What’s one thing you’d prefer to do instead of your taxes? If you answered “spend an evening doing homework,” you’re in good company; a recent survey¹ by OnePoll on behalf of Chime® found that a quarter of Americans would rather do homework than do their taxes.

Others said they’d rather dissect a frog, take their SATs, or take a calculus exam. Clearly, taxes are low on the list of enjoyable grown-up activities.

But why are we wary of taxes? One possible reason is the fear of the unknown. Our survey found that Americans are more likely to know the Pythagorean theorem than be able to define “taxable income” correctly. High school does a great job preparing us to pass tests and graduate to adulthood – but it doesn’t teach us how to “adult.”

This Financial Progress Month™ and beyond, Chime is committed to filling in the gaps by making financial education more accessible. Let’s dive into our survey results to discover the missing pieces in a typical high school education.

Proving the memes right

The memes don’t lie: our survey found that over half (52%) of Gen Zers could identify the mitochondria as the powerhouse of the cell. In comparison, only a quarter (26%) of the same group knew the correct definition of “taxable income.”

Survey results also show that Americans have a better understanding of rarely used information, like the definitions of equilateral (72%), scalene (69%), and isosceles (57%) triangles, than they do about crucial financial information, like the difference between a W-2 and a W-4 (46%).

Our survey also found that almost one-third (32%) of Americans learned “nothing at all” about personal finances in high school. Unsurprisingly, 55% of Gen Zers admit they rely on search engines more than their formal education. Sounds like it’s past time for a change.

Where we’re ready to learn

The first step toward change is understanding the gaps. So where do you struggle most with your finances?

Among our survey respondents, the top responses were sticking to a budget (34%), paying off debt (30%), investing (28%), and saving for retirement (27%).

Some respondents specified the areas where they struggle the most, such as:

- Saving for large purchases

- Making enough money to get by

- Finding and keeping a job

- Social Security and Medicare

Most high school curriculums teach us the difference between isosceles and equilateral triangles but not how to file taxes, make a budget, or even apply for a credit card. What’s missing in the high school experience is learning the everyday skills we need to be successful adults in today’s world.

A new approach to the high school curriculum

Our survey suggests it may be time to rethink the high school curriculum to help kids become financially empowered adults. High school graduates should be prepared for what awaits them in the real world.

Let’s reimagine a high school curriculum teaching us how to “adult”: here are some course ideas for high school students, as informed by our survey results:

- Personal Finances 101: In this course, you’ll learn how to file taxes, how to invest your money, and how to save, spend, and budget.

- Intro to Adulting: In this course, you’ll learn how to cook, clean, do laundry, and navigate adult relationships.

- Caring For Your Car: This course will teach you how to change the oil in your car, how to change a tire, general car repairs and maintenance, and the location of common engine parts.

- Homeownership 101: This course will cover the home-buying process, how to get a mortgage, and basic DIY home repairs.

- Navigating the Workplace: In this course, you’ll discover how to write a resume and cover letter, basic workplace etiquette, and networking best practices.

- Advanced Technology: Here, you’ll learn how to set up a wireless router, the basics of computer coding, how to use Excel and other common software programs.

- Health and Retirement: This course will help you learn how to find a doctor within your health insurance network, how to access mental health services, and how to save for retirement successfully.

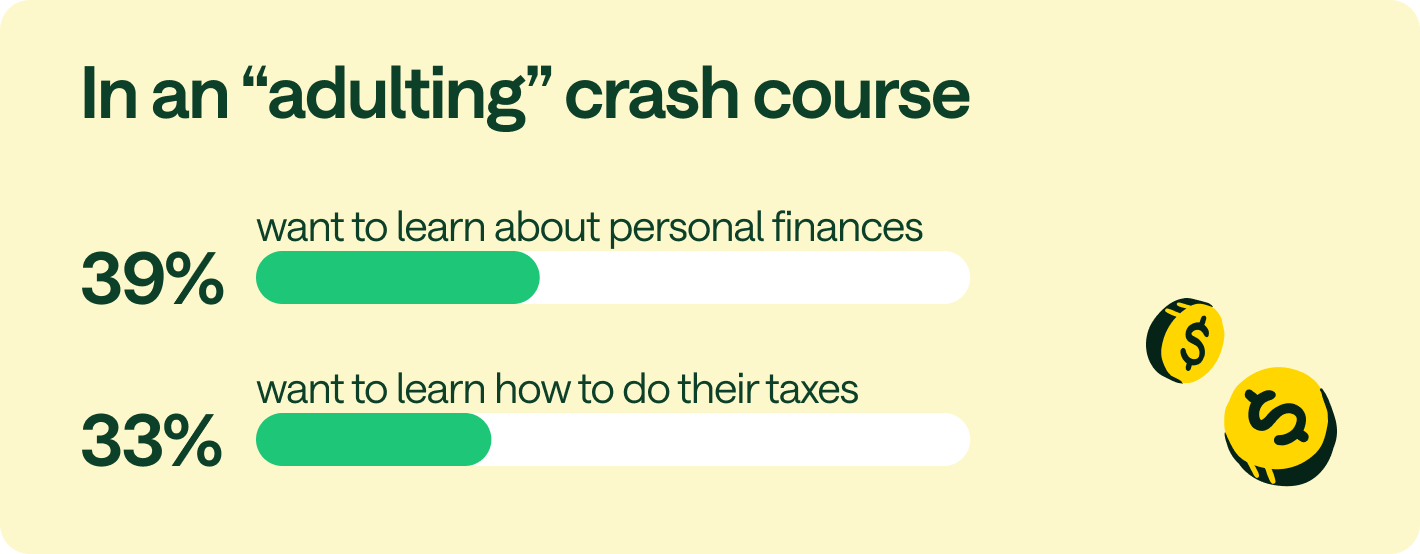

Why these courses? Our survey showed that there is an eagerness for progress in financial education. 81% of respondents would be willing to take an “adulting crash course” or the opportunity to learn relevant skills for being an adult.

The most-requested topics were:

- Managing personal finances (39%)

- Filing taxes (33%)

- Home buying and mortgages (31%)

- How to write a cover letter or resume (23%)

- How to change the oil in a car (22%)

- How to cook (21%).

These skills can prepare students for life after high school.

The study showed that Americans struggle the most with sticking to a budget (34%), paying off debts (30%), and investing (28%). This new curriculum would cover all that and more.

Sounding off on Financial Progress Month™

Financial Progress Month is an excellent time to start learning more about personal finances, but it shouldn’t end there. Our survey shows that Americans are hungry for knowledge about their finances, and we want to help our members broaden their knowledge so they can make intelligent financial decisions and reach their goals.

Chime wants to help. We have a comprehensive library of easy-to-understand financial content, including the following:

- How to consolidate debt

- How do student loans work?

- How to rebuild your credit score

- How to write a check

It’s time to take action to improve your personal finance know-how. Interested to learn more? Read our biggest takeaways from our recent survey on how Gen Z views and builds wealth.

Log in

Log in