Chime® has declared 2024 as “The Year of #FinTok.” To see why #FinTok exploded in popularity this year, Chime has compiled a first-of-its-kind recap of 2024’s hottest trends on #FinTok — through AI social mining and a 2,000-person survey of Americans across four generations — to uncover how they perceive and use the financial side of TikTok® to Unlock Financial Progress™ in their lives.

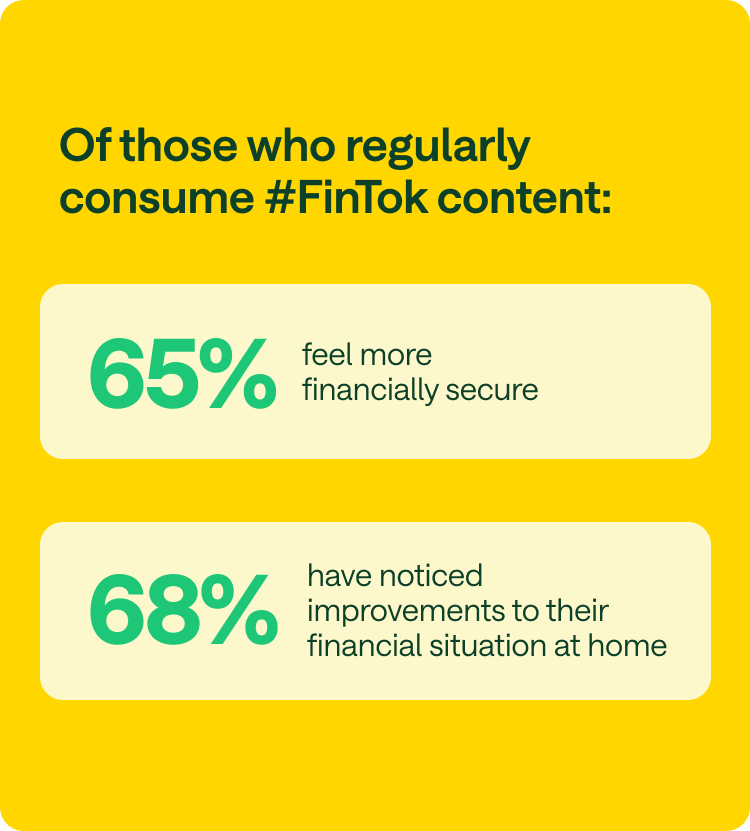

Americans are increasingly turning to TikTok for their financial advice, searching for money tips on budgeting (25%), investing (24%), credit cards/credit scores (33%), and more. The time spent scrolling through #FinTok has paid off, as those who regularly consume #FinTok content report feeling more financially secure (65%) and seeing noticeable improvements to their financial situation at home (68%).

Using the findings from AI listening and our nationwide survey,¹ Chime has created a handy “fin-glossary,” declaring the hottest trends this year and dissecting what they mean. From money dysmorphia to loud budgeting, readers can take the personalized quiz to discover the #FinTok trend that best reflects their financial mindset. Head to chimefintok.com to explore more.

Top 10 #FinTok trends of 2024

Chime analyzed #FinTok using AI and other tools to find the top 10 #FinTok trends this year:

- Girl Math

- Cash Stuffing

- Loud Budgeting

- Money Dysmorphia

- Underconsumption

- Digital Minimalism

- Financial Therapy

- Phantom Debt

- No-Spend Challenge

- De-Influencing

How Americans are using #FinTok

While TikTok is still home to hilarious memes and viral dance challenges, #FinTok is quickly turning into a mini classroom where people of all ages can access bite-sized money tips to level up their finances.

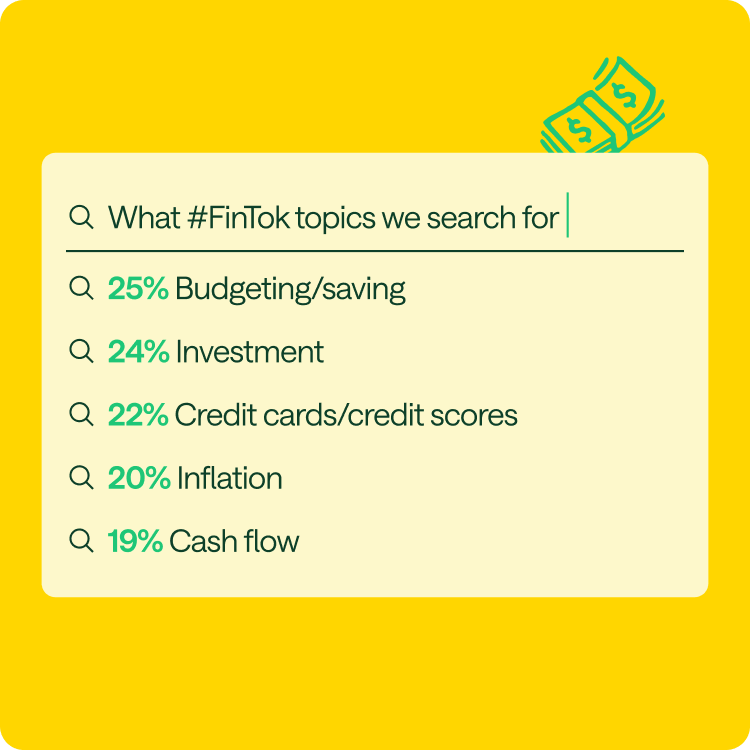

According to our survey, many Americans got their financial information from family members (47%) or friends (40%) before #FinTok existed. Today, TikTok is leading the way, with many turning to influencers on the platform for money tips. On average, our survey respondents said they discovered 42 new pieces of financial knowledge through #FinTok. And here’s what they’re searching for most when scrolling through it:

- Budgeting/saving (25%)

- Investment (24%)

- Credit cards/credit scores (22%)

- Inflation (20%)

- Cash flow (19%)

Should you trust #FinTok for financial advice?

TikTok’s #FinTok hashtag has become people’s go-to for financial advice, money-making tips, and trends like loud budgeting and underconsumption. But as more Americans turn to “finfluencers” for money advice, should you trust the information you get from #FinTok?

According to our study, 22% of Americans trust influencers who are older than them, while 38% seek out information from those who have achieved the financial success they aspire to. A smaller group (19%) trusts financial influencers with large followings.

But here’s the thing: anyone can post content on TikTok, regardless of their credentials. So, always take #FinTok financial advice with a grain of salt. Some content creators without credentials may relay information that’s inaccurate. That’s why Chime’s In The Green™ blog is written by a team of 20 accredited finance experts to help you cut through all the clutter. For specific financial advice, consider meeting with an accredited financial advisor.

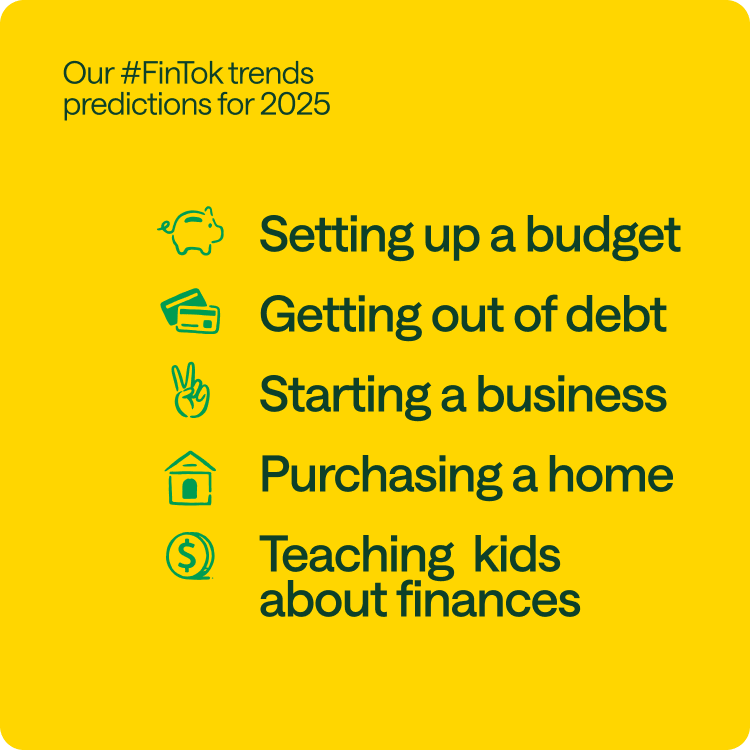

#FinTok 2025 trend predictions

Using survey data, we predict the top #FinTok information and trends for 2025 will be:

- Setting up a budget

- Getting out of debt

- Starting a business

- Purchasing a home

- Teaching children about finances

Unlock Financial Progress™ with Chime

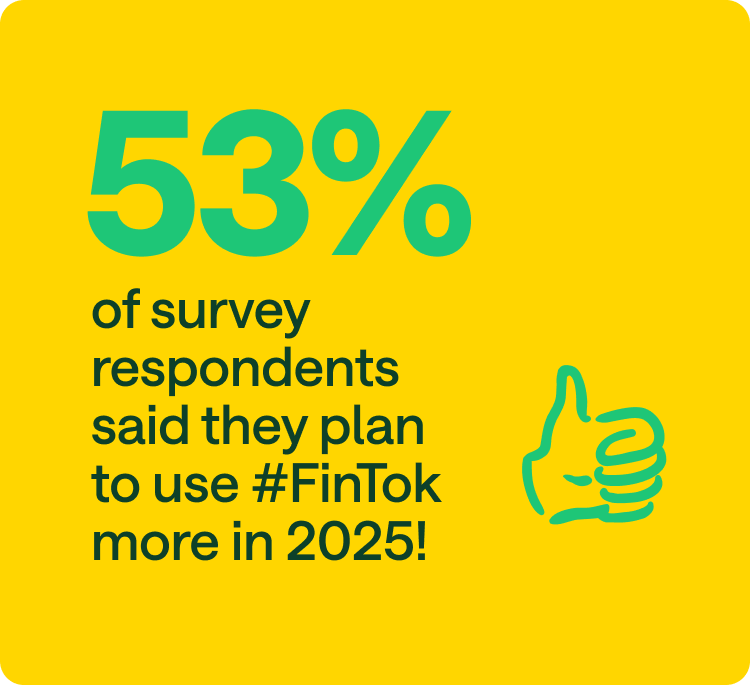

With 53% of survey respondents planning to use #FinTok more in the year ahead, the rise of #FinTok shows no stopping in 2025. Whether you plan to try out the trends from #FinTok next year or stick to the basics, Chime offers a suite of tools to help you Unlock Financial Progress in 2025.

Rianka Dorsainvil, Chime’s Consumer Certified Financial Planner, agrees. “The advent of TikTok has made financial information and budgeting tips more accessible and digestible,” she said. “Armed with knowledge from #FinTok and free online budgeting tools like those available from Chime, consumers are feeling more empowered to take their finances into their own hands and unlock their financial progress.” When you combine #FinTok with free tools from Chime like those below, you reap even more benefits. Remember to talk to a financial advisor for specific guidance.

Here’s how you could use our resources to achieve some common financial milestones.

Start a budget

Creating a budget is the first step toward financial progress. Chime’s budget calculator is free to use and gives you a high-level view of your spending across each category and how to divide your income based on the 50/30/20 rule, which suggests putting 50% of your income toward needs, 30% toward wants, and 20% toward savings and debt.

Build an emergency fund

An emergency fund can be a lifesaver when life throws financial surprises your way. Our emergency fund calculator shows you a breakdown of how long it will take you to save $1,000, or between three to nine months of funds to fill up your emergency fund account.

Create a savings goal

From planning for short-term needs like an emergency fund to reaching long-term goals in retirement, Chime’s savings goal calculator helps you learn about how to set and reach achievable savings goals.

Live within your means

Chime’s rent calculator can help you determine how much rent you can afford based on your current gross income, savings, and monthly expenses.

2024 #FinTok Wrapped by the numbers:

- 65% of Americans feel more financially secure since using FinTok.

- 68% of Americans say #FinTok has improved their financial situation at home.

- 53% of Americans are planning to use #FinTok more in 2025 than they did in 2024.

- In 2024, Americans used #FinTok to search for tips and information on budgeting/saving (25%), investment (24%), credit cards/credit scores (22%), inflation (20%), and cash flow (19%)

- 39% of Americans plan to use #FinTok to set up a budget in 2025. Another 37% and 19% plan to use it to get out of debt and start a business, respectively.

- Americans were more likely to go to other social media sites for information (40%) than they were financial websites or blog posts (37%).

- 50% believe that the information they get on #FinTok is better than other sources they’ve used.

- 15% of Gen Zers have never met with a financial advisor or bank worker in person, compared to 27% of baby boomers.

- 32% of Americans say they’re embarrassed about asking their loved ones for financial guidance.

- 47% of Americans trust Google® more than #FinTok for financial information.

- 52% of Americans turn to search engines like Google to gather more information about things they learn on #FinTok.

- Prior to #FinTok, respondents typically got their financial advice from family members (47%) or friends (40%).

- Gen Z gained an average of 49 new pieces of information on #FinTok, millennials gained 44, and baby boomers gained an average of 32.

- 27% of Gen Z learned about finances in school or an educational setting, as opposed to Gen X or baby boomers (both 8%).

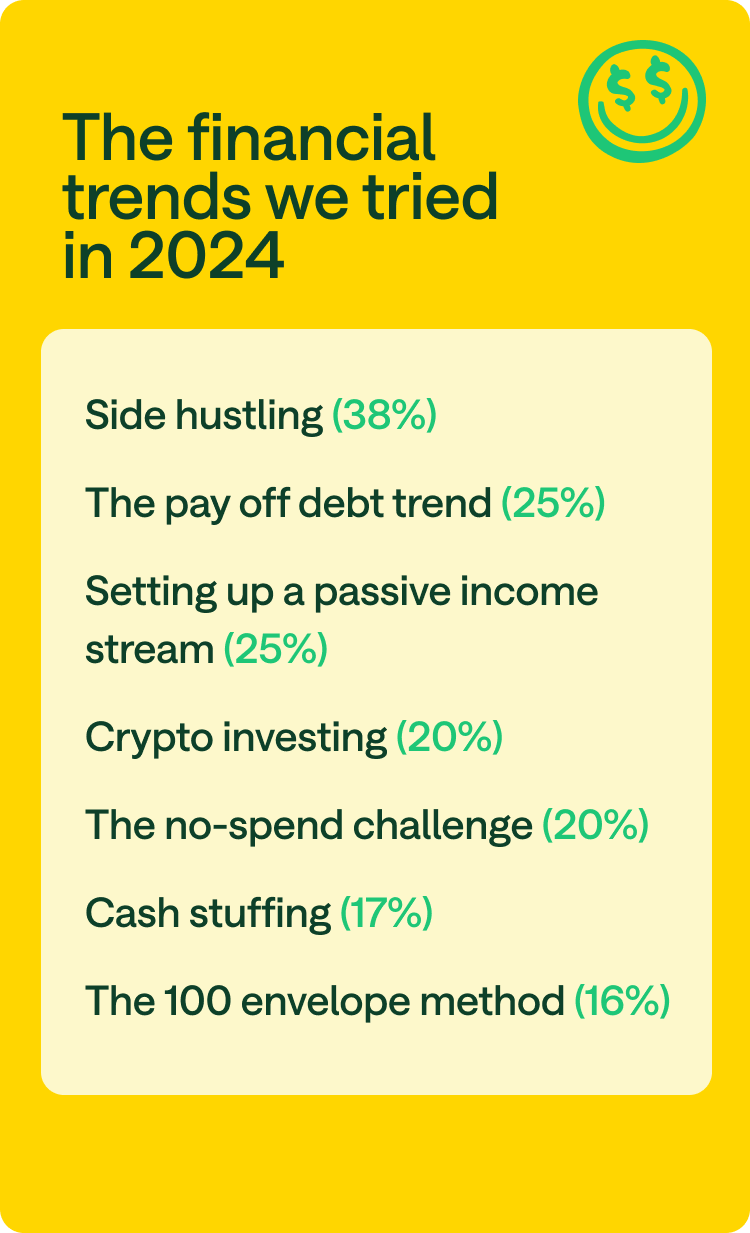

- In 2024, 38% tried “side hustling,” 25% tried the “pay off debt trend,” 25% tried “passive income”, 20% tried “crypto investing”, 20% tried the “no spend challenge,” 17% tried “cash stuffing,” and 16% tried the “100 envelope method.”

- Americans stick with a new #FinTok trend for an average of four weeks.

- Americans found an average of 44% #FinTok trends to be successful.

- Respondents determine the success of a #FinTok trend by seeing benefits (46%), learning something new (36%), or feeling more confident in their financial ability (33%).

- “Budgeting/saving” (25%), “investing” (24%), “credit/credit scores” (22%), “inflation” (20%), and “cash flow” (19%) were the most searched terms on FinTok this year.

- 48% of Americans believe that they have more financial knowledge than other people in their lives.

- 76% of Americans are open with their friends and family about using FinTok for financial planning. Millennials are the most open generation, as 36% are “very open” about their FinTok usage, compared to just 24% of baby boomers.

- 44% of Americans polled agree that those who are not on social media are doing themselves a disservice, not just financially but culturally.

- 22% of Americans have more trust in #FinTok influencers who are older than them, and they seek out information from those who are where they want to be in the future (38%) and have a lot of followers (23%).

#FinTok trends may fade, but financial literacy stays

Our survey shows that Americans aren’t just spending hours doomscrolling on TikTok. They’re using the platform as a tool to take charge of their financial futures and stay ahead of the curve. And while #FinTok trends may not last forever, the financial knowledge gained from them can.

Social media is a great starting point for Unlocking Financial Progress™, but it’s not the only resource available. Chime’s In The Green provides a library of easy-to-digest financial content to help you level up your money knowledge and master the financial lessons school didn’t teach you.

For more information and to check out the fin-glossary and quiz, head to chimefintok.com.

Log in

Log in