helps you save money and earn interest on your deposit. When you open a savings account, you deposit money into the account and earn a small amount of interest on that balance over time (although the interest earned depends on the financial institution).

A standard savings account is similar to a checking account, except you wouldn’t use it to make everyday transactions. Instead, it’s an ideal place to store funds you don’t plan on spending soon.

Unlike checking accounts, most savings accounts don’t include a debit card. Similarly, savings accounts usually have withdrawal limits and minimum balance requirements as an incentive to avoid spending the funds.

Here are some key features of a savings account:

- Deposits and withdrawals: You can make deposits and withdrawals from your savings account, although there are usually limits on the number of withdrawals you can make each month without incurring fees.

- Minimum balance requirements: Some savings accounts require a minimum balance to avoid fees or earn higher interest rates.

- Interest rates: Savings accounts offer interest rates that are typically higher than checking accounts but are also quite small. If you open a high-yield savings account, you can earn more money on the balance you keep in your account over time.

- No debit card: Unlike checking accounts, savings accounts typically do not come with a debit card, as they aren’t for everyday spending.

Overall, savings accounts are the perfect partner to a checking account, as they can help you build an emergency fund or work toward a savings goal, like a car down payment.

How to choose the right savings account

When deciding on the right savings account, consider whether you prefer to open one through a traditional bank or an online financial institution.

Then, consider the following to find the right savings account for your needs:

- Interest rate: While savings account interest rates don’t amount to much, you can still shop around for an account with the most competitive rate.

- Minimum balance requirements: Make sure you meet any minimum balance requirements for the account you’re considering.

- Access to funds: Consider how easily you can access your funds and your preferred access method. Different accounts may offer different access levels through online transfers, ATM withdrawals, or visits to a branch.

- Extra features: Some savings accounts may offer extra features like budgeting tools, mobile banking, or linked checking accounts, so compare what different accounts offer.

Online banks tend to offer higher interest rates on savings accounts and may have fewer fees, but you may miss out on the convenience of having a physical branch to visit. Traditional banks offer more in-person customer support and access to additional financial products but are more likely to come with monthly fees.

Also consider the interest rate and any associated fees. Look for a savings account that offers a competitive interest rate and low or no fees.

Think about the purpose of the account and what features you need. If you’re saving for something and want to keep the money separate from your other accounts, look for a savings account that allows you to create and label sub-accounts. Or, if you want to be able to access your money quickly in case of an emergency, look for a savings account that offers instant online transfers.

Chime tip: If you’re after the highest interest rate possible, a high-yield savings account through an online bank can offer a higher annual percentage yield (APY) than you may find at a physical bank.

Money market deposit account

Who should open one: Those who want to earn slightly more interest than a traditional savings account

A money market account (MMA) is a type of savings account that typically offers higher interest rates than a traditional savings account, in exchange for a higher minimum balance requirement.

MMAs can offer higher interest rates than a savings account while providing easy access to your funds. Think of an MMA as a hybrid between a savings account and a checking account – like a checking account, MMAs may come with a debit card, and like a savings account, they allow you to earn interest on your deposit.

Money market accounts typically require a higher minimum balance than a regular savings account but offer higher interest rates in exchange.

Here are some key features of a money market account:

- Higher interest rates: Money market accounts may earn higher interest rates than standard savings accounts.

- Minimum balance requirements: Money market accounts typically require a higher minimum balance than regular savings accounts.

- Withdrawal restrictions: Money market accounts typically limit the number of withdrawals you can make each month, often six per month.

- Check-writing and debit card: Some money market accounts offer debit card and check-writing privileges.

Generally, money market accounts are a place to stash long-term savings and earn slightly more interest on your funds.

How to choose the right money market deposit account

Similar to savings and checking accounts, pay close attention to the fees and features of different MMAs you’re considering, including:

- Minimum balance requirements: While you can find MMAs with a minimum balance as low as $1,000, you’ll earn more in interest if you deposit a higher balance that you can maintain over time. Keep this in mind when choosing an MMA.

- Fees: Compare the total cost of any maintenance or transaction fees to the interest rate to ensure the account is worth it. Better yet, look for a money market account with no monthly fee.

- Transaction limits: If you’re looking for an MMA with debit card access, find out what the limit is for debit card transactions and ensure it aligns with your needs.

- Check-writing and debit card: Check whether an MMA offers them if this feature is essential to you.

If you’re looking for a low-risk investment option with easy access to your funds, a money market account may be a good choice. However, if you need more flexibility in your savings or are looking for higher returns, you may want to explore other investment options, like mutual funds or stocks.

Certificate of deposit (CD)

Who should open one: Those with a specific savings goal and don’t need immediate access to their funds

A certificate of deposit (CD) is a type of savings account where you deposit funds for a specified period, typically from a few months to five years. You earn a fixed interest rate over time in return for storing your funds.

CDs are useful for saving for a specific upcoming purchase, like a house down payment or a child’s college education. While they typically offer higher interest rates than traditional savings accounts, they also require keeping your money tied up for the specified term length – and if you want to withdraw your funds early, you’ll incur a penalty fee.

Here are some of the key features of a certificate of deposit:

- Fixed interest rate: CDs have a fixed interest rate, meaning that you know up front how much interest you’ll earn on your deposit.

- Set term length: When you open a CD, you’ll select a term length for how long your funds remain in the account. You can’t withdraw your funds before the term length is up without paying a penalty fee.

- FDIC-insured: CDs are FDIC-insured up to $250,000, so your money is safe in the event of bank failure.

At the end of the CD term, you can withdraw the money, roll it over into a new one, or add more money to the account.

How to choose the right CD account

The main things to consider when choosing a CD are the term length and interest rate. If you don’t need access to your money anytime soon, consider a longer term to lock in a more competitive interest rate.

Here’s what else to consider:

- Interest rate: Look for a competitive CD that will help your savings grow faster. Shop around to compare rates at different banks or credit unions to ensure you get the best deal.

- Term length: Determine the length of time you’re comfortable not accessing your funds and choose a CD term length accordingly. Remember that longer-term CDs typically offer higher interest rates but require a longer commitment.

- Penalties for early withdrawal: Be aware of the penalties for early withdrawal in case you need to access your funds before the CD term ends. Some CDs may charge a fee or reduce interest rates if you withdraw funds early.

- FDIC insurance: Ensure the CD is FDIC-insured, as not all are.

Above all, look for a CD with a term length that aligns with your goals and learn the penalties for early withdrawal. This can help you make a more informed decision about whether you need to access your funds before the term ends.

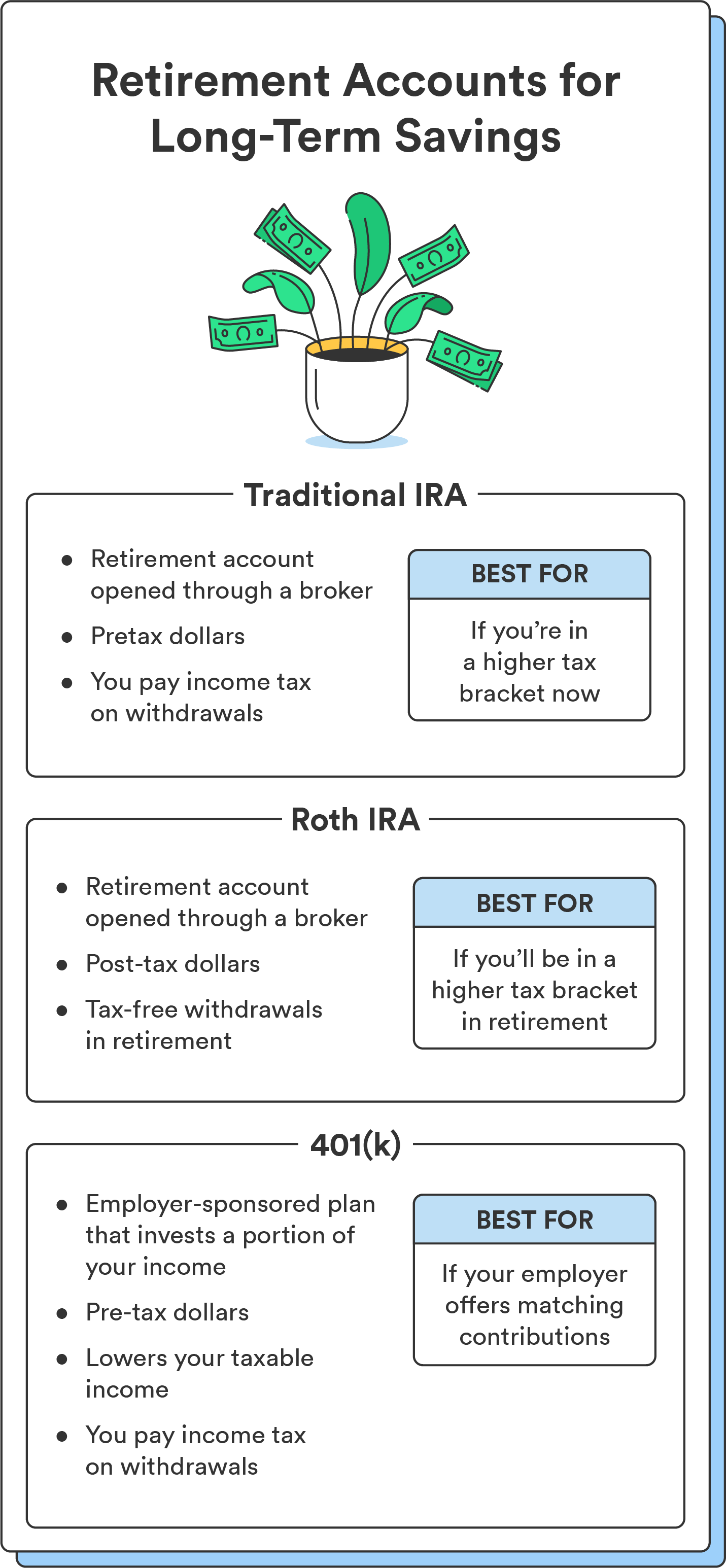

Plus: Retirement accounts to consider

Once you’re comfortable with the common types of bank accounts, you can start thinking about long-term financial planning. While retirement may seem distant for some, it’s never too early to start saving and investing for the future.

Two common retirement funds are a 401(k) and an Individual Retirement Account (IRA).

An IRA is a retirement savings account that lets you save for retirement with tax-free growth. There are two types of IRAs: traditional and Roth. Both offer tax advantages for retirement, meaning your contributions are typically tax-deductible, and earnings grow tax-free until withdrawal.

Here’s what to know about IRAs:

- Tax-advantaged: IRA contributions are tax-deductible, and both traditional and Roth IRAs let you grow your earnings tax-free until retirement.

- Contribution limits: Contributions to traditional and Roth IRAs are capped at $6,500 ($7,500 if you’re 50 or older).¹

- Withdrawal rules: For a Roth IRA, you can withdraw contributions tax- and penalty-free (only your original contributions, not any earnings on your investment).

401(k)s are another type of retirement account that you get through your employer. If you sign up for one, your contributions are automatically deducted from your paycheck and invested on your behalf.

Here’s what to know about 401(k)s:

- Pre-tax contributions: 401(k) contributions consist of pretax dollars, which lowers your taxable income.

- Employer matching: Employers may match a portion of any contributions you make to your 401(k), which is an excellent way to boost your savings.

- Contribution limits: Contributions to your 401(k) are capped at $22,500 for individuals.²

- Withdrawal rules: Withdrawals from 401(k) accounts are subject to income tax and may incur penalties if they occur before age 59 ½.

IRAs and 401(k) can help you build a sizable nest egg for retirement and set yourself up for future success.

Choose the right bank account for your needs

Bank accounts serve different purposes for your personal finance priorities. For example, you could open a checking account for everyday spending, a savings account for your savings goals, and a CD for funds you don’t plan to use for a while.

Figure out the combination that works for you, do your homework on each account, and know you can always add or remove accounts as time goes on and your financial situation changes.

FAQs

Still have questions about different types of bank accounts? Find answers below.

How many bank accounts should you have?

The number of bank accounts you should have depends on your financial goals, but many people start by having one checking account and one savings account. From there, you can explore additional options, like having multiple separate savings accounts.

Can I open a bank account with bad credit?

Yes, you can open a bank account with bad credit, but you may have to opt for a second-chance account or a secured account and may face certain restrictions and fees.

How can I use my bank account to build my credit score?

You can use your bank account to build your credit score by making regular on-time payments, avoiding overdrafts and fees, and using credit-building products like secured credit cards or credit builder loans.

Which type of bank account is best for everyday transactions?

A checking account is typically best for everyday transactions since they offer easy access to your funds through various payment methods like checks, debit cards, and online bill pay.

Which type of bank account typically offers the least (if any) interest?

Checking accounts usually offer little to no interest.

Log in

Log in